Financial Confidence

LearnVest-Financial-Confidence-Curve

LearnVest-Financial-Confidence-Curve

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

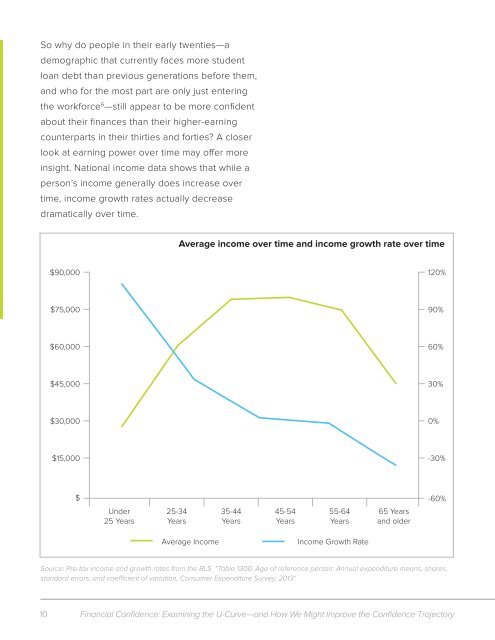

So why do people in their early twenties—a<br />

demographic that currently faces more student<br />

loan debt than previous generations before them,<br />

and who for the most part are only just entering<br />

the workforce 6 —still appear to be more confident<br />

about their finances than their higher-earning<br />

counterparts in their thirties and forties? A closer<br />

look at earning power over time may offer more<br />

insight. National income data shows that while a<br />

person’s income generally does increase over<br />

time, income growth rates actually decrease<br />

dramatically over time.<br />

Average income over time and income growth rate over time<br />

$90,000 120%<br />

$75,000 90%<br />

$60,000 60%<br />

$45,000 30%<br />

$30,000 0%<br />

$15,000 -30%<br />

$<br />

Under<br />

25 Years<br />

25-34<br />

Years<br />

35-44<br />

Years<br />

45-54<br />

Years<br />

55-64<br />

Years<br />

65 Years<br />

and older<br />

-60%<br />

Average Income<br />

Income Growth Rate<br />

Source: Pre-tax income and growth rates from the BLS “Table 1300. Age of reference person: Annual expenditure means, shares,<br />

standard errors, and coefficient of variation, Consumer Expenditure Survey, 2013”<br />

10 <strong>Financial</strong> <strong>Confidence</strong>: Examining the U-Curve—and How We Might Improve the <strong>Confidence</strong> Trajectory