Connected world - KPIT Cummins

Connected world - KPIT Cummins

Connected world - KPIT Cummins

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>KPIT</strong> Infosystems France SAS (formerly known as Pivolis SAS)<br />

Schedules annexed to Profi t and Loss Account for the year ended<br />

(Pursuant to Section 212 of the Companies Act, 1956)<br />

March 31, 2011 March 31, 2010<br />

Euro<br />

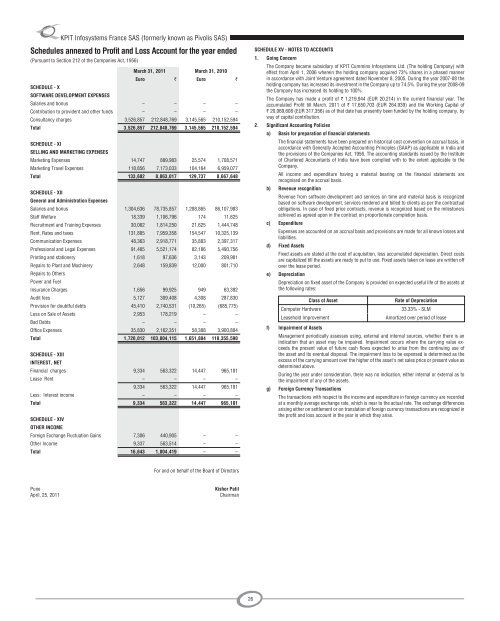

SCHEDULE - X<br />

SOFTWARE DEVELOPMENT EXPENSES<br />

` Euro `<br />

Salaries and bonus – – – –<br />

Contribution to provident and other funds – – – –<br />

Consultancy charges 3,526,857 212,848,769 3,145,565 210,152,594<br />

Total 3,526,857 212,848,769 3,145,565 210,152,594<br />

SCHEDULE - XI<br />

SELLING AND MARKETING EXPENSES<br />

Marketing Expenses 14,747 889,983 25,574 1,708,571<br />

Marketing Travel Expenses 118,856 7,173,033 104,164 6,959,077<br />

Total 133,602 8,063,017 129,737 8,667,648<br />

SCHEDULE - XII<br />

General and Administration Expenses<br />

Salaries and bonus 1,304,636 78,735,857 1,288,865 86,107,983<br />

Staff Welfare 18,339 1,106,796 174 11,625<br />

Recruitment and Training Expenses 30,062 1,814,250 21,625 1,444,748<br />

Rent, Rates and taxes 131,885 7,959,358 154,547 10,325,139<br />

Communication Expenses 48,363 2,918,771 35,883 2,397,317<br />

Professional and Legal Expenses 91,485 5,521,174 82,186 5,490,756<br />

Printing and stationery 1,618 97,636 3,143 209,981<br />

Repairs to Plant and Machinery<br />

Repairs to Others<br />

Power and Fuel<br />

2,648 159,839 12,000 801,710<br />

Insurance Charges 1,656 99,925 949 63,392<br />

Audit fees 5,127 309,408 4,308 287,830<br />

Provision for doubtful debts 45,410 2,740,531 (10,265) (685,775)<br />

Loss on Sale of Assets 2,953 178,219 – –<br />

Bad Debts – – – –<br />

Offi ce Expenses 35,830 2,162,351 58,388 3,900,884<br />

Total 1,720,012 103,804,115 1,651,804 110,355,590<br />

SCHEDULE - XIII<br />

INTEREST, NET<br />

Financial charges 9,334 563,322 14,447 965,181<br />

Lease Rent – – – –<br />

9,334 563,322 14,447 965,181<br />

Less: Interest income – – – –<br />

Total 9,334 563,322 14,447 965,181<br />

SCHEDULE - XIV<br />

OTHER INCOME<br />

Foreign Exchange Fluctuation Gains 7,306 440,905 – –<br />

Other Income 9,337 563,514 – –<br />

Total 16,643 1,004,419 – –<br />

For and on behalf of the Board of Directors<br />

Pune Kishor Patil<br />

April, 25, 2011 Chairman<br />

26<br />

SCHEDULE XV - NOTES TO ACCOUNTS<br />

1. Going Concern<br />

The Company became subsidiary of <strong>KPIT</strong> <strong>Cummins</strong> Infosystems Ltd. (The holding Company) with<br />

effect from April 1, 2006 wherein the holding company acquired 73% shares in a phased manner<br />

in accordance with Joint Venture agreement dated November 8, 2005. During the year 2007-08 the<br />

holding company has increased its investment in the Company up to 74.5%. During the year 2008-09<br />

the Company has increased its holding to 100%.<br />

The Company has made a profi t of ` 1,219,944 (EUR 20,214) in the current fi nancial year. The<br />

accumulated Profi t till March, 2011 of ` 17,650,703 (EUR 264,939) and the Working Capital of<br />

` 20,069,608 (EUR 317,356) as of that date has presently been funded by the holding company, by<br />

way of capital contribution.<br />

2. Signifi cant Accounting Policies<br />

a) Basis for preparation of fi nancial statements<br />

The fi nancial statements have been prepared on historical cost convention on accrual basis, in<br />

accordance with Generally Accepted Accounting Principles (GAAP) as applicable in India and<br />

the provisions of the Companies Act, 1956. The accounting standards issued by the Institute<br />

of Chartered Accountants of India have been complied with to the extent applicable to the<br />

Company.<br />

All income and expenditure having a material bearing on the fi nancial statements are<br />

recognised on the accrual basis.<br />

b) Revenue recognition<br />

Revenue from software development and services on time and material basis is recognized<br />

based on software development, services rendered and billed to clients as per the contractual<br />

obligations. In case of fi xed price contracts, revenue is recognized based on the milestone/s<br />

achieved as agreed upon in the contract on proportionate completion basis.<br />

c) Expenditure<br />

Expenses are accounted on an accrual basis and provisions are made for all known losses and<br />

liabilities.<br />

d) Fixed Assets<br />

Fixed assets are stated at the cost of acquisition, less accumulated depreciation. Direct costs<br />

are capitalized till the assets are ready to put to use. Fixed assets taken on lease are written off<br />

over the lease period.<br />

e) Depreciation<br />

Depreciation on fi xed asset of the Company is provided on expected useful life of the assets at<br />

the following rates:<br />

Class of Asset Rate of Depreciation<br />

Computer Hardware 33.33% - SLM<br />

Leasehold Improvement Amortized over period of lease<br />

f) Impairment of Assets<br />

Management periodically assesses using, external and internal sources, whether there is an<br />

indication that an asset may be impaired. Impairment occurs where the carrying value exceeds<br />

the present value of future cash fl ows expected to arise from the continuing use of<br />

the asset and its eventual disposal. The impairment loss to be expensed is determined as the<br />

excess of the carrying amount over the higher of the asset's net sales price or present value as<br />

determined above.<br />

During the year under consideration, there was no indication, either internal or external as to<br />

the impairment of any of the assets.<br />

g) Foreign Currency Transactions<br />

The transactions with respect to the income and expenditure in foreign currency are recorded<br />

at a monthly average exchange rate, which is near to the actual rate. The exchange differences<br />

arising either on settlement or on translation of foreign currency transactions are recognized in<br />

the profi t and loss account in the year in which they arise.