PARCHMENT

to download ParchWebDec08.pdf - the Dublin Solicitors Bar ...

to download ParchWebDec08.pdf - the Dublin Solicitors Bar ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

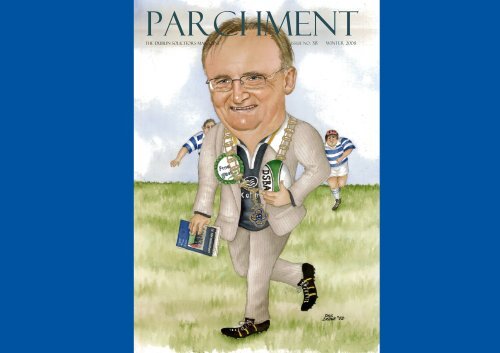

<strong>PARCHMENT</strong><br />

THE DUBLIN SOLICITORS MAGAZINE ISSUE NO. 38 WINTER 2008

2 <strong>PARCHMENT</strong>

<strong>PARCHMENT</strong><br />

Presidents Message<br />

Colleagues, I’m enormously honoured to be<br />

your president for the year ahead and indeed<br />

humbled by the proud office I am privileged<br />

to hold.<br />

This Association has played a special part in<br />

my professional career epitomising for me all<br />

that is good and honourable in our<br />

profession. By it’s core principles of integrity,<br />

the espousing of best practice, education, and<br />

collegiality it has continuously had a very<br />

positive affect on my career.<br />

What has made the DSBA such a vibrant and<br />

potent bar association of 4000 plus members<br />

is the fact that at its essence we are a purely<br />

voluntary. Made up of decent hard working<br />

people like you who put the hours in at their<br />

own offices but then give unstintingly to the<br />

Association either on Council itself or on one<br />

or other of the various committees.<br />

Of course, not everyone would have the time<br />

or inclination to put in that sort of effort but<br />

what you put in you get back in spades by<br />

the commoraderie, problem sharing and<br />

general looking out for our colleagues who<br />

need a steer or advice .It‘s the assuredness<br />

that the DSBA is there to help. Not, of course,<br />

that we have all the answers- far from it but<br />

chances are we’ll know whoever the<br />

particular guru is or where to ferret the<br />

information and we’ll do our damnest to<br />

assist.<br />

Our strength comes from never taking our<br />

members for granted, keeping in touch, the<br />

imparting of information, encouraging<br />

dialogue with each other either through<br />

seminars or social inter-action. Because as we<br />

all know a colleague whom you know on the<br />

other side of a transaction makes for a<br />

smoother running file and more enjoyable<br />

experience.<br />

I am also conscious that for a myriad of<br />

reasons, not least the slow down in some<br />

4 <strong>PARCHMENT</strong><br />

aspects of work, that opportunities to come across colleagues may not<br />

present as frequently as before .While this is to be regretted there are<br />

always plenty of opportunities to rub shoulders either professionally<br />

or socially-just check our web site or open the latest mail from Maura<br />

and head along to your friends in the DSBA and be sure to hang<br />

around for a coffee or refreshments afterwards.!<br />

None of us are immune from the mayhem and turmoil swirling<br />

around us. This affects our clients and is impacting on both our cost<br />

base and, of course our bottom line. For many of us merely to survive<br />

and get through it all will require prudent management, careful<br />

planning and an understanding banker!. I know of colleagues let go or<br />

put on part time. Others more fortunate have been re-deployed.<br />

Elsewhere, in this edition John Geary has an earthy and up to the<br />

minute account as to how the down turn is affecting our practices. We<br />

wish we had the answers but we are all in it together from the largest<br />

firms to the one man firms like mine and please God we’ll manage to<br />

pull through but it may need a reshaping of our practices to diversify<br />

or embrace emerging areas of law just as we have done in the past and<br />

the persuit of as much efficiencies in our offices as we can manage.<br />

Already, in my first month as president it’s been my privilege to meet<br />

with colleagues in our sister bar associations in Mayo, Belfast and also<br />

Bristol, Manchester, and Liverpool. These are associations with whom<br />

we have always had the closest of links and we learn much from each<br />

other. My highlight to date has undoubtedly been a very special legal<br />

gathering in which my Council colleagues and I hosted a dinner for<br />

the entire High Court and Dublin based Circuit judiciary and we were<br />

honoured by their attendance as well as the 40 or so other colleagues<br />

drawn primarily from the litigation departments of the larger offices<br />

in the City. I don’t think any such event of that magnitude has ever<br />

occurred before and it was an inspiring occasion for us all. To judge<br />

from what the judiciary were kind enough to say they, also<br />

appreciated and valued the occasion in the context of an opportunity<br />

for dialogue with an essential part of the legal system. Ultimately<br />

though for us it was all about breaking down barriers, actual or<br />

illusionary and the overwhelming impression left with me and my<br />

colleagues is that we, for the most part have an extraordinary group of<br />

level headed, fair minded judiciary – no longer in the ivory towers but<br />

grounded, for the most part to realty. At the tail end of my predecessor<br />

Michael Quinlan’s year we also hosted a dinner for Judge Malone and<br />

her District Court colleagues.<br />

The DSBA is delighted to announce a partnership project with the Irish<br />

Cancer Society during 2009. We hope to learn from them and their<br />

many activities so that we can in turn get to know a little more about<br />

cancer . We look forward to working with our membership in making<br />

a real and lasting difference in the lives of all of those living with<br />

cancer. This will be achieved not alone by our support for their fund<br />

raising activities but also by the raising of awareness of the disease in<br />

it’s various forms.<br />

To conclude, my first address to you , I wanted also to thank the<br />

managing partners of all the large firms who gave of their time to meet<br />

with me and my vice president John O’Malley over recent weeks. The<br />

DSBA greatly appreciate and value the support of the large offices<br />

which we view as indicative that notwithstanding your size and,<br />

perhaps the international spread of your work that you too are very<br />

much part of the Dublin legal community. It has been a fascinating<br />

insight into the diversity of practices and the issues and challenges as<br />

they see it. One if those managing partners Emer Gilvarry is featured<br />

elsewhere in this edition.<br />

Finally , I have been bowled over by the depth of good wishes and<br />

kind words bestowed upon my by very many colleagues. With the<br />

tremendous support of my Council I wont let you down and together,<br />

please God this time next year we’ll be in a better place.<br />

Kevin O’Higgins<br />

O' Higgins Pays Tribute<br />

to Outgoing President<br />

DSBA President Kevin O'Higgins speaking on behalf of<br />

the Council paid a fulsome tribute to Michael Quinlan at<br />

his last meeting as President of the DSBA as follows<br />

On my own behalf and on behalf of council I would like<br />

to express my heartfelt appreciation to Michael in<br />

relation to the work and effort he has put into his role as<br />

President of the Association.<br />

Michael Quinlan has represented us with great<br />

distinction and none more so than in his efforts with the<br />

conference.<br />

He really will be a tough act to follow!<br />

During Michael's tenure as President he re-established<br />

the Association in what will hopefully be our new home<br />

here in Harcourt Street for some time to come.<br />

He brought in additional skills to the administration<br />

aspects of the Association with the recruitment of Anna.<br />

He drove on the committees which are all working and<br />

functioning well, and put on a very successful dinner<br />

dance.<br />

But of course the highlight for those of us lucky enough<br />

to have been there - China- a place where no one had<br />

dared go before and probably will never dare to go<br />

again!<br />

As Shakespeare said<br />

<strong>PARCHMENT</strong><br />

" We have come to bury Caeser-not to praise him "<br />

But I say to Michael -<br />

With his easy going, non-confrontational manner and<br />

general willingness to get along with people we have<br />

come to praise him not to hurry him!<br />

And I think you will agree that Michael deserves and<br />

has earned our fullest commendation.<br />

Kevin O'Higgins<br />

And it’s goodbye from him……<br />

It is with great pleasure that I hand over the editorship of the Parchment to John Geary and wish him the<br />

very best in the many, many, many years of enjoyment ahead. While there is a good bit of work involved, it<br />

is one of the most satisfying jobs in the D.S.B.A.<br />

Over the past few years the Parchment has grown from a basic newsletter format of 8 or 12 pages into its<br />

current editions of 40 pages plus. We have adopted advertisers to subsidise the cost of the Parchment and it<br />

is also available on our website. The range and depth (and length) of the articles featured in the Parchment<br />

has grown and I hope it will continue to grow, provided that the Parchment remains relevant to the needs of<br />

its readers. In addition to providing information to solicitors in Dublin, the Parchment has also tried to create<br />

some sense of the collegiality in Dublin by reporting on D.S.B.A. social events and by having the odd poke at<br />

some issue or another. The general feeling in the Parchment has always been that a sense of humour is<br />

essential if you are to maintain your sanity while making a living as a solicitor.<br />

