Echo Therapeutics (ECTE) needlefree

ECTE Update 08-16-11 - LifeTech Capital

ECTE Update 08-16-11 - LifeTech Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Unlocking the Value of Science Boca Raton New York <br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>)<br />

UPDATE REPORT<br />

August 16, 2011<br />

Rating Target<br />

Strong<br />

$6.00<br />

Speculative Buy<br />

Analysts<br />

Stephen M. Dunn<br />

Sr. Managing Director Research<br />

sdunn@LifeTechCapital.com<br />

(954) 240-9968<br />

William D. Dawson<br />

Senior VP Research<br />

wdawson@LifeTechCapital.com<br />

(561) 504-5818<br />

Symbol: <strong>ECTE</strong><br />

Exchange: NASDAQ<br />

8 Penn Center,<br />

1628 JFK Boulevard, Suite 300<br />

Philadelphia, PA 19103<br />

Phone: 215-717-4100<br />

www.echotx.com<br />

CEO – Dr. Patrick T. Mooney<br />

CFO – Christopher P. Schnittker<br />

Expecting FDA Clearance for Prelude SkinPrep Q3<br />

Keystone U.S. Patent for Symphony tCGM System<br />

Symphony tCGM System Nears Final Design & Trial<br />

1.) Prelude Remains on Track: In February, <strong>Echo</strong> partner Ferndale<br />

Pharma, received FDA comments on their 510(k) submission of the Prelude<br />

SkinPrep System that were described as “minor and were consistent with both<br />

companies' expectations.” Management reiterated the Q3 target. Investors<br />

should note that FDA 510(k) clearance for Prelude triggers a $750,000<br />

milestone payment 90 days later from Ferndale Pharma Group plus minimum<br />

guaranteed royalties of $12.6M. While <strong>Echo</strong> has granted Ferndale a license to<br />

develop, market and sell Prelude for delivery of topical 4% lidocaine<br />

product in North America and the United Kingdom, <strong>Echo</strong> retains the rights<br />

to continental Europe and Australia which may provide additional<br />

upside to <strong>Echo</strong> through future partnership licensing and royalty<br />

agreements.<br />

2.) Strengthened IP Portfolio: On August 8, 2011, <strong>Echo</strong> <strong>Therapeutics</strong><br />

received notice that their patent application "System and Method for<br />

Continuous Non-Invasive Glucose Monitoring" will issue as US Patent<br />

7,963,917. We believe this represents a keystone patent in <strong>Echo</strong> <strong>Therapeutics</strong><br />

intellectual property portfolio and provides a significant barrier to competitive<br />

entry. Investors can access the patent at http://1.usa.gov/qEGZ2x<br />

3.) Symphony Remains on Track: <strong>Echo</strong> <strong>Therapeutics</strong> Symphony<br />

transdermal continuous glucose monitor (tCGM) system is a unique <strong>needlefree</strong>,<br />

wireless system which we believe is set to begin a pivotal clinical trial<br />

in ICU/Critical Care patients H1 2012 (following a final pilot trial). We<br />

believe this puts <strong>Echo</strong> <strong>Therapeutics</strong> ahead of the curve with respect to<br />

tougher FDA standards for hospital use. (see FDA to Require Hospitals to<br />

Use More Accurate Glucose Monitors)<br />

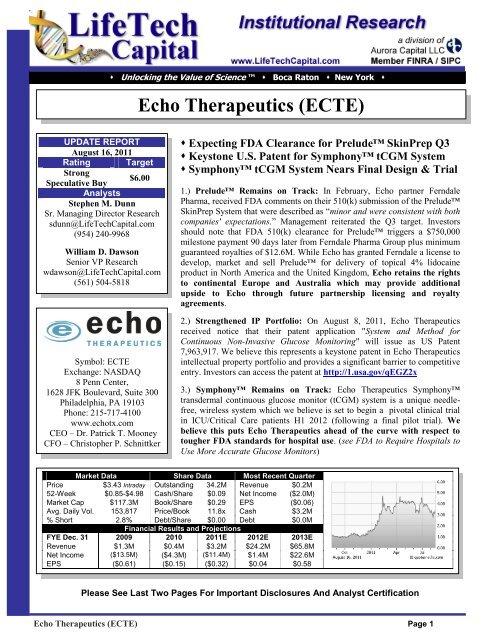

Market Data Share Data Most Recent Quarter<br />

Price $3.43 Intraday Outstanding 34.2M Revenue $0.2M<br />

52-Week $0.85-$4.98 Cash/Share $0.09 Net Income ($2.0M)<br />

Market Cap $117.3M Book/Share $0.29 EPS ($0.06)<br />

Avg. Daily Vol. 153,817 Price/Book 11.8x Cash $3.2M<br />

% Short 2.8% Debt/Share $0.00 Debt $0.0M<br />

Financial Results and Projections<br />

FYE Dec. 31 2009 2010 2011E 2012E 2013E<br />

Revenue $1.3M $0.4M $3.2M $24.2M $65.8M<br />

Net Income ($13.5M) ($4.3M) ($11.4M) $1.4M $22.6M<br />

EPS ($0.61) ($0.15) ($0.32) $0.04 $0.58<br />

Please See Last Two Pages For Important Disclosures And Analyst Certification<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 1

www.LifeTechCapital.com August 16, 2011<br />

4.) National Listing: On Wednesday, June 29, 2011 <strong>Echo</strong> <strong>Therapeutics</strong> began trading on NASDAQ Capital Market on<br />

under the existing ticker symbol "<strong>ECTE</strong>." We believe this is a significant milestone for <strong>Echo</strong> as a national listing increases<br />

visibility on Wall Street and should provide additional liquidity for <strong>Echo</strong> shares.<br />

5.) Clear Market Opportunity: We also remind investors that the results of the STAR 3 trial indicated that continuous<br />

glucose monitoring can benefit patients (see STAR 3 Trial Results-Continuous Glucose Monitoring Benefits), we also<br />

reiterate the need for <strong>Echo</strong>’s transdermal biosensor is growing in light of the FDA Warning Letter to DexCom<br />

(Nasdaq:DXCM) on the risks of sensor wire fractures underneath the patients’ skin, particularly pediatric and adolescent<br />

patients. The warning letter noted that DexCom’s sensor wires are not approved for use in children or adolescents,<br />

pregnant women or persons on dialysis and can only be used in the abdomen. (see FDA Warning Letter to DexCom on<br />

Sensor Wire Factures). We believe this should give <strong>Echo</strong>’s transdermal biosensor a significant advantage in the<br />

marketplace.<br />

6.) We are maintaining <strong>Echo</strong> <strong>Therapeutics</strong> with a Strong Speculative Buy and a 12-18 month price target of $6.00 based<br />

on 35x projected 2013 EPS and discounted 35% for risk as the FDA PMA approval of the Symphony tCGM system<br />

could occur within the forecast period. This would result in a market capitalization of approximately $200 million. This is<br />

a significant discount to DexCom (Nasdaq:DXCM) (see Competition), the only pure-play comparable, which has<br />

FDA approval for their invasive, implantable biosensors with a market capitalization of approximately $800<br />

million.<br />

Company Description<br />

Based in Philadelphia Pennsylvania, <strong>Echo</strong><br />

<strong>Therapeutics</strong> is developing the Symphony<br />

tCGM System which is a next-generation, noninvasive<br />

(needle-free), wireless transdermal<br />

continuous glucose monitor (tCGM) system<br />

designed to provide reliable, on-demand blood<br />

glucose data conveniently, continuously and<br />

cost-effectively. Symphony includes the<br />

Prelude SkinPrep system which incorporates<br />

a patented feedback mechanism for optimal<br />

skin permeation control and their continuous<br />

transdermal sensor to detect glucose trends, for<br />

controlling complications associated with blood<br />

glucose levels that stray outside of a medically<br />

recommended target range. With Symphony,<br />

the company is focused on changing the current<br />

standard of care paradigm of invasive (needlebased),<br />

episodic blood glucose testing with<br />

their needle-free tCGM technology designed to<br />

MILESTONES & EVENTS<br />

Date Prelude SkinPrep Symphony tCGM<br />

Q1’10 Pilot Study<br />

Q2’10<br />

Q3’10 Results of Equivalency Trial<br />

Q4’10 File FDA 510(k) Submission<br />

Q1’11<br />

Q2’11<br />

Q3’11<br />

FDA 510(k) Approval<br />

U.S. Launch (Ferndale Pharma)<br />

Q4’11 Initiate Final Pilot Trial<br />

Q1’12<br />

Complete Final Pilot Trial<br />

Initiate Pivotal Trial<br />

Q2’12 Complete Pivotal Trial<br />

Q3’12 File FDA PMA Submission<br />

Q4’12<br />

FDA PMA Approval<br />

U.S. Launch<br />

Source: <strong>Echo</strong> <strong>Therapeutics</strong> and LifeTech Capital Estimates<br />

improve patient compliance to frequent glucose testing and achieve better overall glucose control. All existing FDAapproved<br />

continuous glucose monitoring (CGM) systems are needle-based, requiring insertion of a glucose sensor into the<br />

patient’s skin, which gives rise to risks of infection, inflammation or bleeding at the insertion site. In addition, the<br />

