Investment Performance Chart

Investment Performance Chart

Investment Performance Chart

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

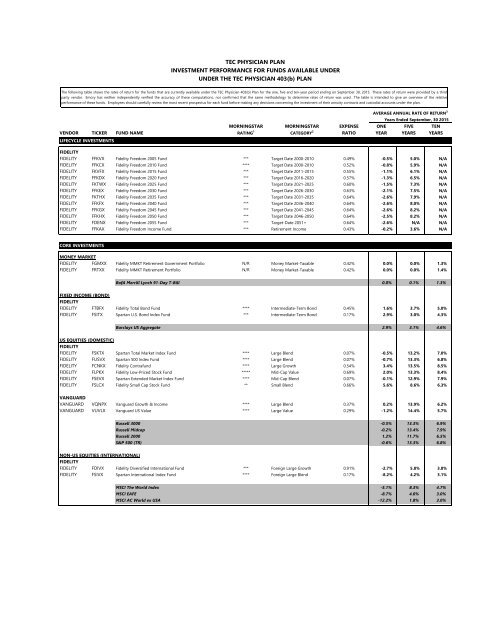

TEC PHYSICIAN PLAN<br />

INVESTMENT PERFORMANCE FOR FUNDS AVAILABLE UNDER<br />

UNDER THE TEC PHYSICIAN 403(b) PLAN<br />

The following table shows the rates of return for the funds that are currently available under the TEC Physician 403(b) Plan for the one, five and ten-year period ending on September 30, 2015. These rates of return were provided by a third<br />

party vendor. Emory has neither independently verified the accuracy of these computations, nor confirmed that the same methodology to determine rates of return was used. The table is intended to give an overview of the relative<br />

performance of these funds. Employees should carefully review the most recent prospectus for each fund before making any decisions concerning the investment of their annuity contracts and custodial accounts under the plan.<br />

AVERAGE ANNUAL RATE OF RETURN 3<br />

Years Ended September, 30 2015<br />

MORNINGSTAR MORNINGSTAR EXPENSE ONE FIVE TEN<br />

VENDOR TICKER FUND NAME RATING 1 CATEGORY 2 RATIO YEAR YEARS YEARS<br />

LIFECYCLE INVESTMENTS<br />

FIDELITY<br />

FIDELITY FFKVX Fidelity Freedom 2005 Fund *** Target Date 2000-2010 0.49% -0.5% 5.0% N/A<br />

FIDELITY FFKCX Fidelity Freedom 2010 Fund **** Target Date 2000-2010 0.52% -0.8% 5.9% N/A<br />

FIDELITY FKVFX Fidelity Freedom 2015 Fund *** Target Date 2011-2015 0.55% -1.1% 6.1% N/A<br />

FIDELITY FFKDX Fidelity Freedom 2020 Fund *** Target Date 2016-2020 0.57% -1.3% 6.5% N/A<br />

FIDELITY FKTWX Fidelity Freedom 2025 Fund *** Target Date 2021-2025 0.60% -1.5% 7.3% N/A<br />

FIDELITY FFKEX Fidelity Freedom 2030 Fund *** Target Date 2026-2030 0.63% -2.1% 7.5% N/A<br />

FIDELITY FKTHX Fidelity Freedom 2035 Fund *** Target Date 2031-2035 0.64% -2.6% 7.9% N/A<br />

FIDELITY FFKFX Fidelity Freedom 2040 Fund *** Target Date 2036-2040 0.64% -2.6% 8.0% N/A<br />

FIDELITY FFKGX Fidelity Freedom 2045 Fund *** Target Date 2041-2045 0.64% -2.6% 8.2% N/A<br />

FIDELITY FFKHX Fidelity Freedom 2050 Fund *** Target Date 2046-2050 0.64% -2.5% 8.2% N/A<br />

FIDELITY FDENX Fidelity Freedom 2055 Fund *** Target-Date 2051+ 0.64% -2.6% N/A N/A<br />

FIDELITY FFKAX Fidelity Freedom Income Fund *** Retirement Income 0.43% -0.2% 3.6% N/A<br />

CORE INVESTMENTS<br />

MONEY MARKET<br />

FIDELITY FGMXX Fidelity MMKT Retirement Government Portfolio N/R Money Market-Taxable 0.42% 0.0% 0.0% 1.3%<br />