The response to our letters to the editor piece on the solicitors writing room in the last edition, encouraged us<br />

to begin a series of ‘legal shrines ’ which takes a sideways look at places of interest in the solicitors landscape<br />

of Dublin. We are always on the lookout for new ideas for articles or for feedback, whether positive or<br />

negative so contact the DSBA if you have any ideas or contributions.<br />

I clearly recall when I was asked to become editor of the Parchment and<br />

wondered why my own happiness appeared to be far exceeded by that of the<br />

outgoing editor, Stuart. It was only subsequently that I realised, becoming<br />

editor is easier than getting someone else to take over and like the famous<br />

unlucky rabbit’s foot, you have to find someone else to take it from you before<br />

you are free of its curse. Now finally I can join former editors Justin<br />

McKenna, Kevin O’Higgins and Stuart Gilhooly in celebrating the passing<br />

of the rabbit’s foot to a new, enthusiastic editor. Happy Christmas !<br />

Keith Walsh<br />

<strong>PARCHMENT</strong> 5

DUBLIN SOLICITORS BAR ASSOCIATION<br />

COUNCIL MEMBERS<br />

PRESIDENT<br />

Kevin O’Higgins<br />

Kevin O’Higgins<br />

15 Carysfort Avenue Blackrock<br />

Co. Dublin<br />

T. 2842420, F.2842421<br />

M. 087 221 8573<br />

E. kevinoh@indigo.ie<br />

John P.O'Malley<br />

Vice President D.S.B.A.<br />

Nominee to the Council of<br />

the Law Society<br />

Helene Coffey<br />

Honorary Secretary<br />

Alma Sheehan<br />

Member of<br />

the Conveyancing<br />

Committee<br />

Claire O’Regan<br />

Member Litigation, PIAB &<br />

Employment Law<br />

Committee<br />

Eamonn Shannon<br />

Joint Chairperson of<br />

Younger Members<br />

Committee<br />

VICE-PRESIDENT<br />

John P. O’Malley<br />

John P. O’Malley & Co.<br />

38 Percy Place Dublin 4<br />

T. 6603687 F. 6680956<br />

E. spanneromalley@ericom.net<br />

Kevin O’Higgins- The Leader at Last<br />

In the history of the DSBA, I would doubt that anyone has ever wanted<br />

the presidency as much as Kevin O’Higgins. After setting a modern<br />

day record of six years as secretary of the Association (see what I<br />

mean?), it has always seemed as though he was destined to be the<br />

President.<br />

I think it’s fair to say that no-one epitomises the spirit of the<br />

Association more than Kevin. He is at every bun-fight and whether it<br />

be a public meeting, committee meeting, seminar, dinner or<br />

conference, if you don’t see Kevin’s wavy comb-over, then you’re in<br />

the wrong place. Everyone knows him and he knows everyone. A<br />

consummate politician, of which more later, but no less real for it.<br />

You see, he actually cares and there are few of his type around.<br />

If you cut Kevin, he bleeds blue. No question. He has three real loves<br />

(outside, of course, of his beloved wife Gay and his three children)<br />

namely Fine Gael, Leinster Rugby and the DSBA. All blue. And does<br />

he love them. None may be criticised and none have any fault. It has<br />

become the ritual among those who know him best to rise him as<br />

much as possible by gently (sometime not so gently) suggesting an<br />

occasional flaw in Fine Gael and/or Leinster (the DSBA is like the pope<br />

- infallible). This will initiate an impassioned defence (rarely logical) of<br />

