S11

facts&utm_content=27590917&utm_medium=social&utm_source=twitter

facts&utm_content=27590917&utm_medium=social&utm_source=twitter

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 ESG & Corporate Financial Performance Deutsche Asset & Wealth Management<br />

2. Context and parameters of the study<br />

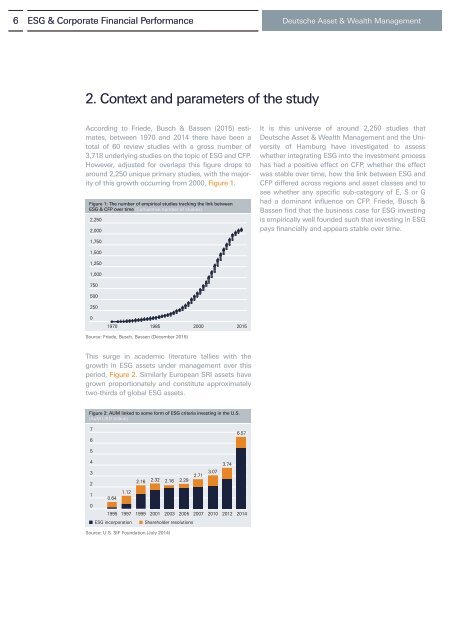

According to Friede, Busch & Bassen (2015) estimates,<br />

between 1970 and 2014 there have been a<br />

total of 60 review studies with a gross number of<br />

3,718 underlying studies on the topic of ESG and CFP.<br />

However, adjusted for overlaps this figure drops to<br />

around 2,250 unique primary studies, with the majority<br />

of this growth occurring from 2000, Figure 1.<br />

Figure 1: The number of empirical studies tracking the link between<br />

ESG & CFP over time (Cumulative number of studies)<br />

2,250<br />

2,000<br />

It is this universe of around 2,250 studies that<br />

Deutsche Asset & Wealth Management and the University<br />

of Hamburg have investigated to assess<br />

whether integrating ESG into the investment process<br />

has had a positive effect on CFP, whether the effect<br />

was stable over time, how the link between ESG and<br />

CFP differed across regions and asset classes and to<br />

see whether any specific sub-category of E, S or G<br />

had a dominant influence on CFP. Friede, Busch &<br />

Bassen find that the business case for ESG investing<br />

is empirically well founded such that investing in ESG<br />

pays financially and appears stable over time.<br />

1,750<br />

1,500<br />

1,250<br />

1,000<br />

750<br />

500<br />

250<br />

0<br />

1970 1985 2000 2015<br />

Source: Friede, Busch, Bassen (December 2015)<br />

This surge in academic literature tallies with the<br />

growth in ESG assets under management over this<br />

period, Figure 2. Similarly European SRI assets have<br />

grown proportionately and constitute approximately<br />

two-thirds of global ESG assets.<br />

Figure 2: AUM linked to some form of ESG criteria investing in the U.S.<br />

(AuM USD trillion)<br />

7<br />

6<br />

6.57<br />

5<br />

4<br />

3.74<br />

3<br />

3.07<br />

2.71<br />

2.16 2.32 2.16 2.29<br />

2<br />

1.12<br />

1<br />

0.64<br />

0<br />

1995 1997 1999 2001 2003 2005 2007 2010 2012 2014<br />

ESG incorporation Shareholder resolutions<br />

Source: U.S. SIF Foundation (July 2014)