Prelude SkinPrep device (a component of the Symphony tCGM system) was licensed to Ferndale Pharma Group to<br />

develop and market for skin preparation prior to the application of a topical analgesic or anesthetic cream for local dermal<br />

anesthesia or analgesia prior to a needle insertion or IV procedure in North America and the U.K.<br />

Symphony Transdermal Continuous Glucose Monitor (tCGM) System<br />

<strong>Echo</strong> <strong>Therapeutics</strong>’ Symphony Transdermal Continuous Glucose Monitor (tCGM) system is needle-free with<br />

continuous glucose readings transmitted to a wireless receiver. The system consists of three distinct parts, the Prelude<br />

SkinPrep System, the transdermal (needle-free) glucose sensor transmitter and a wireless remote receiver. Each is<br />

discussed below:<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 2

www.LifeTechCapital.com August 16, 2011<br />

Symphony Transdermal Continuous Glucose Monitor (tCGM) System<br />

Source: <strong>Echo</strong> <strong>Therapeutics</strong><br />

Prelude Skin Permeation Device<br />

The secret behind the transdermal sensor is the Prelude SkinPrep<br />

System. This advanced microabrasion system enhances the flow of<br />

interstitial fluids and molecules across the protective membrane of the<br />

stratum corneum, the outmost protective layer of the skin. This, in turn,<br />

allows their wireless sensor to read the patient’s glucose measurements<br />

without requiring a needle. The Prelude is painless, takes just a few<br />

seconds, and stops automatically at the precise point of required abrasion<br />

based on signals from the built-in reference electrode. The single-use,<br />

disposable tips represent a continuing revenue stream for <strong>Echo</strong><br />

<strong>Therapeutics</strong>.<br />

Also of note, the Prelude SkinPrep device (a component of the<br />

Symphony tCGM system) was licensed to Ferndale Pharma Group to<br />

develop and market for skin preparation prior to the application of a<br />

topical analgesic or anesthetic cream for local dermal anesthesia or<br />

analgesia prior to a needle insertion or IV procedure in North America<br />

and the U.K.<br />

Prelude Skin Permeation Device<br />

Source: <strong>Echo</strong> <strong>Therapeutics</strong><br />

Symphony Transdermal Wireless Glucose Sensor<br />

The transdermal glucose sensor consists of an electrochemical glucose sensor, a<br />

hydrogel layer, a potentiostat and a short-range RF transmitter. When the sensor is<br />

placed on the permeated skin site (using the Prelude SkinPrep device), a layer of<br />

hydrogel establishes and maintains continuous fluid paths through the skin and acts as<br />

a reliable reservoir for the sensing chemistry to receive glucose flux and convert it into<br />

hydrogen peroxide. The hydrogen peroxide is consumed by the electrochemical sensor<br />

and continuous electrical signal is generated in the process. Once the sensor is<br />

connected and adhered to the skin, the transmitter switches on automatically and starts<br />

to broadcast the data<br />

Symphony BioSensor<br />

Source: <strong>Echo</strong> <strong>Therapeutics</strong><br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 3

www.LifeTechCapital.com August 16, 2011<br />

The diffusion gradient and sensor consumption of glucose are a function of the blood glucose concentration in the<br />

subpapillary vessels beneath the epidermis and the sensor generates continuous current that is proportional to the blood<br />

glucose concentration. The first calibration is made when the sensor stabilizes (about 1 hour), followed by subsequent<br />

calibrations depending on the applications. Due to the advanced<br />

Transdermal BioSensor - Mechanism of Action hydrogel chemistry and the Prelude skin permeation process, the<br />

glucose flux detected by the sensor can provide reliable continuous<br />

glucose readings for 24 hours. To preserve data integrity and save<br />

power, the assembly digitizes, stores and transmits discrete, coded<br />

signals via a wireless link to the wireless remote monitor.<br />

Source: <strong>Echo</strong> <strong>Therapeutics</strong><br />

<strong>Echo</strong> <strong>Therapeutics</strong> is currently using a one-piece biosensor (not<br />

shown), which provides for reduced manufacturing costs and<br />

eliminates most of the motion artifact seen using the pilot biosensor,<br />

thus improving performance. Successful results using the one-piece<br />

biosensor were announced on November 19, 2009. (see Clinical<br />

Trials & Clinical Data)<br />

Symphony Wireless Remote Monitor<br />

The Symphony wireless remote monitor receives digitally coded data from the transdermal glucose sensor transmitter<br />

and decodes the data once every minute. Once a reference blood glucose value is entered manually (a calibration) after a<br />

one hour warm-up period, the decoded data are converted to blood glucose reading by a built-in data algorithm. The<br />

Symphony wireless remote monitor displays the date, time of day, sensor current, blood glucose reading and rate of<br />

increase or decrease, amount of time the transmitter has been switched on, battery status, and any alarm or error modes.<br />

The keypad provides on/off, data entry, calibration, alarm<br />

silencing, and monitor resetting and the monitor also contains<br />

Symphony Wireless Remote Monitors<br />

an audible alarm, a RF receiver, a programming port, a<br />

rechargeable battery pack and a USB data port for computerized<br />

record keeping or in-depth data analysis.<br />

In addition, <strong>Echo</strong> <strong>Therapeutics</strong> expects that hospital monitors<br />

Standalone Monitor Hospital Cellphones<br />

may be fitted with a receiver module for in-patient management.<br />

Source: <strong>Echo</strong> <strong>Therapeutics</strong><br />

Finally, data transmission via internet and/or wireless carrier<br />

opens up the possibility for remote monitoring and telemedicine applications.<br />

Clinical Trials & Clinical Data<br />

Prelude Skin-Prep System<br />

On August 24, 2010, <strong>Echo</strong> <strong>Therapeutics</strong> announced the successful completion of a clinical study of their Prelude skinprep<br />

system in ablating the skin prior to the application of OTC 4% lidocaine cream for faster-acting local dermal<br />

anesthesia. The blinded comparison study evaluated the performance of Prelude prior to the application of 4% lidocaine<br />

cream for local analgesia and demonstrated improvement and a faster onset of action.<br />

On November 11, 2010, a 510(k) premarket notification was submitted to the FDA for <strong>Echo</strong>’s Prelude SkinPrep System<br />

for use with 4% lidocaine cream. Investors should also note that FDA 510(k) clearance triggers a $750,000 milestone<br />

payment 90 days later from <strong>Echo</strong>’s partner, Ferndale Pharma Group in addition to sales royalties. Ferndale Pharma Group<br />

has guaranteed a minimum royalty of $12.6 million to <strong>Echo</strong> <strong>Therapeutics</strong>. While <strong>Echo</strong> has granted Ferndale a license to<br />

develop, market and sell Prelude for delivery of topical 4% lidocaine product in North America and the United<br />

Kingdom, <strong>Echo</strong> retains the rights to continental Europe and Australia which may provide additional upside to <strong>Echo</strong><br />

through future partnership licensing and royalty agreements.<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 4

www.LifeTechCapital.com August 16, 2011<br />

Symphony tCGM<br />

On November 19, 2009 <strong>Echo</strong> <strong>Therapeutics</strong> announced positive results of a clinical study of its Symphony tCGM<br />

System in patients with Type 1 and Type 2 Diabetes using the new one-piece biosensor. This could allow the<br />

Symphony tCGM to complete a final pivotal trial in Q2 2010 with an FDA PMA filing in Q3 2010. Although the<br />

company has not yet announced the trial details, we believe a rational trial design would be approximately 200 critical<br />

care patients, both diabetic and non-diabetic, with a primary endpoint of point and rate accuracy using continuous<br />

glucose-error grid analysis (CG-EGA) versus laboratory reference glucose monitoring.<br />

The details of the November 19, 2009 positive clinical study of the Symphony tCGM System in patients with Type 1<br />

and Type 2 Diabetes using the new one-piece biosensor were as follows:<br />

Study Design: After Prelude skin ablation, 10 Symphony tCGM biosensors were applied to subjects with<br />

Type 1 or Type 2 Diabetes. Venous reference blood samples were taken from intravenous lines at 15-minute<br />

intervals for 24 hours and measured on a YSI 2300STAT PLUS laboratory analyzer. At the conclusion of the 24-<br />

hour study period, the test skin sites were inspected for redness or any other undesirable effects.<br />

Study Results: Using approximately 900 Symphony tCGM glucose readings paired with reference blood<br />

glucose measurements, CG-EGA revealed that the accuracy of the <strong>Echo</strong>’s Symphony tCGM System, measured<br />

as a percentage of accurate readings and benign errors, was 97%. The MARD for the study was 12.89%. There<br />

were no adverse events reported from the Prelude skin permeation or the Symphony tCGM biosensor.<br />

