Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20<br />

Bankinter’s new mortgage loan features all the benefits that<br />

the Bank normally offers with this type of product, and can<br />

be signed up to on the same financial terms as a ‘Hipoteca<br />

Sin Más’, i.e. using the mortgaged residential property as<br />

the only security.<br />

New online fixed income broker<br />

Bankinter has launched a new online fixed income broker,<br />

through which the Bank’s customers can directly access a<br />

wide range of public and private debt issues both domestic<br />

and international.<br />

Bankinter’s fixed income broker enables clients to buy<br />

and sell debt issues in the secondary market, use various<br />

search tools to filter the issues best suited to each particular<br />

customer’s needs and actively monitor the fixed income<br />

portfolio, accessing the valuations of their issues, the details<br />

of their transactions, movements, coupon payments, etc.<br />

The fixed income broker product offering includes domestic<br />

and foreign public and private debt issues: mortgage-backed<br />

bonds, senior private debt and subordinated debt.<br />

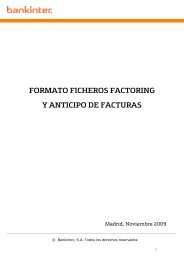

Bankinter Mobile Telephony, relaunch of the operator<br />

with new rates.<br />

During the quarter, Bankinter’s mobile telephony<br />

distribution service launched a new commercial offering<br />

which, among other advantages, includes calls at one<br />

euro cent a minute at any time and to any destination.<br />

The new Smartphone Rate, positioned as one of the<br />

cheapest in the market, involves a drastic reduction in<br />

the nominal price per minute compared with the rates<br />

previously offered by the operator.<br />

Along with calls at one euro cent a minute, the new<br />

Smartphone Rate features the following conditions: a<br />

monthly fee of €6, which includes a flat rate for 500<br />

MB of high-speed data; as well as free calls between<br />

Bankinter telephones and no charge for data traffic to<br />

Bankinter destinations, meaning that navigation and<br />

SMS to the Bank’s web pages and services from a mobile<br />

phone, or even using the broker service from a mobile,<br />

will cost the customer nothing.<br />

For customers who make more intensive use of the<br />

mobile phone, Bankinter offers one of the cheapest<br />

voice and data rates in the market, the ‘Tarifa 19’, which<br />

includes 250 minutes a month of ‘anytime, anywhere’<br />

calls and 1 GB of high-speed data navigation. All this<br />

for just €19 a month for life, without a long-term<br />

commitment.