the sort that will immediately make you regret mentioning the subject<br />

in the first place.<br />

If you pressed him, he would probably concede that Fine Gael is the<br />

first among his equal three first loves. In fairness, the O’Higgins<br />

family go back a long way with the blueshirts. He makes an annual<br />

trip to Beal na mBlath every August to genuflect at the memory of<br />

Michael Collins. Rumours that his Annual Conference will take place<br />

there are unfounded (though with the recession in full flow, anything<br />

is possible). With the local elections upcoming this summer, his<br />

family will be lucky to see the all-action President at all.<br />

Kevin holds another remarkable distinction. He is only mascot<br />

Leinster has had over the age of 10. Yes, he did actually bring the<br />

flag out himself a few years ago before a match. When he grows up,<br />

he wants to play for Leinster at out-half apparently.<br />

One final matter we can’t ignore, is Kevin’s frankly ridiculous penchant<br />

for wearing socks that match his tie. Yes, sober suits are often<br />

matched with luminous yellow or pink matching tie and sock sets.<br />

You couldn’t make it up.<br />

6 <strong>PARCHMENT</strong><br />

Stuart J. Gilhooly<br />

Honorary Treasurer.<br />

Member of the Parchment<br />

Committee<br />

John Glynn<br />

Website & Technology<br />

Co-ordinator, D.S.B.A<br />

Nominee to the council of<br />

the Law Society<br />

Paddy Kelly<br />

Consult a Colleague<br />

Co-ordinator and<br />

Chairperson of the<br />

Practice Management<br />

Committee<br />

Geraldine Kelly<br />

Programmes Director,<br />

Member Conveyancing<br />

Committee.<br />

Keith Walsh<br />

Parchment Editor, Vice<br />

Chairperson of the Family<br />

Law Committee, D.S.B.A.<br />

nominee to the Council of<br />

the Law Society<br />

John Hogan<br />

Chairperson of the<br />

Business & Commercial<br />

Law Committee, Member<br />

of the Practice<br />

Management Committee<br />

Julie Doyle<br />

is a solicitor with the<br />

private client department<br />

of Matheson Ormsby<br />

Prentice solicitors. Julie<br />

has been a member of the<br />

Conveyancing Committee<br />

of the D.S.B.A. for a<br />

number of years and<br />

brings a wide range of<br />

experience to the D.S.B.A.<br />

Council<br />

John Glynn<br />

John Glynn & Co<br />

Law Chambers, The Village Square<br />

Tallaght, Dublin 24<br />

T. 4515099, F. 4515120<br />

E.john@solicitor.net<br />

Keith Walsh<br />

Keith Walsh Solicitors<br />

8 St Agnes Road<br />

Crumlin Village,<br />

Dublin 12<br />

T.4554723, F.4554596<br />

M. 087 8576499<br />

keith@kwsols.ie<br />

John Geary<br />

is a litigation solicitor<br />

practising with D.J. Synott<br />

solicitors. In a former life<br />

he worked as a journalist<br />

with the Connaught<br />

Telegraph. His journalistic<br />

skills will be put to the test<br />

when he takes over as<br />

Editor of the Parchment<br />

following this edition and<br />

no doubt he will elevate<br />

the Parchment to new<br />

heights. John chairs the<br />

Litigation PIAB,<br />

employment and human<br />

rights committee.<br />

John Hogan<br />

Leman Solicitors<br />

10 Herbert Lane,<br />

Dublin 2<br />

T. 6393000, F. 6393000<br />

E.jhogan@lemansolicitors.com<br />

Paddy Kelly<br />

McKeever Rowan<br />

5 Harbourmaster Place<br />

I F S C, Dublin 1<br />

T. 6702990, F.6702988<br />

M. 087 6815215<br />

E.pkelly@mckr.ie<br />

Grainne Whelan<br />

is joint Chairperson of the<br />

Younger Members<br />

Committee and works with<br />

Frank Ward & Co.<br />

solicitors where she<br />

practices in the area of<br />

litigation and most areas<br />

of general practice.<br />

Grainne’s famous<br />

enthusiasm will add plenty<br />

of energy to the D.S.B.A.<br />

Council in the coming<br />

year.<br />

DSBA ORDINARY COUNCIL MEMBERS 2008/2009<br />

Alma Sheehan<br />

Sheehan & Co<br />

1 Clare Street,<br />

Dublin 2<br />

T. 6616067, F. 6610013<br />

E.sheehana@sheehanandco.ie<br />

Claire O’Regan<br />

Mac Guill & Company<br />

34 Charles Street West,<br />

Dublin 7<br />

T. 8787022, F. 7878011<br />

E.claire.oregan@macguill.ie<br />

SECRETARY<br />

Helene Coffey<br />

Coffey & McMahon<br />

223 The Capel Building, Mary’s Abbey,<br />

Dublin 7<br />

T. 6727633 F. 6727639<br />

M. 087 688406<br />

E.helene_coffey@cmsolicitors.ie<br />

TREASURER<br />

Stuart Gilhooly<br />

HJ Ward & Company<br />

Greenmount House, Harold’s Cross Road,<br />

Dublin 6W<br />

T.01 4532133 F. 01 4533461<br />

M.087 2389663<br />

E.stuartgilhooly@hjward.ie<br />

PROGRAMMES DIRECTOR<br />

Geraldine Kelly<br />

Geraldine Kelly & Co<br />

195 Lower Kimmage Road<br />

Dublin 6W<br />

T. 4921223,F. 4921821<br />

M. 087 2592474<br />

E. gerkellysolicitors@eircom.net<br />

Eamonn Shannon<br />

Patrick S Cahill<br />

Heritage House<br />

Dundrum Office Park<br />

Dundrum, Dublin 14<br />

T. 2980707, F. 2980808<br />

E.eamonn.shannon@gmail.com<br />

Grainne Whelan<br />

Frank Ward & Co<br />

Equity House<br />

Upr Ormond Quay, Dublin 7<br />

T. 8732499, F. 8733484<br />

E.grainne@frankward.com<br />

<strong>PARCHMENT</strong> 7

COMMITTEES OF THE DSBA 2008/2009<br />

COMMITTEES OF THE DSBA 2008/2009<br />

John Geary<br />

D J Synnott & Co<br />

25 St Stephens Green, Dublin 2<br />

T. 6612396, F. 6618874<br />

E. jvgeary@gmail.com<br />

Julie Doyle<br />

Matheson Ormsby Prentice<br />

70 Sir John Rogerson’s Quay<br />

Dublin 2<br />

T. 2322000 F. 2323333<br />

E.julie.doyle@mop.ie<br />

CONSULT A COLLEAGUE<br />

Paddy Kelly<br />

McKeever Rowan<br />

5 Harbormaster Place<br />

I F S C, Dublin 1<br />

T. 6702990, F.6702988<br />

M. 087 6815215<br />

E.pkelly@mckr.ie<br />

WEBSITE, TECHNOLOGY &<br />

CPD ON-LINE<br />

CHAIR<br />

John Glynn<br />

John Glynn & Co<br />

Law Chambers, The Village Square<br />

Tallaght, Dublin 24<br />

T. 4515099, F. 4515120<br />

E. john@solicitor.net<br />

<strong>PARCHMENT</strong><br />

EDITOR<br />

Keith Walsh<br />

Keith Walsh Solicitors<br />

8 St Agnes Road<br />

Crumlin Village, Dublin 12<br />

T. 4554723, F. 4554596<br />

E. keith@kwsols.ie<br />

COMMITTEE<br />

John Geary<br />

D J Synnott & Co<br />

25 St Stephens Green, Dublin 2<br />

T. 6612396, F. 6618874<br />

E. jvgeary@gmail.com<br />

Stuart Gilhooly<br />

HJ Ward & Company<br />

Greenmount House<br />

Harold’s Cross Road, Dublin 6W<br />

T.4532133, F. 4533461<br />

M. 087 2389663<br />

E.stuart.gilhooly@hjward.ie<br />

EDUCATION & SEMINARS<br />

COMITTEE, 2008/2009<br />

PROGRAMMES DIRECTOR<br />

Geraldine Kelly<br />

Geraldine Kelly & Co<br />

195 Lr. Kimmage Rd. Dublin 6W<br />

T. 4921223, F. 4921821<br />

M. 087 2592474<br />

gerkellysolicitors@eircom.net<br />

SOCIAL FUNCTIONS<br />

CO-ORDINATOR<br />

Geraldine Kelly<br />

Geraldine Kelly & Co<br />

195 Lr Kimmage Rd. Dublin 6W<br />

T. 4921223, F. 4921821<br />

E. gerkellysolicitors@eircom.net<br />

COMMITTEE<br />

Julie Doyle<br />

Matheson Ormsby Prentice<br />

70 Sir John Rogerson’s Quay<br />

Dublin 2<br />

T. 2322000, F. 2323333<br />

E. julie.doyle@mop.ie<br />

NOMINEES TO LAW<br />

SOCIETY COUNCIL<br />

John P O’Malley<br />

John P. O’Malley & Co.<br />

38 Percy Place, Dublin 4<br />

T. 6603687, F. 6680956<br />

E. spanneromalley@ericom.net<br />

John Glynn<br />

John Glynn & Co<br />

Law Chambers, The Village Square<br />

Tallaght, Dublin 24<br />

T. 4515099, F. 4515120<br />

E. john@solicitor.net<br />

Keith Walsh<br />

Keith Walsh Solicitors<br />

8 St Agnes Road<br />

Crumlin Village, Dublin 12<br />

T. 4554723, F. 4554596<br />

E. keith@kwsols.ie<br />

PRACTICE MANAGEMENT<br />

COMMITTEE<br />

CHARPERSON<br />

Paddy Kelly<br />

McKeever Rowan<br />

5 Harbormaster Place<br />

I F S C, Dublin 1<br />

T. 6702990, F. 6702988<br />

M. 087 6815215<br />

E. pkelly@mckr.ie<br />

COMMITTEE<br />

John Hogan<br />

Leman Solicitors<br />

10 Herbert Lane, Dublin 2<br />

T. 6393000, F. 6393000<br />

E. jhogan@lemansolicitors.com<br />

Maree Gallagher<br />

Maree Gallagher & Associates<br />

48 Fitzwilliam Square, Dublin 2<br />

T. 688800, F. 6887935<br />

E. maree@mga.ie<br />

Ken Greene<br />

Greene 6 Partners<br />

5 Arkendale Road<br />

Glenageary, Co Dublin<br />

M. 086 2555170<br />

E. kgreene@greene6partners.com<br />

Ruadhan Killeen<br />

Killeen Solicitors<br />

14 Mountjoy Square, Dublin 1<br />

T. 8555197, F. 8554091<br />

E. rkilleen@killeensolrs.ie<br />

Cilian O’Brolchain<br />

Law Library Financial Services<br />

Metropolitan Building<br />

James Joyce Street, Dublin 1<br />

T. 086 3828873<br />

E. cilian_obrolchain@aon.ie<br />

BUSINESS & COMMERCIAL<br />

LAW COMMITTEE<br />

CHAIR<br />

John Hogan<br />

Leman Solicitors<br />

10 Herbert Lane, Dublin 2<br />

T. 01 6393000, F. 01 6393000<br />

E. jhogan@lemansolicitors.com<br />

COMMITTEE<br />

Pauline O Donovan<br />

Matheson Ormsby Prentice<br />

70 Sir John Rogerson’s Quay<br />

Dublin 2<br />

T. 2322000<br />

E. pauline.odonovan@mop.ie<br />

Patrick Rowan<br />

McKeever Rowan<br />

5 Harbourmaster Place<br />