Methods: CGM performance is evaluated with multiple analytical tools, as defined by the Clinical and<br />

Laboratory Standards Institute’s POCT05-A guideline. The primary metric, used to evaluate clinical accuracy, is<br />

the continuous glucose–error grid analysis (CG-EGA). The CG-EGA is a categorization of all data pairs based on<br />

the clinical significance of the accuracy. Accurate readings result in the same clinical decision when based on the<br />

CGM trend vs. the underlying blood glucose fluctuations. Benign errors lead to the same clinical outcome as<br />

accurate readings even though the actual clinical decision may differ. Erroneous readings lead to clinical errors.<br />

CGM performance is measured as the sum of accurate readings and benign errors. Numerical accuracy is the other<br />

key method for evaluating CGM performance. The most widely accepted tool is mean absolute relative difference<br />

(MARD). MARD is a standard error calculation tool that is used to measure the average absolute value of the<br />

relative (or percentage) difference between two measurements.<br />

Previous Pilot Studies<br />

Research results from three human clinical pilot studies titled “Pilot Studies of Transdermal Continuous Glucose<br />

Measurement in Outpatient Diabetic Patients and in Patients during and after Cardiac Surgery”* and published in the<br />

July 2008 issue of the Journal of Diabetes Science and Technology indicated that <strong>Echo</strong> <strong>Therapeutics</strong> transdermal<br />

Continuous Glucose Monitoring (tCGM) system was successful and that the new Prelude abrasion technology works as<br />

well the older, bulkier SonoPrep ultrasound system.<br />

* Authors: Han Chuang, Ph.D., <strong>Echo</strong> <strong>Therapeutics</strong>, Inc.<br />

My-Quyen Trieu, B.S., <strong>Echo</strong> <strong>Therapeutics</strong>, Inc.<br />

James Hurley, Ph.D., <strong>Echo</strong> <strong>Therapeutics</strong>, Inc.<br />

Elizabeth J. Taylor, M.S., CCRC, CDE, MassResearch, LLC<br />

Michael R. England, M.D., Department of Anesthesia, Tufts University School of Medicine<br />

Stanley A. Nasraway, Jr., M.D., FCCM, Department of Surgery, Tufts Medical Center<br />

The number of patients with demographic data for the three studies is shown below:<br />

Patient<br />

Demographics<br />

Study 1<br />

Diabetes<br />

Study 2<br />

Critical Care<br />

Study 3<br />

Abrasion vs.<br />

Ultrasound<br />

Male 5 (50%) 7 (87.5%) 4 (66.7%)<br />

Female 5 (50%) 1 (12.5%) 2 (33.3%)<br />

Type I Diabetes 1 (10%) 1 (12.5%) 0<br />

Type II Diabetes 9 (90%) 4 (50%) 0<br />

Non-Diabetic 0 3 (37.5%) 6 (100%)<br />

Ave. Age / Std. Dev. 63.4 / 8.8 66.4 / 6.8 41.1 / 8.9<br />

Source: Chuang, et al, “Pilot Studies of Transdermal Continuous Glucose Measurement in Outpatient<br />

Diabetic Patients and in Patients during and after Cardiac Surgery”, J Diabetes Sci Technol 2008;2(4):595-602<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 5

www.LifeTechCapital.com August 16, 2011<br />

Study I - Patients with Diabetes: Patients with<br />

diabetes (type-1 or type-2) were enrolled in the study<br />

and were free to eat, move, or sleep at the clinic,<br />

simulating home use. SonoPrep (ultrasound) skin<br />

permeation and installation of the tCGM was<br />

performed at the clinic with blood glucose<br />

measurements taken at least hourly during the waking<br />

period with data being blinded to ensure that there<br />

were no changes in the subjects’ routine medication.<br />

The reference device was Bayer’s Ascensia Contour<br />

meter.<br />

Study I Results – 12 Hour Biosensor Data<br />

A total of 222 biosensor data points were processed.<br />

The calibration point was the first reference blood<br />

glucose measurement taken 1 hour after the tCGM<br />

was turned on, and a lag time of 22 minutes was<br />

applied to BG data, based on the best correlation<br />

between reference BG and biosensor data as computed<br />

by the algorithm. Using polyethylene glycol diacrylate<br />

(PEGDA hydrogel), the 12-hour mean absolute<br />

relative difference (MARD) was 12.4% with 89.6% of<br />

the data points within the clinically accurate A zone of<br />

the Clarke error grid (CEG) plot and 98.7% in the<br />

clinically relevant A+B zones. It also showed strong<br />

correlation to the reference measurements with a<br />

median R2 (square of correlation coefficient) of 0.77.<br />

The data plot is shown below:<br />

Source: Chuang, et al, “Pilot Studies of Transdermal Continuous Glucose Measurement<br />

in Outpatient Diabetic Patients and in Patients during and after Cardiac Surgery”,<br />

J Diabetes Sci Technol 2008;2(4):595-602<br />

Using PEGDA hydrogel with a porous membrane, the 12-hour MARD was 20.4% and the medium R2 was 0.64 when<br />

compared to reference measurements. Error grid analysis revealed that 70.7% of the data points fell in the A zone with<br />

96.9% in the A+B zones. Introduction of the protective membrane appeared to deteriorate the biosensor performance.<br />

However, the authors noted that using a composite porous membrane showed significant improvement in Study II.<br />

Below are two sample datasets, where the continuous trace of tCGM measurements closely tracks the discrete reference<br />

BG values for 12 hours.<br />

Real-Time Biosensor Blood Glucose Measurements Correlate With Reference Blood Glucose Levels<br />

Patient with High Glucose Levels<br />

Patient with Low Glucose Levels<br />

Source: Chuang, et al, “Pilot Studies of Transdermal Continuous Glucose Measurement in Outpatient Diabetic Patients and in Patients during and after<br />

Cardiac Surgery”, J Diabetes Sci Technol 2008;2(4):595-602<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 6

www.LifeTechCapital.com August 16, 2011<br />

Study II - Patients in Surgical Critical Care: Data was collected from 8 out 11 patients enrolled, of which 1 patient did<br />

not complete the study, and 2 patients were excluded<br />

due to a low biosensor signal, which the authors<br />

Study II Results – 24 Hour Biosensor Data<br />

believe was due to low glucose flux and insufficient<br />

skin permeation using the older SonoPrep<br />

(ultrasound). The reference device during surgery was<br />

the Nova Stat Profile Ultra C and the devices used in<br />

the cardiothoracic intensive care unit (CITU) were the<br />

Accu-Check Inform system glucometer, the Bayer<br />

Rapidlab 865 blood gas analyzer for whole blood<br />

glucose and the Unicel DXC 800 for serum glucose.<br />

Using PEGDA hydrogel with a composite porous<br />

membrane and hermetic seals, 147 biosensor data<br />

points were analyzed from the 8 evaluable patients in<br />

12 datasets (7 intraoperative and 5 postoperative). The<br />

24-hour mean absolute relative difference (MARD)<br />

was 11.6% with 86.4% of the data points within the<br />

clinically accurate A zone of the Clarke error grid<br />

(CEG) plot and 100% in the clinically relevant A+B<br />

zones. It also showed strong correlation to the<br />

reference measurements with a median R2 (square of<br />

correlation coefficient) of 0.83. The data plot is shown<br />

below:<br />

Source: Chuang, et al, “Pilot Studies of Transdermal Continuous Glucose Measurement<br />

in Outpatient Diabetic Patients and in Patients during and after Cardiac Surgery”,<br />

J Diabetes Sci Technol 2008;2(4):595-602<br />

Below are datasets from the intraoperative and postoperative periods showing that the continuous trace of tCGM<br />

measurements closely tracked the discrete reference values. There was no marked difference of sensor performance<br />

between intraoperative and postoperative study periods and no observable interferences from the surgical procedure and<br />

the use of routinely administered concomitant medications. The study demonstrated that the tCGM system accurately<br />

predicted blood glucose readings in a cardiac surgical ICU setting every minute for up to 24 hours.<br />

Real-Time Biosensor Blood Glucose Measurements Correlate With Reference Blood Glucose Levels<br />

Patient During Cardiac Surgery<br />

Patient in Intensive Care Unit (ICU)<br />

Source: Chuang, et al, “Pilot Studies of Transdermal Continuous Glucose Measurement in Outpatient Diabetic Patients and in Patients during and after<br />