FIDELITY FRTXX Fidelity MMKT Retirement Portfolio N/R Money Market-Taxable 0.42% 0.0% 0.0% 1.4%<br />

MLX:MLG0O BofA Merrill Lynch 91-Day T-Bill 0.0% 0.1% 1.3%<br />

FIXED INCOME (BOND)<br />

FIDELITY<br />

FIDELITY FTBFX Fidelity Total Bond Fund **** Intermediate-Term Bond 0.45% 1.6% 3.7% 5.0%<br />

FIDELITY FSITX Spartan U.S. Bond Index Fund *** Intermediate-Term Bond 0.17% 2.9% 3.0% 4.3%<br />

LEH:LHMN00Barclays US Aggregate 2.9% 3.1% 4.6%<br />

US EQUITIES (DOMESTIC)<br />

FIDELITY<br />

FIDELITY FSKTX Spartan Total Market Index Fund **** Large Blend 0.07% -0.5% 13.2% 7.0%<br />

FIDELITY FUSVX Spartan 500 Index Fund **** Large Blend 0.07% -0.7% 13.3% 6.8%<br />

FIDELITY FCNKX Fidelity Contrafund **** Large Growth 0.54% 3.4% 13.5% 8.5%<br />

FIDELITY FLPKX Fidelity Low-Priced Stock Fund ***** Mid-Cap Value 0.69% 2.0% 13.3% 8.4%<br />

FIDELITY FSEVX Spartan Extended Market Index Fund **** Mid-Cap Blend 0.07% -0.1% 12.9% 7.9%<br />

FIDELITY FSLCX Fidelity Small Cap Stock Fund ** Small Blend 0.66% 5.6% 8.6% 6.3%<br />

VANGUARD<br />

VANGUARD VQNPX Vanguard Growth & Income **** Large Blend 0.37% 0.2% 13.9% 6.2%<br />

VANGUARD VUVLX Vanguard US Value **** Large Value 0.29% -1.2% 14.4% 5.7%<br />

RUSSELL:R.30Russell 3000 -0.5% 13.3% 6.9%<br />

RUSSELL:R.MRussell Midcap -0.2% 13.4% 7.9%<br />

RUSSELL:R.20Russell 2000 1.2% 11.7% 6.5%<br />

SPN:SP50.R S&P 500 (TR) -0.6% 13.3% 6.8%<br />

NON-US EQUITIES (INTERNATIONAL)<br />

FIDELITY<br />

FIDELITY FDIVX Fidelity Diversified International Fund *** Foreign Large Growth 0.91% -2.7% 5.8% 3.8%<br />

FIDELITY FSIVX Spartan International Index Fund **** Foreign Large Blend 0.17% -8.2% 4.2% 3.1%<br />

MSCI_N:9901MSCI The World Index -5.1% 8.3% 4.7%<br />

MSCI_N:9903MSCI EAFE -8.7% 4.0% 3.0%<br />

MSCI_N:8999MSCI AC World ex USA -12.2% 1.8% 3.0%

TEC PHYSICIAN PLAN<br />

INVESTMENT PERFORMANCE FOR FUNDS AVAILABLE UNDER<br />

UNDER THE TEC PHYSICIAN 403(b) PLAN<br />

The following table shows the rates of return for the funds that are currently available under the TEC Physician 403(b) Plan for the one, five and ten-year period ending on September 30, 2015. These rates of return were provided by a third<br />

party vendor. Emory has neither independently verified the accuracy of these computations, nor confirmed that the same methodology to determine rates of return was used. The table is intended to give an overview of the relative<br />

performance of these funds. Employees should carefully review the most recent prospectus for each fund before making any decisions concerning the investment of their annuity contracts and custodial accounts under the plan.<br />

AVERAGE ANNUAL RATE OF RETURN 3<br />

Years Ended September, 30 2015<br />

MORNINGSTAR MORNINGSTAR EXPENSE ONE FIVE TEN<br />

VENDOR TICKER FUND NAME RATING 1 CATEGORY 2 RATIO YEAR YEARS YEARS<br />

EXPANDED INVESTMENTS<br />

FIDELITY<br />

FIDELITY FAGIX Fidelity Capital & Income Fund ***** High Yield Bond 0.72% -0.5% 7.0% 7.9%<br />

