You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CAUTIOUS<br />

SPENDING<br />

INTENTIONS<br />

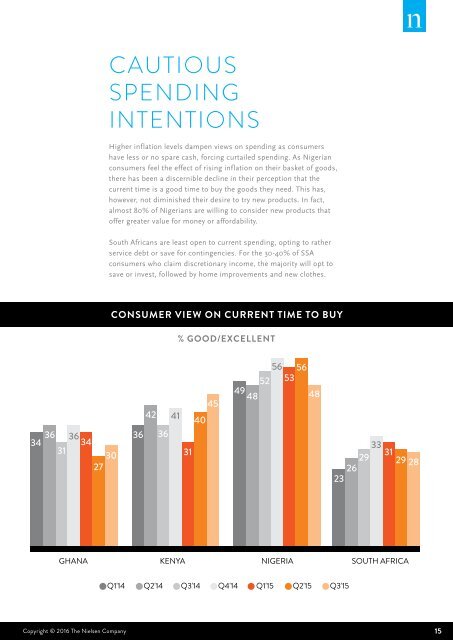

Higher inflation levels dampen views on spending as consumers<br />

have less or no spare cash, forcing curtailed spending. As Nigerian<br />

consumers feel the effect of rising inflation on their basket of goods,<br />

there has been a discernible decline in their perception that the<br />

current time is a good time to buy the goods they need. This has,<br />

however, not diminished their desire to try new products. In fact,<br />

almost 80% of Nigerians are willing to consider new products that<br />

offer greater value for money or affordability.<br />

South Africans are least open to current spending, opting to rather<br />

service debt or save for contingencies. For the 30-40% of SSA<br />

consumers who claim discretionary income, the majority will opt to<br />

save or invest, followed by home improvements and new clothes.<br />

CONSUMER VIEW ON CURRENT TIME TO BUY<br />

% GOOD/EXCELLENT<br />

34 36 36 34<br />

31<br />

30<br />

27<br />

42 41<br />

36 36<br />

31<br />

40<br />

45<br />

56 56<br />

52 53<br />

49<br />

48<br />

48<br />

33<br />

31<br />

29 29 28<br />

26<br />

23<br />

GHANA<br />

KENYA NIGERIA SOUTH AFRICA<br />

Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15<br />

Copyright © 2016 The Nielsen Company<br />

15