Fact Sheet - Golden Arrow Resources Corporation

Fact Sheet - Golden Arrow Resources Corporation

Fact Sheet - Golden Arrow Resources Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Share Structure<br />

(As of Dec 7, 2012)<br />

Shares Issued: 47,216,655*<br />

Warrants: 0<br />

Options: 4,100,000<br />

Fully Diluted: 51,316,655<br />

Contact:<br />

Corporate Communications<br />

T | 604 687 1828<br />

TF | 800 901 0058<br />

E | info@goldenarrowresources.com<br />

Suite 709, 837 West Hastings St.<br />

Vancouver, BC, Canada V6C 3N6<br />

* The company will have 41,823,655 shares issued, see<br />

news release dated September 20th, 2012 for details.<br />

Projects. People. Performance.<br />

TSX Venture: GRG<br />

Frankfurt: GAC<br />

goldenarrowresources.com<br />

<strong>Golden</strong> <strong>Arrow</strong> <strong>Resources</strong> <strong>Corporation</strong> is a Vancouver-based, explorer<br />

and prospect generator focused on identifying, acquiring and advancing<br />

precious and base metal projects in Argentina, with the goal of achieving a<br />

world class discovery.<br />

The core focus will be on advancing its flagship Chinchillas Silver Project<br />

located in Jujuy, Argentina. <strong>Golden</strong> <strong>Arrow</strong> has a strong treasury which will<br />

allow the company to drill its Chinchillas Silver Project over the coming<br />

months with the aim of publishing the first NI 43-101 resource calculation<br />

on Chinchillas in the first half of 2013. <strong>Golden</strong> <strong>Arrow</strong> will continue to execute<br />

its strategy to leverage the Company’s<br />

exploration exposure by attracting partners<br />

to fund work on its other high quality<br />

mineral projects.<br />

<strong>Golden</strong> <strong>Arrow</strong> is a member of Grosso Group,<br />

a management company specialized in<br />

resource exploration, and working in<br />

Argentina where it is highly regarded and<br />

trusted since 1993.<br />

Chinchillas Silver Project<br />

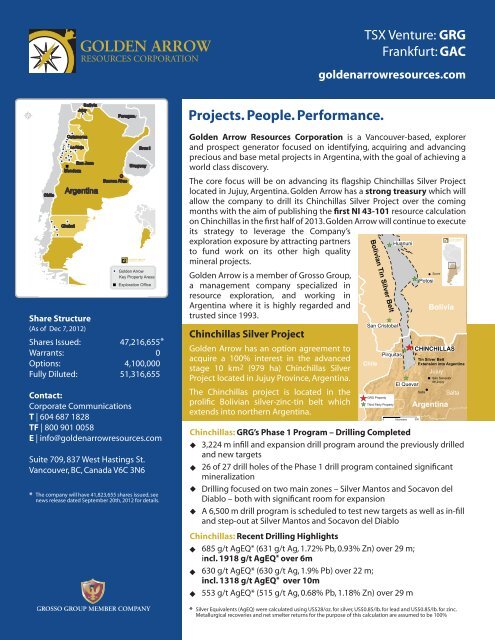

<strong>Golden</strong> <strong>Arrow</strong> has an option agreement to<br />

acquire a 100% interest in the advanced<br />

stage 10 km2 (979 ha) Chinchillas Silver<br />

Project located in Jujuy Province, Argentina.<br />

The Chinchillas project is located in the<br />

prolific Bolivian silver-zinc-tin belt which<br />

extends into northern Argentina.<br />

Chinchillas: GRG’s Phase 1 Program – Drilling Completed<br />

u 3,224 m infill and expansion drill program around the previously drilled<br />

and new targets<br />

u 26 of 27 drill holes of the Phase 1 drill program contained significant<br />

mineralization<br />

u Drilling focused on two main zones – Silver Mantos and Socavon del<br />

Diablo – both with significant room for expansion<br />

u A 6,500 m drill program is scheduled to test new targets as well as in-fill<br />

and step-out at Silver Mantos and Socavon del Diablo<br />

Chinchillas: Recent Drilling Highlights<br />

u 685 g/t AgEQ* (631 g/t Ag, 1.72% Pb, 0.93% Zn) over 29 m;<br />

incl. 1918 g/t AgEQ* over 6m<br />

u 630 g/t AgEQ* (630 g/t Ag, 1.9% Pb) over 22 m;<br />

incl. 1318 g/t AgEQ* over 10m<br />

u 553 g/t AgEQ* (515 g/t Ag, 0.68% Pb, 1.18% Zn) over 29 m<br />

* Silver Equivalents (AgEQ) were calculated using US$28/oz. for silver, US$0.85/lb. for lead and US$0.85/lb. for zinc.<br />