FIDELITY FBNDX Fidelity <strong>Investment</strong> Grade Bond Fund *** Intermediate-Term Bond 0.45% 1.2% 3.4% 4.2%<br />

FIDELITY FTHRX Fidelity Intermediate Bond Fund *** Intermediate-Term Bond 0.45% 2.1% 2.7% 4.1%<br />

FIDELITY FSICX Fidelity Strategic Income Fund **** Multisector Bond 0.69% -1.3% 3.8% 5.8%<br />

FIDELITY FIDKX Fidelity International Discovery Fund **** Foreign Large Growth 0.78% -1.1% 6.0% 4.5%<br />

FIDELITY FDEKX Fidelity Disciplined Equity Fund *** Large Blend 0.39% -0.8% 12.2% 5.3%<br />

FIDELITY FVDKX Fidelity Value Discovery Fund **** Large Value 0.71% -1.4% 13.2% 6.5%<br />

FIDELITY FCAKX Fidelity Capital Appreciation Fund **** Large Growth 0.70% -1.6% 13.8% 7.5%<br />

FIDELITY FGCKX Fidelity Growth Company Fund ***** Large Growth 0.71% 5.4% 15.8% 10.1%<br />

FIDELITY FTRNX Fidelity Trend Fund **** Large Growth 0.75% 1.6% 14.4% 8.7%<br />

FIDELITY FEIKX Fidelity Equity-Income Fund ** Large Value 0.58% -6.1% 9.9% 4.6%<br />

FIDELITY FKMCX Fidelity Mid-Cap Stock Fund **** Mid-Cap Growth 0.64% -0.5% 13.0% 7.8%<br />

FIDELITY FSMVX Fidelity Mid Cap Value Fund ***** Mid-Cap Value 0.83% -0.2% 14.0% 7.5%<br />

FIDELITY FCPGX Fidelity Small Cap Growth Fund **** Small Growth 0.92% 13.4% 14.7% 8.5%<br />

FIDELITY FCPVX Fidelity Small Cap Value Fund ***** Small Value 1.19% 7.4% 13.0% 8.9%<br />

FIDELITY FWWFX Fidelity Worldwide Fund **** World Stock 0.96% -1.2% 9.9% 6.7%<br />

FIDELITY FBAKX Fidelity Balanced Fund ***** Moderate Allocation 0.46% -0.7% 9.6% 6.4%<br />

FIDELITY FPUKX Fidelity Puritan Fund ***** Moderate Allocation 0.46% -0.2% 9.9% 6.6%<br />

VANGUARD<br />

VANGUARD VBMFX Vanguard Total Bond Market Index *** Intermediate-Term Bond 0.20% 2.6% 2.9% 4.5%<br />

VANGUARD VDVIX Vanguard Developed Markets Index N/R Foreign Large Blend 0.20% -8.0% 4.0% 3.0%<br />

VANGUARD VGTSX Vanguard Total Intl Stock Index *** Foreign Large Blend 0.22% -10.8% 2.1% 3.0%<br />

VANGUARD VWIGX Vanguard International Growth *** Foreign Large Growth 0.47% -9.9% 3.6% 4.4%<br />

VANGUARD VTRIX Vanguard International Value *** Foreign Large Value 0.44% -13.9% 2.6% 3.1%<br />

VANGUARD VINEX Vanguard International Explorer *** Foreign Small/Mid Blend 0.40% -0.5% 6.5% 5.5%<br />

VANGUARD VDIGX Vanguard Dividend Growth **** Large Blend 0.32% 1.3% 13.0% 8.4%<br />

VANGUARD VFINX Vanguard 500 Index **** Large Blend 0.17% -0.7% 13.2% 6.7%<br />

VANGUARD VTSMX Vanguard Total Stock Market Index **** Large Blend 0.17% -0.7% 13.2% 7.0%<br />

VANGUARD VHCOX Vanguard Capital Opportunity ***** Large Growth 0.47% 1.7% 15.1% 9.3%<br />

