annual report - AV Concept Holdings Limited

annual report - AV Concept Holdings Limited

annual report - AV Concept Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

116<br />

Av ConCept <strong>Holdings</strong> limited<br />

AnnuAl RepoRt 2012<br />

NOTES TO FINANCIAL STATEMENTS<br />

31 March 2012<br />

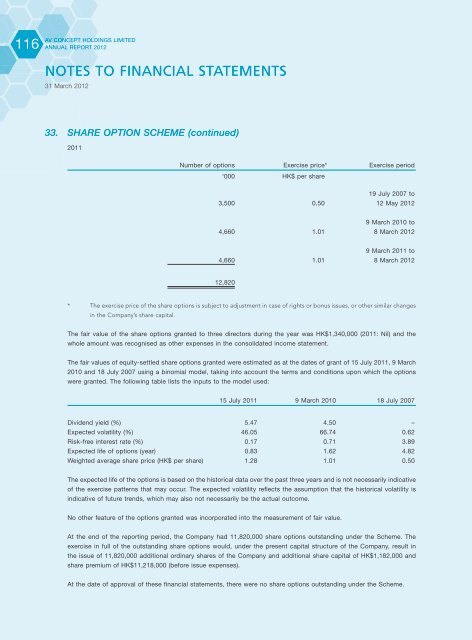

33. SHARE OPTION SCHEME (continued)<br />

2011<br />

number of options exercise price * exercise period<br />

‘000 HK$ per share<br />

19 July 2007 to<br />

3,500 0.50 12 may 2012<br />

9 march 2010 to<br />

4,660 1.01 8 march 2012<br />

9 march 2011 to<br />

4,660 1.01 8 march 2012<br />

12,820<br />

* The exercise price of the share options is subject to adjustment in case of rights or bonus issues, or other similar changes<br />

in the Company’s share capital.<br />

the fair value of the share options granted to three directors during the year was HK$1,340,000 (2011: nil) and the<br />

whole amount was recognised as other expenses in the consolidated income statement.<br />

the fair values of equity-settled share options granted were estimated as at the dates of grant of 15 July 2011, 9 march<br />

2010 and 18 July 2007 using a binomial model, taking into account the terms and conditions upon which the options<br />

were granted. the following table lists the inputs to the model used:<br />

15 July 2011 9 march 2010 18 July 2007<br />

dividend yield (%) 5.47 4.50 –<br />

expected volatility (%) 46.05 66.74 0.62<br />

Risk-free interest rate (%) 0.17 0.71 3.89<br />

expected life of options (year) 0.83 1.62 4.82<br />

Weighted average share price (HK$ per share) 1.28 1.01 0.50<br />

the expected life of the options is based on the historical data over the past three years and is not necessarily indicative<br />

of the exercise patterns that may occur. the expected volatility reflects the assumption that the historical volatility is<br />

indicative of future trends, which may also not necessarily be the actual outcome.<br />

no other feature of the options granted was incorporated into the measurement of fair value.<br />

At the end of the <strong>report</strong>ing period, the Company had 11,820,000 share options outstanding under the scheme. the<br />

exercise in full of the outstanding share options would, under the present capital structure of the Company, result in<br />

the issue of 11,820,000 additional ordinary shares of the Company and additional share capital of HK$1,182,000 and<br />

share premium of HK$11,218,000 (before issue expenses).<br />

At the date of approval of these financial statements, there were no share options outstanding under the scheme.