You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INSURANCE TECHNOLOGY TRENDS<br />

Insurance Distribution – The Changing Health Insurance / Benefits Landscape (cont.)<br />

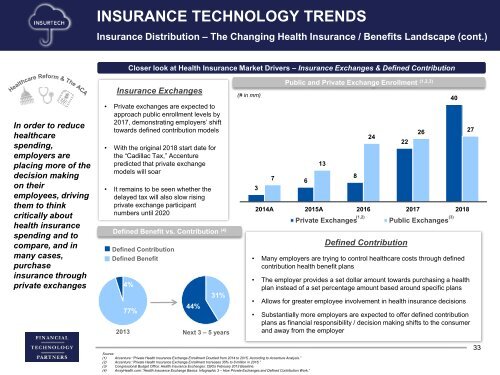

Closer look at Health Insurance Market Drivers – Insurance Exchanges & Defined Contribution<br />

In order to reduce<br />

healthcare<br />

spending,<br />

employers are<br />

placing more of <strong>the</strong><br />

decision making<br />

on <strong>the</strong>ir<br />

employees, driving<br />

<strong>the</strong>m to think<br />

critically about<br />

health insurance<br />

spending and to<br />

compare, and in<br />

many cases,<br />

purchase<br />

insurance through<br />

private exchanges<br />

Insurance Exchanges<br />

• Private exchanges are expected to<br />

approach public enrollment levels by<br />

2017, demonstrating employers’ shift<br />

towards defined contribution models<br />

• With <strong>the</strong> original 2018 start date <strong>for</strong><br />

<strong>the</strong> “Cadillac Tax,” Accenture<br />

predicted that private exchange<br />

models will soar<br />

• It remains to be seen whe<strong>the</strong>r <strong>the</strong><br />

delayed tax will also slow rising<br />

private exchange participant<br />

numbers until 2020<br />

Defined Benefit vs. Contribution (4)<br />

Defined Contribution<br />

Defined Benefit<br />

4%<br />

77%<br />

44%<br />

31%<br />

2013 Next 3 – 5 years<br />

(# in mm)<br />

3<br />

7<br />

Public and Private Exchange Enrollment (1,2,3)<br />

6<br />

13<br />

8<br />

24<br />

22<br />

40<br />

26 27<br />

2014A 2015A 2016 2017 2018<br />

Private Exchanges<br />

(1,2) (3)<br />

Defined Contribution<br />

Public Exchanges<br />

• Many employers are trying to control healthcare costs through defined<br />

contribution health benefit plans<br />

• The employer provides a set dollar amount towards purchasing a health<br />

plan instead of a set percentage amount based around specific plans<br />

• Allows <strong>for</strong> greater employee involvement in health insurance decisions<br />

• Substantially more employers are expected to offer defined contribution<br />

plans as financial responsibility / decision making shifts to <strong>the</strong> consumer<br />

and away from <strong>the</strong> employer<br />

Source:<br />

(1) Accenture: “Private Health Insurance Exchange Enrollment Doubled from 2014 to 2015, According to Accenture Analysis.”<br />

(2) Accenture: “Private Health Insurance Exchange Enrollment Increases 35% to 8 million in 2016.”<br />

(3) Congressional Budget Office: Health Insurance Exchanges: CBOs February 2013 Baseline.<br />

(4) ArrayHealth.com: “Health Insurance Exchange Basics: Infographic 3 – How Private Exchanges and Defined Contribution Work.”<br />

33