VANGUARD VIGRX Vanguard Growth Index **** Large Growth 0.23% 1.8% 14.1% 7.9%<br />

VANGUARD VMRGX Vanguard Morgan Growth **** Large Growth 0.40% 4.8% 13.6% 7.4%<br />

VANGUARD VPMCX Vanguard PRIMECAP ***** Large Growth 0.44% -0.8% 14.5% 9.0%<br />

VANGUARD VWUSX Vanguard US Growth **** Large Growth 0.44% 6.3% 15.3% 7.2%<br />

VANGUARD VEIPX Vanguard Equity-Income ***** Large Value 0.29% -2.1% 13.3% 7.4%<br />

VANGUARD VIVAX Vanguard Value Index **** Large Value 0.23% -3.1% 12.2% 5.8%<br />

VANGUARD VWNFX Vanguard Windsor II Investor *** Large Value 0.36% -4.1% 12.1% 5.7%<br />

VANGUARD VEXMX Vanguard Extended Market Index *** Mid-Cap Blend 0.23% -0.3% 12.8% 7.6%<br />

VANGUARD VIMSX Vanguard Mid Cap Index ***** Mid-Cap Blend 0.23% 1.6% 13.5% 7.7%<br />

VANGUARD VMGRX Vanguard Mid Cap Growth **** Mid-Cap Growth 0.46% 5.4% 13.8% 8.8%<br />

VANGUARD VASVX Vanguard Selected Value **** Mid-Cap Value 0.44% -4.3% 12.6% 7.5%<br />

VANGUARD NAESX Vanguard Small Cap Index **** Small Blend 0.23% -0.3% 12.8% 7.6%<br />

VANGUARD VEXPX Vanguard Explorer *** Small Growth 0.53% -1.3% 12.5% 6.8%<br />

VANGUARD VISGX Vanguard Small Cap Growth Index **** Small Growth 0.23% -0.6% 12.8% 8.1%<br />

VANGUARD VISVX Vanguard Small Cap Value Index ***** Small Value 0.23% 0.0% 12.6% 6.9%<br />

VANGUARD VHGEX Vanguard Global Equity *** World Stock 0.61% -4.1% 8.3% 4.8%<br />

VANGUARD VGSTX Vanguard STAR **** Moderate Allocation 0.34% -1.3% 8.2% 5.9%<br />

VANGUARD VWELX Vanguard Wellington ***** Moderate Allocation 0.26% -0.8% 9.3% 7.0%<br />

VANGUARD VTXVX Vanguard Target Retirement 2015 ***** Target Date 2011-2015 0.16% -0.7% 7.0% 5.3%<br />

VANGUARD VTTVX Vanguard Target Retirement 2025 **** Target Date 2021-2025 0.17% -1.6% 8.2% 5.4%<br />

VANGUARD VTTHX Vanguard Target Retirement 2035 **** Target Date 2031-2035 0.18% -2.8% 9.1% 5.6%<br />

VANGUARD VTIVX Vanguard Target Retirement 2045 **** Target Date 2041-2045 0.18% -3.5% 9.2% 5.7%<br />

Mutual Fund Brokerage Window<br />

Available from Fidelity, TIAA-CREF and Vanguard; the Mutual Fund Brokerage Window gives you access to a wide variety of mutual funds. The Funds available through the Mutual Fund Brokerage Window are not selected or monitored by<br />

Emory in any way. Contact your vendor(s) of choice to discuss which funds are available to you.<br />

1. The "N/R" indicates that the fund has not been assigned a rating or objective by Morningstar, Inc. The rating is through September 30, 2015.<br />

2. The Moderate Allocation category is used for funds with stock holdings of greater than 20% but less than 70% of the portfolio.<br />

3. The "N/A" indicates that the fund has not been in existence for that particular period of time.<br />

Ratings are provided by Morningstar, Inc. based on a scale of one star (lowest rank) to five stars (highest rank). Morningstar has not rated some of the funds. Newer funds are not rated until a history is developed. The rating describes what has<br />

happened over the last three, five and ten-year period and is designed to reflect how a fund performed based on the risks in the fund and the performance compared to a peer universe. The rating does not predict the future performance of the<br />

fund. Morningstar ratings should not be the sole factor in making an investment decision.