IFSC, Dublin 1<br />

T. 6702990, F. 6702988<br />

E. prowan@mckr.ie<br />

Brendan Heneghan<br />

William Fry<br />

Fitzwilton House, Wilton Place,<br />

Dublin 2<br />

T. 6395000/6395143 (Secretary)<br />

F. 6385333/6625026 (direct)<br />

E.brendan.heneghan@williamfry.ie<br />

David Phelan<br />

Hayes Solicitors<br />

Lavery House<br />

Earlsfort Terrace, Dublin 2<br />

T. 6624747, F. 6612163<br />

E. dphelan@hayes-solicitors.ie<br />

Neil Keenan<br />

Lavery Kirby Gilmartin<br />

The Forum, 29-31 Glasthule Road<br />

Glasthule, Co. Dublin<br />

T. 2311430, F. 2311417<br />

E. neilk@laverykirby.ie<br />

Lorcan Tiernan<br />

Dillon Eustace<br />

33 Sir John Rogerson’s Quay<br />

Dublin 2<br />

T. 6670022, F. 6670042<br />

E. lorcan.tiernan@dilloneustace.ie<br />

Deirdre-Ann Barr<br />

Matheson Ormsby Prentice<br />

70 Sir John Rogerson’s Quay<br />

Dublin 2<br />

T. 2322000, F. 2323333<br />

E. deirdreann.barr@mop.ie<br />

Robert Ryan<br />

Doherty Ryan & Associates<br />

6 Lower Hatch Street, Dublin 2<br />

T.6785192, F. 6785196<br />

E. rryan@dohertyryan.com<br />

Fiona Ward<br />

O Donnell Sweeney Eversheds<br />

The Earlsfort Centre<br />

Earlsfort Terrace, Dublin 2<br />

T. 6644200, F.6644300<br />

E. fward@odse.ie<br />

Declan McNulty<br />

Eames & Company<br />

Unit 2, Block C<br />

Dundrum Business park<br />

Dundrum, Dublin 14<br />

CONVEYANCING<br />

COMMITTEE<br />

CHAIR<br />

Julie Doyle<br />

Matheson Ormsby Prentice<br />

70 Sir John Rogerson’s Quay<br />

Dublin 2.<br />

T. 01 6199000, F. 01 6199010<br />

E. julie.doyle@mop.ie<br />

COMMITTEE<br />

Alma Sheehan<br />

Sheehan & Co<br />

1 Clare Street, Dublin 2<br />

T. 6616067, F. 6610013<br />

E. sheehana@sheehanandco.ie<br />

Ray Quinn<br />

Raymond Quinn<br />

Merchants Hall<br />

25/26 Merchants Quay, Dublin 8<br />

T. 6705726, F. 6705727<br />

E. ray@rqsolicitor.ie<br />

Garbhan O’Nuallain<br />

G. O’Nuallain & Co<br />

7 Argyle Square<br />

Morehampton Road, Dublin 4<br />

T. 6630814, F. 6630815<br />

E. gonuallain@eircom.net<br />

Liz Roche<br />

Mason Hayes & Curran<br />

South Bank House<br />

Barrow Street, Dublin 4<br />

T. 6145000, F.6145001<br />

E. eroche@mch.ie<br />

Natasha McKenna<br />

B C M Hanby Wallace<br />

88 Harcourt Street, Dublin 2<br />

T.4186900, F. 4186901<br />

Jackie Buckley<br />

Hayes Solicitors<br />

Lavery House<br />

Earlsfort Terrace, Dublin 2<br />

T. 6624747, F.6612163<br />

E. jbuckley@hayes-solicitors.ie<br />

Mairead Cashman<br />

Dublin City Council<br />

Law Department<br />

Civic Offices, Wood Quay, Dublin 8<br />

T. 6723212, F. 6707687<br />

mairead.cashman@dublincityp.ie<br />

Justin McKenna<br />

Partners At Law<br />

8 Adelaide Street<br />

Dun Laoghaire, Co Dublin<br />

T. 2800340, F. 2803101<br />

E.jmk@pals.ie<br />

Julie Doyle<br />

Matheson Ormsby Prentice<br />

70 Sir John Rogerson’s Quay<br />

Dublin 2<br />

T. 6199000, F. 6199010<br />

E. julie.doyle@mop.ie<br />

FAMILY LAW & MINORS<br />

COMMITTEE<br />

CHAIR<br />

Jennifer O’ Brien<br />

Mason Hayes & Curran<br />

South Bank House<br />

Barrow Street, Dublin 4<br />

T. 6145000, F.6145001<br />

E. jobrien@mhc.ie<br />

COMMITTEE<br />

Keith Walsh<br />

Keith Walsh Solicitors<br />

8 St Agnes Road<br />

Crumlin Village, Dublin 12<br />

T. 01 4554723, F. 01 4554596<br />

E. keith@kwsols.ie<br />

Justin Spain<br />

Eugene Davy<br />

6-18 Harcourt Road, Dublin 2<br />

T.4751953, F.4782224<br />

E. jspain@eugenedavy.ie<br />

Helene Coffey<br />

Coffey & McMahon<br />

223 The Capel Building<br />

Mary’s Abbey,Dublin 7<br />

T. 01 6727633, F. 01 6727639<br />

M. 087 688406<br />

E.helene_coffey@cmsolicitors.ie<br />

Hugh Cunniam<br />

Legal Aid Board<br />

Law Centre, Tower Centre<br />

Clondalkin Village, Dublin 22<br />

T. 4576011, F.4576007<br />

Mary Hayes<br />

Gore & Grimes<br />

Cavendish House<br />

Smithfield, Dublin 7<br />

T. 8729299, F.8729877<br />

E. mary.hayes@goregrimes.ie<br />

Hilary Coveney<br />

Matheson Ormsby Prentice<br />

70 Sir John Rogerson’s Quay,<br />

Dublin 2<br />

T. 2322000, F. 2323333<br />

E. hilary.coveney@mop.ie<br />

Kathy Irwin<br />

Irwin Solicitors<br />

I Northumberland Avenue<br />

Dun Laoghaire, Co Dublin<br />

T. 2140454, F.2303260<br />

E.irwinsol@securemail.ie<br />

Cliona Costelloe<br />

O Connor & Bergin<br />

Suites 234 – 236<br />

The Capel Building<br />

Mary’s Abbey, Dublin 7<br />

T. 8732411, F. 8732517<br />

clionacostelloe@oconnorbergin.ie<br />

Audrey Byrne<br />

McCann Fitzgerald<br />

Riverside One<br />

Sir John Rogerson’s Quay,Dublin 2<br />

T. 8290000, F.8290010<br />

audrey.byrne@mccannfitzgerald.ie<br />

Anne O’Neill<br />

McKeever Rowan<br />

5 Harbourmaster Place<br />

I F S C, Dublin 1<br />

T. 6702990, F.6702988<br />

E. aoneill@mckr.ie<br />

Peter Quinn<br />

Sheridan Quinn<br />

29 Upper Mount Street, Dublin 2<br />

T. 6762810, F.6610295<br />

E. peter.quinn@sheridanquinn.ie<br />

Diego Gallagher<br />

BCM Hanby Wallace<br />

88 Harcourt Street, Dublin 2<br />

T. 4186900, F.4186901<br />

Rachel Murphy<br />

L K Shields<br />

39/40 Upper Mount St, Dublin 2<br />

T.6610866, F. 6610883<br />

E. rmurphy@lkshields.ie<br />

Caroline Staunton<br />

Anderson & Gallagher<br />

29 Westmoreland Street, Dublin 2<br />

T. 6776066, F. 6798494<br />

E. caroline@andersongallagher.ie<br />

LITIGATION , P.I.A.B.,<br />

EMPLOYMENT LAW,<br />

IMMIGRATION, HUMAN<br />

RIGHTS, AND CRIMINAL<br />

LAW COMMITTEE<br />

CHAIR<br />

John Geary<br />

D J Synnott & Co<br />

25 St Stephens Green, Dublin 2<br />

T. 6612396, F. 6618874<br />

E. jvgeary@gmail.com<br />

COMMITTEE<br />

Claire O’Regan<br />

Mac Guill & Company<br />

34 Charles Street West, Dublin 7<br />

T. 8787022, F. 7878011<br />

E. claire.oregan@macguill.ie<br />

Stuart Gilhooly<br />

H.J. Ward & Company<br />

Greenmount House<br />

Harold’s Cross Road, Dublin 6W<br />

T. 4532133, F. 4533461<br />

E. Stuart.gilhooly@hjward.ie<br />

Barra O Cochloain<br />

John Glynn & Company<br />

Law Chambers, The Village Square<br />

Tallaght, Dublin 24<br />

T. 4515099, F. 4515120<br />

E. barra@solicitor.net<br />

Fiona Duffy<br />

Patrick F O Reilly & Co<br />

9/10 South Great Georges Street<br />

Dublin 2<br />

T. 6793565, F.6793421<br />

E. fiona.duffy@pforeilly.ie<br />

Michelle Ni Longain<br />

BCM Hanby Wallace<br />

88 Harcourt Street, Dublin 2<br />

T. 4186900, F. 4186901<br />

mnilongain@bcmhanbywallace.cm<br />

Deirdre McDermott<br />

Denis I Finn<br />

5 Lr Hatch Street, Dublin 2<br />

T. 6760844, F. 6764684<br />

E. dmcd@denisifinn.ie<br />

Hilkka Becker<br />

Immigrant Council of Ireland<br />

2 St Andrew Street,Dublin 2,<br />

T. 674 0202<br />

E. hilkka@immigrantcouncil.ie<br />

Margaret MacEvilly<br />

Terence Lyons & Co<br />

4 Arran Quay, Dublin 7<br />

T. 8723944, F.8723954<br />

E. macavilly@tlyonssolicitor.ie<br />

Evelyn Savage<br />

Dawson Solicitors<br />

RSA House<br />

Dundrum Town Centre<br />

Sanyford Road, Dundrum<br />

Dublin 16<br />

T. 2901813<br />

E.Evelyn.Savage@ie.rsagroup.com<br />

Gerard Prendiville<br />

Newman Solicitors<br />

Mespil Court<br />

Mespil Road, Dublin 4<br />

T. 6133200, F.7023736<br />

E. Gerry.predniville@allianz.ie<br />

Darragh Lenehan<br />

AXA Legal Services Solicitors<br />

AXA Ireland<br />

Wolfe Tone House<br />

Wolfe Tone Street, Dublin 1<br />

T.4533309, F.4538180<br />

E. dwlenehan@yahoo.com<br />

Cahir O Higgins<br />

Cahir F O Higgins<br />

Unit 330, The Capel Building<br />

Marys Abbey, Dublin 7<br />

T. 8744744<br />

E. cohiggins@eircom.net<br />

Triona Price<br />

Eames & Company<br />

2 Malthouse Square<br />

Smithfield Village<br />

Bow Street, Dublin 7<br />

T. 8725155, F .8725664<br />

E. t.price@eames.ie<br />

Fiona Ward<br />

O Donnell Sweeney Eversheds<br />

The Earlsfort Centre<br />

Earlsfort Terrace, Dublin 2<br />

T. 6644200, F.6644300<br />

E. fward@odse.ie<br />

8 <strong>PARCHMENT</strong><br />

<strong>PARCHMENT</strong> 9

Grainne Whelan<br />

Frank Ward & Co<br />

Equity House<br />

Upr Ormond Quay, Dublin 7<br />

T.8732499, F.8733484<br />

E. grainne@frankward.com<br />

PROBATE & TAXATION<br />

COMMITTEE<br />

CHAIR<br />

Justin McKenna<br />

Partners At Law<br />

8 Adelaide Street<br />

Dun Laoghaire, Co Dublin<br />

T.2800340, F. 2803101<br />

E. jmk@pals.ie<br />

Finola O’Hanlon<br />

O Hanlon Tax Limited<br />

6 City Gate<br />

Lower Bridge Street, Dublin 8<br />

T.604 0280 F. 604 0281<br />

E. finola@hanlontax.ie<br />

Cedric Christie<br />

Christie & Co<br />

Pepper Canister House<br />

Mount Street Crescent, Dublin 2<br />

T. 6627185, F. 6627187<br />

E. cchristie@indigo.ie<br />

COMMITTEES OF THE DSBA 2008/2009<br />

Sonya Manzor<br />

William Fry<br />

Fitzwilton House<br />

Wilton Place,Dublin 2<br />

T.01 6395213, F.01 6395333<br />

E. sonya.manzor@williamfry.ie<br />

Anne Stephenson<br />

Fallon & Stephenson<br />

55 Carysfort Avenue<br />

Blackrock, Co Dublin<br />

T.2756759, F. 2109845<br />

E. falllonstephenson@eircom.net<br />

Jennifer Tuite<br />

Matheson Ormsby Prentice<br />

