Building trust

1WCSR6E

1WCSR6E

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Corporate Reports<br />

Business India u the magazine of the corporate world<br />

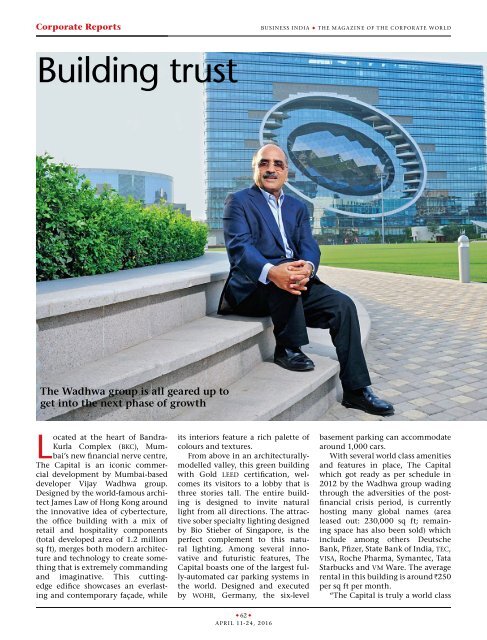

<strong>Building</strong> <strong>trust</strong><br />

The Wadhwa group is all geared up to<br />

get into the next phase of growth<br />

Located at the heart of Bandra-<br />

Kurla Complex (bkc), Mumbai’s<br />

new financial nerve centre,<br />

The Capital is an iconic commercial<br />

development by Mumbai-based<br />

developer Vijay Wadhwa group.<br />

Designed by the world-famous architect<br />

James Law of Hong Kong around<br />

the innovative idea of cybertecture,<br />

the office building with a mix of<br />

retail and hospitality components<br />

(total developed area of 1.2 million<br />

sq ft), merges both modern architecture<br />

and technology to create something<br />

that is extremely commanding<br />

and imaginative. This cuttingedge<br />

edifice showcases an everlasting<br />

and contemporary façade, while<br />

its interiors feature a rich palette of<br />

colours and textures.<br />

From above in an architecturallymodelled<br />

valley, this green building<br />

with Gold leed certification, welcomes<br />

its visitors to a lobby that is<br />

three stories tall. The entire building<br />

is designed to invite natural<br />

light from all directions. The attractive<br />

sober specialty lighting designed<br />

by Bio Stieber of Singapore, is the<br />

perfect complement to this natural<br />

lighting. Among several innovative<br />

and futuristic features, The<br />

Capital boasts one of the largest fully-automated<br />

car parking systems in<br />

the world. Designed and executed<br />

by woh r, Germany, the six-level<br />

basement parking can accommodate<br />

around 1,000 cars.<br />

With several world class amenities<br />

and features in place, The Capital<br />

which got ready as per schedule in<br />

2012 by the Wadhwa group wading<br />

through the adversities of the postfinancial<br />

crisis period, is currently<br />

hosting many global names (area<br />

leased out: 230,000 sq ft; remaining<br />

space has also been sold) which<br />

include among others Deutsche<br />

Bank, Pfizer, State Bank of India, tec,<br />

visa, Roche Pharma, Symantec, Tata<br />

Starbucks and vm Ware. The average<br />

rental in this building is around H250<br />

per sq ft per month.<br />

“The Capital is truly a world class<br />

u 62 u<br />

april 11-24, 2016

Business India u the magazine of the corporate world<br />

Corporate Reports<br />

commercial office building<br />

which has all the ingredients<br />

that a modern work<br />

place should have. It features one of<br />

the largest automated car parking<br />

systems, and is a green building. We<br />

are happy the way various facilities<br />

in this building are being managed<br />

by the Wadhwas,” says Abhay Tiwari,<br />

vice-president, Deutsche Bank, one of<br />

the anchor tenants, occupying over<br />

90,000 sq ft of space since 2012.<br />

“The Capital is an architectural<br />

marvel which everyone would like<br />

to be part of. Its cutting-edge systems<br />

and facilities such as automated<br />

parking, intelligent elevator and integrated<br />

building management system<br />

photos: sanjay borade<br />

Wadhwa: we<br />

want to give our<br />

best<br />

improve staff productivity considerably.<br />

As a developer and owner, the<br />

Wadhwa group has come up with a<br />

spectacular project, and they serve<br />

their tenants quite well,” says Ahmed<br />

Malim, head, global operations of<br />

Pfizer which has leased around 89,000<br />

sq ft of office space in this 21st century<br />

edifice that goes much beyond a<br />

conventional construction.<br />

“This structure is one of the creations<br />

of new age architecture, where<br />

there is a seamless assimilation of<br />

modern architecture and technology.<br />

With the innovations of cybertecture<br />

and the unique egg structure,<br />

The Capital has resulted in being an<br />

extremely eco-friendly building,<br />

enabled with smart features. Despite<br />

the adverse financial condition as a<br />

fallout of the global crisis in 2008,<br />

the Wadhwa group went ahead with<br />

this challenging project and showed<br />

