Asthma Therapeutics in Major Developed Markets Growth & Trend to 2020 Radiant Insights, Inc

Summary Radiant Insights, a leading business intelligence provider, has released its latest research report,"Asthma Therapeutics in Major Developed Markets to 2020 - Personalized Treatment for Severe Asthma to Drive Market Growth despite Patent Expirations".The asthma therapeutics market is forecast to grow marginally over the forecast period across the top eight developed nations, from $18.4 billion in 2013 to a projected value of $21.7 billion by 2020 at a Compound Annual Growth Rate (CAGR) of 2.4%. This is in spite of generic erosion facing several of the leading asthma brands, such as Advair (fluticasone propionate/salmeterol xinafoate), Symbicort (budesonide/formoterol fumarate) and Xolair (omalizumab), and is a consequence of new market entrants and rising disease prevalence. The global prevalence of asthma is significant, believed to affect approximately 300 million people worldwide. This burden is predicted to increase in future, reaching 400 million by 2025. Access This Full Report @ http://www.radiantinsights.com/research/asthma-therapeutics-in-major-developed-markets-to-2020-personalized-treatment-for-severe-asthma-to-drive-market-growth-despite-patent-expirations Although the majority of asthma patients are able to manage their symptoms effectively using currently marketed products, some remain inadequately controlled with these same products. This unmet need, coupled with rising global prevalence, has resulted in strong industry interest. Consequently, the current asthma pipeline is highly innovative, featuring several promising molecules in late-stage drug development. Biologics and monoclonal antibodies, the latter in particular, are gaining prominence within the indication. Novel monoclonal antibodies such as mepolizumab, reslizumab, lebrikizumab, and dupilumab target Interleukins (IL), or IL receptors, and have demonstrated potential in severe and inadequately controlled eosinophilic asthma, in turn representing a shift towards personalized therapy. Despite the fact that they target only a small patient sub-set, they are likely to be priced highly and to drive market growth, offsetting the impact of generic erosion.

Summary

Radiant Insights, a leading business intelligence provider, has released its latest research report,"Asthma Therapeutics in Major Developed Markets to 2020 - Personalized Treatment for Severe Asthma to Drive Market Growth despite Patent Expirations".The asthma therapeutics market is forecast to grow marginally over the forecast period across the top eight developed nations, from $18.4 billion in 2013 to a projected value of $21.7 billion by 2020 at a Compound Annual Growth Rate (CAGR) of 2.4%. This is in spite of generic erosion facing several of the leading asthma brands, such as Advair (fluticasone propionate/salmeterol xinafoate), Symbicort (budesonide/formoterol fumarate) and Xolair (omalizumab), and is a consequence of new market entrants and rising disease prevalence.

The global prevalence of asthma is significant, believed to affect approximately 300 million people worldwide. This burden is predicted to increase in future, reaching 400 million by 2025.

Access This Full Report @ http://www.radiantinsights.com/research/asthma-therapeutics-in-major-developed-markets-to-2020-personalized-treatment-for-severe-asthma-to-drive-market-growth-despite-patent-expirations

Although the majority of asthma patients are able to manage their symptoms effectively using currently marketed products, some remain inadequately controlled with these same products. This unmet need, coupled with rising global prevalence, has resulted in strong industry interest.

Consequently, the current asthma pipeline is highly innovative, featuring several promising molecules in late-stage drug development. Biologics and monoclonal antibodies, the latter in particular, are gaining prominence within the indication. Novel monoclonal antibodies such as mepolizumab, reslizumab, lebrikizumab, and dupilumab target Interleukins (IL), or IL receptors, and have demonstrated potential in severe and inadequately controlled eosinophilic asthma, in turn representing a shift towards personalized therapy. Despite the fact that they target only a small patient sub-set, they are likely to be priced highly and to drive market growth, offsetting the impact of generic erosion.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

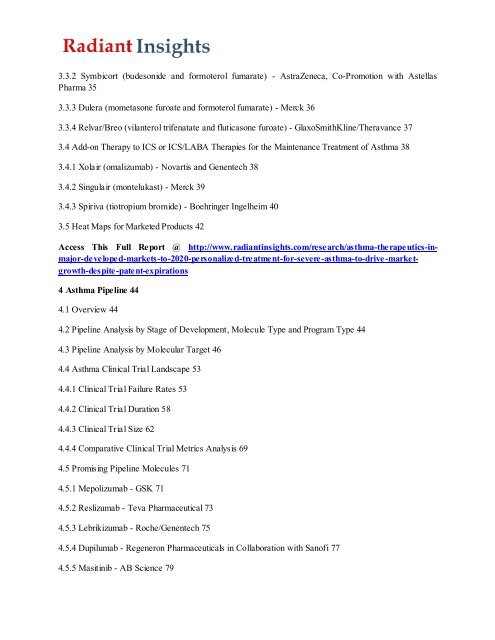

3.3.2 Symbicort (budesonide and formoterol fumarate) - AstraZeneca, Co-Promotion with Astellas<br />

Pharma 35<br />

3.3.3 Dulera (mometasone furoate and formoterol fumarate) - Merck 36<br />

3.3.4 Relvar/Breo (vilanterol trifenatate and fluticasone furoate) - GlaxoSmithKl<strong>in</strong>e/Theravance 37<br />

3.4 Add-on Therapy <strong>to</strong> ICS or ICS/LABA Therapies for the Ma<strong>in</strong>tenance Treatment of <strong>Asthma</strong> 38<br />

3.4.1 Xolair (omalizumab) - Novartis and Genentech 38<br />

3.4.2 S<strong>in</strong>gulair (montelukast) - Merck 39<br />

3.4.3 Spiriva (tiotropium bromide) - Boehr<strong>in</strong>ger Ingelheim 40<br />

3.5 Heat Maps for Marketed Products 42<br />

Access This Full Report @ http://www.radiant<strong>in</strong>sights.com/research/asthma-therapeutics-<strong>in</strong>major-developed-markets-<strong>to</strong>-<strong>2020</strong>-personalized-treatment-for-severe-asthma-<strong>to</strong>-drive-marketgrowth-despite-patent-expirations<br />

4 <strong>Asthma</strong> Pipel<strong>in</strong>e 44<br />

4.1 Overview 44<br />

4.2 Pipel<strong>in</strong>e Analysis by Stage of Development, Molecule Type and Program Type 44<br />

4.3 Pipel<strong>in</strong>e Analysis by Molecular Target 46<br />

4.4 <strong>Asthma</strong> Cl<strong>in</strong>ical Trial Landscape 53<br />

4.4.1 Cl<strong>in</strong>ical Trial Failure Rates 53<br />

4.4.2 Cl<strong>in</strong>ical Trial Duration 58<br />

4.4.3 Cl<strong>in</strong>ical Trial Size 62<br />

4.4.4 Comparative Cl<strong>in</strong>ical Trial Metrics Analysis 69<br />

4.5 Promis<strong>in</strong>g Pipel<strong>in</strong>e Molecules 71<br />

4.5.1 Mepolizumab - GSK 71<br />

4.5.2 Reslizumab - Teva Pharmaceutical 73<br />

4.5.3 Lebrikizumab - Roche/Genentech 75<br />

4.5.4 Dupilumab - Regeneron Pharmaceuticals <strong>in</strong> Collaboration with Sanofi 77<br />

4.5.5 Masit<strong>in</strong>ib - AB Science 79