EBF 401 EBF401 Midterm 3 Answers (Penn State University)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>EBF</strong> <strong>401</strong> <strong>EBF</strong><strong>401</strong> <strong>Midterm</strong> 3 <strong>Answers</strong><br />

(<strong>Penn</strong> <strong>State</strong> <strong>University</strong>)<br />

BUY HERE⬊<br />

http://www.homeworkmade.com/ebf-<br />

<strong>401</strong>-ebf<strong>401</strong>-midterm-3-answers-pennstate-university/<br />

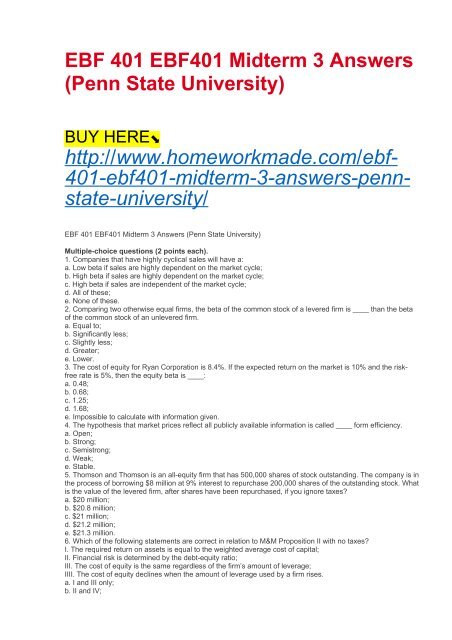

<strong>EBF</strong> <strong>401</strong> <strong>EBF</strong><strong>401</strong> <strong>Midterm</strong> 3 <strong>Answers</strong> (<strong>Penn</strong> <strong>State</strong> <strong>University</strong>)<br />

Multiple-choice questions (2 points each).<br />

1. Companies that have highly cyclical sales will have a:<br />

a. Low beta if sales are highly dependent on the market cycle;<br />

b. High beta if sales are highly dependent on the market cycle;<br />

c. High beta if sales are independent of the market cycle;<br />

d. All of these;<br />

e. None of these.<br />

2. Comparing two otherwise equal firms, the beta of the common stock of a levered firm is ____ than the beta<br />

of the common stock of an unlevered firm.<br />

a. Equal to;<br />

b. Significantly less;<br />

c. Slightly less;<br />

d. Greater;<br />

e. Lower.<br />

3. The cost of equity for Ryan Corporation is 8.4%. If the expected return on the market is 10% and the riskfree<br />

rate is 5%, then the equity beta is ____:<br />

a. 0.48;<br />

b. 0.68;<br />

c. 1.25;<br />

d. 1.68;<br />

e. Impossible to calculate with information given.<br />

4. The hypothesis that market prices reflect all publicly available information is called ____ form efficiency.<br />

a. Open;<br />

b. Strong;<br />

c. Semistrong;<br />

d. Weak;<br />

e. Stable.<br />

5. Thomson and Thomson is an all-equity firm that has 500,000 shares of stock outstanding. The company is in<br />

the process of borrowing $8 million at 9% interest to repurchase 200,000 shares of the outstanding stock. What<br />

is the value of the levered firm, after shares have been repurchased, if you ignore taxes?<br />

a. $20 million;<br />

b. $20.8 million;<br />

c. $21 million;<br />

d. $21.2 million;<br />

e. $21.3 million.<br />

6. Which of the following statements are correct in relation to M&M Proposition II with no taxes?<br />

I. The required return on assets is equal to the weighted average cost of capital;<br />

II. Financial risk is determined by the debt-equity ratio;<br />

III. The cost of equity is the same regardless of the firm’s amount of leverage;<br />

IIII. The cost of equity declines when the amount of leverage used by a firm rises.<br />

a. I and III only;<br />

b. II and IV;

c. I and II;<br />

d. III and IV;<br />

e. I and IV.<br />

7. If the efficient market hypothesis holds, investors should expect:<br />

a. To earn only a normal return;<br />

b. To receive a fair price for their securities;<br />

c. To always be able to pick stocks that will outperform the market averages;<br />

