uc santa cruz

2012â2013 Dependent Student Verification Packet - UC Santa Cruz ...

2012â2013 Dependent Student Verification Packet - UC Santa Cruz ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

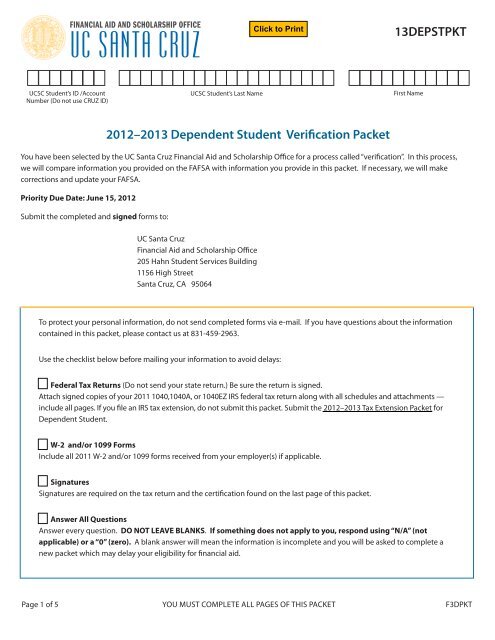

FINANCIAL AID AND SCHOLARSHIP OFFICE<br />

<strong>uc</strong> <strong>santa</strong> <strong>cruz</strong><br />

13DEPSTPKT<br />

UCSC Student’s ID /Account<br />

Number (Do not use CRUZ ID)<br />

UCSC Student’s Last Name<br />

First Name<br />

2012–2013 Dependent Student Verification Packet<br />

You have been selected by the UC Santa Cruz Financial Aid and Scholarship Office for a process called “verification”. In this process,<br />

we will compare information you provided on the FAFSA with information you provide in this packet. If necessary, we will make<br />

corrections and update your FAFSA.<br />

Priority Due Date: June 15, 2012<br />

Submit the completed and signed forms to:<br />

UC Santa Cruz<br />

Financial Aid and Scholarship Office<br />

205 Hahn Student Services Building<br />

1156 High Street<br />

Santa Cruz, CA 95064<br />

To protect your personal information, do not send completed forms via e-mail. If you have questions about the information<br />

contained in this packet, please contact us at 831-459-2963.<br />

Use the checklist below before mailing your information to avoid delays:<br />

q Federal Tax Returns (Do not send your state return.) Be sure the return is signed.<br />

Attach signed copies of your 2011 1040,1040A, or 1040EZ IRS federal tax return along with all schedules and attachments —<br />

include all pages. If you file an IRS tax extension, do not submit this packet. Submit the 2012–2013 Tax Extension Packet for<br />

Dependent Student.<br />

q W-2 and/or 1099 Forms<br />

Include all 2011 W-2 and/or 1099 forms received from your employer(s) if applicable.<br />

q Signatures<br />

Signatures are required on the tax return and the certification found on the last page of this packet.<br />

q Answer All Questions<br />

Answer every question. DO NOT LEAVE BLANKS. If something does not apply to you, respond using “N/A” (not<br />

applicable) or a “0” (zero). A blank answer will mean the information is incomplete and you will be asked to complete a<br />

new packet which may delay your eligibility for financial aid.<br />

Page 1 of 5 You must complete all pages of this packet F3DPKT

FINANCIAL AID AND SCHOLARSHIP OFFICE<br />

<strong>uc</strong> <strong>santa</strong> <strong>cruz</strong><br />

13DEPSTPKT<br />

UCSC Student’s ID /Account<br />

Number (Do not use CRUZ ID)<br />

UCSC Student’s Last Name<br />

2012–2013 Dependent Student Verification Packet<br />

First Name<br />

1. Print the student’s name and ID/account number clearly at the top of all pages of this packet.<br />

2. The parent and student who provided the FAFSA information must complete and sign the Certification on page 5.<br />

3. The parent and student must answer all questions. IF THE ANSWER IS ZERO, OR IS NOT APPLICABLE, WRITE IN A “O”. DO NOT LEAVE BLANKS.<br />

