Commodity Tips, MCX Tips and NCDEX Tips performance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Daily Market Reflection<br />

31th May 2016<br />

Market Outlook<br />

Gold <strong>and</strong> silver showed bearish movement as US holiday so market<br />

moves in a range <strong>and</strong> in coming session selling can be continued. Gold<br />

is very bearish <strong>and</strong> selling gold would be a profitable strategy. Crude<br />

also showed bullish movement. In coming session buying in crude can<br />

be profitable strategy in near term. Base metals showed sideways<br />

movement as LME holiday <strong>and</strong> in near term selling would be<br />

profitable.<br />

Fundamental News<br />

Fundamental Factors<br />

Gold prices fell Monday, moving in the opposite direction of the<br />

U.S. dollar, which soared after comments by Federal Reserve<br />

Chairwoman Janet Yellen last week indicated an interest-rate hike<br />

could come this summer.<br />

Crude oil prices continue to battle to remain above the $50 price<br />

level but find the resistance hard to breach. Traders remain<br />

focused on Thursday’s Producers Meeting.<br />

Important Data<br />

Time Currency Event Forecast Previous<br />

1:30pm<br />

2:30pm<br />

EUR<br />

EUR<br />

2:30pm EUR Core CPI Flash<br />

Estimate y/y<br />

6:00pm USD Core PCE Price<br />

Index m/m<br />

6:00pm<br />

USD<br />

M3 Money Supply<br />

y/y 5.0% 5.0%<br />

CPI Flash Estimate<br />

y/y -0.1% -0.2%<br />

Personal Spending<br />

m/m<br />

0.8% 0.7%<br />

0.2% 0.1%<br />

0.6% 0.1%<br />

For our BIG PROFIT calls <strong>and</strong> LATEST Report<br />

SUBSCRIBE to premium reports, click here.<br />

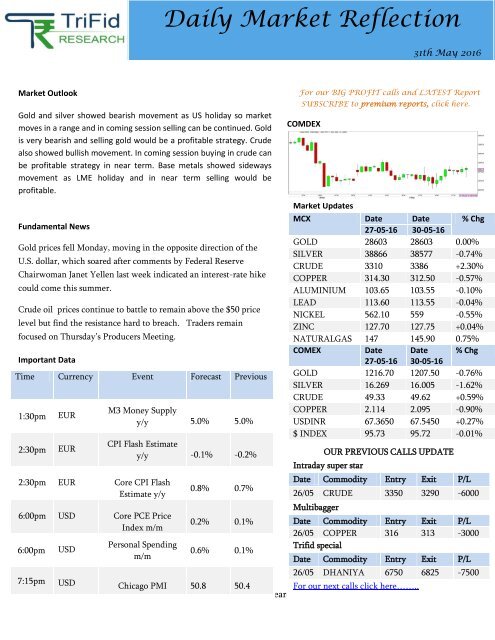

COMDEX<br />

Market Updates<br />

<strong>MCX</strong> Date Date % Chg<br />

27-05-16 30-05-16<br />

GOLD 28603 28603 0.00%<br />

SILVER 38866 38577 -0.74%<br />

CRUDE 3310 3386 +2.30%<br />

COPPER 314.30 312.50 -0.57%<br />

ALUMINIUM 103.65 103.55 -0.10%<br />

LEAD 113.60 113.55 -0.04%<br />

NICKEL 562.10 559 -0.55%<br />

ZINC 127.70 127.75 +0.04%<br />

NATURALGAS 147 145.90 0.75%<br />

COMEX<br />

Date Date % Chg<br />

27-05-16 30-05-16<br />

GOLD 1216.70 1207.50 -0.76%<br />

SILVER 16.269 16.005 -1.62%<br />

CRUDE 49.33 49.62 +0.59%<br />

COPPER 2.114 2.095 -0.90%<br />

USDINR 67.3650 67.5450 +0.27%<br />

$ INDEX 95.73 95.72 -0.01%<br />

OUR PREVIOUS CALLS UPDATE<br />

Intraday super star<br />

Date <strong>Commodity</strong> Entry Exit P/L<br />

26/05 CRUDE 3350 3290 -6000<br />

Multibagger<br />

Date <strong>Commodity</strong> Entry Exit P/L<br />

26/05 COPPER 316 313 -3000<br />

Trifid special<br />

Date <strong>Commodity</strong> Entry Exit P/L<br />

26/05 DHANIYA 6750 6825 -7500<br />

7:15pm USD Chicago PMI 50.8 50.4 For our next calls click here……..<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Gold <strong>and</strong> Silver<br />

GOLD<br />

COMEX GOLD<br />

PIVOTS S1 S2 R1 R2<br />

<strong>MCX</strong> 28400 28200 28665 28900<br />

COMEX 1195 1190 1215 1230<br />

SILVER<br />

Gold today continue on lower note <strong>and</strong> broke its important<br />

support of 28500 <strong>and</strong> showed sideways trend. Sustaining<br />

below 28400 again drag it upto the support level of 28300.<br />

On higher side if some correction happens then 28900 will<br />

act as strong resistance level.<br />

COMEX SILVER<br />

PIVOTS S1 S2 R1 R2<br />

<strong>MCX</strong> 38250 37700 38750 39250<br />

COMEX 16.00 15.80 16.35 16.55<br />

SILVER over all showed sideways trend as gap down<br />

opening drag it towards the support level od 38300. Now<br />

bearishness may again drag it upto the support level of<br />

37900. On the other h<strong>and</strong> 39000 will act as major resistance<br />

level above only some correction may be seen.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Crude <strong>and</strong> Copper<br />

