You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

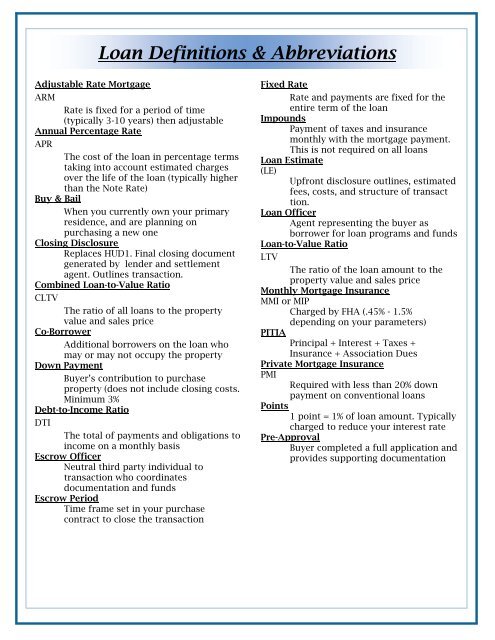

Loan Definitions & Abbreviations<br />

Adjustable Rate Mortgage<br />

ARM<br />

Rate is fixed for a period of time<br />

(typically 3-10 years) then adjustable<br />

Annual Percentage Rate<br />

APR<br />

The cost of the loan in percentage terms<br />

taking into account estimated charges<br />

over the life of the loan (typically higher<br />

than the Note Rate)<br />

Buy & Bail<br />

When you currently own your primary<br />

residence, and are planning on<br />

purchasing a new one<br />

Closing Disclosure<br />

Replaces HUD1. Final closing document<br />

generated by lender and settlement<br />

agent. Outlines transaction.<br />

Combined Loan-to-Value Ratio<br />

CLTV<br />

The ratio of all loans to the property<br />

value and sales price<br />

Co-Borrower<br />

Additional borrowers on the loan who<br />

may or may not occupy the property<br />

Down Payment<br />

<strong>Buyer</strong>’s contribution to purchase<br />

property (does not include closing costs.<br />

Minimum 3%<br />

Debt-to-Income Ratio<br />

DTI<br />

The total of payments and obligations to<br />

income on a monthly basis<br />

Escrow Officer<br />

Neutral third party individual to<br />

transaction who coordinates<br />

documentation and funds<br />

Escrow Period<br />

Time frame set in your purchase<br />

contract to close the transaction<br />

Fixed Rate<br />

Rate and payments are fixed for the<br />

entire term of the loan<br />

Impounds<br />

Payment of taxes and insurance<br />

monthly with the mortgage payment.<br />

This is not required on all loans<br />

Loan Estimate<br />

(LE)<br />

Upfront disclosure outlines, estimated<br />

fees, costs, and structure of transact<br />

tion.<br />

Loan Officer<br />

Agent representing the buyer as<br />

borrower for loan programs and funds<br />

Loan-to-Value Ratio<br />

LTV<br />

The ratio of the loan amount to the<br />

property value and sales price<br />

Monthly Mortgage Insurance<br />

MMI or MIP<br />

Charged by FHA (.45% - 1.5%<br />

depending on your parameters)<br />

PITIA<br />

Principal + Interest + Taxes +<br />

Insurance + Association Dues<br />

Private Mortgage Insurance<br />

PMI<br />

Required with less than 20% down<br />

payment on conventional loans<br />

Points<br />

1 point = 1% of loan amount. Typically<br />

charged to reduce your interest rate<br />

Pre-Approval<br />

<strong>Buyer</strong> completed a full application and<br />

provides supporting documentation