MAGAZINE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STATE BANK OF INDIA MERGER HAS MANY BENEFITS.<br />

State bank of India, the country’s largest<br />

lender approved the merger of its<br />

operations and five of its associate banks.<br />

State bank of Travancore, State bank of<br />

Mysore, state bank of Jaipur and Bikaner,<br />

state bank of Hyderabad, state bank of<br />

Patiala and Mahila bank will stand merged<br />

with SBI.<br />

HERE ARE EIGHT THINGS YOU<br />

SHOULD KNOW ABOUT THE<br />

MERGER:<br />

1) This is the first ever large scale<br />

consolidation in the Indian banking<br />

industry.<br />

2) The merger will create a banking<br />

behemoth with an asset book of Rs<br />

37 lakh crore.<br />

3) SBI will give 28 of its shares for<br />

every 10 shares held of state bank<br />

of Bikaner.<br />

4) It will give 22 of its shares for<br />

every 10 shares held of State Bank<br />

of Mysore.<br />

5) The lender will give 22 of its own<br />

shares for every 10 shares held of<br />

State Bank of Travancore.<br />

6) SBI will give 4, 42, 31,510 shares<br />

with face value of Re 1 for every<br />

100 crore equity shares of Bhartiya<br />

Mahila Bank.<br />

7) The merger will see SBI’s ranking<br />

approve in the bloomberg’s largest<br />

bank by asset ranking. It may well<br />

break through the 50-mark in the<br />

ranking.<br />

8) SBI’s asset base will now be five<br />

times larger than the second largest<br />

Indian bank, ICICI<br />

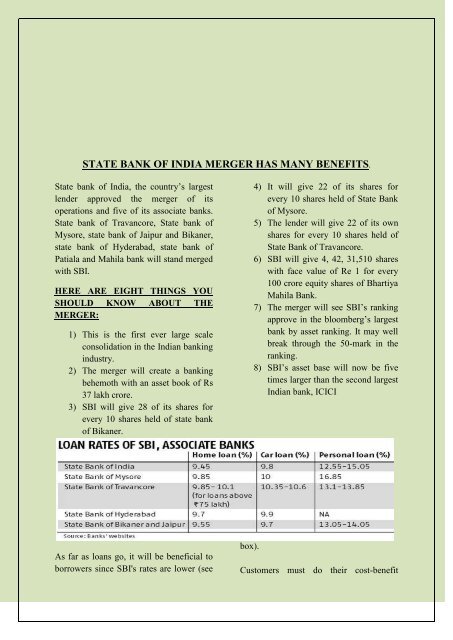

As far as loans go, it will be beneficial to<br />

borrowers since SBI's rates are lower (see<br />

box).<br />

Customers must do their cost-benefit