their exemplary perseverance,”<br />

states James Law, chairman & chief<br />

cybertect, James Law Cybertecture.<br />

Modern amenities<br />

Platina is another new age commercial<br />

office space, built by the Wadhwa<br />

group. Also located in the prime<br />

location of bkc, Mumbai, this modern<br />

office building (came up in 2007<br />

before the global financial crisis) has<br />

been one of the landmark office<br />

buildings in this premier commercial<br />

business district of<br />

Mumbai. Ground plus 12<br />

floors, spread across around<br />

400,000 sq ft of developed<br />

area, having large floor<br />

plates with limited column<br />

structures, it showcases a triple<br />

height covered entrance lobby<br />

with sheer glass wall atria, consisting<br />

of a concave, faceted façade supported<br />

on stainless steel tubular<br />

structure within which are set the<br />

stainless steel portico entrance doors.<br />

Focussing on the concept of sustainable<br />

development, there is controlled<br />

air-conditioning with fresh air inputs<br />

for avoiding sick building syndrome.<br />

Equipped with a range of intelligent<br />

solutions and state-of-the art amenities,<br />

the structure boasts of an efficient<br />

building maintenance system<br />

for single point seamless monitoring,<br />

control and maintenance. The<br />

building has a coveted list of tenants<br />

(leased space: around 307,105 sq<br />

ft; average rental: H270 per sq ft per<br />

month), including National Bank of<br />

Abu Dhabi, sap, Sybase, at&t, Qualcomm,<br />

NetApp, Regus, msd Pharma<br />

and Juniper Networks.<br />

“Though we wanted to be in bkc,<br />

we zeroed in on to Platina after lots of<br />

deliberations across several buildings<br />

in this location,” says Rajeev Pant,<br />

ceo (India), National Bank of Abu<br />

Dhabi. “Besides the amenities being<br />

offered, we are happy the way the<br />

entire premise has been maintained.<br />

In the Wadhwa group, we have found<br />

a professional team, which has been<br />

quite quick in response”. The bank<br />

has leased about 22,000 sq ft of<br />

space on the XIth and XIIth floor of<br />

the building. Touted as the biggest<br />

in West Asia, it signed an agreement<br />

in March last year and started operations<br />

out of Platina four months later<br />

in August.<br />

“Platina is a wholesome experience,”<br />

says Rajesh Pillay, associate<br />

director, facility management, msd<br />

Pharma. “It has everything that a<br />

tenant would look for in an office –<br />

be it location, quality of construction<br />

or services related to facility management.<br />

The Wadhwas have put in lots<br />

of effort in detailing the project in<br />

terms of functionality and aesthetics”.<br />

msd Pharma has been in this<br />

building for over six years, occupying<br />

around 58,000 sq ft of space.<br />

Trade Centre in bkc is another<br />

commercial office building (saleable<br />

area: 5,00,000 sq ft), which is a testimony<br />

to Wadhwa group’s consistent<br />

penchant for quality and innovations<br />

in the field of commercial<br />

office space. Most of its buildings in<br />

this space have got integration with<br />

retail and hospitality towards creating<br />

self-sustained premises. Above<br />

all, they have been backed by world<br />

class maintenance and facility management<br />

services by players like jll,<br />

cbre and others. In Trade Centre,<br />

the developer has leased out about<br />

235,000 sq ft (rest of the space sold)<br />

of space across corporates and other<br />

players like vfs, gia, hdfc, Chorus<br />

Call Conferencing, apm Terminal,<br />

Cable & Wireless, hrd Diamond.<br />

“We are in Trade Centre for over<br />

u 63 u<br />

april 11-24, 2016

Corporate Reports<br />

Business India u the magazine of the corporate world<br />

six years now and quite satisfied the<br />

way things have moved so far,” says<br />

Manish Agnihotri, company secretary,<br />

apm Terminal. “As an owner of<br />

this building, the Wadhwas are professional<br />

in their approach and always<br />

ready to listen to their tenants. Even<br />

as a structure, the building lives up to<br />

our expectations”.<br />

“As a developer, they have always<br />

believed in creating inspirational creations<br />

with lots of innovations,” says<br />

