Ashika Monthly Insight August 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AUGUST <strong>2016</strong><br />

ECONOMIC REVIEW<br />

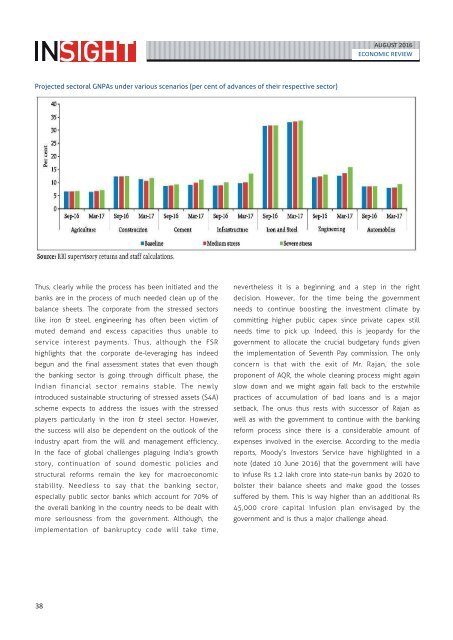

Projected sectoral GNPAs under various scenarios (per cent of advances of their respective sector)<br />

Thus, clearly while the process has been initiated and the<br />

banks are in the process of much needed clean up of the<br />

balance sheets. The corporate from the stressed sectors<br />

like iron & steel, engineering has often been victim of<br />

muted demand and excess capacities thus unable to<br />

service interest payments. Thus, although the FSR<br />

highlights that the corporate de-leveraging has indeed<br />

begun and the final assessment states that even though<br />

the banking sector is going through difficult phase, the<br />

Indian financial sector remains stable. The newly<br />

introduced sustainable structuring of stressed assets (S4A)<br />

scheme expects to address the issues with the stressed<br />

players particularly in the iron & steel sector. However,<br />

the success will also be dependent on the outlook of the<br />

industry apart from the will and management efficiency.<br />

In the face of global challenges plaguing India’s growth<br />

story, continuation of sound domestic policies and<br />

structural reforms remain the key for macroeconomic<br />

stability. Needless to say that the banking sector,<br />

especially public sector banks which account for 70% of<br />

the overall banking in the country needs to be dealt with<br />

more seriousness from the government. Although, the<br />

implementation of bankruptcy code will take time,<br />

nevertheless it is a beginning and a step in the right<br />

decision. However, for the time being the government<br />

needs to continue boosting the investment climate by<br />

committing higher public capex since private capex still<br />

needs time to pick up. Indeed, this is jeopardy for the<br />

government to allocate the crucial budgetary funds given<br />

the implementation of Seventh Pay commission. The only<br />

concern is that with the exit of Mr. Rajan, the sole<br />

proponent of AQR, the whole cleaning process might again<br />

slow down and we might again fall back to the erstwhile<br />

practices of accumulation of bad loans and is a major<br />

setback. The onus thus rests with successor of Rajan as<br />

well as with the government to continue with the banking<br />

reform process since there is a considerable amount of<br />

expenses involved in the exercise. According to the media<br />

reports, Moody’s Investors Service have highlighted in a<br />

note (dated 10 June <strong>2016</strong>) that the government will have<br />

to infuse Rs 1.2 lakh crore into state-run banks by 2020 to<br />

bolster their balance sheets and make good the losses<br />

suffered by them. This is way higher than an additional Rs<br />

45,000 crore capital infusion plan envisaged by the<br />

government and is thus a major challenge ahead.<br />

38