CRUDE<br />

COMEX CRUDE<br />

<strong>MCX</strong> Crude opened on higher note <strong>and</strong> showed bullish<br />

movement. Now bullishness may bounce it towards the<br />

PIVOTS S1 S2 R1 R2<br />

resistance level of 3400. And on lower side 3270 will act as<br />

<strong>MCX</strong> 3350 3400 3280 3240<br />

important support level.<br />

COMEX 48.60 48.00 49.90 50.50<br />

COPPER<br />

COMEX COPPER<br />

PIVOTS S1 S2 R1 R2<br />

<strong>MCX</strong> 312 310 315.80 318.05<br />

COMEX 2.1165 2.3500 2.0835 2.0585<br />

Copper showed sideways movement as LME holiday. Now<br />

if it maintain above 316 then 320 will act as next resistance<br />

level. On other h<strong>and</strong> 312 will act as important support<br />

level.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Other Commodities<br />

PIVOTS<br />

COMMODITIES S1 S2 R1 R2 VOLUME OI TREND<br />

ALUMINIUM 103.20 102.20 104.50 105.50 2112 2293 Bearish<br />

LEAD 113 112 114 115 3902 3014 Bullish<br />

NICKEL 552 540 570 580 7898 19253 Bearish<br />

ZINC 127 126 128 129 4933 3730 Bullish<br />

NATURAL<br />

GAS<br />

145 142 148 150 21258 6144 Sideways<br />

LME Inventory<br />

Commodities 24/05/2016 25/05/2016 26/05/2016 27/05/2016 30/05/2016<br />

ALUMINIUM -5550 -5375 -4425 -5900 -<br />

COPPER +2250 -2000 +725 -2225 -<br />

LEAD +5575 +5575 -275 -25 -<br />

NICKEL -384 -630 -978 +1848 -<br />

ZINC -100 -600 -50 -2025 -<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Agri <strong>Commodity</strong> Updates<br />

CHANA<br />

Chana showed sideways movement all the day broke its<br />

important resistance level of 6100. Now if it maintains<br />

above 6120 then 6160 will be next resistance level. And<br />

on lower side 6040 will act as major support level.<br />

PIVOTS S1 S2 R1 R2<br />

6045 6000 6120 6160<br />

DHANIYA<br />

Dhaniya showed sideways trend <strong>and</strong> formed head <strong>and</strong><br />

shoulder pattern on 30 min chart. Now on higher side<br />

6925 will act as important resistance level above which<br />

it will pull towards the resistance level of 7050 On<br />

lower side some bearishness drag towards the support<br />

level of 6800.<br />

PIVOTS S1 S2 R1 R2<br />

6810 6715 6925 7000<br />

GUARSEED<br />

Guarseed showed sideways movement all the day <strong>and</strong><br />

correction on higher side take it towards the resistance<br />

level of 3175. Now if it sustains below 3090 then 3025<br />

will be next support level. And on higher side 3185will<br />

act as major resistance level.<br />

PIVOTS S1 S2 R1 R2<br />

3080 3045 3150 3185<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Intraday Super Star<br />

(Premium Section)<br />

**** TARGETS ****/**** SL ****. For complete call subscribe our premium reports.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Multibagger Call<br />

(Premium Section)<br />

**** TARGETS ****/**** SL ****. For complete call subscribe our premium reports.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Trifid Special<br />

(Premium Section)<br />

**** TARGETS **** SL ****. For complete call subscribe our premium reports.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

DISCLAIMER<br />

Trifid Research respects <strong>and</strong> values the Right to Policy of each <strong>and</strong> every individual. We are esteemed<br />

by the relationship <strong>and</strong> by becoming our clients; you have a promise from our side that we shall<br />

remain loyal to all our clients <strong>and</strong> non-clients whose information resides with us. This Privacy Policy<br />

of Trifid Research applies to the current clients as well as former clients. Below are the word by word<br />

credentials of our Privacy Policy:<br />

1. Your information, whether public or private, will not be sold, rented, exchanged, transferred<br />

or given to any company or individual for any reason without your consent.<br />

2. The only use we will be bringing to your information will be for providing the services to you<br />

for which you have subscribed to us.<br />

3. Your information given to us represents your identity with us. If any changes are brought in<br />

any of the fields of which you have provided us the information, you shall bring it to our<br />

notice by either calling us or dropping a mail to us.<br />

4. In addition to the service provided to you, your information (mobile number, E-mail ID etc.)<br />

can be brought in use for sending you newsletters, surveys, contest information, or<br />

information about any new services of the company which will be for your benefit <strong>and</strong> while<br />

subscribing for our services, you agree that Trifid Research has the right to do so.<br />

5. By subscribing to our services, you consent to our Privacy Policy <strong>and</strong> Terms of Use.<br />

6. Trifid research does not guarantee or is responsible in any which way, for the trade execution<br />

of our recommendations, this is the sole responsibility of the client.<br />

7. Due to the market’s volatile nature, the trader may/ may not get appropriate opportunity to<br />

execute the trades at the mentioned prices <strong>and</strong> Trifid Research hold’s no liability for any<br />

profit/ loss incurred whatsoever in this case.<br />

8. It is the responsibility of the client to view the report timely from our Premium member<br />

section on our website: www.trifidresearch.com <strong>and</strong> the same will also be mailed to this<br />

registered email id.<br />

9. Trifid research does not hold any liability or responsibility of delay in mail delivery of<br />

reports, as this depends on our mail service provider’s network infrastructure.<br />

10. The clients can call us for any query related to buying/selling the securities, based on our<br />

recommendations.<br />

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410