Cardiac Surgery”, J Diabetes Sci Technol 2008;2(4):595-602<br />

Study III - Abrasion vs Ultrasound Skin Permeation: This study was designed to compare two skin permeation<br />

methods, the new Prelude (abrasion) versus the older SonoPrep (ultrasound) technologies for transdermal glucose<br />

monitoring. 6 healthy in-house subjects completed the enrollment with 183 Prelude and 195 SonoPrep biosensor data<br />

points collected. The reference device was Bayer’s Ascensia Contour meter.<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 7

www.LifeTechCapital.com August 16, 2011<br />

The 24-hour MARD was 9.0% with Prelude and 10.8% with SonoPrep. 100% of the data points from both methods fell in<br />

the A+B zones of the CEG. The median R2 was 0.70 and 0.79 for Prelude and SonoPrep, respectively. Shown below is<br />

one sample dataset overlapping two calibrated continuous glucose measurements, where close proximity of the two traces<br />

can be clearly seen throughout the study period. Overall, Prelude exhibited equivalent performance to SonoPrep for use of<br />

the tCGM system.<br />

Study III Results – Prelude Abrasion Equivalent to Ultrasound<br />

Source: Chuang, et al, “Pilot Studies of Transdermal Continuous Glucose Measurement in<br />

Outpatient Diabetic Patients and in Patients during and after Cardiac Surgery”,<br />

J Diabetes Sci Technol 2008;2(4):595-602<br />

The authors summarized their conclusions as follows:<br />

“A reliable method for continuous glucose monitoring represents an unmet need for both home care and critical<br />

care settings; when developed and refined successfully, the tCGM product can address this need. A cost-effective<br />

and easy-to-use Prelude SkinPrep exhibits equivalent performance to SonoPrep for tCGM application. With the<br />

advantages of a 1-hour warm-up period and minimally invasive nature, the tCGM system may become a preferred<br />

medical device in facilitating diabetes management. A combination of our new skin permeation and needle-free<br />

sensing technologies may provide a low-cost, convenient, safe, and effective solution for continuous glucose<br />

monitoring in diverse populations.”<br />

Diabetes Market<br />

According to the U.S. Centers for Disease Control (CDC), almost 18 million people have been diagnosed with diabetes in<br />

the United States and almost 6 million people remain undiagnosed. Diabetes is currently the seventh leading cause of<br />

death U.S. based on death certificates. Even then, diabetes is likely to be underreported as a cause of death as studies have<br />

found that only about 35% to 40% of decedents with diabetes had it listed anywhere on the death certificate and only<br />

about 10% to 15% had it listed as the underlying cause of death. Overall, the risk for death among people with diabetes is<br />

about twice that of people without diabetes of similar age.<br />

Diagnosed<br />

Undiagnosed<br />

Total<br />

Diabetes Prevalence in U.S.<br />

17.9 million people 5.9% of US Population<br />

5.7 million people 1.9% of US Population<br />

23.6 million people 7.8% of US Population<br />

Diabetes Demographics in U.S.<br />

Age 20+ Years 23.5 million 10.7% of this Age Group<br />

Age 60+ Years 12.2 million 23.1% of this Age Group<br />

Men 12.0 million 11.2% of men over 20<br />

Women 11.5 million 10.2% of women over 20<br />

Source: US Centers for Disease Control (CDC) data for 2007<br />

Uncontrolled diabetes can result in heart disease and stroke, high blood pressure, blindness, kidney disease, nervous<br />

system disease, amputations and dental disease. Total direct medical costs are estimated at $116 billion and costs for<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 8

www.LifeTechCapital.com August 16, 2011<br />

people diagnosed with diabetes were 2.3 times higher than what expenditures would be in the absence of diabetes. An<br />

additional $58 billion in indirect costs are due to disability, work loss, and premature mortality.<br />

Costs spent on inpatient hospital care were $58.3 billion and $9.9 billion on physician’s office visits directly attributed to<br />

diabetes. Diabetes-related hospitalizations totaled 24.3 million days in 2007 (an increase of 7.4 million from 2002). The<br />

average cost for a hospital inpatient day due to diabetes was $1,853. The average cost for a hospital inpatient day due to<br />

diabetes-related chronic complications, including neurological, peripheral vascular, cardiovascular, renal, metabolic, and<br />

ophthalmic complications was $2,281.<br />

FDA to Require Hospitals to Use More Accurate Glucose Monitors<br />

As reported in the July 19, 2009 issue of The New York Times titled “Standards Might Rise on Monitors for Diabetics”,<br />

the FDA is concerned that current self-monitoring blood glucose (SMBG) devices are not accurate enough as error rates<br />

up to 20% are allowed under existing approval standards (ISO 15197) developed 7 years ago. The FDA has now placed<br />

this approval standard up for review in light of the failed NICE-SUGAR in-hospital trial (see NICE-SUGAR Trial). The<br />

FDA Center for Devices and Radiological Health (CDRH) believes the high incidence of hypoglycemia seen in the NICE-<br />

SUGAR trial was probably caused by hospitals using inaccurate glucose monitors in attempting tight glycemic control for<br />

hospital patients which resulted in too much insulin being delivered to the patient.<br />

In response to the NICE-SUGAR results, FDA Commissioner, Dr. Margaret Hamburg June 24, 2009 letter (including<br />

CDRH analysis) to the American Association of Clinical Endocrinologists stated:<br />

“Nevertheless, many hospitals continue to use SMBG devices, cleared only as aids in the management of diabetic<br />

patients, in these settings, even though they are not FDA cleared to diagnose disease or to maintain tight glycemic control<br />

of diabetic and non-diabetic patients in the hospital environment. This practice can be problematic. Where hospitalized<br />

patients are sicker (such as those in the ICU), any inaccuracies in the meters would pose different risks of greater<br />

magnitude than expected in the population and use for which the SMBG devices are cleared.”<br />

The FDA now wants to restrict the use of self-monitoring glucose monitors in hospitals in favor of more accurate methods<br />

including the development of continuous glucose monitors for intensive insulin therapy in the hospital setting such as<br />

<strong>Echo</strong> <strong>Therapeutics</strong>’ Symphony Transdermal Continuous Glucose Monitor (tCGM) system.<br />

Reference Information<br />

New York Times – July 19, 2009<br />

“Standards Might Rise on Monitors for Diabetics”<br />

http://www.nytimes.com/2009/07/19/health/policy/19monitor.html<br />

FDA Letter and CDRH Analysis– June 24, 2009<br />

FDA Commissioner Dr. Hamburg to AACE President Dr. Garber<br />

http://www.nytimes.com/packages/pdf/health/20090717_MONITOR_1.pdf<br />

FDA Warns of Potentially Fatal Errors with GDH-PQQ Glucose Monitors<br />

On August 13, 2009, the FDA issued a Public Health Notification warning of potentially fatal errors with GDH-PQQ<br />

glucose monitoring technology. Specifically, GDH-PQQ (glucose dehydrogenase pyrroloquinoline quinine) glucose<br />

monitoring measures a patient’s blood glucose value using methodology that cannot distinguish between glucose and<br />

other sugars. Certain non-glucose sugars, including maltose, xylose, and galactose, are found in certain drug and biologic<br />

formulations, or can result from the metabolism of a drug or therapeutic product. When these non-glucose sugars are<br />

present in the patient’s blood, using a GDH-PQQ glucose test strip will produce an elevated glucose result which may<br />

suggest the need for clinical action. This can lead to inappropriate dosing and administration of insulin, potentially<br />

resulting in hypoglycemia, coma, or death. In addition, cases of actual hypoglycemia may go unrecognized if the patient<br />

and healthcare practitioner rely solely on the test result obtained with the GDH-PQQ glucose test strips. The FDA<br />

recommends avoiding the use of GDH-PQQ glucose test strips in healthcare facilities.<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 9

www.LifeTechCapital.com August 16, 2011<br />

Reference Information<br />

FDA Public Health Notification: Potentially Fatal Errors with GDH-PQQ* Glucose Monitoring Technology<br />

http://www.fda.gov/MedicalDevices/Safety/AlertsandNotices/PublicHealthNotifications/ucm176992.htm<br />

List of GDH-PQQ Glucose Test Strips and Manufacturers<br />

http://www.fda.gov/MedicalDevices/Safety/AlertsandNotices/PublicHealthNotifications/ucm176992.htm#attachment<br />

We believe this demonstrate the new FDA desire to restrict the use of self-monitoring glucose monitors in hospitals in<br />

favor of more accurate methods including the development of continuous glucose monitors for intensive insulin therapy in<br />

the hospital setting such as <strong>Echo</strong> <strong>Therapeutics</strong>’ Symphony Transdermal Continuous Glucose Monitor (tCGM) system.<br />

COMPETITION<br />

There are a limited number of continuous glucose monitor<br />

systems currently on the market. The significant differences<br />

between <strong>Echo</strong> <strong>Therapeutics</strong> Symphony system and the<br />

competition is the needle-free transdermal biosensor, clinical<br />

trials in the hospital setting and biosensor life.<br />

We believe the transdermal biosensor is a significant advantage<br />

over the existing biosensors on the market. All existing FDAapproved<br />

continuous glucose monitoring (CGM) systems are<br />

needle-based, requiring insertion of a glucose sensor into the<br />

patient’s skin, which gives rise to risks of infection,<br />

inflammation or bleeding at the insertion site. Symphony is a<br />

non-invasive tCGM system that does not require insertion of its<br />

glucose sensor and thus does not give rise to the risks associated<br />

with needle-based CGM systems.<br />

Transdermal vs. Needle BioSensor<br />

Source: Mayo Clinic and LifeTech Capital<br />

We also believe <strong>Echo</strong> <strong>Therapeutics</strong> clinical trials in the critical care setting provides a major marketing advantage over the<br />

competition in the hospital market. The Symphony system would represent an answer to the new FDA demands for<br />

more accurate glucose monitors in the hospital. (see FDA to Require Hospitals to Use More Accurate Glucose Monitors)<br />