70 Sir John Rogerson’s Quay,<br />

Dublin 2<br />

T.6199000, F. 6199010<br />

jennifer.tuite@mop.ie<br />

William Christopher<br />

B C M Hanby Wallace<br />

88 Harcourt Street, Dublin 2<br />

T. 4186900<br />

E. wchristopher@bcmhw.com<br />

Nora Larkin<br />

Mason Hayes & Curran<br />

South Bank House<br />

Barrow Street, Dublin 4<br />

T 6145000, E. nlarkin@mhc.ie<br />

YOUNG MEMBERS<br />

COMMITTEE<br />

CHAIR<br />

Eamonn Shannon<br />

Patrick S Cahill<br />

Heritage House<br />

Dundrum Office Park<br />

Dundrum, Dublin 14<br />

T2980707, F 2980808<br />

E., eamonn.shannon@gmail.com<br />

COMMITTEE<br />

Grainne Whelan<br />

Frank Ward & Company<br />

Equity House<br />

Upr Ormond Quay, Dublin 7<br />

T. 8732499, F. 8733484<br />

E. grainne@frankward.com<br />

Isobel McCarthy<br />

Ahearn O Shea<br />

5 Clare Street, Dublin 2<br />

T. 6616102, F. 6624726<br />

E. Isobel@ahernoshea.ie<br />

Liam Fitzgerald<br />

A B Wolfe & Co<br />

76 Lr. Baggot Street, Dublin 2<br />

T.777 1941, F. 775 1910<br />

E. Liam.Fitzgerald@mop.abw.ie<br />

Conor Canavan<br />

Joseph T Mooney & Company<br />

23 Upper Mount Street<br />

Dublin 2<br />

T.6624299, F.6620004<br />

E. conor.canavan@gmail.com<br />

Paul Ryan<br />

Ben O Rafferty Solicitor<br />

18 Merrion Row, Dublin 2<br />

T. 6764638, F.6612020<br />

E. paul@benoraffertysols.ie<br />

Danielle Conaghan<br />

Arthur Cox<br />

Earlsfort Centre<br />

Earlsfort Terrace, Dublin 2<br />

T. 6180000, F. 6180618<br />

Deborah Kearney<br />

Leman Solicitors<br />

10 Herbert Lane, Dublin 2<br />

T. 639300, F. 639001<br />

dkearney@lemansolicitors.com<br />

Book Review<br />

Statutory<br />

Interpretation<br />

in Ireland;<br />

David Dodd,<br />

2008, Tottel<br />

Publishing<br />

€140.00,<br />

hardback.<br />

This detailed and scholarly book<br />

examines the criteria and principles<br />

used by the Courts in interpreting<br />

primary and secondary legislation. As<br />

any solicitor who has attended the<br />

Superior Courts in a case involving an<br />

interpretation of a particular article of<br />

an act is aware, this is an extremely<br />

tricky area and while some of the<br />

answers are to be found in the 2005<br />

Statutory Interpretation Act, many<br />

more questions are raised when you<br />

are forced to look into the common<br />

law. David Dodd has performed a<br />

painstaking task with great skill and<br />

produced an accessible text which is as<br />

straightforward as its subject matter is<br />

complex.<br />

He introduces basic concepts of<br />

statutory construction and simply<br />

states the objective of statutory<br />

interpretation as identifying the<br />

intention of the legislature. He<br />

examines in some detail the 2005 Act<br />

as well as examining interpretative<br />

criteria from the case law. The real<br />

problems with this area become<br />

obvious as you read through the book<br />

and you learn that, in Dodd’s words,<br />

‘interpretative criterion generally fly in<br />

pairs and for every criterion<br />

supporting a particular interpretation,<br />

another can usually be found pointing<br />

to a different conclusion’. I found that<br />

the most useful way of approaching<br />

this book in relation to a particular<br />

point was to start with the 2005 Act<br />

and Dodd in his chapter on the Act<br />

will then refer you to the relevant<br />

other chapters in the book which deal<br />

with principles and concepts, many of<br />

which have been to a degree<br />

incorporated in the Act, for example<br />

some of the types of interpretative<br />

doubt –ambiguity, obscurity,<br />

absurdity. In conclusion, this is an<br />

excellent, accessible text in an area of<br />

great complexity and when you are<br />

faced with a statutory interpretation<br />

dilemma, this book should be your<br />

first port of call.<br />

KW<br />

PRACTITIONER<br />

Litigation<br />

PIAB Delay in<br />

Registering Claim not<br />

Fatal<br />

A break at last for the poor stressed out solicitor. On 26 November<br />

2008, Ms Justice Elizabeth Dunne decided that delay by the Personal<br />

Injuries Assessment Board (PIAB or Injuries Board depending on<br />

what mood they are in) should not mean a claim is outside the two<br />

year time limit to stop the time running for the purposes of the<br />

Statute of Limitations in circumstances where the correct claim was<br />

sent to PIAB within the time limit but officially registered outside of<br />

it.<br />

The case of Isis Figueredo -v- Eamon McKiernan (High Court -<br />

Record No. 2007/9078P) arose out a road traffic accident that<br />

occurred on 10 November 2004. As a result of the Civil Liability and<br />

Courts Act 2004, it fell into the category of accident which, having<br />

occurred between 31 March 2004 and 31 March 2005, had a statute<br />

that expired on 30 March 2005.<br />

This was common case in the action that came before Ms Justice<br />

Dunne on foot of a Notice of Motion following the plea by the<br />

Defendant that the case was statute-barred as a preliminary point.<br />

What was in dispute was that the Plaintiff’s solicitors had made the<br />

claimant’s application by registered post on 29 March 2007 but PIAB<br />

had registered it on 2 April 2007 and so informed the Plaintiff’s<br />

solicitors by letter. An authorisation issued on 2 July 2007 and<br />

personal injuries summons on 5 December 2007.<br />

The Defendants in the case argued that Rule 3(3) of the PIAB Rules<br />

2004, which states, inter alia, that the date that time stops running<br />

under Section 50 of the 2003 Act is the date that the claimants<br />

application under Section 11 “is acknowledged in writing as having<br />

been received by the Board”, meant that the Plaintiff’s claim was<br />

statute-barred.<br />

Ms Justice Dunne said that if the Defendant was correct that this<br />

would mean the Plaintiff would be statute-barred by reason of<br />

circumstances outside his control. She referred to the case of Poole v<br />

O’Sullivan (1993) ILRM 55 which arose out a Plenary Summons which<br />

the Plaintiff sought to issue following an accident on 8 July 1987. As<br />

the 7 July 1990 fell on a Saturday, the next available date to issue it<br />

was Monday, 9 July 1990, when the Central Office next opened, and<br />

in those circumstances, Morris J felt the summons was issued in time.<br />

In this instance, the 30 March 2007 was a Friday but as the<br />

application was posted properly the day before, she saw no reason<br />

why the application should not have been received that day. She<br />

found that the affixing of a date stamp by PIAB in those<br />

circumstances should not oust the statutory provisions in relation to<br />

the limitation period and she therefore found that the Plaintiff was<br />

not statute-barred.<br />

A couple of observations. Firstly, it’s not clear if this has been<br />

appealed though it seems unlikely given the inherent logic of the<br />

decision. Secondly and more importantly, this case should not be<br />

seen as giving carte blanche to send in an application on the last day<br />

and take a chance. This was a case which to some extent turned on<br />

its facts and, of course, if the application had been sent back for<br />

correction/amendment, the case would have been statute-barred. It is<br />

infinitely more preferable to have a letter from PIAB before the<br />

statute runs out confirming that the case has been properly<br />

registered. Ideally, all applications should be made long before this<br />

stage.<br />

Stuart Gilhooly<br />

10 <strong>PARCHMENT</strong><br />

<strong>PARCHMENT</strong> 11

PRACTICE MANAGEMENT<br />

PRACTICE MANAGEMENT<br />

Falling off a cliff<br />

Anne Neary examines and advises on the huge changes facing<br />

you as a solicitor following the seismic economic changes.<br />

I have completed a countrywide<br />

series of seminars sponsored by the<br />

Solicitors Mutual Defence Fund<br />

called How to Succeed in a Slowing<br />

Economy. I sent around<br />

questionnaires at each seminar to<br />

get a good sense of how firms are<br />

faring. The responses changed<br />

throughout the year. At the<br />

beginning of the year, solicitors<br />

reported that they experienced a<br />

fall in turnover averaging 10% but<br />

by September one solicitor in<br />

particular describing the experience<br />

as “falling off a cliff”.<br />

It is not true that every firm is<br />

experiencing such difficulties. A<br />

small number of firms positioned<br />

themselves carefully over the past<br />

few years and developed expertise<br />

in insolvency and receivership<br />

before the recession really took<br />

hold. Others who had a<br />

serendipitous balance within a<br />

number of areas are finding that<br />

probate and litigation have picked<br />

up and have balanced the fall in<br />

conveyancing fees.<br />

Onward to 2009 – the rule is<br />

“survival”.<br />

There are nearly 9,000 practicing<br />

solicitors in Ireland. If we assume<br />

that there are approximately 4<br />