renowned architect Shakti Parmar.<br />

“While putting emphasis on design<br />

and quality, they have always kept<br />

in mind sustainable developments<br />

and hence always inducted the latest<br />

technologies in their structures<br />

which are efficient in all aspects.<br />

They have never compromised with<br />

their vision of ‘Landmarks Planned<br />

with Passion’”. Parmar has been<br />

involved in many of the Wadhwa<br />

group’s projects.<br />

“While designing our projects,<br />

we put emphasis not only on the<br />

aesthetics, but also performance<br />

aspects. Our core strength is planning<br />

and detailing in such a way<br />

that we create efficient and innovative<br />

projects where our customers<br />

feel privileged. We want to give our<br />

best to build products, which stand<br />

out in the market and satisfy our<br />

customers,” says Vijay Wadhwa, 64,<br />

chairman, Wadhwa group which, in<br />

the last 45 years of its real estate journey,<br />

has delivered 10 million sq ft of<br />

projects across commercial, office, it<br />

and residential segments in Mumbai<br />

and mmr region.<br />

Apart from commercial office<br />

space where it boasts of over 70 multinational<br />

clients, the company<br />

has an it Park (carpet area leased:<br />

6,60,000 sq ft) in Vashi as also two<br />

malls – Reghuleela Mall, Vashi<br />

(leased: 3,50,000 sq ft) and Reghuleela<br />

Mall, Kandivli (leased: 44,000<br />

sq ft). The company also has significant<br />

presence on the residential<br />

front with landmark projects (delivered)<br />

like Solitaire, Powai, Imperial<br />

Heights, Goregaon, Aquaria Grande,<br />

Borivali, The Address – Ghatkopar<br />

(80 per cent delivered). In fact, 70 per<br />

cent of the company’s total portfolio<br />

(delivered) is made up of residential<br />

projects.<br />

Makhija: leading from the front<br />

Currently, it is executing projects<br />

(primarily residential) involving<br />

about 8.0 milion sq ft (carpet:<br />

5.3 million sq ft) of development<br />

in Mumbai and mmr regions. Some<br />

of the landmark residential projects<br />

being executed are W-54 in<br />

Matunga, Atmosphere in Mulund,<br />

Aquaria Grande in Borivali and<br />

Courtyard in Thane. These projects<br />

will be executed in the next two-four<br />

years. Besides, there is also a pipeline<br />

of about 40 million sq ft of developments,<br />

which will be brought under<br />

execution over a period of the next<br />

8-9 years. The majority of this will be<br />

part of a 450-acre integrated township<br />

project in Panvel, Navi Mumbai.<br />

The company has already got special<br />

township clearance for Phase I of<br />

this project and is expected to start<br />

execution in the next few months.<br />

No compromise<br />

Wadhwa started its real estate journey<br />

way back in 1970 in a modest<br />

manner in Mumbai. His family had<br />

shifted to Mumbai from Mathura,<br />

UP, where he was born and where his<br />

and other Sindhi families had found<br />

shelter just before Partition. His<br />

father, Vasudeo Wadhwa had a small<br />

electrical shop in Old Delhi’s Bhagirath<br />

Place and would struggle to support<br />

a family of seven (three sons,<br />

two sisters and a wife). But Wadhwa<br />

Senior was conscious about providing<br />

education to his kids. Despite his<br />

modest income, he sent Vijay, the<br />

eldest child, to Scindia School, Gwalior,<br />

where he studied alongside<br />

scions of the wealthiest families.<br />

“Despite all sorts of financial<br />

difficulties, my father never compromised<br />

on our education. I owe<br />

everything to my father for what I<br />

am today. I learnt a lot from his values,<br />

dedication and passion,” says<br />

Wadhwa, who started taking interest<br />

in his father’s business at an early<br />

stage, even before he could complete<br />

his education.<br />

In 1964, when the business was<br />

in bad shape, his father decided<br />

to try his luck in Mumbai. Many<br />

of his friends had done so. Mumbai<br />

proved to be lucky too. Wadhwa<br />

Senior’s business fared relatively better,<br />

enabling the family to move into<br />

a one bhk flat in Mumbai’s Khar suburb.<br />

By then, Vijay had finished his<br />

term in Scindia School and started<br />