d. Both to earn only a normal return and to receive a fair price for their securities;<br />

e. Both to receive a fair price for their securities and to always be able to pick stocks that will outperform the<br />

market averages.<br />

8. Insider trading does not offer any advantages if the financial markets are:<br />

a. Weak form efficient;<br />

b. Semiweak form efficient;<br />

c. Semistrong form efficient;<br />

d. Strong form efficient;<br />

e. Inefficient.<br />

9. The proposition that the value of the firm is independent of its capital structure is called:<br />

a. The capital asset pricing model;<br />

b. M&M Proposition I;<br />

c. M&M Proposition II;<br />

d. The law of one price;<br />

e. The efficient market hypothesis.<br />

10. According to the efficient market hypothesis, financial markets fluctuate daily because they:<br />

a. Are inefficient;<br />

b. Slowly react to new information;<br />

c. Are continually reacting to new information;<br />

d. Offer many arbitrage opportunities;<br />

e. Only reflect historical information.<br />

Short questions<br />

Please answer 2 questions worth 5 points.<br />

11. Define the three forms of market efficiency.<br />

12. What are the implications of the efficient market hypothesis for investors who buy and sell stocks in an<br />

attempt to “beat the market”?<br />

13. <strong>State</strong> the law of one price. Does this result always hold in a perfect market? Do we expect it to hold in an<br />

efficient market?<br />

Please answer 2 questions worth 10 points.<br />

14. Define the three main factors that determine beta and explain how they affect betas.<br />

(10 points)<br />

15. How can firms create value through financing opportunities? Describe the three methods discussed in<br />

class.<br />

16. What does Proposition I of Modigliani and Miller state (in a world without taxes)? What is the key<br />

assumption that lies behind the theory, and what does this assumption imply?<br />

Problems<br />

Please answer 1 question worth 20 points.<br />

17. Online Text Co. has four new text publishing products that it must decide on publishing to expand its<br />

services. The firm’s WACC has been 17%. The projects are of equal risk, and all of their β are equal to 1.6.<br />

The risk-free rate is 7% and the market rate is expected to be 12%. The projects are expected to earn as<br />

follows:<br />

Projec<br />

t<br />

W 14%<br />

X 18%<br />

Y 17%<br />

Z 15%<br />

18. Levered, Inc., and Unlevered, Inc., are identical in every way except their capital structures. Each company<br />

expects to earn $29 million before interest per year in perpetuity, with each company distributing all its earnings<br />

as dividends. Levered’s perpetual debt has a market value of $91 million and costs 8% per year. Levered has<br />

2.3 million shares outstanding, currently worth $105 per share. Unlevered has no debt and 4.5 million shares<br />

outstanding, currently worth $80 per share. Neither firm pays taxes. Is Levered’s stock a better buy than<br />

Unlevered’s stock?<br />

Please answer 3 questions worth 10 points.<br />

19. You own 25% of Unique Vacations, Inc. You have decided to retire and want to sell your shares in this allequity<br />

firm. The other shareholders have agreed to have the firm borrow $1.5 million to purchase your 1,000<br />

shares of stock. What is the total value of the all-equity firm today, if you ignore taxes?

20. Bigelow, Inc. has a cost of equity of 13.56% and a pre-tax cost of debt of 7%. The required return on the<br />

assets is 11%. What is the firm’s debt-equity ratio, based on M&M Proposition II with no taxes?<br />

21. The Free Cash Flows of your firm for years 1, 2 and 3 are $42,000, $49,000 and $64,000, respectively.<br />

After year 3, the growth rate in cash flow is a constant 2% with a WACC of 8%. What is the present value of the<br />

terminal value?<br />

22. Bose, Inc. has a target debt-equity ratio (D/E) of 0.45. Its WACC is 11.2% and the tax rate is 35%. If the<br />

company’s cost of equity is 15%, what is its pretax cost of debt?