2014/2015 ANNUAL REPORT

UuF8C

UuF8C

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

for the financial year ended 30 June <strong>2015</strong><br />

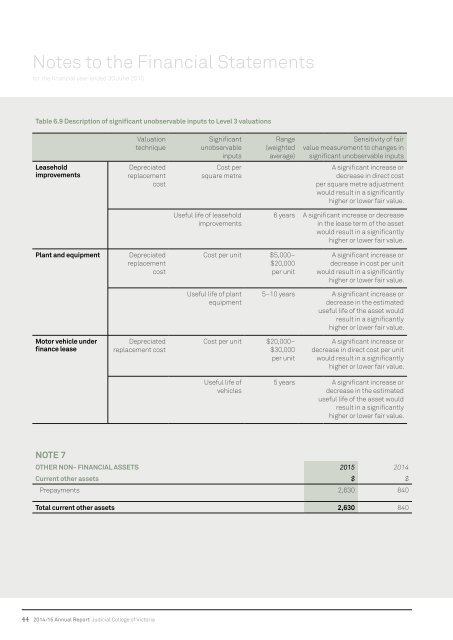

Table 6.9 Description of significant unobservable inputs to Level 3 valuations<br />

Leasehold<br />

improvements<br />

Plant and equipment<br />

Motor vehicle under<br />

finance lease<br />

Note 7<br />

Valuation<br />

technique<br />

Depreciated<br />

replacement<br />

cost<br />

Depreciated<br />

replacement<br />

cost<br />

Depreciated<br />

replacement cost<br />

Significant<br />

unobservable<br />

inputs<br />

Cost per<br />

square metre<br />

Useful life of leasehold<br />

improvements<br />

Range<br />

(weighted<br />

average)<br />

Cost per unit $5,000–<br />

$20,000<br />

per unit<br />

Useful life of plant<br />

equipment<br />

Cost per unit $20,000–<br />

$30,000<br />

per unit<br />

Useful life of<br />

vehicles<br />

Sensitivity of fair<br />

value measurement to changes in<br />

significant unobservable inputs<br />

A significant increase or<br />

decrease in direct cost<br />

per square metre adjustment<br />

would result in a significantly<br />

higher or lower fair value.<br />

6 years A significant increase or decrease<br />

in the lease term of the asset<br />

would result in a significantly<br />

higher or lower fair value.<br />

A significant increase or<br />

decrease in cost per unit<br />

would result in a significantly<br />

higher or lower fair value.<br />

5–10 years A significant increase or<br />

decrease in the estimated<br />

useful life of the asset would<br />

result in a significantly<br />

higher or lower fair value.<br />

A significant increase or<br />

decrease in direct cost per unit<br />

would result in a significantly<br />

higher or lower fair value.<br />

5 years A significant increase or<br />

decrease in the estimated<br />

useful life of the asset would<br />

result in a significantly<br />

higher or lower fair value.<br />

Other non- financial assets <strong>2015</strong> <strong>2014</strong><br />

Current other assets $ $<br />

Prepayments 2,630 840<br />

Total current other assets 2,630 840<br />

Note 8<br />

PayABLES <strong>2015</strong> <strong>2014</strong><br />

Current payables $ $<br />

Contractual<br />

Supplies and services administrative 54,737 47,891<br />

Supplies and services capital - -<br />

Supplies and services Judicial training - 8,860<br />

Employee benefits 14,115 7,434<br />

68,852 64,185<br />

Statutory<br />

Taxes payable - 1,931<br />

Total payables 68,852 66,116<br />

(a) Maturity analysis of payables<br />

Refer to table 15.2 in note 15.<br />

(b) Nature and extent of risk arising from payables<br />

Refer to table 15.3 in note 15.<br />

Note 9<br />

Borrowings <strong>2015</strong> <strong>2014</strong><br />

Current borrowings $ $<br />

Lease liabilities (i) (note 12) 5,180 5,180<br />

Total current borrowings 5,180 5,180<br />

Non-current borrowings<br />

Lease liabilities (i) (note 12) 7,274 12,808<br />

Total non-current borrowings 7,274 12,808<br />

Total borrowings 12,454 17,988<br />

(i) secured by assets leased. Finance leases are effectively secured as the rights to the leased assets revert to the lessor in the event of default.<br />

(a) Maturity analysis of interest bearing liabilities<br />

Refer to table 15.2 in Note 15.<br />

(b) Nature and extent of risk arising from interest bearing liabilities<br />

Refer to table 15.3 in Note 15.<br />

44 <strong>2014</strong>/15 Annual Report Judicial College of Victoria Judicial College of Victoria <strong>2014</strong>/15 Annual Report 45