Focus on Barbados Budget

EY - Caribbean Elections

EY - Caribbean Elections

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Budget</strong> commentary c<strong>on</strong>t’d<br />

Comment<br />

The <strong>Barbados</strong> Income Tax Act provides that where a pers<strong>on</strong>, including a company or an individual,<br />

carrying <strong>on</strong> business in <strong>Barbados</strong> derives assessable income from fees in respect of qualifying overseas<br />

professi<strong>on</strong>al services, in computing the tax payable <strong>on</strong> such income, a FCEC would be applied against<br />

the tax otherwise payable.<br />

In an effort to stimulate the productive sector, it has been proposed that the range of qualifying<br />

overseas professi<strong>on</strong>al services eligible for the FCEC be expanded to include explorati<strong>on</strong>, extracti<strong>on</strong><br />

and other mining, oil and gas activities, licensing and sub-licensing of intellectual property and<br />

shipping services.<br />

Currently, the majority of the double taxati<strong>on</strong> treaties that <strong>Barbados</strong> has with its major trading<br />

partners, including Canada, the United States and the United Kingdom, c<strong>on</strong>tain provisi<strong>on</strong>s which<br />

prohibit entities with special incentives, such as IBCs and ISRLs, from taking advantage of either all of<br />

or some of the benefits of these treaties. Therefore, investors seeking to provide the above services<br />

outside the Caricom market can alternatively set up a regular <strong>Barbados</strong> company to claim treaty<br />

benefits and also take advantage of the FCEC provided under the <strong>Barbados</strong> Income Tax Act. As a result,<br />

a pers<strong>on</strong> may be able to substantially reduce his overall tax liability.<br />

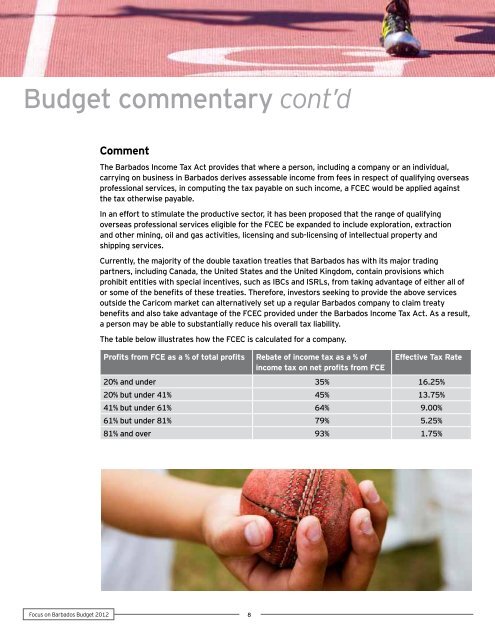

The table below illustrates how the FCEC is calculated for a company.<br />

Profits from FCE as a % of total profits<br />

Rebate of income tax as a % of<br />

income tax <strong>on</strong> net profits from FCE<br />

Effective Tax Rate<br />

20% and under 35% 16.25%<br />

20% but under 41% 45% 13.75%<br />

41% but under 61% 64% 9.00%<br />

61% but under 81% 79% 5.25%<br />

81% and over 93% 1.75%<br />

<str<strong>on</strong>g>Focus</str<strong>on</strong>g> <strong>on</strong> <strong>Barbados</strong> <strong>Budget</strong> 2012<br />

8