You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

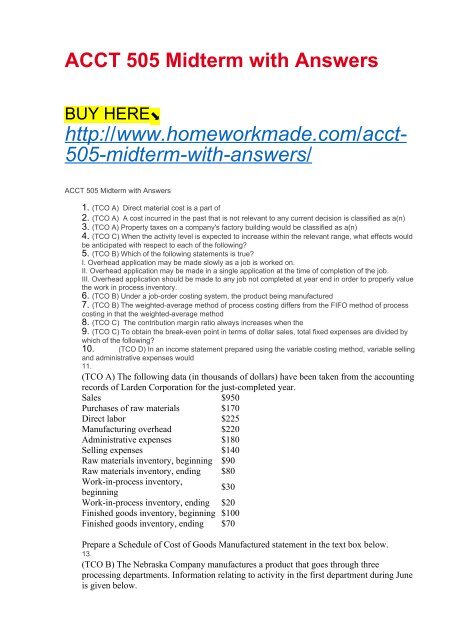

<strong>ACCT</strong> <strong>505</strong> <strong>Midterm</strong> <strong>with</strong> <strong>Answers</strong><br />

BUY HERE⬊<br />

http://www.homeworkmade.com/acct-<br />

<strong>505</strong>-midterm-<strong>with</strong>-answers/<br />

<strong>ACCT</strong> <strong>505</strong> <strong>Midterm</strong> <strong>with</strong> <strong>Answers</strong><br />

1. (TCO A) Direct material cost is a part of<br />

2. (TCO A) A cost incurred in the past that is not relevant to any current decision is classified as a(n)<br />

3. (TCO A) Property taxes on a company's factory building would be classified as a(n)<br />

4. (TCO C) When the activity level is expected to increase <strong>with</strong>in the relevant range, what effects would<br />

be anticipated <strong>with</strong> respect to each of the following?<br />

5. (TCO B) Which of the following statements is true?<br />

I. Overhead application may be made slowly as a job is worked on.<br />

II. Overhead application may be made in a single application at the time of completion of the job.<br />

III. Overhead application should be made to any job not completed at year end in order to properly value<br />

the work in process inventory.<br />

6. (TCO B) Under a job-order costing system, the product being manufactured<br />

7. (TCO B) The weighted-average method of process costing differs from the FIFO method of process<br />

costing in that the weighted-average method<br />

8. (TCO C) The contribution margin ratio always increases when the<br />

9. (TCO C) To obtain the break-even point in terms of dollar sales, total fixed expenses are divided by<br />

which of the following?<br />

10. (TCO D) In an income statement prepared using the variable costing method, variable selling<br />

and administrative expenses would<br />

11.<br />

(TCO A) The following data (in thousands of dollars) have been taken from the accounting<br />

records of Larden Corporation for the just-completed year.<br />

Sales $950<br />

Purchases of raw materials $170<br />

Direct labor $225<br />

Manufacturing overhead $220<br />

Administrative expenses $180<br />

Selling expenses $140<br />

Raw materials inventory, beginning $90<br />

Raw materials inventory, ending $80<br />

Work-in-process inventory,<br />

$30<br />

beginning<br />

Work-in-process inventory, ending $20<br />

Finished goods inventory, beginning $100<br />

Finished goods inventory, ending $70<br />

Prepare a Schedule of Cost of Goods Manufactured statement in the text box below.<br />

13.<br />

(TCO B) The Nebraska Company manufactures a product that goes through three<br />

processing departments. Information relating to activity in the first department during June<br />

is given below.

Percentage Completed<br />

Units Materials Conversion<br />

Work in process, June 1140,00065% 45%<br />

Work in process, Jun<br />

120,00075% 65%<br />

30<br />

The department started 580,000 units into production during the month and transferred<br />

600,000 completed units to the next department.<br />

Required: Compute the equivalent units of production for the first department for June,<br />

assuming that the company uses the weighted-average method of accounting for units and<br />

costs.<br />

15.<br />

(TCO C) A cement manufacturer has supplied the following data.<br />

Tons of cement produced and sold 220,000<br />

Sales revenue $924,000<br />

Variable manufacturing expense $297,000<br />

Fixed manufacturing expense $280,000<br />

Variable selling and admin<br />

$165,000<br />

expense<br />

Fixed selling and admin expense $82,000<br />

Net operating income $100,000<br />

Required:<br />

Calculate the company's unit contribution margin.<br />

Calculate the company's contribution margin ratio.<br />

If the company increases its unit sales volume by 5% <strong>with</strong>out increasing its fixed expenses,<br />

what would the company's net operating income be?<br />

17.<br />

(TCO D) Lincoln Company, which has only one product, has provided the following data<br />

concerning its most recent month of operations.<br />

Selling price $125<br />

Units in beginning inventory 600<br />

Units produced 3,000<br />

Units sold 3,500<br />

Units in ending inventory 100<br />

Variable costs per unit:<br />

Direct materials $27<br />

Direct labor $18<br />

Variable manufacturing<br />

overhead<br />

$10<br />

Variable selling and admin $12<br />

Fixed costs:<br />

Fixed manufacturing overhead $75,000<br />

Fixed selling and admin $30,000

Required:<br />

What is the unit product cost for the month under variable costing?<br />

What is the unit product cost for the month under absorption costing?<br />

Prepare an income statement for the month using the variable costing method.<br />

Prepare an income statement for the month using the absorption costing method