Produktinformationsblatt Englisch - FPM-AG

Produktinformationsblatt Englisch - FPM-AG

Produktinformationsblatt Englisch - FPM-AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

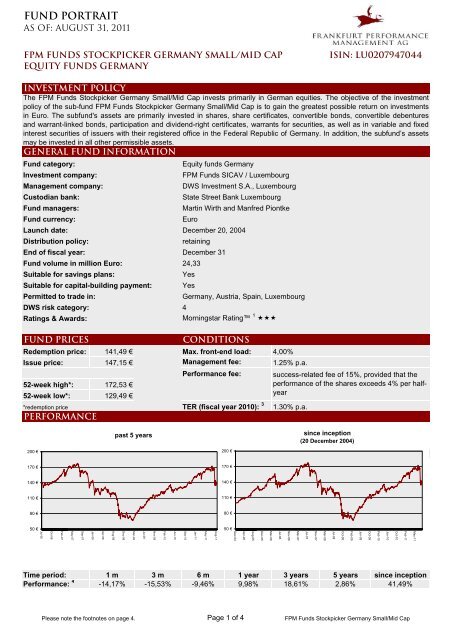

Fund portrait<br />

as of: August 31, 2011<br />

<strong>FPM</strong> Funds Stockpicker Germany Small/Mid Cap ISIN: LU0207947044<br />

Equity Funds Germany<br />

Investment Policy<br />

The <strong>FPM</strong> Funds Stockpicker Germany Small/Mid Cap invests primarily in German equities. The objective of the investment<br />

policy of the sub-fund <strong>FPM</strong> Funds Stockpicker Germany Small/Mid Cap is to gain the greatest possible return on investments<br />

in Euro. The subfund's assets are primarily invested in shares, share certificates, convertible bonds, convertible debentures<br />

and warrant-linked bonds, participation and dividend-right certificates, warrants for securities, as well as in variable and fixed<br />

interest securities of issuers with their registered office in the Federal Republic of Germany. In addition, the subfund’s assets<br />

