SERVICE TURNOVER TAX For Hoteliers and Tourist Marine Vessel Operators

SERVICE TURNOVER TAX For Hoteliers and Tourist Marine Vessel ...

SERVICE TURNOVER TAX For Hoteliers and Tourist Marine Vessel ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

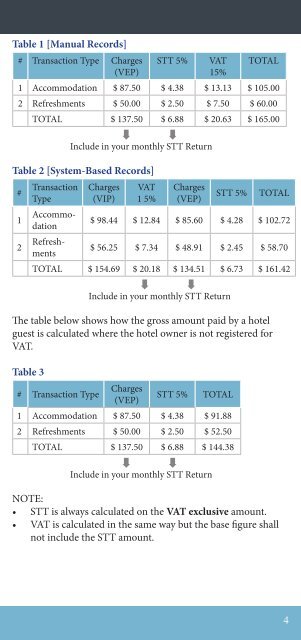

Table 1 [Manual Records]<br />

# Transaction Type Charges<br />

(VEP)<br />

STT 5%<br />

VAT<br />

15%<br />

TOTAL<br />

1 Accommodation $ 87.50 $ 4.38 $ 13.13 $ 105.00<br />

2 Refreshments $ 50.00 $ 2.50 $ 7.50 $ 60.00<br />

TOTAL $ 137.50 $ 6.88 $ 20.63 $ 165.00<br />

Table 2 [System-Based Records]<br />

#<br />

1<br />

2<br />

Transaction<br />

Type<br />

Accommodation<br />

Refreshments<br />

Charges<br />

(VIP)<br />

VAT<br />

1 5%<br />

Charges<br />

(VEP)<br />

STT 5%<br />

TOTAL<br />

$ 98.44 $ 12.84 $ 85.60 $ 4.28 $ 102.72<br />

$ 56.25 $ 7.34 $ 48.91 $ 2.45 $ 58.70<br />

TOTAL $ 154.69 $ 20.18 $ 134.51 $ 6.73 $ 161.42<br />

The table below shows how the gross amount paid by a hotel<br />

guest is calculated where the hotel owner is not registered for<br />

VAT.<br />

Table 3<br />

# Transaction Type<br />

Include in your monthly STT Return<br />

Include in your monthly STT Return<br />

Charges<br />

(VEP)<br />

STT 5%<br />

TOTAL<br />

1 Accommodation $ 87.50 $ 4.38 $ 91.88<br />

2 Refreshments $ 50.00 $ 2.50 $ 52.50<br />

TOTAL $ 137.50 $ 6.88 $ 144.38<br />

Include in your monthly STT Return<br />

NOTE:<br />

• STT is always calculated on the VAT exclusive amount.<br />

• VAT is calculated in the same way but the base figure shall<br />

not include the STT amount.<br />

4