Annual Report 2016

VBS-2016-Annual-Report

VBS-2016-Annual-Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

86 NOTES TO THE ANNUAL FINANCIAL STATEMENTS<br />

87<br />

- for the year ended 31 March <strong>2016</strong> -<br />

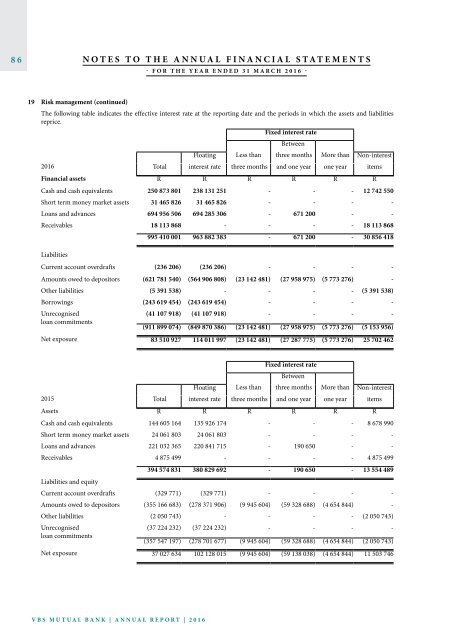

19 Risk management (continued)<br />

The following table indicates the effective interest rate at the reporting date and the periods in which the assets and liabilities<br />

reprice.<br />

Fixed interest rate<br />

Between<br />

Floating Less than three months More than Non-interest<br />

<strong>2016</strong> Total interest rate three months and one year one year items<br />

Financial assets R R R R R R<br />

Cash and cash equivalents 250 873 801 238 131 251 - - - 12 742 550<br />

Short term money market assets 31 465 826 31 465 826 - - - -<br />

Loans and advances 694 956 506 694 285 306 - 671 200 - -<br />

Receivables 18 113 868 - - - - 18 113 868<br />

995 410 001 963 882 383 - 671 200 - 30 856 418<br />

Liabilities<br />

Current account overdrafts (236 206) (236 206) - - - -<br />

Amounts owed to depositors (621 781 540) (564 906 808) (23 142 481) (27 958 975) (5 773 276) -<br />

Other liabilities (5 391 538) - - - - (5 391 538)<br />

Borrowings (243 619 454) (243 619 454) - - - -<br />

Unrecognised<br />

(41 107 918) (41 107 918) - - - -<br />

loan commitments<br />

(911 899 074) (849 870 386) (23 142 481) (27 958 975) (5 773 276) (5 153 956)<br />

Net exposure 83 510 927 114 011 997 (23 142 481) (27 287 775) (5 773 276) 25 702 462<br />

Fixed interest rate<br />

Between<br />

Floating Less than three months More than Non-interest<br />

2015 Total interest rate three months and one year one year items<br />

Assets R R R R R R<br />

Cash and cash equivalents 144 605 164 135 926 174 - - - 8 678 990<br />

Short term money market assets 24 061 803 24 061 803 - - - -<br />

Loans and advances 221 032 365 220 841 715 - 190 650 - -<br />

Receivables 4 875 499 - - - - 4 875 499<br />

394 574 831 380 829 692 - 190 650 - 13 554 489<br />

Liabilities and equity<br />

Current account overdrafts (329 771) (329 771) - - - -<br />

Amounts owed to depositors (355 166 683) (278 371 906) (9 945 604) (59 328 688) (4 654 844) -<br />

Other liabilities (2 050 743) - - - - (2 050 743)<br />

Unrecognised<br />

(37 224 232) (37 224 232) - - - -<br />

loan commitments<br />

(357 547 197) (278 701 677) (9 945 604) (59 328 688) (4 654 844) (2 050 743)<br />

Net exposure 37 027 634 102 128 015 (9 945 604) (59 138 038) (4 654 844) 11 503 746<br />

(d)Operational risk<br />

Operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events.<br />

The bank operates within a risk management framework approved by the board of directors . This framework demarcates risk limits,<br />

delegations and levels of authority, which are incorporated in comprehensive operational procedures.<br />

The internal audit function has been outsourced to PwC Inc. They perform an independent, objective assurance designed to add value and<br />

improve the bank's operations. Internal audit assists the bank in accomplishing its objectives by employing a systematic, disciplined approach<br />

to evaluating and improving the effectiveness of the risk management, control and governance processes.<br />

20 Statement of financial position - categories of financial instruments<br />

Notes Total Held to maturity Loans and<br />

receivables<br />

Financial liabilities<br />

at amortised cost<br />

<strong>2016</strong> R R R<br />

Assets<br />

Cash and cash equivalents 2 250 873 801 - 250 873 801 -<br />

Short term money market assets 3 31 465 826 31 465 826 - -<br />

Loans and advances 4 694 956 506 - 694 956 506 -<br />

Receivables 18 113 868 - 18 113 868 -<br />

Total 995 410 001 31 465 826 963 944 175 -<br />

Liabilities<br />

Current account overdrafts (236 206) - - (236 206)<br />

Amounts owed to depositors 9 (621 781 540) - - (621 781 540)<br />

Other liabilities 10 (5 391 538) - - (5 391 538)<br />

Borrowings 15 (243 619 454) - - (243 619 454)<br />

Total (871 028 738) - - (871 028 738)<br />

Notes Total Held to maturity Loans and<br />

receivables<br />

Financial liabilities at<br />

amortised cost<br />

2015 R R R<br />

Assets<br />

Cash and cash equivalents 2 144 605 164 - 144 605 164 -<br />

Short term money market assets 3 24 061 803 24 061 803 - -<br />

Loans and advances 4 221 032 365 - 221 032 365 -<br />

Receivables 4 875 499 - 4 875 499 -<br />

Total 394 574 831 24 061 803 370 513 028 -<br />

Liabilities<br />

Current account overdrafts (329 771) - - (329 771)<br />

Amounts owed to depositors 9 (355 166 683) - - (355 166 683)<br />

Other liabilities 10 (2 050 743) - - (2 050 743)<br />

Total (357 547 197) - - (357 547 197)<br />

VBS Mutual Bank | <strong>Annual</strong> <strong>Report</strong> | <strong>2016</strong><br />

People With A Purpose