You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Thought Leaders Corner<br />

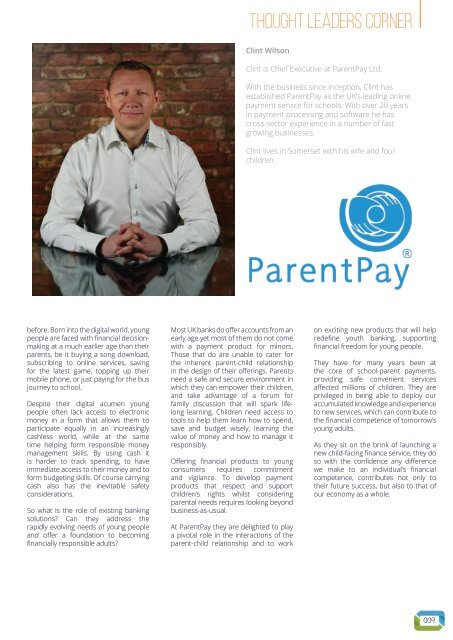

Clint Wilson<br />

Clint is Chief Executive at ParentPay Ltd.<br />

With the business since inception, Clint has<br />

established ParentPay as the UK’s leading online<br />

payment service for schools. With over 20 years<br />

in payment processing and software he has<br />

cross-sector experience in a number of fast<br />

growing businesses.<br />

Clint lives in Somerset with his wife and four<br />

children.<br />

before. Born into the digital world, young<br />

people are faced with financial decisionmaking<br />

at a much earlier age than their<br />

parents, be it buying a song download,<br />

subscribing to online services, saving<br />

for the latest game, topping up their<br />

mobile phone, or just paying for the bus<br />

journey to school.<br />

Despite their digital acumen young<br />

people often lack access to electronic<br />

money in a form that allows them to<br />

participate equally in an increasingly<br />

cashless world, while at the same<br />

time helping form responsible money<br />

management skills. By using cash it<br />

is harder to track spending, to have<br />

immediate access to their money and to<br />

form budgeting skills. Of course carrying<br />

cash also has the inevitable safety<br />

considerations.<br />

So what is the role of existing banking<br />

solutions? Can they address the<br />

rapidly evolving needs of young people<br />

and offer a foundation to becoming<br />

financially responsible adults?<br />

Most UK banks do offer accounts from an<br />

early age yet most of them do not come<br />

with a payment product for minors.<br />

Those that do are unable to cater for<br />

the inherent parent-child relationship<br />

in the design of their offerings. Parents<br />

need a safe and secure environment in<br />

which they can empower their children,<br />

and take advantage of a forum for<br />

family discussion that will spark lifelong<br />

learning. Children need access to<br />

tools to help them learn how to spend,<br />

save and budget wisely, learning the<br />

value of money and how to manage it<br />

responsibly.<br />

Offering financial products to young<br />

consumers requires commitment<br />

and vigilance. To develop payment<br />

products that respect and support<br />

children’s rights whilst considering<br />

parental needs requires looking beyond<br />

business-as-usual.<br />

At ParentPay they are delighted to play<br />

a pivotal role in the interactions of the<br />

parent-child relationship and to work<br />

on exciting new products that will help<br />

redefine youth banking, supporting<br />

financial freedom for young people.<br />

They have for many years been at<br />

the core of school-parent payments,<br />

providing safe convenient services<br />

affected millions of children. They are<br />

privileged in being able to deploy our<br />

accumulated knowledge and experience<br />

to new services, which can contribute to<br />

the financial competence of tomorrow’s<br />

young adults.<br />

As they sit on the brink of launching a<br />

new child-facing finance service, they do<br />

so with the confidence any difference<br />

we make to an individual’s financial<br />

competence, contributes not only to<br />

their future success, but also to that of<br />

our economy as a whole.<br />

009