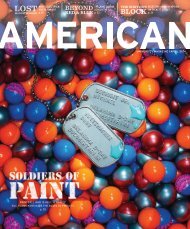

American Magazine: November 2015

In this issue, explore the painful past and peaceful rebirth of Hiroshima; meet plane crash survivor and author Robin Suerig Holleran; reminisce about a time when AU was a soccer powerhouse, hop on the Metro to Bethesda, and get to know some of AU’s 1,800 San Fran transplants. Also in the November issue: 3 minutes on the Federal Reserve, the history of Clawed, and an Uber quiz.

In this issue, explore the painful past and peaceful rebirth of Hiroshima; meet plane crash survivor and author Robin Suerig Holleran; reminisce about a time when AU was a soccer powerhouse, hop on the Metro to Bethesda, and get to know some of AU’s 1,800 San Fran transplants. Also in the November issue: 3 minutes on the Federal Reserve, the history of Clawed, and an Uber quiz.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

expert<br />

3 MINUTES ON . . . The Federal Reserve<br />

Eric Pajonk<br />

CAS/BA ’09<br />

Media relations director<br />

Federal Reserve Bank of New York<br />

The Federal Reserve is the<br />

central bank<br />

of the United States.<br />

It’s composed of a<br />

central, independent<br />

governmental agency called<br />

the Board of Governors in<br />

Washington, DC, and a dozen<br />

regional Federal Reserve<br />

Banks in cities throughout<br />

the nation.<br />

President Woodrow Wilson<br />

established it in 1913 when he<br />

signed the Federal<br />

Reserve Act into<br />

law. Prior to that, the US<br />

economy was plagued by<br />

frequent episodes of financial<br />

turmoil, bank failures, and<br />

credit scarcity,<br />

most notably the<br />

Panic of<br />

1907. In<br />

response, the Fed, as it’s come<br />

to be known, was created to<br />

provide the nation with a safer,<br />

more flexible, and more stable<br />

monetary and financial system.<br />

The entire Federal<br />

Reserve System has<br />

about 20,000 employees. They<br />

are a wide range of professionals,<br />

from economists, markets<br />

experts, and bank examiners to<br />

staff that handle<br />

cash processing<br />

and even gold<br />

vault custodians.<br />

Janet Yellen is the chair of the<br />

Federal Reserve Board.<br />

The Fed has four general<br />

responsibilities. First, we<br />

conduct the nation’s monetary<br />

policy by influencing money and<br />

credit conditions in<br />

the economy in<br />

pursuit of full<br />

employment and stable prices.<br />

Second, we supervise<br />

banks and other financial<br />

institutions. Third, we<br />

maintain the<br />

stability of the financial<br />

system and contain systemic<br />

risk that may arise in financial<br />

markets. And finally,<br />

we provide certain<br />

financial services to<br />

the US government, US financial<br />

institutions, and foreign official<br />

institutions. We play a major role<br />

in operating and overseeing the<br />

nation’s payments systems.<br />

Lots of people know the Fed<br />

simply as the institution that sets<br />

interest rates. Monetary<br />

policy actually is set<br />

by the Federal<br />

Open Market<br />

Committee (FOMC),<br />

which is composed of the<br />

members of the Fed’s Board of<br />

Governors and the presidents of<br />

five Federal Reserve Banks,<br />

including the Federal Reserve<br />

Bank of New York. The FOMC<br />

formulates<br />

monetary policy<br />

by setting a target for the federal<br />

funds rate, the interest rate that<br />

banks charge one another for<br />

short-term loans.<br />

As stipulated by law,<br />

the aim of monetary<br />

policy is “to promote<br />

effectively the goals of maximum<br />

employment, stable prices, and<br />

moderate long-term interest<br />

rates.” One way the Fed<br />

accomplishes this is by<br />

changing its target for the federal<br />

funds rate. Such changes affect<br />

other short-term and long-term<br />

interest rates,<br />

including those on Treasury<br />

securities, corporate bonds,<br />

mortgages, and other loans. In<br />

turn, changes in these variables<br />

will affect households’<br />

and businesses’<br />

spending decisions, thereby<br />

affecting growth in aggregate<br />

demand and the economy.<br />

The FOMC holds eight<br />

regularly scheduled<br />

meetings per year,<br />

which garner<br />

a lot of attention<br />

from investors and the media.<br />

At these, the committee reviews<br />

economic and financial<br />

conditions, determines the<br />

appropriate stance of monetary<br />

policy, and assesses the risks<br />

to its long-run goals of<br />

price stability and<br />

sustainable<br />

economic growth.<br />

FOLLOW US @AU_AMERICANMAG 5