Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

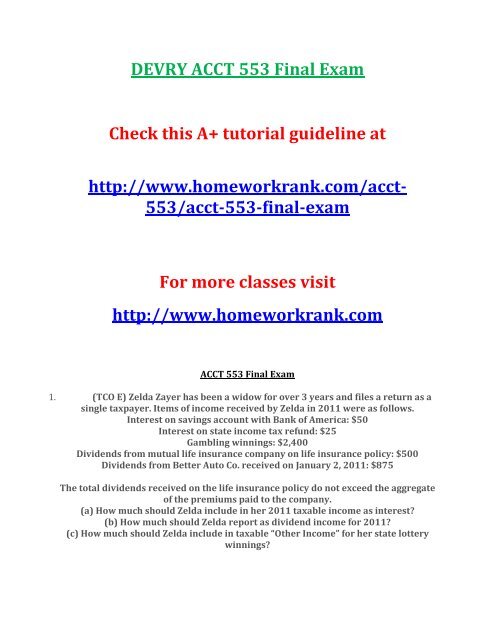

<strong>DEVRY</strong> <strong>ACCT</strong> <strong>553</strong> <strong>Final</strong> <strong>Exam</strong><br />

Check this A+ tutorial guideline at<br />

http://www.homeworkrank.com/acct-<br />

<strong>553</strong>/acct-<strong>553</strong>-final-exam<br />

For more classes visit<br />

http://www.homeworkrank.com<br />

<strong>ACCT</strong> <strong>553</strong> <strong>Final</strong> <strong>Exam</strong><br />

1. (TCO E) Zelda Zayer has been a widow for over 3 years and files a return as a<br />

single taxpayer. Items of income received by Zelda in 2011 were as follows.<br />

Interest on savings account with Bank of America: $50<br />

Interest on state income tax refund: $25<br />

Gambling winnings: $2,400<br />

Dividends from mutual life insurance company on life insurance policy: $500<br />

Dividends from Better Auto Co. received on January 2, 2011: $875<br />

The total dividends received on the life insurance policy do not exceed the aggregate<br />

of the premiums paid to the company.<br />

(a) How much should Zelda include in her 2011 taxable income as interest?<br />

(b) How much should Zelda report as dividend income for 2011?<br />

(c) How much should Zelda include in taxable “Other Income” for her state lottery<br />

winnings?

2. (TCO E) Distinguish between realized gains and losses and recognized gains<br />

and losses.(Points : 17)<br />

3. (TCO F) Describe the current tax law for sale of residence.(Points : 17)<br />

4. (TCO G) Briefly describe what “material participation” is. Why is the<br />

determination of whether a taxpayer materially participates important?(Points : 17)<br />

5. (TCO I) Amos, a single individual with a salary of $50,000, incurred and paid<br />

the following expenses during the year.<br />

Medical expenses: $5,000<br />

Alimony: $14,000<br />

Casualty loss (after $100 floor): $1,000<br />

State income taxes: $4,000<br />

Moving expenses: $1,500<br />

Contribution to a traditional IRA: $2,000<br />

Student loan interest: $1,200<br />

Analyze the above expenses and determine which ones are deductible for AGI. Please<br />

support your position.(Points : 17)<br />

6. (TCO I) A review of Bearing’s Year 2 records disclosed the following tax<br />

information:<br />

Wages $ 20,000<br />

Taxable interest and qualifying dividends 4,000<br />

Schedule C trucking business net income 32,000<br />

Rental (loss) from residential property (35,000)<br />

Limited partnership (loss) (5,000)<br />

Bearing actively participated in the rental property and was a limited partner in the<br />

partnership. Bearing had sufficient amounts at risk for the rental property and the<br />

partnership. What is Bearing’s Year 2 adjusted gross income?<br />

7. (TCO F) (Becker CPA Review Course, Reg. 1) Smith has an adjusted gross<br />

income (AGI) of $140,000 without taking into consideration $40,000 of losses from<br />

rental real estate activities. Smith actively participates in the rental real estate<br />

activities. What amount of the rental losses may Smith deduct in determining taxable<br />

income?(Points : 17)<br />

8. (TCO B) (Becker CPA Review Course Reg. 3) For the year ended December 31,<br />

Year 6, Taylor Corp. had a net operating loss of $200,000. Taxable income for the<br />

earlier years of corporate existence, computed without reference to the net<br />

operating loss, was as follows:<br />

Taxable Income:<br />

Year 1 $ 5,000<br />

Year 2 10,000<br />

Year 3 20,000<br />

Year 4 50,000<br />

Year 5 50,000<br />

What amount of net operating loss will be available to Taylor for the year ended<br />

December 31, Year 7?(Points : 17)

9. (TCO F) (Becker CPA Review <strong>Exam</strong> Reg. 1) Randolph is a single individual who<br />

always claims the standard deduction. Randolph received the following in the<br />

current year:<br />

Wages $ 22,000<br />

Unemployment compensation 6,000<br />

Pension distribution (100% taxable) 4,000<br />

A state tax refund from the previous year 425<br />

What is Randolph’s gross income?(Points : 17)<br />

10. (TCO H) Alex Smith purchased 30 shares of XYZ stock on April 30, 2010 for<br />

$210, and on September 1, 2010, he purchased 90 additional shares for $900. On<br />

November 8, 2010, he sold 48 shares, which could not be specifically identified, for<br />

$528, and on December 15, 2010, he sold another 25 shares for $50. What is his<br />

recognized gain or loss?(P