living in Mumbai. While helping<br />

his father run his small business, the<br />

possibilities in the field of construction<br />

attracted him. <strong>Building</strong> materials<br />

were doing well. At 18, he egged<br />

his father on to get into the construction<br />

line. In 1970, the father-son duo<br />

identified a plot of land in Mumbai’s<br />

Prarthana Samaj area and constructed<br />

Vijay Chambers, a building<br />

of residential flats. However, it was<br />

not a cake-walk, as they had to face<br />

u 64 u<br />

april 11-24, 2016

Business India u the magazine of the corporate world<br />

Corporate Reports<br />

difficult market conditions and buyers<br />

were hard to come by. In fact,<br />

they had decided to abandon the<br />

entire project midway. But, their<br />

perseverance prevailed and they<br />

managed to sail through.<br />

“This project was a big learning<br />

curve for us as we had tried to<br />

enter into a completely new area of<br />

business and that too in a place like<br />

Mumbai, where we had just come<br />

in from a small place like Mathura,”<br />

recalls Wadhwa. There was no looking<br />

back since. The money realised<br />

from the sales of Vijay Chambers<br />

came in handy to work on various<br />

projects in South Mumbai, which<br />

included Vijay Deep at Malabar Hill,<br />

Ritu Apartments at Ban Ganga, Silver<br />

Beach at Shivaji Park, etc. By the<br />

early 1980s, the Wadhwas started<br />

getting recognition in Mumbai’s<br />

realty market. Buyers started appreciating<br />

their work and their commitments.<br />

All through the 1980s, they<br />

ramped up their portfolio in Mumbai’s<br />

western suburbs, though in a<br />

gradual manner.<br />

In 1992, the three brothers<br />

involved in the business under one<br />

umbrella decided to separate amicably.<br />

While Vijay and his youngest<br />

brother Manoj remained in the real<br />

estate business pursuing their interest<br />

separately, his brother Deepak<br />

got into the marble and granite business<br />

and is based out of Bengaluru.<br />

Manoj’s Wadhwa Constructions is<br />

engaged in the real estate markets of<br />

Mumbai and Pune.<br />

Sanjay Chhabria, Wadhwa’s<br />

nephew (son of his brother-in-law),<br />

who was with the company for several<br />

years, separated a couple of years<br />

ago to form his own venture, Radius<br />

Developers, which has also been<br />

showing its aggressive intent in the<br />

Mumbai realty market. However, his<br />

nephew’s exit has been well-substituted<br />

by his son-in-law (daughter’s<br />

husband) Navin Makhija, 34, who is<br />

leading the company from the front<br />

now, as its managing director. Navin<br />

has been with the company for the<br />

last 15 years now. A commerce graduate<br />

who also pursued a course in<br />

opm (owner/president manage Programme)<br />

from Harvard University,<br />

Navin was joint managing director<br />

of the company since 2010.<br />

Backed by its impeccable track<br />

record of innovations, construction<br />

quality and delivery schedule,<br />

the Wadhwas have certainly carved<br />

a niche for themselves. In fact, the<br />

company has today emerged as one<br />

of the most reputed developers. Even<br />

as buyers and customers are reposing<br />

tremendous faith in the company’s<br />

projects (in the sluggish market,<br />

the Wadhwas continue to command<br />

premium), it has developed a strong<br />

ecosystem of business partners that<br />

include architects & design consultants<br />

(such as Hafeez Contractor,<br />

James Law, Aedas, lpa and Sitectonix)<br />

contractors (l&t, mft, hbo+emtb<br />

and Sterling) property consultants/<br />

brokers (jll, cbre, Knight Frank,<br />

Brookfield), as also financial partners,<br />

such as Piramal Fund, iilf, kkr,<br />

il&fs, Indiabulls Financial Services,<br />

Bank of Baroda, icici, hdfc, Yes<br />

Bank, Bank of India and others.<br />

Strong product portfolio<br />

Even in this difficult market condition,<br />

the company has never faced<br />

any problem for funding as financial<br />

partners have felt more comfortable<br />

in financing/investing its projects,<br />

which are always well received in<br />

the market. Moreover, much of this<br />

funding is based on lease rental discounting<br />

since the company earns<br />

