ACCT 346 Week 4 Midterm

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ACCT</strong> <strong>346</strong> <strong>Week</strong> 4 <strong>Midterm</strong><br />

BUY HERE⬊<br />

http://www.homeworkmade.com/acct-<br />

<strong>346</strong>-week-4-midterm-1/<br />

<strong>ACCT</strong> <strong>346</strong> <strong>Week</strong> 4 <strong>Midterm</strong><br />

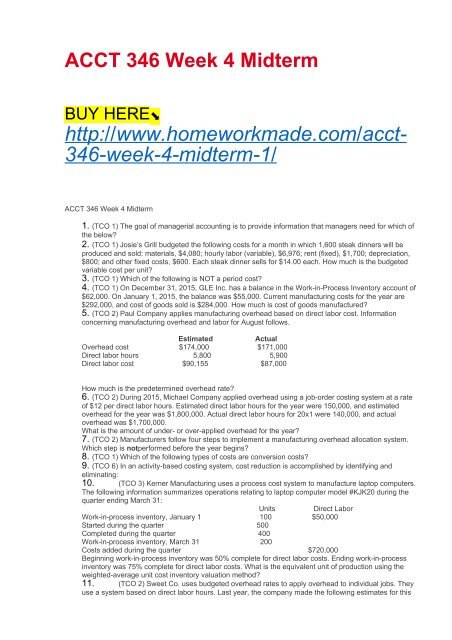

1. (TCO 1) The goal of managerial accounting is to provide information that managers need for which of<br />

the below?<br />

2. (TCO 1) Josie’s Grill budgeted the following costs for a month in which 1,600 steak dinners will be<br />

produced and sold: materials, $4,080; hourly labor (variable), $6,976; rent (fixed), $1,700; depreciation,<br />

$800; and other fixed costs, $600. Each steak dinner sells for $14.00 each. How much is the budgeted<br />

variable cost per unit?<br />

3. (TCO 1) Which of the following is NOT a period cost?<br />

4. (TCO 1) On December 31, 2015, GLE Inc. has a balance in the Work-in-Process Inventory account of<br />

$62,000. On January 1, 2015, the balance was $55,000. Current manufacturing costs for the year are<br />

$292,000, and cost of goods sold is $284,000. How much is cost of goods manufactured?<br />

5. (TCO 2) Paul Company applies manufacturing overhead based on direct labor cost. Information<br />

concerning manufacturing overhead and labor for August follows.<br />

Estimated<br />

Actual<br />

Overhead cost $174,000 $171,000<br />

Direct labor hours 5,800 5,900<br />

Direct labor cost $90,155 $87,000<br />

How much is the predetermined overhead rate?<br />

6. (TCO 2) During 2015, Michael Company applied overhead using a job-order costing system at a rate<br />

of $12 per direct labor hours. Estimated direct labor hours for the year were 150,000, and estimated<br />

overhead for the year was $1,800,000. Actual direct labor hours for 20x1 were 140,000, and actual<br />

overhead was $1,700,000.<br />

What is the amount of under- or over-applied overhead for the year?<br />

7. (TCO 2) Manufacturers follow four steps to implement a manufacturing overhead allocation system.<br />

Which step is notperformed before the year begins?<br />

8. (TCO 1) Which of the following types of costs are conversion costs?<br />

9. (TCO 6) In an activity-based costing system, cost reduction is accomplished by identifying and<br />

eliminating:<br />

10. (TCO 3) Kerner Manufacturing uses a process cost system to manufacture laptop computers.<br />

The following information summarizes operations relating to laptop computer model #KJK20 during the<br />

quarter ending March 31:<br />

Units<br />

Direct Labor<br />

Work-in-process inventory, January 1 100 $50,000<br />

Started during the quarter 500<br />

Completed during the quarter 400<br />

Work-in-process inventory, March 31 200<br />

Costs added during the quarter $720,000<br />

Beginning work-in-process inventory was 50% complete for direct labor costs. Ending work-in-process<br />

inventory was 75% complete for direct labor costs. What is the equivalent unit of production using the<br />

weighted-average unit cost inventory valuation method?<br />

11. (TCO 2) Sweet Co. uses budgeted overhead rates to apply overhead to individual jobs. They<br />

use a system based on direct labor hours. Last year, the company made the following estimates for this

year.<br />

Direct labor costs $48,000,000<br />

Factory overhead costs $6,400,000<br />

Direct Labor Hours 80,000<br />

Machine Hours 110,000<br />

(a) What is the budgeted overhead rate for the company?<br />

(b) If Job #34567 had the following:<br />

Material costs were $500,000;<br />

Direct labor costs were $450,000;<br />

Direct labor hours were 25,000; and<br />

Machine hours were 36,000,<br />

then what is the total cost of Job #34567?<br />

12. (TCO 3) Adnan Company uses process costing. At the beginning of the month, there were<br />

8,000 units in process, 90% complete with respect to material and 80% complete with respect to<br />

conversion costs. 40,000 units were started during the month and 40,000 units were completed. The units<br />

in ending Work-In-Process Inventory were 70% complete with respect to material and 10% complete with<br />

respect to conversion costs. How many equivalent units will be used in calculating the cost per unit for<br />

materials?<br />

13. (TCO 6) Handy Display Company manufactures display cases to be sold to retail stores. The<br />

cases come in three sizes: large, medium, and small. Currently, Handy Display Company uses a single<br />

plant-wide overhead rate to allocate its $3,357,800 of annual manufacturing overhead. Of this amount,<br />

$820,000 is associated with the Large Case line, $1,276,800 is associated with the Medium Case line,<br />

and $1,261,000 is associated with the Small Case line. Handy Display Company is currently running a<br />

total of 33,000 machine hours: 10,000 in the Large Case line, 13,300 in the Medium Case line, and 9,700<br />

in the Small Case line. Handy Display Company uses machine hours as the cost driver for manufacturing<br />

overhead costs.<br />

Requirement: Calculate the departmental overhead rate for each of the three departments listed.<br />

14. (TCO 2) Fred Co. incurred costs of $900,000 for direct materials (raw) purchased. Direct labor<br />

was $10,000 and factory overhead was $10,000 for March.<br />

Inventories were as follows:<br />

raw materials beginning $1,000; raw materials ending $2,000<br />

work-in-process beginning $190,000; work-in-process ending $170,000<br />

finished goods beginning $10,000; finished goods ending $10,500<br />

What is the cost of goods manufactured? Please show your work.