ZaraAnnual-English2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

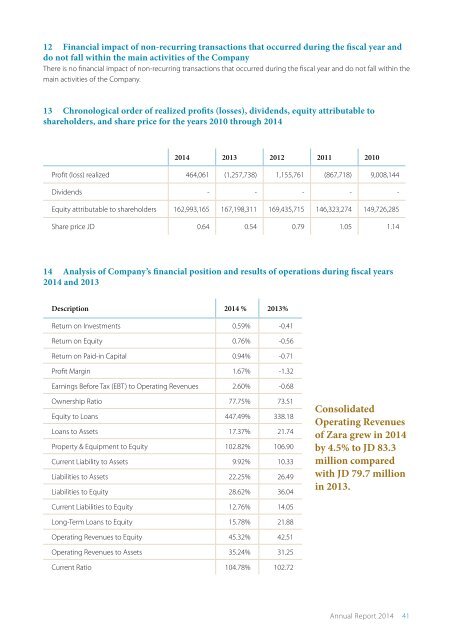

12 Financial impact of non-recurring transactions that occurred during the fiscal year and<br />

do not fall within the main activities of the Company<br />

There is no financial impact of non-recurring transactions that occurred during the fiscal year and do not fall within the<br />

main activities of the Company.<br />

13 Chronological order of realized profits (losses), dividends, equity attributable to<br />

shareholders, and share price for the years 2010 through 2014<br />

2014<br />

2013<br />

2012<br />

2011<br />

2010<br />

Profit (loss) realized<br />

464,061<br />

(1,257,738)<br />

1,155,761<br />

(867,718)<br />

9,008,144<br />

Dividends<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Equity attributable to shareholders<br />

162,993,165<br />

167,198,311<br />

169,435,715<br />

146,323,274<br />

149,726,285<br />

Share price JD<br />

0.64<br />

0.54<br />

0.79<br />

1.05<br />

1.14<br />

14 Analysis of Company’s financial position and results of operations during fiscal years<br />

2014 and 2013<br />

Description 2014 % 2013%<br />

Return on Investments 0.59% -0.41<br />

Return on Equity 0.76% -0.56<br />

Return on Paid-in Capital 0.94% -0.71<br />

Profit Margin 1.67% -1.32<br />

Earnings Before Tax (EBT) to Operating Revenues 2.60% -0.68<br />

Ownership Ratio 77.75% 73.51<br />

Equity to Loans 447.49% 338.18<br />

Loans to Assets 17.37% 21.74<br />

Property & Equipment to Equity 102.82% 106.90<br />

Current Liability to Assets 9.92% 10.33<br />

Liabilities to Assets 22.25% 26.49<br />

Liabilities to Equity 28.62% 36.04<br />

Consolidated<br />

Operating Revenues<br />

of Zara grew in 2014<br />

by 4.5% to JD 83.3<br />

million compared<br />

with JD 79.7 million<br />

in 2013.<br />

Current Liabilities to Equity 12.76% 14.05<br />

Long-Term Loans to Equity 15.78% 21.88<br />

Operating Revenues to Equity 45.32% 42.51<br />

Operating Revenues to Assets 35.24% 31.25<br />

Current Ratio 104.78% 102.72<br />

Annual Report 2014 41