ZaraAnnual-Arabic2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

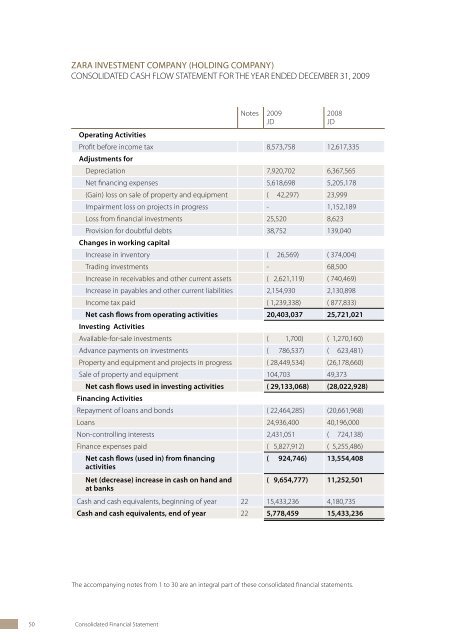

ZARA INVESTMENT COMPANY (HOLDING COMPANY)<br />

CONSOLIDATED CASH FLOW STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2009<br />

ZARA INVESTMENT COMPANY (HOLDING COMPANY)<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2009<br />

Notes 2009<br />

JD<br />

2008<br />

JD<br />

Operating Activities<br />

Profit before income tax 8,573,758 12,617,335<br />

Adjustments for<br />

Depreciation 7,920,702 6,367,565<br />

Net financing expenses 5,618,698 5,205,178<br />

(Gain) loss on sale of property and equipment ( 42,297) 23,999<br />

Impairment loss on projects in progress - 1,152,189<br />

Loss from financial investments 25,520 8,623<br />

Provision for doubtful debts 38,752 139,040<br />

Changes in working capital<br />

Increase in inventory ( 26,569) ( 374,004)<br />

Trading investments - 68,500<br />

Increase in receivables and other current assets ( 2,621,119) ( 740,469)<br />

Increase in payables and other current liabilities 2,154,930 2,130,898<br />

Income tax paid ( 1,239,338) ( 877,833)<br />

Net cash flows from operating activities 20,403,037 25,721,021<br />

Investing Activities<br />

Available-for-sale investments ( 1,700) ( 1,270,160)<br />

Advance payments on investments ( 786,537) ( 623,481)<br />

Property and equipment and projects in progress ( 28,449,534) (26,178,660)<br />

Sale of property and equipment 104,703 49,373<br />

Net cash flows used in investing activities ( 29,133,068) (28,022,928)<br />

Financing Activities<br />

Repayment of loans and bonds ( 22,464,285) (20,661,968)<br />

Loans 24,936,400 40,196,000<br />

Non-controlling interests 2,431,051 ( 724,138)<br />

Finance expenses paid ( 5,827,912) ( 5,255,486)<br />

Net cash flows (used in) from financing<br />

activities<br />

( 924,746) 13,554,408<br />

Net (decrease) increase in cash on hand and<br />

at banks<br />

( 9,654,777) 11,252,501<br />

Cash and cash equivalents, beginning of year 22 15,433,236 4,180,735<br />

Cash and cash equivalents, end of year 22 5,778,459 15,433,236<br />

1. General<br />

Zara Investment Company was established on May 10, 1994 as a public shareholding company. The<br />

Company’s subscribed and paid in capital is JD 125,000,000 consisting of 125,000,000 shares, each having<br />

a par value of JD 1.<br />

The principal activities of the Company as a holding company are to manage its subsidiaries and<br />

participate in other companies’ management in which it is a principal owner, investing in stocks, bonds<br />

and financial instruments, granting loans, guarantees and financing its subsidiaries. The Company owns<br />

through its subsidiaries’ hotels and resorts located in several places in Jordan (Amman, Dead Sea, Petra,<br />

Himmeh and Aqaba).<br />

The consolidated financial statements were authorized for issue by the Board of Directors subsequent<br />

to their meeting held on February 28, 2010. The consolidated financial statements require shareholders<br />

approval.<br />

2. Accounting policies<br />

Basis of preparation<br />

The accompanying consolidated financial statements have been prepared in accordance with<br />

International Financial Reporting Standards (IFRS).<br />

The consolidated financial statements have been prepared under the historical cost convention as<br />

modified for the measurement at fair value of available-for-sale investments.<br />

The consolidated financial statements have been presented in Jordanian Dinars “JD”, which is the<br />

functional currency of the Group.<br />

Changes in Accounting Policies<br />

The accounting policies adopted for the period are consistent with those used in the previous year<br />

except that the Group applied the following standard:<br />

IAS 1 ‘Presentation of financial statements’ (Revised)<br />

The revised standard requires changes in equity arising from transactions with owners in their capacity<br />

as owners (i.e. owner change in equity) to be presented in the statement of changes in equity. All<br />

other changes in equity (i.e. non owner changes in equity) are required to be presented separately<br />

in a performance statement (consolidated statement of comprehensive income). Components of<br />

comprehensive income are not permitted to be presented in the statement of changes in equity. The<br />

Group has elected to present two statements.<br />

IFRS 8- Operating Segments<br />

IFRS 8 replaces IAS 14, Segments Reporting. This standard requires to define operating segments and<br />

segments performance in the financial statements based on information used by the chief operating<br />

decision maker. Operating segments are the same as the business segments under IAS 14.<br />

IAS 23 Borrowing Costs<br />

The revised IAS 23 requires capitalization of borrowing costs that are directly attributable to the acquisition,<br />

construction or production of a qualifying asset. The adoption of this revised standard did not have any<br />

impact on the financial position or the performance of the Company.<br />

The accompanying notes from 1 to 30 are an integral part of these consolidated financial statements.<br />

50 Consolidated Financial Statement Annual Report 2009<br />

51