million people in Ireland; that gives<br />

a figure of one solicitor for every<br />

444 people, man woman and child<br />

in the country. Almost 90% of<br />

solicitors practice either as sole<br />

practitioners, sole principals or in<br />

firms with two partners.<br />

The recession is bringing about<br />

radical change very quickly.<br />

Market forces are putting small<br />

firms under unprecedented<br />

pressure, and the dramatic rise in<br />

PI insurance premiums is forcing<br />

many solicitors to rethink how they<br />

practice.<br />

Premiums available for solicitors<br />

selling practices<br />

We have found that the market in<br />

purchases of solicitors’ practices is<br />

very active at the moment. There is<br />

a dearth of good profitable<br />

practices for sale, and there are<br />

many solicitors anxious to buy<br />

practices in good locations. So,<br />

surprisingly, there is a premium<br />

available for solicitors selling<br />

practices and we have seen good<br />

prices paid, particularly towards<br />

the end of the year.<br />

The biggest trend in 2008/09 -<br />

mergers<br />

However, the biggest trend is for<br />

firms to seek suitable firms with<br />

which to merge. Sharing expenses<br />

and overheads is an obvious way<br />

to survive the financial pressures of<br />

falling turnover. The difficulty<br />

which we have seen is that so many<br />

firms are tied into their current<br />

offices, making a move impossible.<br />

So, again, there is considerable<br />

demand for flexible firms who wish<br />

to move premises to either<br />

associate with or merge with a<br />

compatible firm.<br />

2008 – the devil we know – 2009<br />

– the devil we don’t<br />

Those of us who practiced<br />

throughout the ‘80s and early ‘90s<br />

have survival tools which need to<br />

be dusted off and used now. There<br />

is a horrible sense about that the<br />

achievement of the last 10 years<br />

have crumbled to dust and that a<br />

new economic world order is<br />

taking shape. What that shape will<br />

be is unclear to us all. 2008 has<br />

been very difficult, but 2009 is the<br />

year I believe will present the<br />

ultimate challenges.<br />

The rules of survival for 2009<br />

There are many causes for law<br />

firms to fail. The main cause of<br />

firms failing is when they run out<br />

of cash, but it is also due to a<br />

number of other factors such as:<br />

failure to respond to changing<br />

demands; weak leadership;<br />

undiversified practices; large<br />

overheads taken on over the past 3<br />

years; investments in property;<br />

weak firm culture and stifled<br />

innovation.<br />

Have a strategic re-think<br />

If you were to start all over again<br />

on a blank page, what would you<br />

do differently? Why not make<br />

those changes now? Change can be<br />

put on the long finger when cases<br />

and clients flow in, but when it all<br />

Anne Neary<br />

slows down, this is the time to<br />

re-examine the business.<br />

Watch your cash flow<br />

Keep watching all your bank<br />

arrangements. Re-finance ahead of<br />

deadlines. Manage your accounts<br />

aggressively. Keep talking to your<br />

bankers<br />

A zero based budget<br />

Start your budget now for 2009.<br />

Look at all your expenditure,<br />

including rent on your office space,<br />

and start looking for the best value.<br />

Manage your Risk<br />

PI insurance premiums have risen<br />

dramatically this year. Many<br />

claims have arisen not because of<br />

failure of solicitors to adequately<br />

advise their clients but due to<br />

careless practices in overstretched<br />

firms during the boom years. Its<br />

time now to start managing our<br />

risk and putting controls in place.<br />

Communicate<br />

Your staff will be wondering what<br />

is going to happen next year. Now<br />

is the time to get everyone together<br />

in a room for a few hours to have a<br />

frank discussion about the future.<br />

You may be surprised at the<br />

entrepreneurial ideas which might<br />

flow.<br />

Join our confidential register if<br />

you want to buy, sell or merge<br />

in 2009.<br />

We have set up a free register for<br />

solicitors who are interested in<br />

merging, forming alliances, selling<br />

a practice or looking for a practice<br />

to buy. This is a practical way of<br />

getting in contact with other like<br />

minded firms. We have a large<br />

number of firms on the register<br />

already, many of whom are<br />

actively in discussions and<br />

negotiations about creative ways to<br />

reduce costs and increase focus on<br />

business development. If you<br />

would like to join, please email me<br />

at anne@anneneary.ie<br />

The End of Lawyers?<br />

Rethinking the Nature of Legal<br />

Services<br />

This is the title of a book on my<br />

Christmas list, written by Richard<br />

Susskind, a professor at Gresham<br />

College in London and the<br />

University of Strathclyde in<br />

Glascow.<br />

The basic theme of the book is that<br />

markets will no longer tolerate<br />

expensive lawyers for tasks that<br />

can be better discharged with<br />

support of modern systems and<br />

techniques. He states that the legal<br />

profession will be driven by two<br />

forces in the coming decade: by a<br />

market pull towards the<br />

commoditization of legal services<br />

and by the pervasive development<br />

and uptake of new legal<br />

technologies.<br />

We have seen the dramatic results<br />

of the commoditization of legal<br />

services here over the past few<br />

years– prices falling for<br />

conveyancing and land related<br />

services and PIAB putting<br />

commoditization of personal<br />

injuries on an institutionalized<br />

basis.<br />

England says goodbye to the<br />

monopoly on Legal Services<br />

There have been extraordinary<br />

changes in England and Wales,<br />

where widespread liberalization of<br />

the legal profession is underway.<br />

The monopoly on the provision of<br />

legal services is gradually being<br />

eroded, and solicitors will now be<br />

competing with banks, insurance<br />

companies, accountants and<br />

grocery chains in the provision of<br />

legal services.<br />

These changes have not been<br />

discussed much in Ireland, but are<br />

signals of the way forward for the<br />

legal profession. The latest<br />

revolutionary changes have been<br />

enacted in the Legal Services Act<br />

2007. Up to this, lawyers were<br />

prohibited from entering into<br />

partnership with non-lawyers and<br />

there were restrictions on<br />

unregulated persons being<br />

formally involved in the<br />

management of these businesses,<br />

and unregulated persons having<br />

any stake in the ownership of such<br />

businesses.<br />

This generally meant that neither<br />

different types of lawyers (for<br />

example, solicitors and barristers)<br />

nor lawyers and non-lawyers could<br />

work together in legal<br />

partnerships, as is the case in<br />

Ireland.<br />

Alternative Business Structures<br />

permit lawyers and non lawyers<br />

practice together<br />

The Legal Services Act 2007<br />

provides for the establishment of<br />

Alternative Business Structures<br />

(ABS) which will enable lawyers<br />

and non-lawyers to work together<br />

on an equal footing to deliver legal<br />

and other services. External<br />

investment will be possible, and<br />

new business structures will give<br />

legal providers greater flexibility to<br />

respond to market demands,<br />

within the UK and overseas.<br />

Licences will be conferred by<br />

licensing<br />

authorities.<br />

Current trading conditions<br />

We still have a monopoly on the<br />

provision of legal services, but<br />

despite the monopoly, solicitors are<br />

finding trading in the current<br />

economic environment extremely<br />

difficult. We are all hearing the<br />

stories of pay cuts across the board<br />

in many firms, equity partners<br />

required to contribute large capital<br />

sums to refinance their firms,<br />

decades old firms in danger of<br />

ceasing operations, lay offs of<br />

experienced solicitors and trainees<br />

being let go.<br />

Anne Neary<br />

Tel. 4911866 or 086 1955919,<br />

anne@anneneary.ie<br />

Anne Neary Consultants Services<br />

Anne Neary Consultants Services Management Programmes<br />

Practice Management Programmes Regulation Advice<br />

Business Development and Marketing Risk Assessment Partnership Issues<br />

Work Systems Standardising legal work<br />

(systems and precedents – conveyancing; probate; litigation)<br />

ISO 9001-2000<br />

Business standards and quality – ISO 9001<br />

Sales, Purchases and Mergers Sale and Purchase of Legal Practices<br />

Mergers and Amalgamations Staff Training<br />

Firm retreats (Training for Staff & Solicitors)<br />

Publications<br />

The Solicitor’s Toolkit The Legal Secretaries Toolkit The Managing Partners Toolkit<br />