Student living arrangements during the 2012-13 academic year (check one):<br />

q On Campus q Off Campus q With parent(s) q Undecided<br />

Federal Tax Returns and Income Information<br />

STUDENT<br />

q A complete, signed copy of my 2011 IRS federal income tax return is attached (including schedules and attachments).<br />

q I will not file a 2011 IRS federal income tax return. Please report wages earned and business income below.<br />

q Wages earned during 2011 from work<br />

q Net business income<br />

$____________<br />

Do Not Leave Blank<br />

$____________<br />

Do Not Leave Blank<br />

q Do you own and control more than 50% of a business with over 100 employees? q yes<br />

q no<br />

PARENT<br />

q A complete, signed copy of my 2011 IRS federal income tax return is attached (including schedules and attachments).<br />

q I will not file a 2011 IRS federal income tax return. Please report wages earned and business income below.<br />

q Wages earned during 2011 from work by $_______________ Do Not Leave Blank father/stepfather<br />

$_______________ Do Not Leave Blank mother/stepmother<br />

q Net business income earned by<br />

$_______________ Do Not Leave Blank father/stepfather<br />

$_______________ Do Not Leave Blank mother/stepmother<br />

q Do you own and control more than 50% of a business with over 100 employees? q yes q no<br />

In 2010 or 2011, did you or anyone in your household receive benefits from any of the Federal programs listed? Mark all programs that apply:<br />

q Supplemental Security Income q Food Stamps (SNAP) q Free or red<strong>uc</strong>ed price lunch q TANF q WIC<br />

other Income Information<br />

PARENT<br />

STUDENT<br />

1. Child support received by you for any of your children. Don’t include foster care or adoption payments. $____________/yr. Do Not Leave Blank $____________ N/A<br />

2. Housing, food, and other living allowances paid to members of the military, clergy and<br />

others (including cash payments and cash value of benefits). Don’t include the value of<br />

on-base military housing or the value of a basic military allowance for housing. $____________/yr. Do Not Leave Blank $____________/yr.<br />

Do Not Leave Blank<br />

3. Veterans noned<strong>uc</strong>ation benefits, s<strong>uc</strong>h as Disability, Death Pension, or Dependency &<br />

Indemnity Compensation (DIC) and/or VA Ed<strong>uc</strong>ational Work-Study allowances. $____________/yr. Do Not Leave Blank $____________/yr.<br />

Do Not Leave Blank<br />

4. Other untaxed income not reported s<strong>uc</strong>h as workers’ compensation, disability, etc. Do not<br />

include student aid, earned income credit, additional child tax credit, welfare payments, untaxed<br />

Social Security Benefits, Supplemental Security Income, Workforce Investment Act ed<strong>uc</strong>ational<br />

benefits, combat pay (if you are not a tax filer), benefits from special spending arrangements<br />

(e.g. cafeteria plans), foreign income exclusion, or credit for federal tax on special fuels. $____________ Do Not Leave Blank $____________/yr.<br />

Do Not Leave Blank<br />

5. Money received or paid on your behalf (e.g. bills) not reported elsewhere on this form. $____________/yr. N/A<br />

$____________/yr.<br />

Do Not Leave Blank<br />

Do not include financial aid. Please state source: _____________________________________<br />

Page 2 of 5 You must complete all pages of this packet F3DPKT

UCSC Student’s ID /Account<br />

Number (Do not use CRUZ ID)<br />

UCSC Student’s Last Name<br />

First Name<br />

other Income Information continued PARENT STUDENT<br />

6. Child support paid by you because of divorce or separation or as a result of a legal requirement.<br />

Don’t include support for children in your household.<br />

List names _______________________________________________________________ $____________/yr. Do Not Leave Blank $____________/yr.<br />

