Amsterdam

EIB Q1 09.qxp - ACAI

EIB Q1 09.qxp - ACAI

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

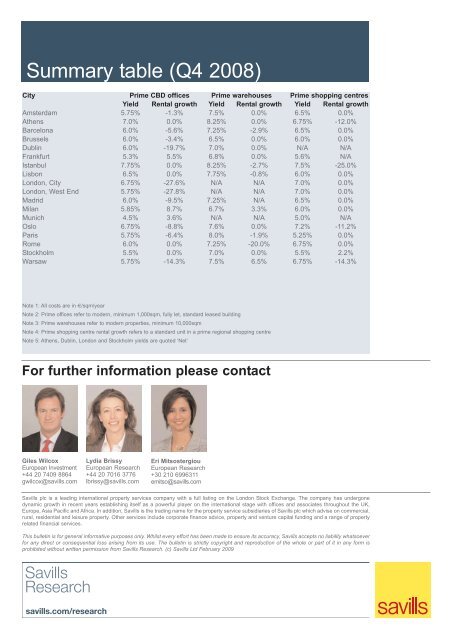

Summary table (Q4 2008)<br />

City Prime CBD offices Prime warehouses Prime shopping centres<br />

Yield Rental growth Yield Rental growth Yield Rental growth<br />

<strong>Amsterdam</strong> 5.75% -1.3% 7.5% 0.0% 6.5% 0.0%<br />

Athens 7.0% 0.0% 8.25% 0.0% 6.75% -12.0%<br />

Barcelona 6.0% -5.6% 7.25% -2.9% 6.5% 0.0%<br />

Brussels 6.0% -3.4% 6.5% 0.0% 6.0% 0.0%<br />

Dublin 6.0% -19.7% 7.0% 0.0% N/A N/A<br />

Frankfurt 5.3% 5.5% 6.8% 0.0% 5.6% N/A<br />

Istanbul 7.75% 0.0% 8.25% -2.7% 7.5% -25.0%<br />

Lisbon 6.5% 0.0% 7.75% -0.8% 6.0% 0.0%<br />

London, City 6.75% -27.6% N/A N/A 7.0% 0.0%<br />

London, West End 5.75% -27.8% N/A N/A 7.0% 0.0%<br />

Madrid 6.0% -9.5% 7.25% N/A 6.5% 0.0%<br />

Milan 5.85% 8.7% 6.7% 3.3% 6.0% 0.0%<br />

Munich 4.5% 3.6% N/A N/A 5.0% N/A<br />

Oslo 6.75% -8.8% 7.6% 0.0% 7.2% -11.2%<br />

Paris 5.75% -6.4% 8.0% -1.9% 5.25% 0.0%<br />

Rome 6.0% 0.0% 7.25% -20.0% 6.75% 0.0%<br />

Stockholm 5.5% 0.0% 7.0% 0.0% 5.5% 2.2%<br />

Warsaw 5.75% -14.3% 7.5% 6.5% 6.75% -14.3%<br />

Note 1: All costs are in €/sqm/year<br />

Note 2: Prime offices refer to modern, minimum 1,000sqm, fully let, standard leased building<br />

Note 3: Prime warehouses refer to modern properties, minimum 10,000sqm<br />

Note 4: Prime shopping centre rental growth refers to a standard unit in a prime regional shopping centre<br />

Note 5: Athens, Dublin, London and Stockholm yields are quoted ‘Net’<br />

For further information please contact<br />

Giles Wilcox<br />

European Investment<br />

+44 20 7409 8864<br />

gwilcox@savills.com<br />

Lydia Brissy<br />

European Research<br />

+44 20 7016 3776<br />

lbrissy@savills.com<br />

Eri Mitsostergiou<br />

European Research<br />

+30 210 6996311<br />

emitso@savills.com<br />

Savills plc is a leading international property services company with a full listing on the London Stock Exchange. The company has undergone<br />

dynamic growth in recent years establishing itself as a powerful player on the international stage with offices and associates throughout the UK,<br />

Europe, Asia Pacific and Africa. In addition, Savills is the trading name for the property service subsidiaries of Savills plc which advise on commercial,<br />

rural, residential and leisure property. Other services include corporate finance advice, property and venture capital funding and a range of property<br />

related financial services.<br />

This bulletin is for general informative purposes only. Whilst every effort has been made to ensure its accuracy, Savills accepts no liability whatsoever<br />

for any direct or consequential loss arising from its use. The bulletin is strictly copyright and reproduction of the whole or part of it in any form is<br />

prohibited without written permission from Savills Research. (c) Savills Ltd February 2009