STR 581 Week 4 Capstone Exam - Latest 2015

STR 581 Week 4 Capstone Exam - Latest 2015 IF You Want To Purchase A+ Work then Click The Link Below For Instant Down Load http://psummer.com/STR-581-Week-4-Capstone-Exam-Latest-2015-1202.htm IF You Face Any Problem Then E Mail Us At JOHNMATE1122@GMAIL.COM

STR 581 Week 4 Capstone Exam - Latest 2015 IF You Want To Purchase A+ Work then Click The Link Below For Instant Down Load http://psummer.com/STR-581-Week-4-Capstone-Exam-Latest-2015-1202.htm IF You Face Any Problem Then E Mail Us At JOHNMATE1122@GMAIL.COM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

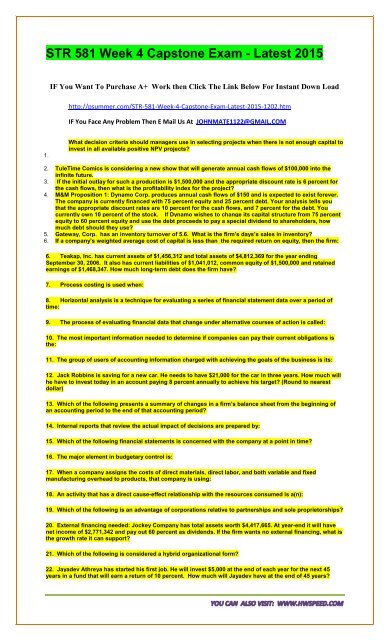

<strong>STR</strong> <strong>581</strong> <strong>Week</strong> 4 <strong>Capstone</strong> <strong>Exam</strong> - <strong>Latest</strong> <strong>2015</strong><br />

IF You Want To Purchase A+ Work then Click The Link Below For Instant Down Load<br />

http://psummer.com/<strong>STR</strong>-<strong>581</strong>-<strong>Week</strong>-4-<strong>Capstone</strong>-<strong>Exam</strong>-<strong>Latest</strong>-<strong>2015</strong>-1202.htm<br />

IF You Face Any Problem Then E Mail Us At JOHNMATE1122@GMAIL.COM<br />

1.<br />

What decision criteria should managers use in selecting projects when there is not enough capital to<br />

invest in all available positive NPV projects?<br />

2. TuleTime Comics is considering a new show that will generate annual cash flows of $100,000 into the<br />

infinite future.<br />

3. If the initial outlay for such a production is $1,500,000 and the appropriate discount rate is 6 percent for<br />

the cash flows, then what is the profitability index for the project?<br />

4. M&M Proposition 1: Dynamo Corp. produces annual cash flows of $150 and is expected to exist forever.<br />

The company is currently financed with 75 percent equity and 25 percent debt. Your analysis tells you<br />

that the appropriate discount rates are 10 percent for the cash flows, and 7 percent for the debt. You<br />

currently own 10 percent of the stock. If Dynamo wishes to change its capital structure from 75 percent<br />

equity to 60 percent equity and use the debt proceeds to pay a special dividend to shareholders, how<br />

much debt should they use?<br />

5. Gateway, Corp. has an inventory turnover of 5.6. What is the firm’s days’s sales in inventory?<br />

6. If a company’s weighted average cost of capital is less than the required return on equity, then the firm:<br />

6. Teakap, Inc. has current assets of $1,456,312 and total assets of $4,812,369 for the year ending<br />

September 30, 2006. It also has current liabilities of $1,041,012, common equity of $1,500,000 and retained<br />