N/A<br />

7. Taxable earnings from need-based employment programs, s<strong>uc</strong>h as Federal Work-Study and<br />

need-based employment portions of fellowships and assistantships. $____________/yr. Do Not Leave Blank $____________/yr.<br />

Do Not Leave Blank<br />

8. Taxable student grant and scholarship aid reported to the IRS in your adjusted gross income.<br />

Includes AmeriCorps benefits (awards, living allowances and interest accrual payments), as<br />

well as grant and scholarship portions of fellowships and assistantships. $____________/yr. Do Not Leave Blank $____________/yr.<br />

Do Not Leave Blank<br />

9. Combat pay or special combat pay. Only enter the amount that was taxable and included<br />

in your adjusted gross income. Do not enter untaxed combat pay.<br />

10. Earnings from work under a cooperative ed<strong>uc</strong>ation program offered by a college.<br />

$____________/yr. Do Not Leave Blank<br />

$____________/yr. Do Not Leave Blank<br />

$____________/yr.<br />

Do Not Leave Blank<br />

$____________/yr.<br />

Do Not Leave Blank<br />

Savings, Investments and Other Assets on the Date the FAFSA was Filed<br />

Note: Investments do not include the home you live in, the value of life insurance, retirement plans (pension funds,<br />

annuities, non-ed<strong>uc</strong>ation IRA’s, Keogh plans, etc.)<br />

PARENT<br />

STUDENT<br />

Cash, Savings and Checking Accounts $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Trust Funds $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

UGMA/UTMA Accounts $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Money Market $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Mutual Funds $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Certificates of Deposit $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Stock $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Stock Options $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Bonds, other securities $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Installment and Land Sale Contracts $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Other (specify)_____________________________ $____________________ Do Not Leave Blank<br />

$____________________<br />

Do Not Leave Blank<br />

Ed<strong>uc</strong>ational Benefits $____________________ Do Not Leave Blank<br />

$____________________<br />

N/A<br />

Ed<strong>uc</strong>ational Savings Accounts $____________________ Do Not Leave Blank<br />

$____________________<br />

N/A<br />

529 College Savings Accounts for all family members $____________________ Do Not Leave Blank<br />

$____________________<br />

N/A<br />

Refund Value of 529 Prepaid Tuition Plans $____________________ Do Not Leave Blank<br />

$____________________<br />

N/A<br />

For Office Use Only:<br />

Total Investments ____________________ ____________________<br />

Page 3 of 5 You must complete all pages of this packet F3DPKT

UCSC Student’s ID /Account<br />

Number (Do not use CRUZ ID)<br />

UCSC Student’s Last Name<br />

First Name<br />

Parent Real Estate Investments<br />

Does your parent own real estate investments excluding the home you live in? q Yes q No<br />

If yes, provide details below.<br />

Complete this information for all real estate you own other than the home you live in, s<strong>uc</strong>h as mobile homes, condos, duplexes,<br />

rental property, land, summer homes, etc, as of the date the 2012-13 FAFSA was filed.<br />

Property 1 (Do not report the home you live in):<br />

Current Market Value* $ ____________ Mortgage Balance $ ____________ Purchase Price $ ____________ Year Acquired _______<br />

Property Address _______________________________________________________________________________________________<br />

Street address City State Zip Code<br />

Property 2 (Do not report the home you live in):<br />

Current Market Value* $ ____________ Mortgage Balance $ ____________ Purchase Price $ ____________ Year Acquired _______<br />

Property Address _______________________________________________________________________________________________<br />

Street address City State Zip Code<br />

Property 3 (Do not report the home you live in):<br />

Current Market Value* $ ____________ Mortgage Balance $ ____________ Purchase Price $ ____________ Year Acquired _______<br />

Property Address _______________________________________________________________________________________________<br />

