Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

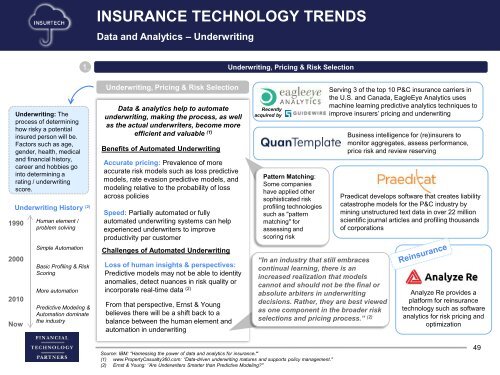

INSURANCE TECHNOLOGY TRENDS<br />

Data and Analytics – Underwriting<br />

1.<br />

Underwriting, Pricing & Risk Selection<br />

Underwriting: The<br />

process of determining<br />

how risky a potential<br />

insured person will be.<br />

Factors such as age,<br />

gender, health, medical<br />

and financial history,<br />

career and hobbies go<br />

into determining a<br />

rating / underwriting<br />

score.<br />

Underwriting History (2)<br />

1990<br />

2000<br />

2010<br />

Now<br />

Human element /<br />

problem solving<br />

Simple Automation<br />

Basic Profiling & Risk<br />

Scoring<br />

More automation<br />

Predictive Modeling &<br />

Automation dominate<br />

<strong>the</strong> industry<br />

Underwriting, Pricing & Risk Selection<br />

Data & analytics help to automate<br />

underwriting, making <strong>the</strong> process, as well<br />

as <strong>the</strong> actual underwriters, become more<br />

efficient and valuable (1)<br />

Benefits of Automated Underwriting<br />

Accurate pricing: Prevalence of more<br />

accurate risk models such as loss predictive<br />

models, rate evasion predictive models, and<br />

modeling relative to <strong>the</strong> probability of loss<br />

across policies<br />

Speed: Partially automated or fully<br />

automated underwriting systems can help<br />

experienced underwriters to improve<br />

productivity per customer<br />

Challenges of Automated Underwriting<br />

Loss of human insights & perspectives:<br />

Predictive models may not be able to identity<br />

anomalies, detect nuances in risk quality or<br />

incorporate real-time data (2)<br />

From that perspective, Ernst & Young<br />

believes <strong>the</strong>re will be a shift back to a<br />

balance between <strong>the</strong> human element and<br />

automation in underwriting<br />

Recently<br />

acquired by<br />

Pattern Matching:<br />

Some companies<br />

have applied o<strong>the</strong>r<br />

sophisticated risk<br />

profiling technologies<br />

such as "pattern<br />

matching" <strong>for</strong><br />

assessing and<br />

scoring risk<br />

“In an industry that still embraces<br />

continual learning, <strong>the</strong>re is an<br />

increased realization that models<br />

cannot and should not be <strong>the</strong> final or<br />

absolute arbiters in underwriting<br />

decisions. Ra<strong>the</strong>r, <strong>the</strong>y are best viewed<br />

as one component in <strong>the</strong> broader risk<br />

selections and pricing process.” (2)<br />

Serving 3 of <strong>the</strong> top 10 P&C insurance carriers in<br />

<strong>the</strong> U.S. and Canada, EagleEye Analytics uses<br />

machine learning predictive analytics techniques to<br />

improve insurers’ pricing and underwriting<br />

Business intelligence <strong>for</strong> (re)insurers to<br />

monitor aggregates, assess per<strong>for</strong>mance,<br />

price risk and review reserving<br />

Praedicat develops software that creates liability<br />

catastrophe models <strong>for</strong> <strong>the</strong> P&C industry by<br />

mining unstructured text data in over 22 million<br />

scientific journal articles and profiling thousands<br />

of corporations<br />

Analyze Re provides a<br />

plat<strong>for</strong>m <strong>for</strong> reinsurance<br />

technology such as software<br />

analytics <strong>for</strong> risk pricing and<br />

optimization<br />

Source: IBM: “Harnessing <strong>the</strong> power of data and analytics <strong>for</strong> insurance."<br />

(1) www.PropertyCasualty360.com: “Data-driven underwriting matures and supports policy management."<br />

(2) Ernst & Young: ‘’Are Underwriters Smarter than Predictive Modeling?"<br />

49