may be invested in all other permissible assets.<br />

General Fund Information<br />

Fund category: Equity funds Germany<br />

Investment company: <strong>FPM</strong> Funds SICAV / Luxembourg<br />

Management company: DWS Investment S.A., Luxembourg<br />

Custodian bank: State Street Bank Luxembourg<br />

Fund managers: Martin Wirth and Manfred Piontke<br />

Fund currency: Euro<br />

Launch date:<br />

Distribution policy: retaining<br />

End of fiscal year: December 31<br />

Fund volume in million Euro: 24,33<br />

Suitable for savings plans: Yes<br />

Suitable for capital-building payment: Yes<br />

Permitted to trade in: Germany, Austria, Spain, Luxembourg<br />

DWS risk category: 4<br />

Ratings & Awards:<br />

Morningstar Rating 1 December 20, 2004<br />

���<br />

Fund prices Conditions<br />

Redemption price: 141,49 € Max. front-end load: 4,00%<br />

Issue price: 147,15 € Management fee: 1.25% p.a.<br />

Performance fee: success-related fee of 15%, provided that the<br />

52-week high*: 172,53 €<br />

performance of the shares exceeds 4% per half-<br />

52-week low*: 129,49 €<br />

year<br />

*redemption price TER (fiscal year 2010): 3<br />

Performance<br />

200 200 € €<br />

170 €<br />

170 €<br />

140 €<br />

140 €<br />

110 €<br />

110 80 € €<br />

50 €<br />

80 €<br />

50 €<br />

Jul-06<br />

Mai. 05<br />

Oct-06<br />

Aug. 05<br />

Past 5 years<br />

Feb-07<br />

Dez. 05<br />

May-07<br />

Mrz. 06<br />

Sep-07<br />

Jul. 06<br />

Okt. 06<br />

Jan-08<br />

Feb. 07<br />

Apr-08<br />

Jun. 07<br />

Aug-08<br />

past 5 years<br />

Sep. 07<br />

Dec-08<br />

Jan. 08<br />

Mar-09<br />

Mai. 08<br />

Jul-09<br />

Aug. 08<br />

Nov-09<br />

Dez. 08<br />

Feb-10<br />

Apr. 09<br />

Jun-10<br />

Jul. 09<br />

Sep-10<br />

Nov. 09<br />

Jan-11<br />

Mrz. 10<br />

May-11<br />

Aug-11<br />

200 € €<br />

170 €<br />

170 €<br />

140 €<br />

140 €<br />

110 €<br />

110 80 €<br />

50 €<br />

80 €<br />

50 €<br />

1.30% p.a.<br />

Since inception since inception<br />

(20 December 2004) (20 December 2004)<br />

Investment level<br />

Time period: 1 m 3 m 6 m 1 year 3 years 5 years since inception<br />

Performance: 4<br />

-14,17% -15,53% -9,46% 9,98% 18,61% 2,86% 41,49%<br />

Please note the footnotes on page 4. Page 1 of 4 <strong>FPM</strong> Funds Stockpicker Germany Small/Mid Cap<br />

Dez. 04<br />

Dec-04<br />

Apr. 05<br />

Apr-05<br />

Aug-05<br />

Aug. 05<br />

Dec-05<br />

Dez. 05<br />

Mar-06<br />

Mrz. 06<br />

Jul-06<br />

Jul. 06<br />

Nov-06<br />

Nov. 06<br />

Mar-07<br />

Mrz. 07<br />

Jul-07<br />

Jul. 07<br />

Nov-07<br />

Mar-08<br />

Nov. 07<br />

Jul-08<br />

Mrz. 08<br />

Oct-08<br />

Jul. 08<br />

Feb-09<br />

Okt. 08<br />

Jun-09<br />

Feb. 09<br />

Oct-09<br />

Jun. 09<br />

Feb-10<br />

Okt. 09<br />

Jun-10<br />

Feb. 10<br />

Oct-10<br />

Feb-11<br />

May-11

Fund portrait<br />

as of: August 31, 2011<br />

Performance in recent 12-month-periods 5<br />

31.08.2010 - 31.08.2011 9,98%<br />

31.08.2009 - 31.08.2010 18,33%<br />

31.08.2008 - 31.08.2009 -8,86%<br />

31.08.2007 - 31.08.2008 -26,78%<br />

31.08.2006 - 31.08.2007 18,43%<br />

Risk Assessment<br />

max. profit 6<br />

max. loss 6<br />

volatility 7<br />

sharpe ratio 8<br />

1 year 75,97% -52,11% 17,76% 0,50<br />

3 years 43,50% -52,74% 24,55% 0,18<br />

Fund Manager Analysis<br />

After the loss of investor confidence in government bonds and heightened by the looming economic slump, August turned out<br />

to be one of the worst months in decades for the German stock market. Due to the popularity enjoyed by German stocks in the<br />

last few quarters, in some cases the losses were greater than in the crisis countries, presumably intensified by the ban on<br />

short selling in some European markets, which was then redirected to German stocks. The valuation of the stocks anticipates<br />

a recession with a weak recovery, although not a depression or collapse of the system, which is still also true for government<br />

bonds. While we are more optimistic, we do expect to see a longer phase of high volatility and are consequently maintaining<br />

relatively high liquidity in the <strong>FPM</strong> Funds. The degree of investment of the TOP 25 S was between 0% and 35% in August.<br />

