Harnessing Technology to Narrow the Insurance Protection Gap

harnessing-technology-to-narrow-the-insurance-protection-gap

harnessing-technology-to-narrow-the-insurance-protection-gap

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

e.g. through telematics or wearables. By integrating <strong>the</strong>se<br />

elements, insurers can build a proposition which offers<br />

much more value <strong>to</strong> <strong>the</strong> cus<strong>to</strong>mer than traditional insurance<br />

policies. Through innovative marketing techniques, insurers<br />

can also address a major weakness compared with o<strong>the</strong>r<br />

industries—<strong>the</strong> current relative paucity of client interaction<br />

(see Figure 8). In distribution, insurers will have <strong>to</strong> respond<br />

<strong>to</strong> cus<strong>to</strong>mers’ desire for multiple channels, both digital<br />

and non-digital. Existing channels will have <strong>to</strong> be digitally<br />

empowered in order <strong>to</strong> boost agent or broker productivity<br />

as well as cost-effectiveness and cost-efficiency. Based on a<br />

powerful digital multi-channel proposition, insurers are well<br />

positioned <strong>to</strong> fight disintermediation and disruption from<br />

new competi<strong>to</strong>rs operating in digital ecosystems.<br />

Last but not least, ‘digital’ will have an impact on insurers’<br />

‘moment of truth’, <strong>the</strong> settlement of claims. Self-service<br />

applications can go a long way in improving <strong>the</strong> cus<strong>to</strong>mer<br />

experience, whilst reducing operating expenses at <strong>the</strong><br />

insurer’s end. At <strong>the</strong> same time, digital technologies<br />

increase <strong>the</strong> scope for fighting insurance fraud, which,<br />

in non-life insurance, devours almost 10 per cent of <strong>the</strong><br />

insurance premium pie. 20<br />

Major potential for efficiency gains<br />

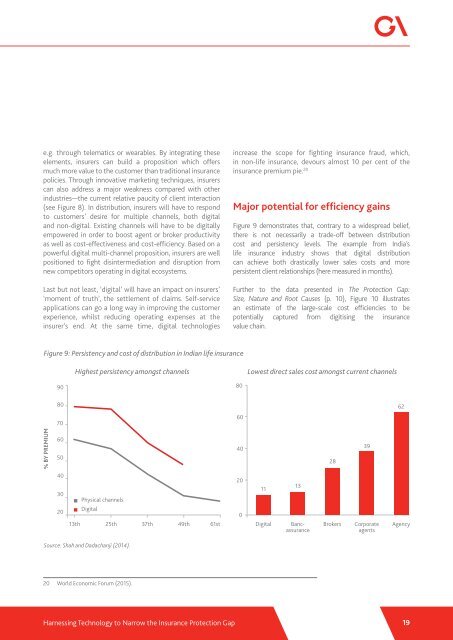

Figure 9 demonstrates that, contrary <strong>to</strong> a widespread belief,<br />

<strong>the</strong>re is not necessarily a trade-off between distribution<br />

cost and persistency levels. The example from India’s<br />

life insurance industry shows that digital distribution<br />

can achieve both drastically lower sales costs and more<br />

persistent client relationships (here measured in months).<br />

Fur<strong>the</strong>r <strong>to</strong> <strong>the</strong> data presented in The <strong>Protection</strong> <strong>Gap</strong>:<br />

Size, Nature and Root Causes (p. 10), Figure 10 illustrates<br />

an estimate of <strong>the</strong> large-scale cost efficiencies <strong>to</strong> be<br />

potentially captured from digitising <strong>the</strong> insurance<br />

value chain.<br />

Figure 9: Persistency and cost of distribution in Indian life insurance<br />

Highest persistency amongst channels<br />

Lowest direct sales cost amongst current channels<br />

90<br />

80<br />

80<br />

62<br />

70<br />

60<br />

% BY PREMIUM<br />

60<br />

50<br />

40<br />

28<br />

39<br />

40<br />

30<br />

20<br />

Physical channels<br />

Digital<br />

13th 25th 37th 49th 61st<br />

20<br />

0<br />

11<br />

Digital<br />

13<br />

Bancassurance<br />

Brokers<br />

Corporate<br />

agents<br />

Agency<br />

Source: Shah and Dadachanji (2014).<br />

20 World Economic Forum (2015).<br />

<strong>Harnessing</strong> <strong>Technology</strong> <strong>to</strong> <strong>Narrow</strong> <strong>the</strong> <strong>Insurance</strong> <strong>Protection</strong> <strong>Gap</strong><br />

19