Irritation From 7-Day DexCom BioSensor<br />

We further believe that the comparatively short 1-2 day biosensor life<br />

is not a drawback, but rather an advantage. In the at-home market, the<br />

weekly biosensors begin to lose adhesion after several showers,<br />

swimming and other physical activity and rubbing against clothing. It<br />

can cost a person $60 if they accidently dislodge or damage the<br />

biosensor whereas a cheaper 1-2 day biosensor reduces the economic<br />

risk of biosensor damage through daily activity.<br />

lenses.<br />

Source: Kerri Morrone Sparling<br />

Additionally, skin irritation from being in contact with the adhesive as<br />

well as the possibility of infection raises hygiene issues. The risk of<br />

infection becomes a significant issue in the critical care/ICU market.<br />

We believe a 1 or 2 day biosensor makes more sense in the same way<br />

daily disposable contact lenses are safer than extended wear contact<br />

Finally, there are risks involving the competitor’s need for sensor wires resulting in sensor wire fractures underneath the<br />

patients’ skin. The FDA issued a warning letter to DexCom concerning these sensor wire fractures in May 2010 and also<br />

noted that the DexCom SEVEN and SEVEN PLUS Systems are not approved for use in children or adolescents, pregnant<br />

women or persons on dialysis and can only be used in the abdomen. (see FDA Warning Letter to DexCom on Sensor Wire<br />

Factures)<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 10

www.LifeTechCapital.com August 16, 2011<br />

Continuous Glucose Monitors<br />

Company<br />

<strong>Echo</strong><br />

<strong>Therapeutics</strong><br />

Abbott Labs DexCom Medtronic MiniMed<br />

Stock Symbol <strong>ECTE</strong> ABT DXCM MDT (div. of MDT)<br />

Device Symphony Freestyle Navigator<br />

DexCom<br />

SEVEN PLUS<br />

Guardian RT Paradigm<br />

Target Markets<br />

Critical Care<br />

& Home use<br />

Home use Home use Home use Home use<br />

Needle-Free Yes No No No No<br />

Sensor Life 24 to 48 hours 120 hours 168 hours 72 hours 72 hours<br />

Initialization Time ~ 1 hour 10 hours 2 hours 2 hours 2 hours<br />

Calibrations<br />

At 10, 12, 24 and<br />

TBA<br />

Required<br />

74 hours<br />

Every 12 hours Every 12 hours Every 12 hours<br />

Accuracy >97% 98.0% 97.0% 98.9% 98.9%<br />

MARD 7.5% - 16% 9.3% - 12.3% 13.0% - 15.9% 15.6% - 19.7% 15.6% - 19.7%<br />

Frequency of<br />

Reading<br />

1 min 1 min 5 min 5 min 5 min<br />

Pricing for<br />

System:<br />

Sensors:<br />

TBA<br />

(competitive)<br />

$1,000<br />

$370<br />

$450<br />

$280<br />

$1,000<br />

$370<br />

$1,000<br />

$370<br />

(1 mo. supply)<br />

Regulatory Status Clinical trials Approved Approved Approved Approved<br />

Source: <strong>Echo</strong> <strong>Therapeutics</strong> and LifeTech Capital<br />

Competitive Update: <strong>Echo</strong> <strong>Therapeutics</strong> competitor DexCom (Nasdaq:DXCM) and their partner, Edwards<br />

LifeSciences (NYSE:EW) received a CE-Mark in Europe in October 2009 for their 1 st generation GlucoClear ®<br />

continuous glucose monitoring (CGM) system for in-hospital critical use and filed with the FDA in Q2 2010. They<br />

stated they have enhanced its ease of use in their 2 nd generation product, which they expect to receive a CE-Mark by<br />

year-end with a launch in Europe in 2012. Investors should note that the GlucoClear ® system uses an invasive<br />

blood-based intravenous sensor, not a subcutaneous interstitial fluid sensor.<br />

DexCom has stated they are working on a 5th generation sensor platform which applies aspects of their blood-based<br />

hospital sensor, for Edwards LifeSciences, into a subcutaneous sensor for both a future ambulatory sensor and a<br />

subcutaneous sensor for use in the hospital outside of critical care. DexCom stated that it is currently in human<br />

feasibility studies.<br />

We continue to believe that <strong>Echo</strong> <strong>Therapeutics</strong> Symphony transdermal continuous glucose monitoring system<br />

(tCGM) will be the first transdermal CGM system to file with the FDA for the in-hospital use.<br />

FDA Warning Letter to DexCom on Sensor Wire Factures<br />

On May 21, 2010, <strong>Echo</strong> <strong>Therapeutics</strong> competitor DexCom (Nasdaq:DXCM) received an FDA Warning Letter for their<br />

Seven PLUS Continuous Glucose Monitoring System due to complaints involving sensor wire fractures underneath<br />

patient's skin as reported to the FDA. In addition, their sensors are not approved for use in children or adolescents,<br />

pregnant women or persons on dialysis and can only be used in the abdomen. Investors should note that <strong>Echo</strong><br />

<strong>Therapeutics</strong> Symphony Transdermal Continuous Glucose Monitoring (tCGM) system eliminates the need for<br />

sensor wires and could be considered safer, especially for children and adolescents.<br />

(see http://www.fda.gov/ICECI/EnforcementActions/WarningLetters/ucm213414.htm )<br />

Customer Report: 09-5141, dated 7/11/2009 reported a sensor wire broke off in a three (3) year old and reported a<br />

piece of it was under her skin. The mother reported the child had surgery under general anesthesia to remove the<br />

broken wire underneath her skin.<br />

Customer Report: 09-0274, dated 1/6/09 reported the sensor wire tip broke off in patient's body. The DexCom<br />

representative advised patient to not to pursue extraction. The report states "sensor break with fragment retained under<br />

the skin".<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 11

www.LifeTechCapital.com August 16, 2011<br />

Customer Report: 09-3516, dated 5/07/09 the report states (that when) the nurse went to pull the old sensor off the<br />

sensor wire it was not there. The patient's nurse reported she could see it under the skin but she could not get hold of it<br />

with tweezers and then it disappeared. The nurse thinks "it came off and is still in his skin."<br />

Customer Report: 09-3641, dated 5/18/09. Patient reports 2 sensors have broken off under his skin. His most recent<br />

sensor looks broken upon removal today, and he can feel the wire under his skin. Site is red and he is going to<br />

prescribing physician.<br />

Customer Report: 09-5555, dated 7/20/2009. Patient called (to) report a failed sensor and has irritated skin. Patient<br />

reported he thought the wire came out completely, but his doctor removed a "hair like structure" from under his skin.<br />

Customer Report: 09-4237, dated 6/17/2009. Patient is a 30 month old child. Mother called to report sensor wire<br />

breakage under skin of child. Patient taken to the ER when an infection developed.<br />

Partnerships<br />

<strong>Echo</strong> <strong>Therapeutics</strong> has two licensing partnerships which validate the Symphony technology platform:<br />

Handok Pharmaceuticals: The Symphony tCGM was licensed in South Korea to Handok Pharmaceuticals, the largest<br />

diabetes pharmaceutical company in South Korea. Specifically, on June 15, 2009 Handok paid a licensing fee of<br />

approximately $600,000 and will pay <strong>Echo</strong> <strong>Therapeutics</strong> milestone payments upon receipt of US FDA clearance of<br />

Symphony and upon the first commercial sale of Symphony in South Korea. Handok will also pay a royalty on net sales<br />

of Symphony and additional milestone payments based on Handok’s achievement of certain other targets. Handok is<br />

responsible for all product development fees and costs, and for all regulatory filings, for the final development of<br />

Symphony in South Korea.<br />

Ferndale Pharma Group: The Prelude SkinPrep device was licensed to Ferndale Pharma Group to develop and<br />

market for skin preparation prior to the application of a topical analgesic or anesthetic cream for local dermal anesthesia<br />

or analgesia prior to a needle insertion or IV procedure in North America and the U.K. Specifically, on May 27, 2009,<br />

Ferndale Pharma Group paid a licensing fee of $750,000 and will pay <strong>Echo</strong> <strong>Therapeutics</strong> a milestone payment of<br />

$750,000 90 days after US FDA 510(k) medical device clearance of Prelude. Ferndale will also pay an escalating royalty<br />

on net sales and milestone payments based on Ferndale’s achievement of certain net sales targets, as well as guaranteed<br />

minimum royalties, totaling an additional $12.6 million. Ferndale is responsible for all product development fees and<br />

costs, and for all regulatory filings, for the final development of Prelude in North America and the U.K.<br />

