The Automotive Cluster in Morocco

Morocco_Automotive_Cluster_2015

Morocco_Automotive_Cluster_2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

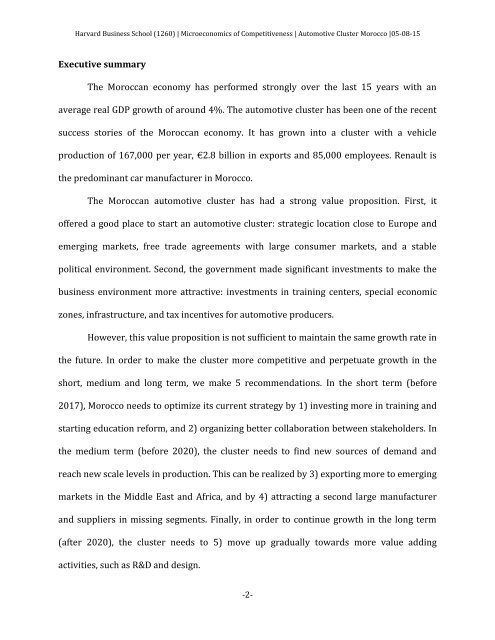

Harvard Bus<strong>in</strong>ess School (1260) | Microeconomics of Competitiveness | <strong>Automotive</strong> <strong>Cluster</strong> <strong>Morocco</strong> |05-08-15<br />

Executive summary<br />

<strong>The</strong> Moroccan economy has performed strongly over the last 15 years with an<br />

average real GDP growth of around 4%. <strong>The</strong> automotive cluster has been one of the recent<br />

success stories of the Moroccan economy. It has grown <strong>in</strong>to a cluster with a vehicle<br />

production of 167,000 per year, €2.8 billion <strong>in</strong> exports and 85,000 employees. Renault is<br />

the predom<strong>in</strong>ant car manufacturer <strong>in</strong> <strong>Morocco</strong>.<br />

<strong>The</strong> Moroccan automotive cluster has had a strong value proposition. First, it<br />

offered a good place to start an automotive cluster: strategic location close to Europe and<br />

emerg<strong>in</strong>g markets, free trade agreements with large consumer markets, and a stable<br />

political environment. Second, the government made significant <strong>in</strong>vestments to make the<br />

bus<strong>in</strong>ess environment more attractive: <strong>in</strong>vestments <strong>in</strong> tra<strong>in</strong><strong>in</strong>g centers, special economic<br />

zones, <strong>in</strong>frastructure, and tax <strong>in</strong>centives for automotive producers.<br />

However, this value proposition is not sufficient to ma<strong>in</strong>ta<strong>in</strong> the same growth rate <strong>in</strong><br />

the future. In order to make the cluster more competitive and perpetuate growth <strong>in</strong> the<br />

short, medium and long term, we make 5 recommendations. In the short term (before<br />

2017), <strong>Morocco</strong> needs to optimize its current strategy by 1) <strong>in</strong>vest<strong>in</strong>g more <strong>in</strong> tra<strong>in</strong><strong>in</strong>g and<br />

start<strong>in</strong>g education reform, and 2) organiz<strong>in</strong>g better collaboration between stakeholders. In<br />

the medium term (before 2020), the cluster needs to f<strong>in</strong>d new sources of demand and<br />

reach new scale levels <strong>in</strong> production. This can be realized by 3) export<strong>in</strong>g more to emerg<strong>in</strong>g<br />

markets <strong>in</strong> the Middle East and Africa, and by 4) attract<strong>in</strong>g a second large manufacturer<br />

and suppliers <strong>in</strong> miss<strong>in</strong>g segments. F<strong>in</strong>ally, <strong>in</strong> order to cont<strong>in</strong>ue growth <strong>in</strong> the long term<br />

(after 2020), the cluster needs to 5) move up gradually towards more value add<strong>in</strong>g<br />

activities, such as R&D and design.<br />

-2-