Metallurgical recoveries and net smelter returns for the purpose of this calculation are assumed to be 100%

Investment Highlights<br />

u<br />

u<br />

u<br />

u<br />

Upcoming drilling program on its advanced<br />

Chinchillas Silver Project<br />

Option agreement with Vale SA, the world’s<br />

second largest mining company by market<br />

capitalization.<br />

Strong property base in Argentina – over<br />

30 projects, most are 100% owned with 7 at<br />

drill ready stage<br />

Project generator business model;<br />

leveraging treasury and exploration<br />

exposure through joint ventures<br />

MANAGEMENT AND DIRECTORS<br />

Joseph Grosso -President & CEO<br />

Brian McEwen, PGeol<br />

VP Exploration and Development<br />

Bassam Moubarak, CA<br />

CFO & Corporate Secretary<br />

Bruce Smith, AUSIMM, MSc, MEng<br />

Exploration Manager<br />

David Terry, PhD, PGeo -Director<br />

Leonard Harris -Director<br />

Nikolaos Cacos, MIM, BSc -Director<br />

David Horton, MBA, BComm -Director<br />

John Gammon, PhD -Director<br />

Chad Williams, PEng -Director<br />

Key Projects<br />

Key Projects Option Agreement with Vale S.A.<br />

Mogote Copper-Gold-Silver Project – 100% owned, 83km2 (8,300 ha)<br />

u Located within World-class porphyry and epithermal mineral belts with<br />

deposits including: El Indio, Pascua–Lama, Veladero, Aldebaran, Marte/<br />

Lobo and Refugio<br />

u Drilling confirmed the presence of a large porphyry system, with<br />

significant copper-gold intercepts including 495.3m averaging 0.23<br />

g/t gold and 0.17% copper from MOG-1A<br />

u Vale completed a 3,695m drill program in April 2012 and will commence<br />

the 3rd year of the drill program in November 2012<br />

Option Terms: Vale can earn an initial 70% interest by completing US$6.8<br />

million in exploration expenditures and making US$2.3 million in cash<br />

payments over three years. Agreement signed September 2010.<br />

TSX Venture: GRG<br />

Frankfurt: GAC<br />

PROJECT PORTFOLIO HIGHLIGHTS – AvAILABLE FOR JOINT vENTuRE<br />

Caballos Copper-Gold Project - 100% owned, 252km2 (25,200 ha)<br />

Located in a developing porphyry district, home to several world-class<br />

discoveries and producing mines, between the south end of the Maricunga<br />

Copper-Gold Belt and the northern extent of the El Indio Gold-Silver Belt<br />

in La Rioja Province, Argentina, along the border with Chile. The Caballos<br />

Project was discovered and staked by GRG’s technical team.<br />

u 12m chip sample averaged 2.4% Cu and 5m averaged 0.6% Cu<br />

u High grade porphyry copper gold target includes 12m averaging 2.4%<br />

copper within an 18m chip sample<br />

u Permits for trenching and drilling are in place and targets identified<br />

Potrerillos Gold-Silver Property - 100% owned, 40km2 (4,000 ha)<br />

Located 8km east of Barrick Gold’s massive Veladero gold/silver mine which<br />

has been in production since 2006 and contains Proven and Probable<br />

reserves of 11.3 Moz gold equivalent (projections from Barrick’s 2010 Annual Report)<br />

u Previous surface sampling returned high-grade gold-silver mineralization<br />

on surface up to 15.4 g/t Au, 2,900 g/t Ag over 0.6m.<br />

goldenarrowresources.com