The Big Nine

2atweSD

2atweSD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

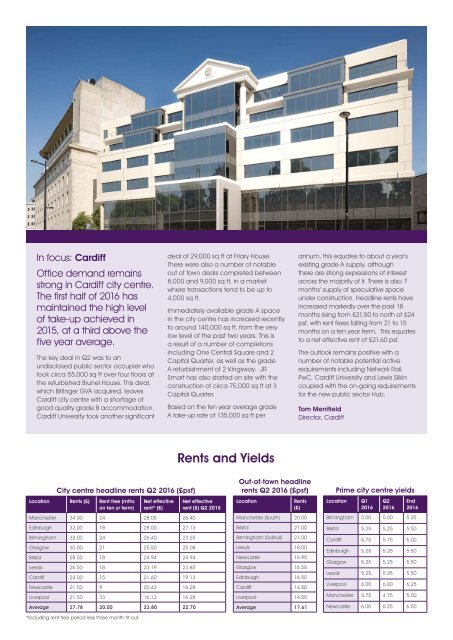

In focus: Cardiff<br />

Office demand remains<br />

strong in Cardiff city centre.<br />

<strong>The</strong> first half of 2016 has<br />

maintained the high level<br />

of take-up achieved in<br />

2015, at a third above the<br />

five year average.<br />

<strong>The</strong> key deal in Q2 was to an<br />

undisclosed public sector occupier who<br />

took circa 55,000 sq ft over four floors at<br />

the refurbished Brunel House. This deal,<br />

which Bilfinger GVA acquired, leaves<br />

Cardiff city centre with a shortage of<br />

good quality grade B accommodation.<br />

Cardiff University took another significant<br />

deal of 29,000 sq ft at Friary House.<br />

<strong>The</strong>re were also a number of notable<br />

out of town deals completed between<br />

8,000 and 9,000 sq ft, in a market<br />

where transactions tend to be up to<br />

4,000 sq ft.<br />

Immediately available grade A space<br />

in the city centre has increased recently<br />

to around 140,000 sq ft, from the very<br />

low level of the past two years. This is<br />

a result of a number of completions<br />

including One Central Square and 2<br />

Capital Quarter, as well as the grade<br />

A refurbishment of 2 Kingsway. JR<br />

Smart has also started on site with the<br />

construction of circa 75,000 sq ft at 3<br />

Capital Quarter.<br />

Based on the ten year average grade<br />

A take-up rate of 135,000 sq ft per<br />

annum, this equates to about a year’s<br />

existing grade A supply, although<br />

there are strong expressions of interest<br />

across the majority of it. <strong>The</strong>re is also 7<br />

months’ supply of speculative space<br />

under construction. Headline rents have<br />

increased markedly over the past 18<br />

months rising from £21.50 to north of £24<br />

psf, with rent frees falling from 21 to 15<br />

months on a ten year term. This equates<br />

to a net effective rent of £21.60 psf.<br />

<strong>The</strong> outlook remains positive with a<br />

number of notable potential active<br />

requirements including Network Rail,<br />

PwC, Cardiff University and Lewis Silkin<br />

coupled with the on-going requirements<br />

for the new public sector Hub.<br />

Tom Merrifield<br />

Director, Cardiff<br />

Rents and Yields<br />

City centre headline rents Q2 2016 (£psf)<br />

Location Rents (£) Rent free (mths<br />

on ten yr term)<br />

Net effective<br />

rent* (£)<br />

Manchester 34.00 24 28.05 26.40<br />

Edinburgh 32.00 18 28.00 27.13<br />

Birmingham 32.00 24 26.40 23.25<br />

Glasgow 30.00 21 25.50 25.08<br />

Bristol 28.50 18 24.94 24.94<br />

Leeds 26.50 18 23.19 23.85<br />

Cardiff 24.00 15 21.60 19.13<br />

Newcastle 21.50 9 20.43 18.28<br />

Liverpool 21.50 33 16.13 16.28<br />

Average 27.78 20.00 23.80 22.70<br />

*Including rent free period less three month fit-out.<br />

Net effective<br />

rent (£) Q2 2015<br />

Out-of-town headline<br />

rents Q2 2016 (£psf)<br />

Location<br />

Rents<br />

(£)<br />

Manchester (South) 20.00<br />

Bristol 21.00<br />

Birmingham (Solihull) 21.00<br />

Leeds 18.00<br />

Newcastle 16.95<br />

Glasgow 16.50<br />

Edinburgh 16.50<br />

Cardiff 14.50<br />

Liverpool 14.00<br />

Average 17.61<br />

Prime city centre yields<br />

Location<br />

Q1<br />

2016<br />

Q2<br />

2016<br />

End<br />

2016<br />

Birmingham 5.00 5.00 5.25<br />

Bristol 5.25 5.25 5.50<br />

Cardiff 5.75 5.75 6.00<br />

Edinburgh 5.25 5.25 5.50<br />

Glasgow 5.25 5.25 5.50<br />

Leeds 5.25 5.25 5.50<br />

Liverpool 6.00 6.00 6.25<br />

Manchester 4.75 4.75 5.00<br />

Newcastle 6.00 6.25 6.50