SAVE

PRUsave max limited pay (SGD) - Prudential Singapore

PRUsave max limited pay (SGD) - Prudential Singapore

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

You can also choose to add on other supplementary benefits<br />

such as Crisis Waiver III, Early Stage Crisis Waiver, Payer Security<br />

III / Payer Security Plus, Early Payer Security, Comprehensive<br />

Personal Accident III and Early Stage Crisis Cover.<br />

Quick, hassle-free sign-up<br />

PRUsave max limited pay (SGD) is a guaranteed-issuance<br />

plan — so there’s no need to go for a medical check-up or<br />

answer questions regarding your health matters 6 . Sign up<br />

for PRUsave max limited pay (SGD) today and you can get<br />

closer to your savings goals faster with the short premium<br />

payment term.<br />

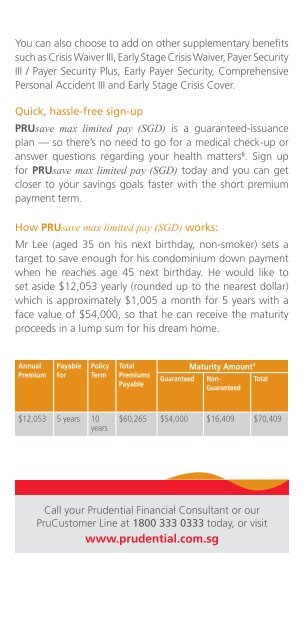

How PRUsave max limited pay (SGD) works:<br />

Mr Lee (aged 35 on his next birthday, non-smoker) sets a<br />

target to save enough for his condominium down payment<br />

when he reaches age 45 next birthday. He would like to<br />

set aside $12,053 yearly (rounded up to the nearest dollar)<br />

which is approximately $1,005 a month for 5 years with a<br />

face value of $54,000, so that he can receive the maturity<br />

proceeds in a lump sum for his dream home.<br />

Annual<br />

Premium<br />

Payable<br />

for<br />

Policy<br />

Term<br />

Total<br />

Premiums<br />

Payable<br />

Maturity Amount 7<br />

Guaranteed Non-<br />

Guaranteed<br />

Total<br />

$12,053 5 years 10<br />

years<br />

$60,265 $54,000 $16,409 $70,409<br />

Call your Prudential Financial Consultant or our<br />

PruCustomer Line at 1800 333 0333 today, or visit<br />

www.prudential.com.sg