Financial Model & Valuation<br />

Our financial model assumes the timing of <strong>Echo</strong> <strong>Therapeutics</strong> clinical milestones and events as show below:<br />

MILESTONES & EVENTS<br />

Date Prelude SkinPrep Symphony tCGM<br />

Q1’10 Pilot Study<br />

Q2’10<br />

Q3’10 Results of Equivalency Trial<br />

Q4’10 File FDA 510(k) Submission<br />

Q1’11<br />

Q2’11<br />

Q3’11<br />

FDA 510(k) Approval<br />

U.S. Launch (Ferndale Pharma)<br />

Q4’11 Initiate Final Pilot Trial<br />

Q1’12<br />

Complete Final Pilot Trial<br />

Initiate Pivotal Trial<br />

Q2’12 Complete Pivotal Trial<br />

Q3’12 File FDA PMA Submission<br />

Q4’12<br />

FDA PMA Approval<br />

U.S. Launch<br />

Source: <strong>Echo</strong> <strong>Therapeutics</strong> and LifeTech Capital Estimates<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 12

www.LifeTechCapital.com August 16, 2011<br />

U.S. ICU Glucose Monitoring Market<br />

According to the Society of Critical Care Medicine (SCCM), approximately 5 million patients are admitted annually into<br />

ICUs in the U.S. (in 87,000 ICU beds) with an average length of ICU stay of 6.1 days when an interventionist is treating<br />

(rising to 9.3 days if treated by an attending physician). The U.S. Centers for Disease Control (CDC) states that the<br />

prevalence of diabetes is 7.8% of the U.S. population (assuming undiagnosed diabetic patients will become diagnosed<br />

once in the ICU). Anecdotally, fully-loaded hospital costs run approximately $50-$100 per day for monitoring glucose<br />

and rise to $200 per day if tight glycemic control is required for the patient.<br />

Estimated U.S. Market for ICU Continuous Glucose Monitoring<br />

Variable Avg. Minimum Upside to Minimum Avg. Maximum Most Likely<br />

ICU Patients 5 million 5 million 5 million<br />

Diabetic Patients 7.8% Pre- and possibly Non-diabetic patients 100% 15%<br />

Length of Stay 6 days Can be up to 9 days if attending physician 8 days 7 days<br />

Cost per Day $50 Can be up to $200 for tight glycemic control $100 $75<br />

Total U.S. Market $120 million $4 billion $400 million<br />

We calculate that the U.S. market, for just diabetic and pre-diabetic patients in ICU, is approximately $400 million<br />

however it will take some time for sales to reach this level. It is important to note that should the <strong>Echo</strong> <strong>Therapeutics</strong><br />

Symphony tCGM system become the standard of care (including non-diabetic patients), the U.S. market opportunity<br />

would increase dramatically to $1+ billion in sales.<br />

U.S. Home-Use Continuous Glucose Monitoring Market<br />

Although we expect <strong>Echo</strong> <strong>Therapeutics</strong> to eventually address the U.S. home-use market for continuous glucose monitors<br />

with the Symphony tCGM system, we have not included this market in our financial models. We believe that <strong>Echo</strong><br />

<strong>Therapeutics</strong> will remain focused on becoming the first continuous glucose monitoring system in the ICU and hospital<br />

setting and exploit their first-mover advantage. However, the home-use market remains a future upside to the company.<br />

U.S. Topical Lidocaine Market<br />

U.S. sales of Endo Pharmaceuticals Lidoderm ® (5% lidocaine) patch were $764 million in 2009 with the market for all<br />

topical local anesthetics estimated to be $1.2 billion for 2009. Based on the Ferndale Pharma Group licensing agreement<br />

(see Partnerships) there is a guaranteed minimum royalty totaling $12.6 million. Until we receive more visibility on<br />

Ferndale’s marketing plan, we are assuming <strong>Echo</strong> <strong>Therapeutics</strong>’ will receive the minimum annual royalty.<br />

Margins<br />

For Symphony tCGM product line, we believe that <strong>Echo</strong> <strong>Therapeutics</strong> will sell for cost, or give away, the Prelude<br />

component of the Symphony system while generating approximately 80% on the consumables (Prelude tips and<br />

BioSensors) yielding an overall margin of that we estimate at35% and is in-line with other medical technology products.<br />

Since Ferndale will purchase the Prelude for use with lidocaine at cost yielding no gross profit, we reflect only the<br />

Prelude royalty portion for the sake of clarity in our financial model. A higher royalty stream from increased Prelude<br />

sales to Ferndale remains an upside to our model.<br />

Valuation<br />

Our valuation based is on 35x projected 2013 EPS and discounted 35% for risk yielding a 12-18 month target of $6.00 as<br />

the FDA PMA approval of the Symphony tCGM system could occur within the forecast period. This would result in a<br />

market capitalization of approximately $200 million. This represents a significant discount to DexCom (Nasdaq:DXCM)<br />

(see Competition), the only pure-play comparable, which has FDA approval for their invasive, implantable biosensors<br />

with a market capitalization of approximately $800 million.<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 13

www.LifeTechCapital.com August 16, 2011<br />

Intellectual Property<br />

Update:<br />

On August 8, 2011, <strong>Echo</strong> <strong>Therapeutics</strong> received notice that their patent application titled, "System and Method for<br />

Continuous Non-Invasive Glucose Monitoring" will issue as U.S. Patent No. 7,963,917 with an expiration in 2025. We<br />

believe U.S. Patent #7,963,917 represents a keystone patent in <strong>Echo</strong> <strong>Therapeutics</strong> intellectual property portfolio and<br />

that their Symphony® tCGM system now has a significant barrier to competitive entry. Investors can access the patent at<br />

http://1.usa.gov/qEGZ2x<br />

The company also received notice that its patent application entitled "Transdermal Analyte for Monitoring Systems and<br />

Methods for Analyte Detection" was issued as South Africa Patent No. 2009/06959 and will expire in 2028. Additionally,<br />

<strong>Echo</strong> has received notice that its applications for the trademark PRELUDE has been registered for use in International<br />

Class 10 in South Korea and Mexico; and its application for the trademark SYMPHONY has been registered for use in<br />

International Class 10 in Israel.<br />

<strong>Echo</strong> Therapeutic has 12 U.S. patents and 29 foreign patents with over 40 patent applications pending in the U.S. and<br />

foreign countries.<br />

Recent Financing Activity<br />

On August 1, 2011 <strong>Echo</strong> <strong>Therapeutics</strong> filed a universal shelf registration statement on Form S-3 with the SEC to raise up<br />

to $75,000,000 in capital.<br />

On February 8, 2011, there was a closing in connection with the Series D Agreement and <strong>Echo</strong> <strong>Therapeutics</strong> received cash<br />

proceeds of $2.5M for the purchase of 2,500,000 shares of Series D Stock. <strong>Echo</strong> issued 1,006,000 shares of Series D<br />

Stock in exchange for the extinguishment of an 8% Senior Promissory Note issued by <strong>Echo</strong> on January 5, 2011 in the<br />

principal amount of $1,000,000, plus interest accrued through February 1, 2011 in the amount of $6,000.<br />

The Company issued an aggregate of 1,753,000 Series D-1 Warrants and 1,753,000 Series D-2 Warrants to the Series D<br />

Investors pursuant to the Series D Agreement. The Series D Warrants are immediately exercisable and expire on<br />

February 7, 2013; however, if the Series D Warrants are not exercised in full by February 7, 2013 by virtue of the<br />

application of a beneficial ownership blocker (described below), then the term of the Series D Warrants shall be extended<br />

for thirty (30) days past the date on which the beneficial ownership blocker is no longer applicable. The exercise price is<br />

subject to adjustment for stock splits, business combinations or similar events. An exercise under the Series D Warrants<br />

may not result in the holder beneficially owning more than 4.99% or 9.99%, as applicable, of all of the Common Stock<br />

outstanding at the time; provided, however, that a holder may waive the foregoing provision upon sixty-one (61) days’<br />

advance written notice to the Company.<br />

Pursuant to the Certificate of Designation, Preferences and Rights of Series D Convertible Preferred Stock, the shares of<br />

Series D Stock are initially convertible into shares of Common Stock at a price per share equal to $1.00, subject to<br />

adjustment for stock splits, business combinations or similar events, and shall have a liquidation preference equal to their<br />

stated value. Each holder who receives Series D Stock may convert it at any time following its issuance. The Series D<br />

Stock does not pay a dividend and is not redeemable.<br />

On January 5, 2011, <strong>Echo</strong> <strong>Therapeutics</strong> entered into a strategic short term financing arrangement with Platinum Montaur<br />