Street address City State Zip Code<br />

Complete this section if you, the parent, RENTED OUT A PORTION OF THE HOME YOU LIVE IN that meets the following criteria:<br />

the rental unit has its own entry and includes a kitchen and bath. The portion of your home that generates rental income is<br />

considered an asset and must be reported as an investment net worth on the FAFSA. Complete the following information about<br />

the home you live in:<br />

Current Market Value* $ ___________ Mortgage Balance $ ___________ Purchase Price $ ___________ Year Acquired ______<br />

Rental Square Footage ___________ + Home Square Footage ___________ = Total Dwelling Square Footage ___________<br />

*on the date you filed the FAFSA<br />

Student Real Estate Investments<br />

Does the student own any real estate investment property q yes<br />

q no<br />

For Office Use Only<br />

Total Current Market Value _______________ – Total Mortgage Balance ________________ = Real Estate Net Worth_____________<br />

Total Investments_________________ + Real Estate Net Worth _______________ =Total Investment Net Worth_________________<br />

Page 4 of 5 You must complete all pages of this packet F3DPKT

UCSC Student’s ID /Account<br />

Number (Do not use CRUZ ID)<br />

UCSC Student’s Last Name<br />

First Name<br />

Household Information<br />

List the people in your household. Include yourself, your spouse, and your children, if (a) you provide more than half of their support or (b) the<br />

children would be required to provide parental information when applying for Federal Student Aid. List any other people if they now live with<br />

you and you provide more than half of their support and will continue to provide more than half of their support from July 1, 2012 through June<br />

30, 2013. If you have additional people to list, attach a separate sheet of paper with the required information.<br />

Full Name of Family<br />

Member in Household<br />

Date<br />

of Birth<br />

MM/DD/YY<br />

Age<br />

Relationship<br />

to Student<br />

Social Security Number<br />

Name of College<br />

(if attending in<br />

2012–2013)<br />

For those enrolled in<br />

college for 2012–13,<br />

list current degree<br />

objective.*<br />

Father/<br />

Stepfather<br />

Mother/<br />

Stepmother<br />

UCSC<br />

Student<br />

self<br />

– –<br />

– –<br />

– –<br />

UCSC<br />

Other<br />

Members in<br />

Household<br />

– –<br />

– –<br />

– –<br />

– –<br />

*AA, BA, BS, Certificate, MA, PhD, MD, DDS<br />

In 2010 or 2011, did you receive federal low-income housing s<strong>uc</strong>h as HUD or Section 8? q Yes q No<br />

CERTIFICATION<br />

• I hereby declare that all information reported on this document is true, complete, and accurate to the best of my knowledge.<br />

• I understand that any false statement or misrepresentation will be cause for denial, red<strong>uc</strong>tion, cancellation and/or repayment of financial aid.<br />

• I understand that verifications of enrollment will be required if family members are listed in college.<br />

• This document must be received no later than June 15, 2012 to meet the priority deadline for all types of financial aid.<br />

Parent, please report your marital status as of the date you submitted the 2012-2013 Fafsa application. Please provide the month and year<br />

you were married, separated, divorced, widowed, or a California Registered Domestic Partner in the box next to your selection.<br />

Single<br />

Divorced<br />

Separated<br />

Month Year<br />

Month Year<br />

Married/Remarried<br />

Widowed<br />

Month<br />

Month<br />

Year<br />

Year<br />

California Registered Domestic Partner<br />

Month<br />

Year<br />

Parent Signature _________________________________________ Date ___/____/_____ Parent Name__________________________________<br />

please print<br />

Parent Phone ( _______ ) ________________________________ Parent E-mail Address ________________________________________________<br />

Student Signature ______________________________________________________ Date ____/_____/______<br />

Return to: UC Santa Cruz Financial Aid and Scholarship Office, 205 Hahn Student Services Building, 1156 High Street, Santa Cruz, CA 95064<br />

Phone: (831) 459-2963 Web: financialaid.<strong>uc</strong>sc.edu. For your protection and security, please do not e-mail forms.<br />

Page 5 of 5 You must complete all pages of this packet F3DPKT