UK

60148Diis

60148Diis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>UK</strong> Property<br />

Index<br />

Q3 2016<br />

Executive<br />

summary<br />

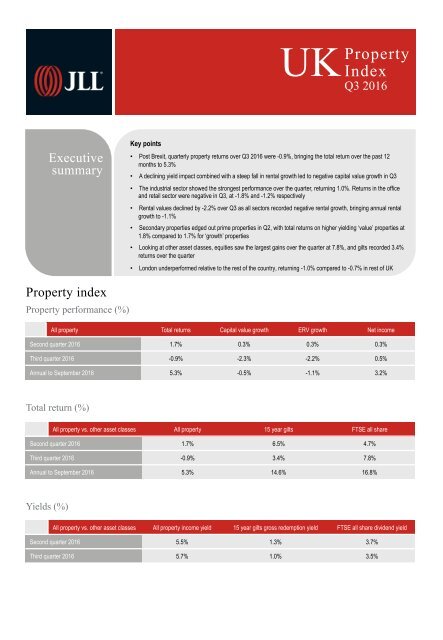

Key points<br />

• Post Brexit, quarterly property returns over Q3 2016 were -0.9%, bringing the total return over the past 12<br />

months to 5.3%<br />

• A declining yield impact combined with a steep fall in rental growth led to negative capital value growth in Q3<br />

• The industrial sector showed the strongest performance over the quarter, returning 1.0%. Returns in the office<br />

and retail sector were negative in Q3, at -1.8% and -1.2% respectively<br />

• Rental values declined by -2.2% over Q3 as all sectors recorded negative rental growth, bringing annual rental<br />

growth to -1.1%<br />

• Secondary properties edged out prime properties in Q2, with total returns on higher yielding ‘value’ properties at<br />

1.8% compared to 1.7% for ‘growth’ properties<br />

• Looking at other asset classes, equities saw the largest gains over the quarter at 7.8%, and gilts recorded 3.4%<br />

returns over the quarter<br />

• London underperformed relative to the rest of the country, returning -1.0% compared to -0.7% in rest of <strong>UK</strong><br />

Property index<br />

Property performance (%)<br />

All property Total returns Capital value growth ERV growth Net income<br />

Second quarter 2016 1.7% 0.3% 0.3% 0.3%<br />

Third quarter 2016 -0.9% -2.3% -2.2% 0.5%<br />

Annual to September 2016 5.3% -0.5% -1.1% 3.2%<br />

Total return (%)<br />

All property vs. other asset classes All property 15 year gilts FTSE all share<br />

Second quarter 2016 1.7% 6.5% 4.7%<br />

Third quarter 2016 -0.9% 3.4% 7.8%<br />

Annual to September 2016 5.3% 14.6% 16.8%<br />

Yields (%)<br />

All property vs. other asset classes All property income yield 15 year gilts gross redemption yield FTSE all share dividend yield<br />

Second quarter 2016 5.5% 1.3% 3.7%<br />

Third quarter 2016 5.7% 1.0% 3.5%

Components of total return (income return vs. yield impact vs. rental growth)<br />

15 Income return<br />

Yield impact<br />

Rental growth<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

Performance by sector<br />

Total returns by sector (%)<br />

Office Retail Industrial<br />

Second quarter 2016 1.9% 1.4% 2.0%<br />

Third quarter 2016 -1.8% -1.2% 1.0%<br />

Annual to September 2016 5.8% 3.1% 8.4%<br />

Capital growth by sector (%)<br />

Office Retail Industrial<br />

Second quarter 2016 0.6% -0.1% 0.5%<br />

Third quarter 2016 -3.0% -2.7% -0.5%<br />

Annual to September 2016 0.5% -2.7% 2.2%<br />

Rental growth by sector (%)<br />

Office Retail Industrial<br />

Second quarter 2016 0.6% -0.1% 0.5%<br />

Third quarter 2016 -3.0% -2.6% -0.5%<br />

Annual to September 2016 -0.3% -3.1% 1.1%

Office, retail and industrial – income yield<br />

%<br />

9<br />

8<br />

Office<br />

Retail<br />

Industrial<br />

7<br />

6<br />

5<br />

4<br />

Q1 2006<br />

Q1 2007<br />

Q1 2008<br />

Q1 2009<br />

Q1 2010<br />

Q1 2011<br />

Q1 2012<br />

Q1 2013<br />

Q1 2014<br />

Q1 2015<br />

Q1 2016<br />

Style index<br />

Property returns by investment style (%)<br />

Prime (growth) properties Total returns Capital value growth<br />

Second quarter 2016 1.7% 0.4%<br />

Third quarter 2016 -0.8% -2.0%<br />

Total Returns by Sector (%)<br />

Annual to September 2016 5.2% 0%<br />

Secondary (value) properties Total returns Capital value growth<br />

Second quarter 2016 1.8% 0.0%<br />

Third quarter 2016 -1.2% -3.0%<br />

Annual to September 2016 5.6% -1.7%<br />

Investment style – income yield<br />

%<br />

10<br />

9<br />

8<br />

Spread<br />

Growth<br />

Value<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Q1 2005<br />

Q1 2006<br />

Q1 2007<br />

Q1 2008<br />

Q1 2009<br />

Q1 2010<br />

Q1 2011<br />

Q1 2012<br />

Q1 2013<br />

Q1 2014<br />

Q1 2015<br />

Q1 2016

Returns - London vs. rest of <strong>UK</strong> London London & South East Rest of <strong>UK</strong><br />

Second quarter 2016 2.0% 1.9% 1.7%<br />

Third quarter 2016 -1.0% -1.0% -0.7%<br />

London vs. London South East vs. rest of <strong>UK</strong><br />

7%<br />

6%<br />

London<br />

LON + SE<br />

Rest of <strong>UK</strong><br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

-1%<br />

-2%<br />

Q1 2011<br />

Q2 2011<br />

Q3 2011<br />

Q4 2011<br />

Q1 2012<br />

Q2 2012<br />

Q3 2012<br />

Q4 2012<br />

Q1 2013<br />

Q2 2013<br />

Q3 2013<br />

Q4 2013<br />

Q1 2014<br />

Q2 2014<br />

Q3 2014<br />

Q4 2014<br />

Q1 2015<br />

Q2 2015<br />

Q3 2015<br />

Q4 2015<br />

Q1 2016<br />

Q2 2016<br />

Q3 2016<br />

Definitions<br />

Based on existing practices in the equity market JLL constructed a style index to analyse the performance of two investment styles, prime<br />

(growth) and secondary (value) distinguished by income and defined by their yields as follows:<br />

• a prime (growth) property is a low yielding property<br />

• a secondary (value) property is characterised by high yields<br />

Index does not include Capital Expenditure.<br />

Contacts<br />

Himanshu Wani<br />

Associate Director<br />

<strong>UK</strong> Research<br />

30 Warwick Street<br />

London<br />

W1B 5NH<br />

+44 (0)207 087 5142<br />

himanshu.wani@eu.jll.com<br />

Mike Penlington<br />

Director<br />

Valuation Advisory<br />

30 Warwick St<br />

London<br />

W1B 5NH<br />

+44 (0)20 7399 5833<br />

mike.penlington@eu.jll.com<br />

<strong>UK</strong> Property Index – Q3 2016<br />

www.jll.co.uk<br />

COPYRIGHT © JONES LANG LASALLE IP, INC. 2016. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without prior written<br />

consent of Jones Lang LaSalle. It is based on material that we believe to be reliable. Whilst every effort has been made to ensure its accuracy, we cannot offer any warranty that it contains<br />

no factual errors. We would like to be told of any such errors in order to correct them.