Life Sciences, one of their largest institutional investors, and issued an 8% Senior Promissory Note in the principal<br />

amount of $1,000,000. The outstanding principal amount of the Note will accrete in value at an annual rate of 8%,<br />

compounded monthly, and is due on February 1, 2011. Also on January 5, 2011, <strong>Echo</strong> and Montaur also entered into a<br />

binding Term Sheet to which Montaur and any new investors will invest at least $3,000,000 through the purchase of<br />

shares of a newly-created class of Series D Convertible Preferred Stock and common stock purchase warrants. The<br />

parties intend to exchange the Note for Series D Stock no later than February 1, 2011, at which time Montaur will<br />

purchase an additional $500,000 of Series D Stock. Montaur subsequently shall purchase $1,500,000 of Series D Stock in<br />

monthly installments from March through May 2011, for a total investment of at least $3,000,000. For every $100,000<br />

face value of Series D Stock purchased, the Investor shall be issued (i) Series 1 warrants to purchase 50,000 shares of the<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 14

www.LifeTechCapital.com August 16, 2011<br />

common stock with an exercise price of $1.50 per share (ii) Series 2 warrants to purchase 50,000 shares of Common<br />

Stock with an exercise price of $2.50 per share. The Warrants shall have a term of two years provided, that if the Warrants<br />

are not exercised in full at the expiration of the term by virtue of the application of a beneficial ownership blocker, then<br />

the term of the Warrants shall be extended until such time as the beneficial ownership blocker is no longer applicable.<br />

On November 26, 2010, <strong>Echo</strong> Therapeutic entered into a Subscription Agreement with certain strategic institutional and<br />

accredited investors of up to 120 units at a price per Unit of $25,000. Each Unit consists of (i) 25,000 shares of the<br />

Company’s Common Stock (ii) Series-1 warrants to purchase 12,500 shares of Common Stock with an exercise price of<br />

$1.50 per share (iii) Series-2 warrants to purchase 12,500 shares of Common Stock with an exercise price of $2.50 per<br />

share. <strong>Echo</strong> <strong>Therapeutics</strong> has received aggregate proceeds of $1,936,500 for the purchase of an aggregate of 77.46 Units.<br />

As a result <strong>Echo</strong> <strong>Therapeutics</strong> issued an aggregate of 968,250 Series-1 Warrants and 968,250 Series-2 Warrants<br />

exercisable immediately and which expire no later than January 4, 2013.<br />

As of June 30, 2011 <strong>Echo</strong> <strong>Therapeutics</strong> had 13,003,221 outstanding common stock warrants with a weighted-average<br />

exercise price of $1.73. In addition, <strong>Echo</strong> <strong>Therapeutics</strong> had 2,413,766 exercisable employee stock options with a<br />

weighted-average exercise price of $0.85 as of June 30, 2010. Finally, <strong>Echo</strong> <strong>Therapeutics</strong> had 34,248,796 shares of<br />

common stock outstanding as of August 10, 2011.<br />

STAR 3 Trial Results - Continuous Glucose Monitoring Benefits<br />

On July 22, 2010, the New England Journal of Medicine published the successful results of the 489-patient STAR 3 Phase<br />

IV clinical trial for Medtronic’s (NYSE:MDT) MiniMed Paradigm REAL-Time System combining an insulin pump with<br />

their continuous glucose monitor. The paper titled “Effectiveness of Sensor-Augmented Insulin-Pump Therapy in Type 1<br />

Diabetes” concluded “In both adults and children with inadequately controlled type 1 diabetes, sensor-augmented pump<br />

therapy resulted in significant improvement in glycated hemoglobin levels, as compared with injection therapy. A<br />

significantly greater proportion of both adults and children in the pump-therapy group than in the injection-therapy<br />

group reached the target glycated hemoglobin level.” Specifically, the results showed that the 1 year baseline glycated<br />

hemoglobin level of 8.3% had decreased to 7.5%, as compared with 8.1% in the injection-therapy group (P

www.LifeTechCapital.com August 16, 2011<br />

As the NEJM editorial points out, the NICE-SUGAR study “simply tells us there is no additional benefit from the<br />

lowering of blood glucose levels below the range of approximately 140 to 180 mg per deciliter”. In fact, we believe this<br />

may have been a result of too tight control in trying to achieve a low level of blood glucose and overshooting the target as<br />

hypoglycemia was seen in 6.8% of the patients versus 0.5% in the control arm. As proof, previous Belgian studies<br />

comparing intensive glycemic management to standard of care showed a patient survival benefit when reduction of<br />

glucose level was initiated only if the level is markedly elevated at >215 mg per deciliter.<br />

A joint statement by the American Diabetes Association (ADA) and the American Association of Clinical<br />

Endocrinologists (AACE) on the NICE-SUGAR study on intensive vs. conventional glucose control in critically ill<br />

patients said the results “should NOT lead to an abandonment of the concept of good glucose management in the hospital<br />

setting. Uncontrolled high blood glucose can lead to serious problems for hospitalized patients, such as dehydration and<br />

increased propensity to infection. It is important to consider that the severely ill patients in this trial were treated<br />

intensively with intravenous insulin to very tight<br />

targets (average of 115 mg/dl), and were compared<br />

to a control group whose glucose control was good<br />

(average glucose 144 mg/dl).”<br />

<strong>Echo</strong> <strong>Therapeutics</strong> Symphony is a continuous<br />

glucose monitoring system (not insulin delivery) and<br />

the trial may have failed because they did not use<br />

accurate continuous glucose monitoring but rather<br />

only checked once an hour (or 30 minutes at start)<br />

and used inaccurate glucose meters resulting in<br />

overshooting the blood glucose target and causing<br />

hypoglycemia. Even the NICE-SUGAR study<br />

authors stated “We do agree that more accurate<br />

systems for blood glucose measurement are<br />

required.” in their NEJM Correspondence reply.<br />

Finally, we note that a meta-analysis, including the<br />

NICE-SUGAR study published in the April 14, 2009 Canadian Medical Association Journal (CMAJ) showed that<br />

intensive glucose therapy may be beneficial to adults and children admitted to a surgical ICU (the setting that <strong>Echo</strong><br />

<strong>Therapeutics</strong> is addressing) and the CMAJ commentary discusses the reasons why patients in surgical ICUs benefit from<br />

intensive insulin therapy.<br />

Management<br />

Reference Information<br />

NEJM Paper<br />

http://content.nejm.org/cgi/content/short/360/13/1283<br />

NEJM Editorial<br />

http://content.nejm.org/cgi/content/short/360/13/1346<br />

NEJM Correspondence<br />

http://content.nejm.org/cgi/content/short/361/1/89<br />

ADA/AACE Joint Statement<br />

http://www.diabetes.org/for-media/pr-NICE_SUGAR-study.jsp<br />

CMAJ Paper<br />

http://www.cmaj.ca/cgi/content/full/180/8/821<br />

CMAJ Commentary<br />

http://www.cmaj.ca/cgi/content/full/180/8/799<br />

NICE-SUGAR Trial Documentation<br />

https://studies.thegeorgeinstitute.org/nice/docs/ALGORITHM.pdf<br />

https://studies.thegeorgeinstitute.org/nice/docs/PROTOCOL.pdf<br />

https://studies.thegeorgeinstitute.org/nice/docs/SAP.pdf<br />

Patrick T. Mooney MD, CEO, President and Chairman of the Board: Dr. Mooney joined <strong>Echo</strong> in September 2007 as<br />

a result of the merger of Sontra Medical Corporation and then privately-held <strong>Echo</strong> <strong>Therapeutics</strong>, Inc. (ETI), for which he<br />

served as President, Chief Executive Officer and director from September 2006 through the date of the merger. Prior to<br />

joining ETI, Dr. Mooney was President, Chief Executive Officer and Chairman of Aphton Corporation (Nasdaq: APHT),<br />

where he had also served as Chief Medical Officer. Prior to that, Dr. Mooney served as Senior Biotechnology Analyst at<br />

Thomas Weisel Partners, LLC, a full service merchant banking firm and as Senior Biotechnology Analyst at Janney<br />

Montgomery Scott, LLC, a full services investment banking firm. Dr. Mooney received his medical degree from the<br />

Jefferson Medical College of Thomas Jefferson University and trained in surgery at Thomas Jefferson University<br />

Hospital.<br />

Christopher P. Schnittker, CPA, Chief Financial Officer: Mr. Schnittker most recently, he served as Vice President –<br />

Administration, Corporate Secretary and Chief Accounting Officer of Soligenix, Inc., a publicly-traded biotechnology<br />

company. Prior to that, Mr. Schnittker served as the Senior Vice President and CFO for VioQuest Pharmaceuticals Inc.,<br />

Micromet Inc., Cytogen Corporation, and Genaera Corporation, all publicly-traded biotechnology companies. Mr.<br />

Schnittker has also held prior financial management positions at GSI Commerce, Rhône-Poulenc Rorer (now part of<br />

Sanofi-Aventis), and PricewaterhouseCoopers. He received his B.A. degree in economics and business from Lafayette<br />

College and is a certified public accountant licensed in the State of New Jersey.<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 16

www.LifeTechCapital.com August 16, 2011<br />

Marshall “Mac” Deweese, Vice President of Operations: Mr. Deweese has 16 years of experience with Abbott<br />