Office Manual Contracts of Employment IT Services<br />

Technology Audit – what have you got and what do you need?<br />

Case Management Software Disaster Recovery Planning<br />

Knowledge Management Offshore Digital Dictation<br />

Our new services<br />

Tenders Writing Service Understanding the Documentation<br />

PQQ or ITT Standard Forms Terms and Conditions<br />

Evaluation Process Selection Criteria Weightings<br />

Enhancing Your Response Developing Your Policies Added Value<br />

Understanding Sustainability Keeping It Simple<br />

Presentations and Site Visits Debriefing Accessing Further Information<br />

Website Makeovers Rebranding and Repositioning your firm<br />

Enhancing your firm image Punching above your weight<br />

Ensuring your full potential is communicated<br />

Using the full power of the internet to market your firm<br />

Redesigning the look of your website Repackaging your services<br />

Content writing and redesign Award Criteria<br />

Using web forms to capture client information<br />

Contact anne@anneneary.ie or phone 01 4911866 or 086 1955919<br />

12 <strong>PARCHMENT</strong><br />

<strong>PARCHMENT</strong> 13

The Case Management System<br />

The New CORT System<br />

The Right System<br />

14 <strong>PARCHMENT</strong> <strong>PARCHMENT</strong> 15

<strong>PARCHMENT</strong><br />

<strong>PARCHMENT</strong><br />

Uncertain<br />

Times<br />

John Geary looks at the bad news for solicitors<br />

from the employment market and looks forward<br />

to better times.<br />

The current economic climate is putting a huge strain<br />

on the legal profession. As work becomes even scarcer,<br />

solicitor’s practices are being forced to let staff go in a<br />

bid to cut overheads.<br />

The property boom which saw a great demand for<br />

conveyancing solicitors over the past five years is now<br />

over and these key professionals are unfortunately<br />

finding themselves without work and on the dole.<br />

According to Recruitment specialist, John Cronin of<br />

PRC there is a recruitment freeze at the moment among<br />

most of the leading law firms and this is turning into a<br />

“PR War” as nobody wants to be seen to be the bearer<br />

of bad news.<br />

Unemployment figures exclusively obtained by The<br />

Parchment under the Freedom of Information Act show<br />

a startling rise in the number of “legal professionals”<br />

currently on job seekers benefit. The latest figure is an<br />

astounding 647 legal eagles on the dole as of 28 th<br />

November 2008. There’s no doubt that that figure will<br />

rise considerably over the coming months as notice<br />

periods are served and the cold wind of recession bites.<br />

It is important to analyse these figures released by the<br />

Department of Social and Family Affairs before<br />

drawing any conclusions. First off, the figures do not<br />

provide a breakdown between Solicitors or Barristers<br />

and also include a portion of legal academic staff and<br />

legal executives/paralegals that are without work.<br />

The number of people on the Live Register on 1st<br />

January 2007 from the Legal Profession was 289. That<br />

figure took a significant rise later that year when a total<br />

of 341 legal professionals were on social welfare as of 1 st<br />

July 2007.<br />

The 1st January 2008 saw that figure rise to a total of<br />

359 and the steady increase continued unabated to 418<br />

legal professionals on the dole by 31 st May 2008.<br />

What then becomes apparent is that only three months<br />

later there was a massive 170 more legal people on the<br />

dole. The department figures for 26 th September 2008<br />

show the figure jumping 40% to 588 – its highest in<br />

years.<br />

But the number of legal people out of work has<br />

unfortunately continued to rise and rise as practitioners<br />

in areas others other than conveyancing are being let<br />

go. At the end of November the jobless figure has more<br />

than doubled in less than two years.<br />

It is indeed uncertain times for solicitors working in the<br />

so-called ‘larger firm’. The Sunday Tribune business<br />

supplement led with an article a few weeks ago saying<br />

that one of Dublin’s largest legal practices had asked its<br />

partners to accept a 15% pay cut. It is understood that<br />

since then, many of the solicitors in that firm (and other<br />

firms) have been asked to take pay cuts in the region of<br />

10%.<br />

Due to the recent down turn, one of the top five firms<br />

have recently terminated the services of an entire unit<br />

of its commercial property practice resulting in a<br />

partner and a number of solicitors and support staff<br />

being made redundant.<br />

This pattern has continued across the small and<br />

mid-tier firms who are letting people go in “ones and<br />

twos” and managing people out due to the downturn.<br />

John Cronin of PRC Recruitment says that there is a<br />

“recruitment embargo” on almost all of the mid-sized<br />

and large Dublin law firms and this is likely to run well<br />

into 2009.<br />

“There are elements of redeployment in offices at the<br />

moment. Solicitors in Commercial Property are moving<br />

to Corporate or Commercial Litigation” says Cronin.<br />

He feels the main reason for the current job crisis is<br />

down to money. “The banks aren’t lending to anyone<br />

and there are no commercial deals or transactions.”<br />

For the past six months, Cronin has been literally<br />

besieged with CV’s from unemployed solicitors. “I was<br />

getting six or seven calls a day from people saying that<br />

they have been given their notice. That has eased off<br />

somewhat now as I think reality is now dawning on<br />

many solicitors that the work just isn’t currently there.”<br />

One of the main places to source new work for<br />

solicitors is the Law Society website. The ‘Employment<br />

Opportunities’ page of the website is one of the first<br />

places solicitors look to find work. It has made grim<br />

reading for the past six months. Whilst there have been<br />

new postings of work every week of some form or<br />

another – many of the positions relate to secretarial and<br />

legal executive roles and the occasional solicitor<br />

opportunity for work can be for as far away as the<br />

Caribbean. The traditional general practice role has<br />

been as scarce as a hen’s tooth and meanwhile all the<br />

more solicitors are applying for the same roles, creating<br />

a headache for practitioners who are reportedly having<br />

to swift through hundreds of CV’s for perhaps just one<br />

position.<br />

Another indicator of the current job crisis for solicitors<br />

is the Irish Times recruitment supplement on a Friday.<br />

It hasn’t seen a solicitor vacancy advertised for a<br />

considerable period of time and in many recent weeks,<br />

the ‘Legal Section’ has been removed altogether as<br />

neither solicitor’s practice or recruitment agent offer a<br />

morsel of consolation for the beleaguered unemployed<br />

solicitor.<br />

The Trainee Cull<br />

The plight of the trainee solicitor is now becoming very<br />

worrying as trainees are being “let go” in wholesale<br />

numbers. Even the larger firms are now notifying their<br />

trainees that unfortunately their services will not be<br />

required once their training contract is up.<br />

“It’s very bleak for newly qualified lawyers” says John<br />

Cronin of PRC Recruitment. With the large numbers of<br />

trainees qualifying – many of them are not being kept<br />

on by their current offices which makes it an uphill<br />

battle to secure a new job without any post qualification<br />

experience.<br />

One large Dublin law firm reportedly told their trainees<br />

that there was no contract of employment for them on<br />

qualifying. They were advised to head to the Australia<br />

or overseas to try and get work in a law firm and then<br />

when the economy here picked up in time, they would<br />

be given preference to be rehired. One astute observer<br />

said that “it’s a case of Shanghai, Dubai or goodbye.”<br />

According to Cronin, the large law firms are still<br />

investing in the same amount of trainees. “The big<br />

firms are not curbing the numbers they are recruiting<br />

for their current intake of trainees. They are<br />

maintaining the high numbers and are not reducing<br />

them. This would indicate that an upturn in the<br />

economy is expected after the three year trainee cycle.”<br />

Numbers at the Law School<br />

Ken Murphy, Director General of the Law Society says<br />

that the law is clear on curtailing numbers entering the<br />

Law School at Blackhall Place. “Following two court<br />

decisions in the 1980s – Gilmore and McGowan, the<br />

numbers cannot be restricted in any way. There was<br />

also the Competition Act of 1991. It’s simply a case of<br />

supply and demand.”<br />

And demand is down a whopping 11% at Blackhall<br />

Place for the last professional practice course. In 2007<br />

the number of trainees attending PP1 was 671 whilst<br />

this has fallen to 596 on the current course. This decline<br />

is the first significant decline in demand for training<br />

places since 2001.<br />

Ken Murphy is keen to point out that the numbers in<br />

Blackhall Place were not “out of control” as was<br />

perceived by some solicitors. “It was simply a case of<br />

accommodating all of the trainees which firms and<br />

offices were willing to take on.”<br />

Murphy reminds us that this is not the first recession<br />

the profession has experienced and he recalls the 1980s<br />

