Free Online Commodity Tips, Gold, Silver, Copper

Best website to book huge profit by using our accurate Commodity Tips, NCDEX Tips and MCX Tips related to both International and Indian markets.

Best website to book huge profit by using our accurate Commodity Tips, NCDEX Tips and MCX Tips related to both International and Indian markets.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Daily Market Reflection<br />

Market Outlook<br />

<strong>Gold</strong> and silver showed bearish movement and in coming session<br />

selling can be continued. <strong>Gold</strong> is very bearish and selling gold would<br />

be a profitable strategy. Crude also showed bearish movement<br />

because of oversupply from Canada. In coming session selling crude<br />

can be profitable strategy in near term. Base metals showed positive<br />

movement and in near term buying would be profitable.<br />

30th May 2016<br />

For our BIG PROFIT calls and LATEST Report<br />

SUBSCRIBE to premium reports, click here.<br />

COMDEX<br />

Fundamental News<br />

<strong>Gold</strong> slipped to its lowest in eight weeks on Friday, and was on<br />

track for its biggest weekly decline in nine, as expectations of a US<br />

Fundamental Factors<br />

interest rate hike in two months on positive economic data hurt<br />

investor appetite.<br />

Base metals will lack ability to rise today. Value added at China’s<br />

large industrials is expected to grow in April as declines in profit at<br />

China’s SOEs narrowed further in April, but increase will slow<br />

compared with March. The figure due for release today should<br />

boost the market.<br />

Important Data<br />

Time Currency Event Forecast Previous<br />

All Day GBP Bank Holiday<br />

All Day USD Bank Holiday<br />

12:30pm CHF KOF Economic<br />

Barometer<br />

12:30pm EUR Spanish Flash CPI<br />

y/y<br />

102.7<br />

-1.1%<br />

6:00pm CAD Current Account -15.4B<br />

6:00pm USD RMPI m/m 4.5%<br />

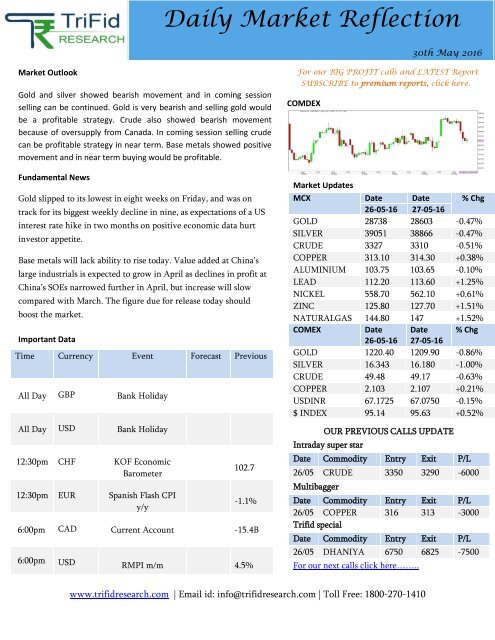

Market Updates<br />

MCX Date Date % Chg<br />

26-05-16 27-05-16<br />

GOLD 28738 28603 -0.47%<br />

SILVER 39051 38866 -0.47%<br />

CRUDE 3327 3310 -0.51%<br />

COPPER 313.10 314.30 +0.38%<br />

ALUMINIUM 103.75 103.65 -0.10%<br />

LEAD 112.20 113.60 +1.25%<br />

NICKEL 558.70 562.10 +0.61%<br />

ZINC 125.80 127.70 +1.51%<br />

NATURALGAS 144.80 147 +1.52%<br />

COMEX<br />

Date Date % Chg<br />

26-05-16 27-05-16<br />

GOLD 1220.40 1209.90 -0.86%<br />

SILVER 16.343 16.180 -1.00%<br />

CRUDE 49.48 49.17 -0.63%<br />

COPPER 2.103 2.107 +0.21%<br />

USDINR 67.1725 67.0750 -0.15%<br />

$ INDEX 95.14 95.63 +0.52%<br />

OUR PREVIOUS CALLS UPDATE<br />

Intraday super star<br />

Date <strong>Commodity</strong> Entry Exit P/L<br />

26/05 CRUDE 3350 3290 -6000<br />

Multibagger<br />

Date <strong>Commodity</strong> Entry Exit P/L<br />

26/05 COPPER 316 313 -3000<br />

Trifid special<br />

Date <strong>Commodity</strong> Entry Exit P/L<br />

26/05 DHANIYA 6750 6825 -7500<br />

For our next calls click here……..<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll <strong>Free</strong>: 1800-270-1410

<strong>Gold</strong> and <strong>Silver</strong><br />

GOLD<br />

COMEX GOLD<br />

PIVOTS S1 S2 R1 R2<br />

MCX 28500 28300 28665 28900<br />

COMEX 1210 1200 1220 1230<br />

SILVER<br />

<strong>Gold</strong> today continue on lower note and broke its important<br />

support of 28700 and found the support of 28500.<br />

Sustaining below 28500 again drag it upto the support level<br />

of 28300. On higher side if some correction happens then<br />

28900 will act as strong resistance level.<br />

COMEX SILVER<br />

PIVOTS S1 S2 R1 R2<br />

MCX 38700 38200 39150 39650<br />

COMEX 16.00 15.80 16.35 16.55<br />

SILVER over all showed sideways to bearish movement all<br />

the day. Now bearishness may again drag it upto the<br />

support level of 38500. On the other hand 39700 will act as<br />

major resistance level above only some correction may be<br />

seen.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll <strong>Free</strong>: 1800-270-1410

