Not-your-fathers-oil-and-gas-business

Not-your-fathers-oil-and-gas-business

Not-your-fathers-oil-and-gas-business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

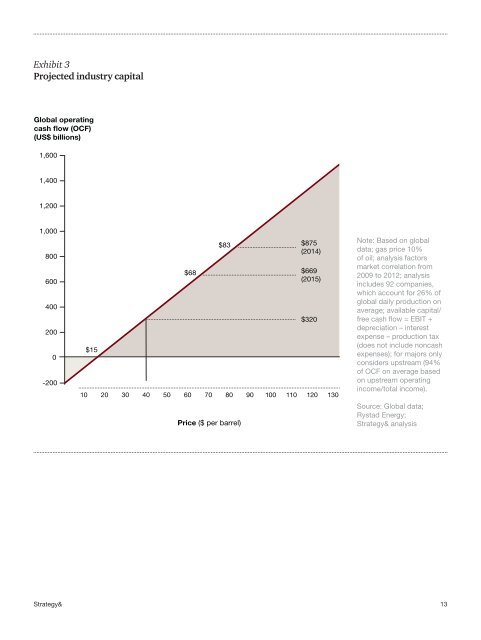

Exhibit 3<br />

Projected industry capital<br />

Global operating<br />

cash flow (OCF)<br />

(US$ billions)<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

-200<br />

$15<br />

$68<br />

$83<br />

Price ($ per barrel)<br />

$875<br />

(2014)<br />

$669<br />

(2015)<br />

$320<br />

10 20 30 40 50 60 70 80 90 100 110 120 130<br />

<strong>Not</strong>e: Based on global<br />

data; <strong>gas</strong> price 10%<br />

of <strong>oil</strong>; analysis factors<br />

market correlation from<br />

2009 to 2012; analysis<br />

includes 92 companies,<br />

which account for 26% of<br />

global daily production on<br />

average; available capital/<br />

free cash flow = EBIT +<br />

depreciation – interest<br />

expense – production tax<br />

(does not include noncash<br />

expenses); for majors only<br />

considers upstream (94%<br />

of OCF on average based<br />

on upstream operating<br />

income/total income).<br />

Source: Global data;<br />

Rystad Energy;<br />

Strategy& analysis<br />

Strategy&<br />

13