ACC 349 Week 5 Final Exam (PHOENIX)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

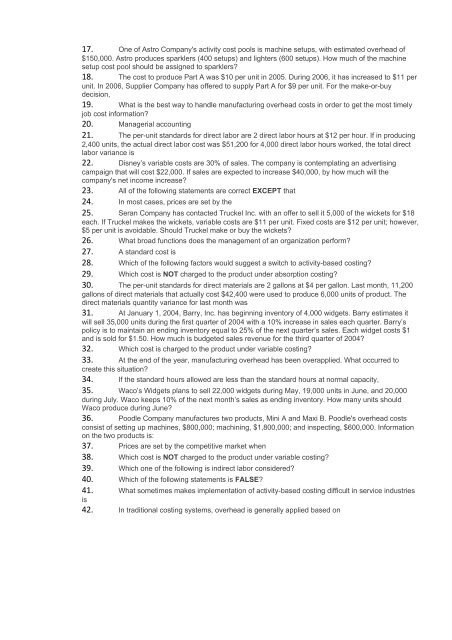

17. One of Astro Company's activity cost pools is machine setups, with estimated overhead of<br />

$150,000. Astro produces sparklers (400 setups) and lighters (600 setups). How much of the machine<br />

setup cost pool should be assigned to sparklers?<br />

18. The cost to produce Part A was $10 per unit in 2005. During 2006, it has increased to $11 per<br />

unit. In 2006, Supplier Company has offered to supply Part A for $9 per unit. For the make-or-buy<br />

decision,<br />

19. What is the best way to handle manufacturing overhead costs in order to get the most timely<br />

job cost information?<br />

20. Managerial accounting<br />

21. The per-unit standards for direct labor are 2 direct labor hours at $12 per hour. If in producing<br />

2,400 units, the actual direct labor cost was $51,200 for 4,000 direct labor hours worked, the total direct<br />

labor variance is<br />

22. Disney’s variable costs are 30% of sales. The company is contemplating an advertising<br />

campaign that will cost $22,000. If sales are expected to increase $40,000, by how much will the<br />

company's net income increase?<br />

23. All of the following statements are correct EXCEPT that<br />

24. In most cases, prices are set by the<br />

25. Seran Company has contacted Truckel Inc. with an offer to sell it 5,000 of the wickets for $18<br />

each. If Truckel makes the wickets, variable costs are $11 per unit. Fixed costs are $12 per unit; however,<br />

$5 per unit is avoidable. Should Truckel make or buy the wickets?<br />

26. What broad functions does the management of an organization perform?<br />

27. A standard cost is<br />

28. Which of the following factors would suggest a switch to activity-based costing?<br />

29. Which cost is NOT charged to the product under absorption costing?<br />

30. The per-unit standards for direct materials are 2 gallons at $4 per gallon. Last month, 11,200<br />

gallons of direct materials that actually cost $42,400 were used to produce 6,000 units of product. The<br />

direct materials quantity variance for last month was<br />

31. At January 1, 2004, Barry, Inc. has beginning inventory of 4,000 widgets. Barry estimates it<br />

will sell 35,000 units during the first quarter of 2004 with a 10% increase in sales each quarter. Barry’s<br />

policy is to maintain an ending inventory equal to 25% of the next quarter’s sales. Each widget costs $1<br />

and is sold for $1.50. How much is budgeted sales revenue for the third quarter of 2004?<br />

32. Which cost is charged to the product under variable costing?<br />

33. At the end of the year, manufacturing overhead has been overapplied. What occurred to<br />

create this situation?<br />

34. If the standard hours allowed are less than the standard hours at normal capacity,<br />

35. Waco’s Widgets plans to sell 22,000 widgets during May, 19,000 units in June, and 20,000<br />

during July. Waco keeps 10% of the next month’s sales as ending inventory. How many units should<br />

Waco produce during June?<br />

36. Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs<br />

consist of setting up machines, $800,000; machining, $1,800,000; and inspecting, $600,000. Information<br />

on the two products is:<br />

37. Prices are set by the competitive market when<br />

38. Which cost is NOT charged to the product under variable costing?<br />

39. Which one of the following is indirect labor considered?<br />

40. Which of the following statements is FALSE?<br />

41. What sometimes makes implementation of activity-based costing difficult in service industries<br />

is<br />

42. In traditional costing systems, overhead is generally applied based on