PROFILES INNOVATION

Goldman-Sachs-report-Blockchain-Putting-Theory-into-Practice

Goldman-Sachs-report-Blockchain-Putting-Theory-into-Practice

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

May 24, 2016<br />

Profiles in Innovation<br />

industry premium rates in the US. We think blockchain could introduce similar efficiencies<br />

into the system, and ultimately lower the cost of insurance to the end consumer.<br />

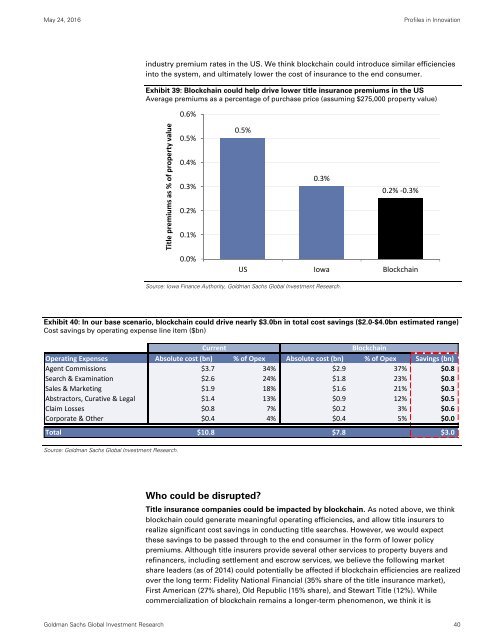

Exhibit 39: Blockchain could help drive lower title insurance premiums in the US<br />

Average premiums as a percentage of purchase price (assuming $275,000 property value)<br />

0.6%<br />

Title premiums as % of property value<br />

0.5%<br />

0.4%<br />

0.3%<br />

0.2%<br />

0.1%<br />

0.5%<br />

0.3%<br />

0.2% ‐0.3%<br />

0.0%<br />

US Iowa Blockchain<br />

Source: Iowa Finance Authority, Goldman Sachs Global Investment Research.<br />

Exhibit 40: In our base scenario, blockchain could drive nearly $3.0bn in total cost savings ($2.0-$4.0bn estimated range)<br />

Cost savings by operating expense line item ($bn)<br />

Current<br />

Blockchain<br />

Operating Expenses Absolute cost (bn) % of Opex Absolute cost (bn) % of Opex Savings (bn)<br />

Agent Commissions $3.7 34% $2.9 37% $0.8<br />

Search & Examination $2.6 24% $1.8 23% $0.8<br />

Sales & Marketing $1.9 18% $1.6 21% $0.3<br />

Abstractors, Curative & Legal $1.4 13% $0.9 12% $0.5<br />

Claim Losses $0.8 7% $0.2 3% $0.6<br />

Corporate & Other $0.4 4% $0.4 5% $0.0<br />

Total $10.8 $7.8 $3.0<br />

Source: Goldman Sachs Global Investment Research.<br />

Who could be disrupted?<br />

Title insurance companies could be impacted by blockchain. As noted above, we think<br />

blockchain could generate meaningful operating efficiencies, and allow title insurers to<br />

realize significant cost savings in conducting title searches. However, we would expect<br />

these savings to be passed through to the end consumer in the form of lower policy<br />

premiums. Although title insurers provide several other services to property buyers and<br />

refinancers, including settlement and escrow services, we believe the following market<br />

share leaders (as of 2014) could potentially be affected if blockchain efficiencies are realized<br />

over the long term: Fidelity National Financial (35% share of the title insurance market),<br />

First American (27% share), Old Republic (15% share), and Stewart Title (12%). While<br />

commercialization of blockchain remains a longer-term phenomenon, we think it is<br />

Goldman Sachs Global Investment Research 40