Laboratories (formerly MediSense) in the technical product development, program management, and mass manufacture of<br />

portable glucose meters. As the Director of R & D, Program Management, and OEM Operations at Abbott Laboratories,<br />

Mr. Deweese led the industrial design, mechanical engineering, and manufacturing preparation of handheld portable<br />

glucose meters. As the Vice President and co-founder of Massachusetts Technology Associates (Mass Tech), Mr.<br />

Deweese provided engineering and manufacturing services to its client base, specializing in high quality, rapid turnaround<br />

prototype and assembly services. Mr. Deweese studied engineering at Massachusetts Institute of Technology.<br />

Kenneth Gary, Vice President of Research, Clinical and New Products: Mr. Gary has more than 25 years of<br />

experience in the design and development of sensor-based diagnostics and data connectivity systems for the point-of-care<br />

and diabetes markets. As R&D Venture Director for Abbott Diabetes Care, he led the design and development of<br />

hospital-based point-of-care and consumer diabetes testing systems. As General Manager of Breathquant Medical, Mr.<br />

Gary led the design and successful clinical trials for Breathquant's novel low-cost diagnostic system for the rapid detection<br />

of pulmonary embolism. Mr. Gary holds a B.S. in Bioengineering and an M.S. in Chemical Engineering from Columbia<br />

University and an MBA from Boston University.<br />

Independent Directors<br />

Vincent D. Enright: Mr. Enright joined our Board of Directors in March 2008. He has more than 30 years of financial<br />

experience with public companies, including as Senior Vice President and Chief Financial Officer of KeySpan<br />

Corporation, a NYSE public utility company. Mr. Enright currently serves as a director and Audit Committee Chairman<br />

of certain of the funds managed by Gabelli Funds, LLC, a leading mutual fund manager, positions he has held since 1991.<br />

Mr. Enright holds a B.S. degree in Accounting from Fordham.<br />

Shawn K. Singh, JD: Mr. Singh joined <strong>Echo</strong> in September 2007 as a result of the merger of Sontra Medical Corporation<br />

and ETI, for which he served as Chairman of the Board from September 2006 through the date of the merger and as<br />

President and director from September 2004 to September 2006. Mr. Singh has been working with life science companies<br />

for nearly 20 years. In addition to his role with <strong>Echo</strong>, Mr. Singh serves, on a part-time basis, as a Principal of Cato<br />

BioVentures and, on a part-time basis, as Chief Operating Officer (Acting) and director of VistaGen <strong>Therapeutics</strong>. Prior to<br />

joining <strong>Echo</strong>, Mr. Singh served as Chief Business Officer of SciClone Pharmaceuticals (Nasdaq: SCLN), founder and<br />

Managing Director of Start-Up Law, President of Artemis Neuroscience and Corporate Finance Associate in the Silicon<br />

Valley offices of Morrison & Foerster. Mr. Singh is a member of the California State Bar.<br />

William F. Grieco: Since 2008, Mr. Grieco has served as the Managing Director of Arcadia Strategies, LLC, a business<br />

and legal consulting organization servicing healthcare, science and technology companies. He brings approximately 30<br />

years of healthcare industry experience. From 2003 to 2008 he served as Senior Vice President and General Counsel of<br />

American Science and Engineering, Inc., an x-ray inspection technology company, and prior to that he served as Senior<br />

Vice President and General Counsel of IDX Systems Corporation, a healthcare information technology company. From<br />

1995 to 1999, he was Senior Vice President and General Counsel for Fresenius Medical Care North America. Mr. Grieco<br />

received a B.S. from Boston College, an M.S. in Health Policy and Management from Harvard University and a J.D. from<br />

Boston College Law School.<br />

James F. Smith: Mr. Smith is Vice President and Chief Financial Officer of Orchid Cellmark, Inc., a leading<br />

international provider of DNA testing services, where he leads all aspects of finance, including control, financial<br />

reporting, tax, treasury, and M&A. He brings over 30 years of financial management experience, including over 20 years,<br />

with Wyeth and American Cyanamid Company, most recently as Vice President of Finance. During his time at Wyeth<br />

and Cyanamid, he obtained extensive commercial international business experience and was involved in numerous new<br />

product commercialization projects. Mr. Smith started his accounting career at PricewaterhouseCoopers. He is licensed as<br />

a certified public accountant.<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 17

www.LifeTechCapital.com August 16, 2011<br />

Risks<br />

Some of the operational and financial risks to <strong>Echo</strong> <strong>Therapeutics</strong> are:<br />

<br />

<br />

<br />

<br />

<br />

<br />

FDA and Regulatory risks: All of <strong>Echo</strong> <strong>Therapeutics</strong>’ products are ultimately reliant on approvals by the U.S.<br />

FDA and other national regulatory bodies. There can be no guarantee of timely or definite FDA or other national<br />

regulatory body approvals for any of their pipeline products.<br />

Need to Raise Additional Funds: Although it is possible that <strong>Echo</strong> <strong>Therapeutics</strong> may raise sufficient funds for<br />

development through partnership fees, milestone payments and warrant conversions, we believe that the company<br />

will be required to raise additional funds for development and commercialization through the issuance of stock<br />

which would be dilutive to existing shareholders and could potentially affect the share price. We have included<br />

our estimate of future share issuance in our financial model but there can be no guarantee that our estimates are<br />

accurate.<br />

Partnerships: <strong>Echo</strong> <strong>Therapeutics</strong> is reliant on partners to successfully market some its products as well as partners<br />

for development, clinical trials and regulatory filings for some of its products. Failure of <strong>Echo</strong> <strong>Therapeutics</strong>’<br />

existing or future partners to perform satisfactorily or in a timely fashion could adversely impact the company’s<br />

financial position.<br />

Patent Litigation: Third-party claims of infringement of intellectual property could require <strong>Echo</strong> <strong>Therapeutics</strong> to<br />

spend time and money on defending their intellectual property rights up to and including adverse judgments<br />

against <strong>Echo</strong>.<br />

Liquidity and Trading Volume: <strong>Echo</strong> <strong>Therapeutics</strong> currently trades on the OTC Bulletin Board which may result<br />

in both lower trading volume and liquidity possibly leading to large spreads and high volatility in the stock price.<br />

However, we believe <strong>Echo</strong> <strong>Therapeutics</strong> will pursue a listing on the Nasdaq or AMEX exchanges sometime in the<br />

future which could result in higher trading volume and liquidity.<br />

Sector Rotation: <strong>Echo</strong> <strong>Therapeutics</strong> is a small medical technology development company often kept in a portfolio<br />

with similar companies. In such cases, a significant event for one company may have a material impact on the<br />

valuation of all similar companies regardless of their unique qualities.<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 18

www.LifeTechCapital.com August 16, 2011<br />

<strong>Echo</strong> <strong>Therapeutics</strong> (<strong>ECTE</strong>) Page 19

www.LifeTechCapital.com August 16, 2011<br />

DISCLOSURES<br />

Ratings and Price Target Changes over Past 3 Years<br />

Initiated January 21, 2010 – Strong Speculative Buy - Price Target $4.50<br />

Updated February 14, 2011 – Strong Speculative Buy - Price Target $6.00<br />

Analyst Certification: We, Stephen M. Dunn and William D. Dawson, the authors of this research report certify that a.) All of the views<br />

expressed in this report accurately reflect our personal views about any and all of the subject securities or issuers discussed b.) No part<br />

of our compensation is directly or indirectly related to the specific recommendations or views expressed in this research report and c.)<br />

We may be eligible to receive other compensation based upon various factors, including total revenues of the Firm and its affiliates as<br />

well as a portion of the proceeds from a broad pool of investment vehicles consisting of components of the compensation generated by<br />

investment banking activities, including but not limited to shares of stock and/or warrants, which may or may not include the securities<br />

referenced in this report.<br />

DISCLOSURES<br />

Does the Analyst or any member of the Analyst’s household have a financial interest in any securities of the Company?<br />

Does the Analyst or any member of the Analyst's household or Firm serve as an officer, director or advisory board member of<br />

the Company?<br />

Has the Analyst or any member of the Analyst’s household received compensation directly or indirectly from the Company in the<br />

previous 12 months?<br />

Does the Firm or affiliates beneficially own ≥1% of the Company’s common stock?<br />

Has the Firm or affiliates received investment banking services compensation in previous 12 months?<br />

Has the Firm or affiliates received non-investment banking securities-related services compensation in previous 12 months?<br />

Does the Firm or affiliates expect to receive or intend to seek investment banking compensation in next 3 months?<br />

Has the Firm or affiliates received non-securities services compensation in previous 12 months?<br />

Does the Firm or affiliates make a market in the Company’s securities?<br />

NO<br />

NO<br />

NO<br />

NO<br />

YES<br />

NO<br />

YES<br />

YES<br />

NO<br />

The Firm and/or its directors and employees may own securities of the company(s) in this report and may increase or decrease<br />