Crude and <strong>Copper</strong><br />

CRUDE<br />

COMEX CRUDE<br />

MCX Crude opened on lower note and showed sideways<br />

movement. Now bullishness may bounce it towards the<br />

PIVOTS S1 S2 R1 R2<br />

resistance level of 3400. And on lower side 3270 will act as<br />

MCX 3350 3400 3280 3240<br />

important support level.<br />

COMEX 48.60 48.00 49.55 50.00<br />

COPPER<br />

COMEX COPPER<br />

PIVOTS S1 S2 R1 R2<br />

MCX 312 310 315.80 318.05<br />

COMEX 2.1165 2.3500 2.0835 2.0585<br />

<strong>Copper</strong> showed bullish movement in morning session and<br />

some correction on lower side on evening session. Now if it<br />

maintain above 316 then 320 will act as next resistance<br />

level. On other hand 312 will act as important support<br />

level.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll <strong>Free</strong>: 1800-270-1410

Other Commodities<br />

PIVOTS<br />

COMMODITIES S1 S2 R1 R2 VOLUME OI TREND<br />

ALUMINIUM 103.20 102.20 104.50 105.50 5094 2567 Bearish<br />

LEAD 113 112 114 115 12864 3552 Bullish<br />

NICKEL 552 540 570 580 21234 21503 Bearish<br />

ZINC 127 126 128 129 20800 4560 Bullish<br />

NATURAL<br />

GAS<br />

142 138 149 153 51948 7088 Sideways<br />

LME Inventory<br />

Commodities 23/05/2016 24/05/2016 25/05/2016 26/05/2016 27/05/2016<br />

ALUMINIUM -5300 -5550 -5375 -4425 -5900<br />

COPPER -725 +2250 -2000 +725 -2225<br />

LEAD -125 +5575 +5575 -275 -25<br />

NICKEL -1668 -384 -630 -978 +1848<br />

ZINC -975 -100 -600 -50 -2025<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll <strong>Free</strong>: 1800-270-1410

Agri <strong>Commodity</strong> Updates<br />

CHANA<br />

Chana showed sideways movement all the day broke its<br />

important resistance level of 6100. Now if it maintains<br />

above 6120 then 6160 will be next resistance level. And<br />

on lower side 6040 will act as major support level.<br />

PIVOTS S1 S2 R1 R2<br />

6045 6000 6120 6160<br />

DHANIYA<br />

Dhaniya showed sideways trend and formed head and<br />

shoulder pattern on 30 min chart. Now on higher side<br />

6925 will act as important resistance level above which<br />

it will pull towards the resistance level of 7050 On<br />

lower side some bearishness drag towards the support<br />

level of 6800.<br />

PIVOTS S1 S2 R1 R2<br />

6810 6715 6925 7000<br />

SOYABEAN<br />

Soyabean showed sideways movement all the day and<br />

correction on higher side take it towards the resistance<br />

level of 3965. Now if it sustains below 3920 then 3875<br />

will be next support level. And on higher side 3965<br />

will act as major resistance level.<br />

PIVOTS S1 S2 R1 R2<br />

3915 3875 3965 4000<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll <strong>Free</strong>: 1800-270-1410

Intraday Super Star<br />

(Premium Section)<br />

**** TARGETS ****/**** SL ****. For complete call subscribe our premium reports.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll <strong>Free</strong>: 1800-270-1410

Multibagger Call<br />

(Premium Section)<br />

**** TARGETS ****/**** SL ****. For complete call subscribe our premium reports.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll <strong>Free</strong>: 1800-270-1410

Trifid Special<br />

(Premium Section)<br />

**** TARGETS **** SL ****. For complete call subscribe our premium reports.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll <strong>Free</strong>: 1800-270-1410

DISCLAIMER<br />

Trifid Research respects and values the Right to Policy of each and every individual. We are esteemed<br />

by the relationship and by becoming our clients; you have a promise from our side that we shall<br />

remain loyal to all our clients and non-clients whose information resides with us. This Privacy Policy<br />

of Trifid Research applies to the current clients as well as former clients. Below are the word by word<br />

credentials of our Privacy Policy:<br />

1. Your information, whether public or private, will not be sold, rented, exchanged, transferred<br />

or given to any company or individual for any reason without your consent.<br />

2. The only use we will be bringing to your information will be for providing the services to you<br />

for which you have subscribed to us.<br />

3. Your information given to us represents your identity with us. If any changes are brought in<br />

any of the fields of which you have provided us the information, you shall bring it to our<br />

notice by either calling us or dropping a mail to us.<br />

4. In addition to the service provided to you, your information (mobile number, E-mail ID etc.)<br />

can be brought in use for sending you newsletters, surveys, contest information, or<br />

information about any new services of the company which will be for your benefit and while<br />

subscribing for our services, you agree that Trifid Research has the right to do so.<br />

5. By subscribing to our services, you consent to our Privacy Policy and Terms of Use.<br />

6. Trifid research does not guarantee or is responsible in any which way, for the trade execution<br />

of our recommendations, this is the sole responsibility of the client.<br />

7. Due to the market’s volatile nature, the trader may/ may not get appropriate opportunity to<br />

execute the trades at the mentioned prices and Trifid Research hold’s no liability for any<br />

profit/ loss incurred whatsoever in this case.<br />

8. It is the responsibility of the client to view the report timely from our Premium member<br />

section on our website: www.trifidresearch.com and the same will also be mailed to this<br />

registered email id.<br />

9. Trifid research does not hold any liability or responsibility of delay in mail delivery of<br />

reports, as this depends on our mail service provider’s network infrastructure.<br />

10. The clients can call us for any query related to buying/selling the securities, based on our<br />

recommendations.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll <strong>Free</strong>: 1800-270-1410