CYBERSECURITY

32524_edentree_cybersecurity_2109_lr_single-pages

32524_edentree_cybersecurity_2109_lr_single-pages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OTHER IMPLICATIONS<br />

Cyber insurance<br />

With the increasing use of internet-connected devices and the increasing importance of digital strategies, cyber<br />

risk is becoming a key concern for businesses and assessing and mitigating potential financial losses from a data<br />

breach should be a top risk management priority. As a result, cyber coverage is an emerging area of growth for<br />

insurance providers. PwC estimate that the gross written premiums in the cyber insurance market currently<br />

amount to $2.5 billion per annum and could grow to $7.5 billion by 2020. 22<br />

This growth is likely to be driven not only by insureds seeking breach damage containment but strong appetite among<br />

insurers to provide cyber insurance writings, reflecting the favourable prices that can be obtained by an underwriter.<br />

According to HM Government (2015), the cost of cyber insurance relative to the limit that is purchased, is typically<br />

three times the cost of cover of more general liability risks. 23 This partly reflects the limited number of insurers offering<br />

such coverage presently, as well as the uncertainty around how much to put aside for potential losses.<br />

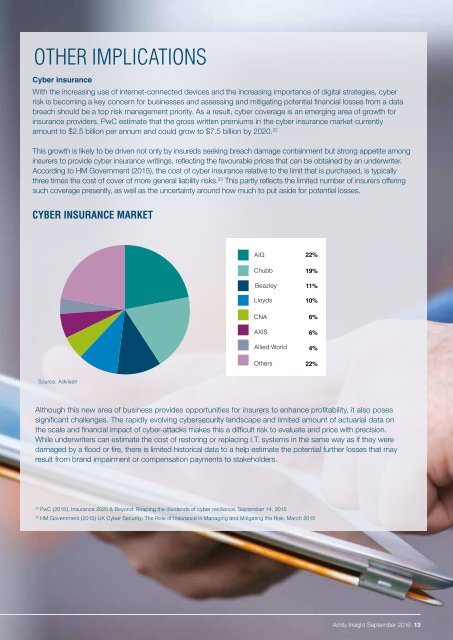

CYBER INSURANCE MARKET<br />

AIG 22%<br />

Chubb<br />

Beazley<br />

Lloyds<br />

CNA<br />

AXIS<br />

Allied World<br />

Others<br />

19%<br />

11%<br />

10%<br />

6%<br />

6%<br />

4%<br />

22%<br />

Source: Advisen<br />

Although this new area of business provides opportunities for insurers to enhance profitability, it also poses<br />

significant challenges. The rapidly evolving cybersecurity landscape and limited amount of actuarial data on<br />

the scale and financial impact of cyber-attacks makes this a difficult risk to evaluate and price with precision.<br />

While underwriters can estimate the cost of restoring or replacing I.T. systems in the same way as if they were<br />

damaged by a flood or fire, there is limited historical data to a help estimate the potential further losses that may<br />

result from brand impairment or compensation payments to stakeholders.<br />

22<br />

PwC (2015), Insurance 2020 & Beyond: Reaping the dividends of cyber resilience, September 14, 2015<br />

23<br />

HM Government (2015) UK Cyber Security: The Role of Insurance in Managing and Mitigating the Risk, March 2015<br />

Amity Insight September 2016 13