You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

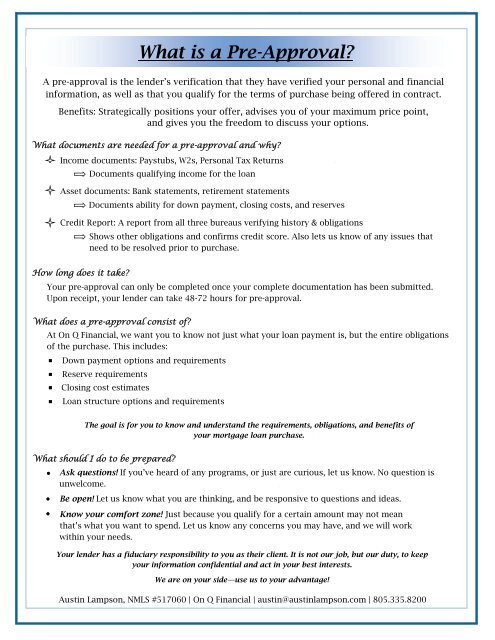

What is a Pre-Approval?<br />

A pre-approval is the lender’s verification that they have verified your personal and financial<br />

information, as well as that you qualify for the terms of purchase being offered in contract.<br />

Benefits: Strategically positions your offer, advises you of your maximum price point,<br />

and gives you the freedom to discuss your options.<br />

What documents are needed for a pre-approval and why?<br />

Income documents: Paystubs, W2s, Personal Tax Returns<br />

Documents qualifying income for the loan<br />

Asset documents: Bank statements, retirement statements<br />

Documents ability for down payment, closing costs, and reserves<br />

Credit Report: A report from all three bureaus verifying history & obligations<br />

Shows other obligations and confirms credit score. Also lets us know of any issues that<br />

need to be resolved prior to purchase.<br />

How long does it take?<br />

Your pre-approval can only be completed once your complete documentation has been submitted.<br />

Upon receipt, your lender can take 48-72 hours for pre-approval.<br />

What does a pre-approval consist of?<br />

At On Q Financial, we want you to know not just what your loan payment is, but the entire obligations<br />

of the purchase. This includes:<br />

Down payment options and requirements<br />

Reserve requirements<br />

Closing cost estimates<br />

Loan structure options and requirements<br />

The goal is for you to know and understand the requirements, obligations, and benefits of<br />

your mortgage loan purchase.<br />

What should I do to be prepared?<br />

Ask questions! If you’ve heard of any programs, or just are curious, let us know. No question is<br />

unwelcome.<br />

Be open! Let us know what you are thinking, and be responsive to questions and ideas.<br />

Know your comfort zone! Just because you qualify for a certain amount may not mean<br />

that’s what you want to spend. Let us know any concerns you may have, and we will work<br />

within your needs.<br />

Your lender has a fiduciary responsibility to you as their client. It is not our job, but our duty, to keep<br />

your information confidential and act in your best interests.<br />

We are on your side—use us to your advantage!<br />

Austin Lampson, NMLS #517060 | On Q Financial | austin@austinlampson.com | 805.335.8200