around H280 crore annually through<br />

its solid portfolio of rental-yielding<br />

office and commercial assets. The<br />

company has leased out around 2<br />

million sq ft (carpet area) of assets<br />

(office, it, retail & hospitality), which<br />

are well backed up by a strong tenant<br />

base (around 70+ mncs).<br />

“The presence of rental-yielding<br />

commercial assets in our portfolio<br />

is something that makes our business<br />

model quite attractive. This has<br />

helped us tide over the challenging<br />

market condition more effectively,<br />

while others struggle. Going forward,<br />

we will continue to pursue this,”<br />

says Wadhwa.<br />

“Our well-recognised market presence<br />

with a strong product portfolio,<br />

efficient construction and execution<br />

capabilities, have helped us develop<br />

a strong loyalty base of customers,<br />

vendors, investors and business<br />

partners. Going forward, we would<br />

like to leverage our strengths to take<br />

the company to the next level of<br />

growth,” says Makhija.<br />

“We are extremely pleased with<br />

our partnership with Wadhwa and<br />

have found them to be diligent<br />

partners with a sharp focus on execution<br />

and a strong design of sensibility.<br />

We also rate them extremely<br />

highly on planning and site facilitation<br />

with an emphasis on customer<br />

acceptability. In my personal interactions<br />

with Navin, I have found him<br />

to be engaging, with a great sense<br />

of vision and drive to continue to<br />

grow the group’s legacy and emerge<br />

as one of the preeminent developers<br />

in the city today,” says Khushru<br />

Jijina, managing director, Piramal<br />

Fund Management, which has<br />

sanctioned about H700 crore in the<br />

Wadhwas’ five projects.<br />

“We partnered with the Wadhwa<br />

group to recapitalise a major residential<br />

project in Mumbai. The group’s<br />

customer-centric approach and focus<br />

on execution prompted us to choose<br />

Wadhwa as our first real estate partner<br />

in India,” says Ashish Khandelia,<br />

director, kkr, which had invested<br />

H127 crore in one of Wadhwa’s major<br />

residential projects – The Address, in<br />

Ghatkopar, Mumbai.<br />

While various partners are keen<br />

to strengthen their relationship with<br />

the Wadhwas to ride over their success<br />

story, lately even developers are<br />

not shying away from joining hands<br />

with them, as they consciously<br />

believe that such a move can help<br />

them sail through the ongoing difficult<br />

period. In fact, for the Wadhwas<br />

also, it is an opportune time to<br />

leverage their brand and the track<br />

record. In the last couple of years,<br />

almost 70 per cent of projects that<br />

have been launched (or due to be<br />

launched shortly) are being undertaken<br />

in joint development where the<br />

company is executing the projects,<br />

while the partners/ landowners are<br />

bringing in the land component.<br />

For instance, in Wadhwa’s ongoing<br />

residential project, Atmosphere<br />

in Mumbai, Mulund suburb, the<br />

company has struck a joint development<br />

agreement (50:50) with Mumbai’s<br />

Man Infraconstruction and<br />

u 65 u<br />

april 11-24, 2016

Corporate Reports<br />

Business India u the magazine of the corporate world<br />

Chandak Group (landowners). Initially,<br />

the partners were developing<br />

this 14-acre land on their own,<br />

but couldn’t generate the adequate<br />

response in the sluggish market condition.<br />

They were forced to look for<br />

a developer which could provide the<br />

much needed momentum to this<br />

project and finally zeroed in on the<br />

Wadhwas. Under the banner of Wadhwas<br />

Group, the Phase I (700 flats)<br />

of the project (total: 2.5 million of<br />

saleable area) was launched in October<br />

2014. Despite, the slowdown in<br />

the market, the company has already<br />

sold 70 per cent of the phase I (average<br />

rate: H14,000 per sq ft), while<br />

there is preparation for the launch of<br />

phase II (about 1,000 flats).<br />

In another instance, the company<br />

is all set to launch one of its milestone<br />

residential projects (luxury<br />

sea-facing) in Mumbai’s Prabhadevi<br />

area. The 1.8-million sq ft project to<br />