Portfolio Structure<br />

Communications<br />

Consumer, Cyclicals<br />

Consumer, Noncyclicals<br />

Investment level*<br />

Top 10 Holdings<br />

87,98 previous month* 81,42<br />

Security current previous<br />

weighting * month *<br />

Sartorius Pref. 7,65 6,13<br />

STO Pref. 7,04 7,23<br />

Takkt 5,27 5,04<br />

Sixt Pref. 4,69 3,50<br />

Grenkeleasing 3,98 3,56<br />

Nexus 3,79 2,60<br />

Software 3,71 3,71<br />

Analytik Jena 3,70 2,56<br />

Freenet 3,57 2,38<br />

Digital Identification Solutions 3,49 3,28<br />

* in % of the fund's assets<br />

Current current month<br />

Energies 0,00%<br />

Financials<br />

Industrials<br />

Technologies<br />

6,97%<br />

11,22%<br />

15,01%<br />

14,60%<br />

12,47%<br />

39,73%<br />

Communications<br />

Consumer, Cyclicals<br />

Consumer, Noncyclicals<br />

Energies<br />

Financials<br />

Industrials<br />

Technologies<br />

Previous previous month<br />

Please note the footnotes on page 4. Page 2 of 4 <strong>FPM</strong> Funds Stockpicker Germany Small/Mid Cap<br />

0,52%<br />

5,38%<br />

15,79%<br />

12,79%<br />

10,54%<br />

12,07%<br />

42,92%

Fund portrait<br />

as of: August 31, 2011<br />

Investment Philosophy<br />

"Advancement through knowledge" - this is what lies at the heart of our investment philosophy. We acquire this knowledge<br />

through intensive, personal management meetings with the companies in which we invest. This approach makes us unique in<br />

the market and forms the basis of our success. The investment philosophy of <strong>FPM</strong> <strong>AG</strong> is based on three cornerstones: We<br />

primarily invest in stocks of German companies with high potential that we have identified as undervalued. Companies are<br />

selected on the basis of our own methodical and fundamental analysis (primary research). Our assessment of companies is<br />

based on regular, face-to-face discussions between management and our fund managers.<br />

The systematic implementation of our investment philosophy offers our investors a large number of advantages. Regular<br />

management meetings allow us to acquire high quality information and gain valuable insights into the market and competitors.<br />

Our analysis are not concerned with short-term trends; instead they focus on identifying high-quality companies before they<br />

come to the market's attention. The performance of companies that have good fundamental prospects but are undervalued on<br />

the market can increase considerably.<br />

<strong>FPM</strong> FUNDS Stockpicker Germany Small/Mid Cap IS WELL SUITED<br />

- for medium- to long-term investment<br />

- for targeted and regular asset growth<br />

- for investment in capital-building payment schemes<br />

Chances<br />

- Price increases on the stock market related to the market, industry and company<br />

- Opportunity for above-average participation in performance through a valuation- and quality-oriented investment<br />

process and active stock picking<br />

Risks<br />

The prices of the assets contained in the fund determine fund price. They are subject to daily fluctuations and may also fall.<br />

Market risk:IThe performance of financial products depends on the performance of the capital markets, which in turn are<br />

affected by real framework conditions as well as irrational factoes (sentiment, opinions and rumors).<br />

Default risk:IThe counterparties' partial or non-ability to fulfill their contractual payment obligations may result in losses for the<br />

investment fund. The risk of a decline in the assets of issuers cannot be eliminated even by the most careful selection of the<br />

securities.<br />

Currency risk:IThe value of assets invested in currencies other than the respective sub-fund currency is subject to fluctuation.<br />

Concentration risk:IBy a concentration of investments in particular markets or assets, the investment fund becomes<br />

particularly dependent on these few markets and assets.<br />

Increased volatility: Due to its permitted investment universe and its compositions as well as the use of derivative<br />

instruments, the investment fund is subject to markedly increased volatility.<br />

Risks in connection with derivative transactions, in particular options:IPrice changes in the underlying instrument can<br />

devalue an option. Options have a leverage effect that influences the investment fund markedly more than the underlying<br />

instrument. Selling options bears the risk that the investment fund experiences a loss of an indefinite amount.<br />

The unit price may at any time be lower than the purchase price at which the customer acquired the unit. I<br />

The full sales prospectus contains a detailed description of the risks involved.<br />

Please note the footnotes on page 4. Page 3 of 4 <strong>FPM</strong> Funds Stockpicker Germany Small/Mid Cap

