Produktinformationsblatt Englisch - FPM-AG

Produktinformationsblatt Englisch - FPM-AG

Produktinformationsblatt Englisch - FPM-AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fund portrait<br />

as of: August 31, 2011<br />

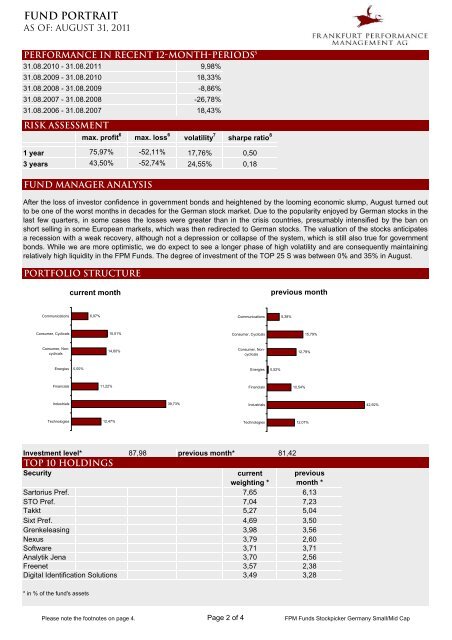

Performance in recent 12-month-periods 5<br />

31.08.2010 - 31.08.2011 9,98%<br />

31.08.2009 - 31.08.2010 18,33%<br />

31.08.2008 - 31.08.2009 -8,86%<br />

31.08.2007 - 31.08.2008 -26,78%<br />

31.08.2006 - 31.08.2007 18,43%<br />

Risk Assessment<br />

max. profit 6<br />

max. loss 6<br />

volatility 7<br />

sharpe ratio 8<br />

1 year 75,97% -52,11% 17,76% 0,50<br />

3 years 43,50% -52,74% 24,55% 0,18<br />

Fund Manager Analysis<br />

After the loss of investor confidence in government bonds and heightened by the looming economic slump, August turned out<br />

to be one of the worst months in decades for the German stock market. Due to the popularity enjoyed by German stocks in the<br />

last few quarters, in some cases the losses were greater than in the crisis countries, presumably intensified by the ban on<br />

short selling in some European markets, which was then redirected to German stocks. The valuation of the stocks anticipates<br />

a recession with a weak recovery, although not a depression or collapse of the system, which is still also true for government<br />

bonds. While we are more optimistic, we do expect to see a longer phase of high volatility and are consequently maintaining<br />

relatively high liquidity in the <strong>FPM</strong> Funds. The degree of investment of the TOP 25 S was between 0% and 35% in August.<br />

Portfolio Structure<br />

Communications<br />

Consumer, Cyclicals<br />

Consumer, Noncyclicals<br />

Investment level*<br />

Top 10 Holdings<br />

87,98 previous month* 81,42<br />

Security current previous<br />

weighting * month *<br />

Sartorius Pref. 7,65 6,13<br />

STO Pref. 7,04 7,23<br />

Takkt 5,27 5,04<br />

Sixt Pref. 4,69 3,50<br />

Grenkeleasing 3,98 3,56<br />

Nexus 3,79 2,60<br />

Software 3,71 3,71<br />

Analytik Jena 3,70 2,56<br />

Freenet 3,57 2,38<br />

Digital Identification Solutions 3,49 3,28<br />

* in % of the fund's assets<br />

Current current month<br />

Energies 0,00%<br />

Financials<br />

Industrials<br />

Technologies<br />

6,97%<br />

11,22%<br />

15,01%<br />

14,60%<br />

12,47%<br />

39,73%<br />

Communications<br />

Consumer, Cyclicals<br />

Consumer, Noncyclicals<br />

Energies<br />

Financials<br />

Industrials<br />

Technologies<br />

Previous previous month<br />

Please note the footnotes on page 4. Page 2 of 4 <strong>FPM</strong> Funds Stockpicker Germany Small/Mid Cap<br />

0,52%<br />

5,38%<br />

15,79%<br />

12,79%<br />

10,54%<br />

12,07%<br />

42,92%