PROFILES INNOVATION

Goldman-Sachs-report-Blockchain-Putting-Theory-into-Practice

Goldman-Sachs-report-Blockchain-Putting-Theory-into-Practice

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

May 24, 2016<br />

Profiles in Innovation<br />

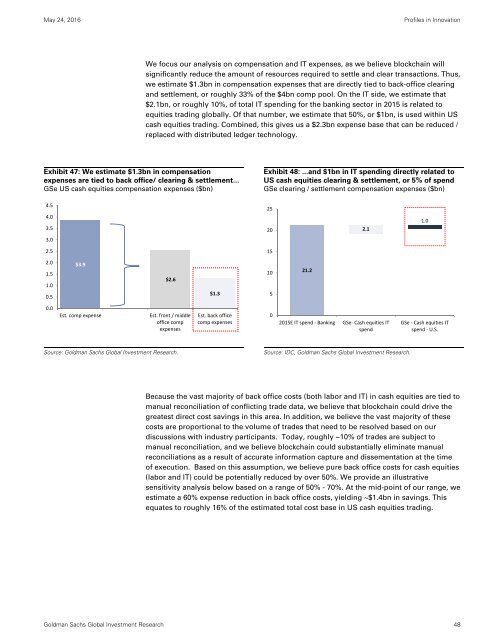

We focus our analysis on compensation and IT expenses, as we believe blockchain will<br />

significantly reduce the amount of resources required to settle and clear transactions. Thus,<br />

we estimate $1.3bn in compensation expenses that are directly tied to back-office clearing<br />

and settlement, or roughly 33% of the $4bn comp pool. On the IT side, we estimate that<br />

$2.1bn, or roughly 10%, of total IT spending for the banking sector in 2015 is related to<br />

equities trading globally. Of that number, we estimate that 50%, or $1bn, is used within US<br />

cash equities trading. Combined, this gives us a $2.3bn expense base that can be reduced /<br />

replaced with distributed ledger technology.<br />

Exhibit 47: We estimate $1.3bn in compensation<br />

expenses are tied to back office/ clearing & settlement...<br />

GSe US cash equities compensation expenses ($bn)<br />

Exhibit 48: ...and $1bn in IT spending directly related to<br />

US cash equities clearing & settlement, or 5% of spend<br />

GSe clearing / settlement compensation expenses ($bn)<br />

4.5<br />

4.0<br />

3.5<br />

25<br />

20<br />

2.1<br />

1.0<br />

3.0<br />

15<br />

$3.9<br />

$2.6<br />

$1.3<br />

10<br />

5<br />

21.2<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Est. comp expense<br />

Est. front / middle<br />

office comp<br />

expenses<br />

Est. back office<br />

comp expenses<br />

0<br />

2015E IT spend ‐ Banking<br />

GSe‐ Cash equities IT<br />

spend<br />

GSe ‐ Cash equities IT<br />

spend ‐ U.S.<br />

Source: Goldman Sachs Global Investment Research.<br />

Source: IDC, Goldman Sachs Global Investment Research.<br />

Because the vast majority of back office costs (both labor and IT) in cash equities are tied to<br />

manual reconciliation of conflicting trade data, we believe that blockchain could drive the<br />

greatest direct cost savings in this area. In addition, we believe the vast majority of these<br />

costs are proportional to the volume of trades that need to be resolved based on our<br />

discussions with industry participants. Today, roughly ~10% of trades are subject to<br />

manual reconciliation, and we believe blockchain could substantially eliminate manual<br />

reconciliations as a result of accurate information capture and dissementation at the time<br />

of execution. Based on this assumption, we believe pure back office costs for cash equities<br />

(labor and IT) could be potentially reduced by over 50%. We provide an illustrative<br />

sensitivity analysis below based on a range of 50% - 70%. At the mid-point of our range, we<br />

estimate a 60% expense reduction in back office costs, yielding ~$1.4bn in savings. This<br />

equates to roughly 16% of the estimated total cost base in US cash equities trading.<br />

Goldman Sachs Global Investment Research 48