earnings of $1,468,347. How much long-term debt does the firm have?<br />

7. Process costing is used when:<br />

8. Horizontal analysis is a technique for evaluating a series of financial statement data over a period of<br />

time:<br />

9. The process of evaluating financial data that change under alternative courses of action is called:<br />

10. The most important information needed to determine if companies can pay their current obligations is<br />

the:<br />

11. The group of users of accounting information charged with achieving the goals of the business is its:<br />

12. Jack Robbins is saving for a new car. He needs to have $21,000 for the car in three years. How much will<br />

he have to invest today in an account paying 8 percent annually to achieve his target? (Round to nearest<br />

dollar)<br />

13. Which of the following presents a summary of changes in a firm’s balance sheet from the beginning of<br />

an accounting period to the end of that accounting period?<br />

14. Internal reports that review the actual impact of decisions are prepared by:<br />

15. Which of the following financial statements is concerned with the company at a point in time?<br />

16. The major element in budgetary control is:<br />

17. When a company assigns the costs of direct materials, direct labor, and both variable and fixed<br />

manufacturing overhead to products, that company is using:<br />

18. An activity that has a direct cause-effect relationship with the resources consumed is a(n):<br />

19. Which of the following is an advantage of corporations relative to partnerships and sole proprietorships?<br />

20. External financing needed: Jockey Company has total assets worth $4,417,665. At year-end it will have<br />

net income of $2,771,342 and pay out 60 percent as dividends. If the firm wants no external financing, what is<br />

the growth rate it can support?<br />

21. Which of the following is considered a hybrid organizational form?<br />

22. Jayadev Athreya has started his first job. He will invest $5,000 at the end of each year for the next 45<br />

years in a fund that will earn a return of 10 percent. How much will Jayadev have at the end of 45 years?

23. Horizontal analysis is also known as:<br />

24. A cost which remains constant per unit at various levels of activity is a:<br />

25. The break-even point is where:<br />

26. The convention of consistency refers to consistent use of accounting principles:<br />

27. Your firm has an equity multiplier of 2.47. What is the debt-to-equity ratio?<br />

28. Turnbull Corp. had an EBIT of $247 million in the last fiscal year. Its depreciation and amortization<br />

expenses amounted to $84 million. The firm has 135 million shares outstanding and a share price of $12.80.<br />

A competing firm that is very similar to Turnbull has an enterprise value/EBITDA multiple of 5.40.What is the<br />

enterprise value of Turnbull Corp.? Round to the nearest million dollars.<br />

29. Serox stock was selling for $20 two years ago. The stock sold for $25 one year ago, and it is currently<br />

selling for $28. Serox pays a $1.10 dividend per year. What was the rate of return for owning Serox in the<br />

most recent year? (Round to the nearest percent.)<br />

30. An unrealistic budget is more likely to result when it:<br />

31. In a process cost system, product costs are summarized:<br />

32. Ajax Corp. is expecting the following cash flows - $79,000, $112,000, $164,000, $84,000, and $242,000 –<br />

over the next five years. If the company’s opportunity cost is 15 percent, what is the present value of these<br />

cash flows? (Round to the nearest dollar.)<br />

33. Firms that achieve higher growth rates without seeking external financing:<br />

34. Regatta, Inc., has six-year bonds outstanding that pay a 8.25 percent coupon rate. Investors buying the<br />

bond today can expect to earn a yield to maturity of 6.875 percent. What should the company’s bonds be<br />

priced at today? Assume annual coupon payments. (Round to the nearest dollar.)<br />

35. How firms estimate their cost of capital: The WACC for a firm is 13.00 percent. You know that the firm’s<br />

cost of debt capital is 10 percent and the cost of equity capital is 20% What proportion of the firm is financed<br />

with debt?<br />

36. Variance reports are:<br />

37. The accumulation of accounting data on the basis of the individual manager who has the authority to<br />

make day-to-day decisions about activities in an area is called:<br />

38. Next year Jenkins Traders will pay a dividend of $3.00. It expects to increase its dividend by $0.25 in<br />

each of the following three years. If their required rate of return if 14 percent, what is the present value of<br />

their dividends over the next four years?<br />

39. The cash conversion cycle?