Annual financial statements 2004 - Euler Hermes ...

Annual financial statements 2004 - Euler Hermes ...

Annual financial statements 2004 - Euler Hermes ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ACCOUNTS<br />

RECEIVABLE<br />

OTHER ASSETS<br />

DEFERRED ITEMS<br />

Notes to the<br />

Financial Statements<br />

Calculation of current market value<br />

The current market value of the capital investments shown in the balance sheet at acquisition costs<br />

stood at TEUR 686,507 at the end of the business year. In the case of land and buildings this is the<br />

capitalized value on the balance sheet date or, in the case of building work in progress, the book<br />

value.<br />

Other <strong>financial</strong> investments are on principle valued at their quoted stock exchange or book value<br />

and, in the case of units in investment trusts, at bid value. In the case of shares in group undertakings<br />

the acquisition cost was determined by the equity method.<br />

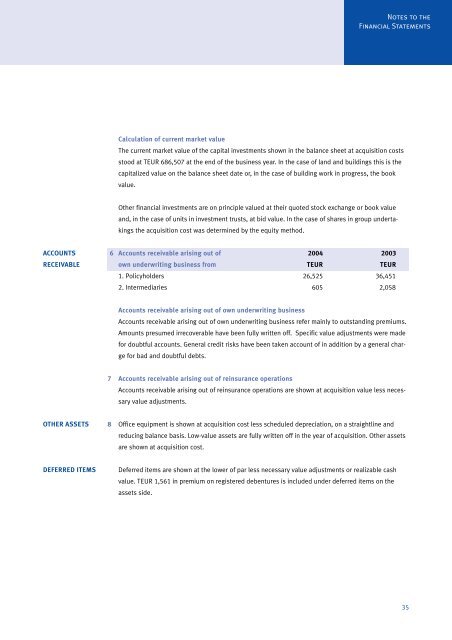

6 Accounts receivable arising out of <strong>2004</strong> 2003<br />

own underwriting business from TEUR TEUR<br />

1. Policyholders 26,525 36,451<br />

2. Intermediaries 605 2,058<br />

Accounts receivable arising out of own underwriting business<br />

Accounts receivable arising out of own underwriting business refer mainly to outstanding premiums.<br />

Amounts presumed irrecoverable have been fully written off. Specific value adjustments were made<br />

for doubtful accounts. General credit risks have been taken account of in addition by a general charge<br />

for bad and doubtful debts.<br />

7 Accounts receivable arising out of reinsurance operations<br />

Accounts receivable arising out of reinsurance operations are shown at acquisition value less necessary<br />

value adjustments.<br />

8 Office equipment is shown at acquisition cost less scheduled depreciation, on a straightline and<br />

reducing balance basis. Low-value assets are fully written off in the year of acquisition. Other assets<br />

are shown at acquisition cost.<br />

Deferred items are shown at the lower of par less necessary value adjustments or realizable cash<br />

value. TEUR 1,561 in premium on registered debentures is included under deferred items on the<br />

assets side.<br />

35