when jobs in the legal profession were very scarce.<br />

“Our economy is cyclical and we have just been<br />

through an unprecedented period of economic growth.<br />

During this current downturn the suffering is likely to<br />

be intense” predicts Murphy.<br />

“The main drivers for the profession over the past ten<br />

years were personal injury actions and then more<br />

recently the property boom. When these two areas<br />

declined it has had a negative impact on the profession.<br />

On a positive note, the number of Personal Injury cases<br />

is on the up. The issuing of High Court Personal Injury<br />

Summons has more than doubled from 2,673 in 2007 to<br />

5,951 in 2007.”<br />

However, Murphy says that it was the suddenness of<br />

the downturn that has shocked everyone. “It has been<br />

an extraordinary collapse. However, we must not<br />

succumb to pessimism. The profession is willing to<br />

adapt to change as we approach more the difficult<br />

times ahead.”<br />

John Geary<br />

16 <strong>PARCHMENT</strong><br />

<strong>PARCHMENT</strong> 17

<strong>PARCHMENT</strong><br />

Time to take stock of your<br />

business and how you<br />

manage it<br />

For many professional service firms the busyness,<br />

growth and profitability of the boom years gave rise to<br />

significant complacency and lip service around key<br />

business, management and professional issues and<br />

processes. In some cases they were dealt with<br />

defensively and this led to some superficial solutions<br />

which tend not to last and often leave people in their<br />

comfort zone. In many other cases there was denial<br />

about the extent of the slippage. Very often the key<br />

weaknesses were masked by the flow of work or<br />

ignored in the rush to meet the demands of clients.<br />

Talent shortages excused a degree of flexibility in<br />

dealing with the shortcomings in processes and<br />

management. The constant pressure to produce meant<br />

that such concerns were not given priority and that<br />

they would be dealt with later.<br />

Well, it’s later now.<br />

With the changed economic climate and business<br />

circumstances it is time to take stock and to carryout a<br />

comprehensive review of your business.<br />

Below is a list of questions just to prompt your<br />

thinking.<br />

1. What has happened for your firm over the<br />

last 5 years?<br />

a. To what extent have you maximised the<br />

opportunities that the Celtic tiger brought?<br />

b. Have you expanded your client base profitably and<br />

serviced your clients in a way that makes a real<br />

difference?<br />

c. Have you managed the internal structures of your<br />

firm so you know, really know the following?<br />

i. How precisely do you analyse the details of the<br />

financial performance and do the key<br />

performance indicators reflect the changes in<br />

this performance?<br />

ii. Have you managed and developed all your<br />

staff so you reap the benefits of their<br />

contribution?<br />

iii. Have you developed the technology necessary<br />

to support your business?<br />

iv. To minimise your commercial and professional<br />

risks have you ensured that the necessary<br />

quality standards are truly in place such as a<br />

clearly documented set of professional<br />

Ken Greene is a member of the DSBA Practice<br />

Management Committee, a Management consultant<br />

with a well-rounded management knowledge gained in a<br />

diversity of senior roles in professional services (A&L<br />

Goodbody) and general management (Jefferson Smurfit<br />

Group) over 20 years.<br />

He is able to offer well-honed management,<br />

interpersonal and communications skills, demonstrably<br />

utilized to devise meaningful strategies and to achieve<br />

bottom line advantage.<br />

procedures, a system to ensure these are<br />

applied consistently and a review process to<br />

monitor this?<br />

2. What is your current situation?<br />

a. Have you a real handle on all aspects of cash<br />

management in your firm?<br />

i. Are you collecting your debtors on time?<br />

ii. Is there an increase in credits and discounts?<br />

iii. How are you managing this process?<br />

b. Have you a clear sense of how well you are keeping<br />

your share of the shrinking pie of work?<br />

i. Is there a niggle that some of the skills and<br />

vigour for business development, selling and<br />

networking have been lost due to the huge<br />

volume of work that was available in recent<br />

years?<br />

c. Do you need to overhaul your appraisal system and<br />

really tackle any areas of underperformance now<br />

that the war for talent has eased?<br />

3. How can you plan for the future?<br />

a. How will you optimise your client retention and<br />

acquisition?<br />

i. How do you keep and develop your<br />

relationships with existing clients?<br />

ii. What 3-5 initiatives are you planning to<br />

generate new business?<br />

iii. Are there new services that you need to provide<br />

to protect and enhance your offering?<br />

b. How will you improve your financial efficiency?<br />

i. How will you tighten up the financial<br />

management of the practice to minimise<br />

overheads and balance this with necessary<br />

service to your clients and the development and<br />

performance management of your staff?<br />

ii. How will pricing be affected by the new<br />

economic climate and how flexible will you<br />

need to be?<br />

c. How will you enhance your professional and<br />

risk management?<br />

i. Do you have the internal disciplines and<br />

processes to minimise your business and<br />

professional risks?<br />

ii. Have you a succession plan in place?<br />

It makes sense to answer these questions now and<br />

to proactively deal with them in a reasonable time<br />

scale. If not then you need to be prepared to be run<br />

over by your competition as they leave you<br />

floundering.<br />

By the way, these answers must be firm specific.<br />

The key issues under each heading, as it pertains<br />

to your individual situation, must be identified.<br />

And you must not fool yourselves by thinking<br />

there are quick ways around this. Your firm needs<br />

a reality check here to ensure that there is an open<br />

and honest debate on these issues. You must stop<br />

kidding yourselves if you really want to address<br />

these new realities and challenges and also if we<br />

want to reap the rewards of new and better ways<br />

of doing things.<br />

Recently I have been involved with the DSBA<br />

Practice Management Committee in facilitating<br />

two seminars on Client Service and Practice<br />

Development. These seminars were innovative and<br />

highly engaging with demonstrations by<br />

professional actors on how to overcome the<br />

challenges in these areas and it resulted in us<br />

identifying some real issues and tackling the<br />

outcomes in a meaningful way. We will be<br />

running the 3 rd seminar on Succession Planning in<br />

the New Year.<br />

Imagine how more comfortable you would be if<br />

you had the answers and solutions in place now<br />

and were ready, as much as one can be, for what<br />

the future may bring. This is not rocket science but<br />

really needs more priority and commitment from<br />

those that are charged with running your firm. In<br />

some circumstances it may appear that there is a<br />

lot to tackle, involving much hard work but the<br />

alternatives are more unpleasant. Surely no one<br />

wants this?<br />

There is always tension between the excitement of<br />

the external aspects and the fear of excessive navel<br />

gazing on the internal challenges of the firm.<br />

However equity partners must wear the three<br />

hats that make up their role as producers, owners<br />

and managers. Without doubt the number one<br />

pressure is producing the legal work. The outcome<br />

of all the work and effort in the firm is the return<br />

to the owners. The relationship between the work<br />

and the outcome achieved will depend on the<br />

quality of its management. Current circumstances<br />

present the opportunity of giving more attention to<br />

the management of your business. This involves<br />

taking care of the key ingredients of clients,<br />

finances, staff, standards and risk.<br />

The time to take stock of these issues is now.<br />

Ken Greene<br />

Greene6 Partners, 5 Arkendale Road, Glenageary,<br />

County Dublin. 086 2555170;<br />

kgreene@greene6partners.com<br />

Book Review<br />

Medical Negligence<br />

Litigation: Emerging Issues,<br />

edited by Ciaran Craven B.L.<br />

and William Binchy,First Law,<br />

2008; €135.00<br />

This collection of essays by<br />

leading academics and<br />

practitioners in the area<br />

examines medical negligence<br />

litigation from the point of<br />

view of the defendant doctors<br />

and the health boards and also<br />

from the plaintiff’s perspective.<br />

Leading medical negligence<br />

solicitor Michael Boylan<br />

contributes a highly informative chapter on the<br />

challenges for plaintiff lawyers embarking on medical<br />

negligence cases. He provides a checklist of medical<br />

records required, advises that the hospital complaints<br />

procedures be used where possible and looks at the<br />

new importance of inquests. Boylan’s chapter is 100%<br />

practical but informed by his undoubted expertise in<br />

the area, he writes also of the evidential requirements<br />

needed before starting a medical negligence case and<br />