be launched shortly is coming up in<br />

a land parcel, owned jointly by Hubtown<br />

(erstwhile Akruti City) and<br />

Rising Straits Capital, promoted by<br />

Subhash Bedi (former co-founder,<br />

Red Fort Capital) Initially, Hubtown<br />

and dlf had bought this land parcel<br />

from the Thackersey family for H350<br />

crore in 2007, just before the global<br />

financial crisis began. The slowdown<br />

after that saw dlf exiting the project<br />

and Hubtown entangled not only<br />

in the complex coastal regulation<br />

Ghatkopar project<br />

zone (crz) and other approvals but<br />

also a liquidity crunch. After failing<br />

to move the project, last year, Hubtown<br />

backed by Rising Straits Capital<br />

joined hands with the Wadhwas,<br />

which has now already conceptualised<br />

and designed the project which<br />

the Wadhwas claim to be one of the<br />

most unique residential projects it<br />

has built so far.<br />

Mega project<br />

However, the proposed 450-acre<br />

integrated township in Panvel, Navi<br />

Mumbai is a real mega project where<br />

the company has entered into a joint<br />

development agreement with Bahrain-based<br />

investment bank Gulf<br />

Finance House, the owner of the<br />

land. The Wadhwa group is planning<br />

to construct a mixed used<br />

project comprising residential, commercial,<br />

retail and hotel spaces along<br />

with schools and hospitals. The massive<br />

project which has development<br />

potential of over 45 million sq ft,<br />

will be executed in phases in a time<br />

frame of 8-10 years. The company is<br />

planning to launch the first phase<br />

in the next few month’s time since<br />

it has already received the Special<br />

Township Clearance. “One of our<br />

major achievements has been this<br />

clearance. It will enable us to initiate<br />

infrastructure works. Besides, the<br />

timing of approval augurs well with<br />

several major infrastructure projects<br />

finally getting initiated including the<br />

international aiport, Mumbai Trans<br />

Harbour Link and Navi Mumbai Airport<br />

Influence Notified Area,” says<br />

Makhija, who is looking to unlock<br />

values of the company’s brand, pursuing<br />

an asset light model. The company<br />

is also preparing to enter the<br />

reit market, once the guidelines<br />

get streamlined.<br />

“Having such a mega project in a<br />

location like Panvel which is emerging<br />

as a preferred destination, will<br />

add tremendously to the portfolio<br />

as a developer. With the government<br />

expediting the whole process<br />

of development in the region, players<br />

like Wadhwa group will gain<br />

significantly,” says Ashok Kumar,<br />

managing director, Cresa Partners.<br />

With all these initiatives in place,<br />

the Wadhwas are all set to enter their<br />

next phase of growth. With its customer-centric<br />

approach and meticulouslydesigned<br />

projects, the company has<br />

uniquely positioned itself in the market.<br />

In the last decade or so, the company<br />

has entered into the big league<br />

of developers which has beaten the<br />

recent slowdown in the market since<br />

buyers are showing them more <strong>trust</strong>.<br />

As the market undergoes a consolidation<br />

phase (which has already started),<br />

and gains more maturity, developers<br />

like the Wadhwa group will call the<br />

shots. Backed by its impeccable track<br />

record of execution and planning,<br />

the company is now trying to leverage<br />

its strengths and the joint development<br />

model is a right move as the<br />

land price constitutes a big chunk of<br />

any project. Such an asset-light model<br />

will also help the company create a<br />

much-needed hedging mechanism<br />

and free up more resources to ramp<br />

up its portfolio.<br />

Above all, it has also created a<br />

robust business model, where it<br />

boasts of a strong portfolio of rental-yielding<br />

assets. This has not only<br />

provided the company much needed<br />

liquidity but also helped raise money<br />

easily based on lease rental discount.<br />

Moreover, the company is also turning<br />

out to be a perfect candidate for<br />

the reit market.<br />

u ARBIND GUPTA<br />

arbind.gupta@businessindiagroup.com<br />

u 66 u<br />

april 11-24, 2016