Private Equity Annual Program Review

item09a-01

item09a-01

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Private</strong> <strong>Equity</strong> <strong>Annual</strong> <strong>Program</strong> <strong>Review</strong><br />

Attachment 1, Page 10 of 34<br />

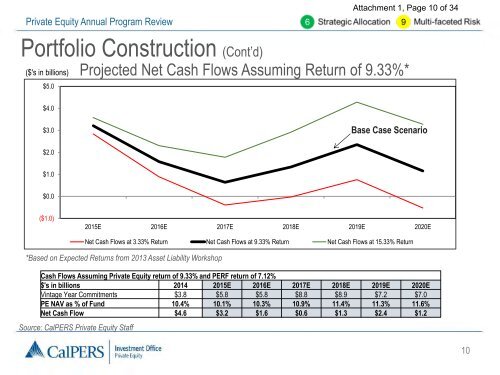

Portfolio Construction (Cont’d)<br />

($'s in billions)<br />

$5.0<br />

Projected Net Cash Flows Assuming Return of 9.33%*<br />

$4.0<br />

$3.0<br />

Base Case Scenario<br />

$2.0<br />

$1.0<br />

$0.0<br />

($1.0)<br />

2015E 2016E 2017E 2018E 2019E 2020E<br />

Source: CalPERS <strong>Private</strong> <strong>Equity</strong> Staff<br />

Net Cash Flows at 3.33% Return Net Cash Flows at 9.33% Return Net Cash Flows at 15.33% Return<br />

*Based on Expected Returns from 2013 Asset Liability Workshop<br />

Cash Flows Assuming <strong>Private</strong> <strong>Equity</strong> return of 9.33% and PERF return of 7.12%<br />

$'s in billions 2014 2015E 2016E 2017E 2018E 2019E 2020E<br />

Vintage Year Commitments $3.8 $5.8 $5.8 $8.8 $8.9 $7.2 $7.0<br />

PE NAV as % of Fund 10.4% 10.1% 10.3% 10.9% 11.4% 11.3% 11.6%<br />

Net Cash Flow $4.6 $3.2 $1.6 $0.6 $1.3 $2.4 $1.2<br />

10