Fund portrait<br />

as of: August 31, 2011<br />

Disclaimer<br />

The information contained in this document does not constitute investment advice and is merely a brief summary of key<br />

aspects of the funds. Full details of the funds can be found in the key investor information document and the sales prospectus,<br />

supplemented in each case by the most recent audited annual report and the most recent half-year report, if this report is more<br />

recent than the most recently available annual report. These documents constitute the sole binding basis for the purchase of<br />

fund units. They are available free of charge in either electronic or printed form from <strong>FPM</strong> Frankfurt Performance Management<br />

<strong>AG</strong> (<strong>FPM</strong> <strong>AG</strong>), Freiherr-vom-Stein-Str. 11, 60323 Frankfurt am Main, from DWS Investment GmbH, Mainzer Landstraße 178 –<br />

190, D- 60327 Frankfurt am Main or from DWS Investment S. A., 2, Boulevard Konrad Adenauer, L-1115 Luxemburg. The<br />

sales prospectus contains detailed information on the risks involved.<br />

All opinions given in this product information reflect the current assessment of <strong>FPM</strong> Frankfurt Performance Management <strong>AG</strong><br />

which may change without notice. In cases where information contained in this document derives from third parties, <strong>FPM</strong> <strong>AG</strong><br />

accepts no liability for the accuracy, completeness or appropriateness of such information, also <strong>FPM</strong> <strong>AG</strong> only uses data that it<br />

deems to be reliable. Calculation of performance is based on the time-weighted return (BVI method) and excludes initial<br />

charges. Individual costs such as fees, commissions and other charges have not been included in this presentation and would<br />

have an adverse impact on returns if they were included. Past performance is not a reliable indicator of future returns. Further<br />

information on taxation can be found in the sales prospectus.<br />

The units issued by DWS Investment S. A. under these funds may only be offered for purchase or sold in jurisdictions in which<br />

such offer or sale is permitted. The units in these funds are not allowed to be offered for purchase or sold either in the US or to<br />

or for the account of US citizens or US persons domiciled in the US. This document and the information contained therein<br />

must not be distributed in the US. The distribution and publication of this document as well as the offering or sale of the fund’s<br />

units may be subject to restrictions in other jurisdictions as well.<br />

<strong>FPM</strong> Frankfurt Performance Management <strong>AG</strong> | Freiherr-vom-Stein-Straße 11 | D-60323 Frankfurt, Germany<br />

Telephone: + 49 69 79 58 86 - 0 | Fax: + 49 69 79 58 86 - 14<br />

E-mail: fpm-funds@fpm-ag.de | Internet: www.fpm-ag.de | www.fpm-deutsche-investmentaktiengesellschaft.de<br />

1 Rating of 31.02.2010; more information at www.morningstar.de.<br />

2 Rating of 31.01.2010; more information at www.feri.de<br />

3 Total expense in per cent of the average fund volume of the fiscal year closed on 31 December. In accordance with the respective national practice,<br />

this ratio only includes the expenses incurred for the investment fund (without transaction costs).<br />

4 Calculated on the basis of time-weighted return (BVI method). Front-end load was excluded. Past performance is not a reliable indicator of future<br />

returns.<br />

5 The future trend indicator relates to each 12-month period indicated. On those days which fall on weekends or national holidays, the price from the<br />

previous day or the last available price is used, as no stock quotations are made on such days.<br />

6 Maximum historical loss/profit that would have been possible with an investment period of one/three year(s) since inception of the fund.<br />

7 Volatility in % is calculated on the basis of weekly (up to 3 years) or monthly data (from 3 years). (Source: Deutsche Performancemessungs-<br />

Gesellschaft für Wertpapierportfolios mbH (short: DPG))<br />

8 The risk-free interest rate depends on the three-month interest rate. A negative sharpe ratio has no significance. (Source: Deutsche<br />

Performancemessungs-Gesellschaft für Wertpapierportfolios mbH (short: DPG))<br />

Please note the footnotes on page 4. Page 4 of 4 <strong>FPM</strong> Funds Stockpicker Germany Small/Mid Cap