FIN 500 Midterm

FIN 500 Midterm

FIN 500 Midterm

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Buy here:<br />

http://homework.plus/fin-<strong>500</strong>-midterm/<br />

Product Description<br />

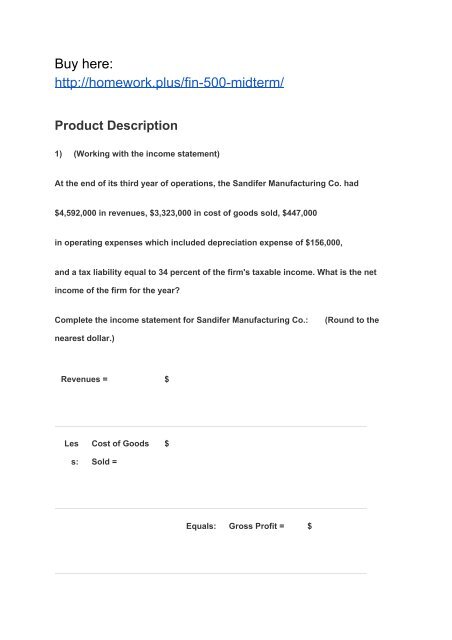

1) (Working with the income statement)<br />

At the end of its third year of operations, the Sandifer Manufacturing Co. had<br />

$4,592,000 in revenues, $3,323,000 in cost of goods sold, $447,000<br />

in operating expenses which included depreciation expense of $156,000,<br />

and a tax liability equal to 34 percent of the firm's taxable income. What is the net<br />

income of the firm for the year?<br />

Complete the income statement for Sandifer Manufacturing Co.:<br />

(Round to the<br />

nearest dollar.)<br />

Revenues = $<br />

Les<br />

s:<br />

Cost of Goods<br />

Sold =<br />

$<br />

Equals: Gross Profit = $

Les<br />

s:<br />

Operating<br />

Expenses =<br />

$<br />

Equals:<br />

Net Operating<br />

Income =<br />

$<br />

Les<br />

s:<br />

Interest<br />

Expense =<br />

$ 0<br />

Equals:<br />

Earnings before<br />

Taxes =<br />

$<br />

Les<br />

s:<br />

Income Taxes<br />

=<br />

$<br />

Equals: Net Income = $<br />

Enter any number in the edit fields and then continue to the next question.

2)<br />

Balance<br />

2013<br />

Sheet<br />

Cash and<br />

$490<br />

marketable<br />

securities<br />

Accounts<br />

5,970<br />

receivable<br />

Inventories 9,480

Current<br />

15,940<br />

assets<br />

Net<br />

property<br />

16,960<br />

plant and<br />

equipment<br />

Total<br />

$32,900<br />

assets<br />

Accounts<br />

$7,150<br />

payable<br />

Short-term<br />

6,840<br />

debt

Current<br />

$13,990<br />

liabilities<br />

Long-term<br />

6,980<br />

liabilities<br />

Total<br />

20,970<br />

liabilities<br />

Total<br />

11,930<br />

owners'<br />

equity<br />

Total<br />

32,900<br />

liabilities<br />

and<br />

owners'<br />

equity

Income<br />

2013<br />

Statement<br />

Revenues $29,960<br />

Cost of goods<br />

sold (19,950)<br />

Gross profit $10,010<br />

Operating<br />

(7,950)<br />

expenses<br />

Net operating<br />

income $2,060<br />

Interest expense (870)

Earnings before<br />

$1,190<br />

taxes<br />

Taxes (433)<br />

Net income $757

The balance sheet and income statement for Carver Enterprises, Inc. are<br />

foundhere:<br />

.<br />

a. Prepare a common-size balance sheet for Carver Enterprises.<br />

b. Prepare a common-size income statement for Carver Enterprises.<br />

a. Prepare a common-size balance sheet for Carver Enterprises.<br />

Complete the common-size balance sheet below:<br />

(Round to one decimal place.)<br />

Common-<br />

2013<br />

Size

Balance<br />

Sheet<br />

Cash and<br />

$ 490 %<br />

marketabl<br />

e<br />

securities<br />

Accounts<br />

5,970<br />

receivable<br />

Inventorie<br />

9,480<br />

s<br />

Current<br />

assets<br />

$ 15,94<br />

0<br />

%

Net<br />

property<br />

16,96<br />

0<br />

plant and<br />

equipmen<br />

t<br />

Total<br />

assets<br />

$ 32,90<br />

0<br />

%<br />

Accounts<br />

$ 7,150 %<br />

payable<br />

Short-ter<br />

6,840<br />

m debt<br />

Current<br />

liabilities<br />

$ 13,99<br />

0<br />

%

Long-ter<br />

6,980<br />

m<br />

liabilities<br />

Total<br />

liabilities<br />

$ 20,97<br />

0<br />

%<br />

Total<br />

owners’<br />

equity<br />

11,93<br />

0<br />

Total<br />

liabilities<br />

and<br />

owners’<br />

equity<br />

$ 32,90<br />

0<br />

%<br />

b. Prepare a common-size income statement for Carver Enterprises.

Complete the common-size income statement below:<br />

(Round to one decimal<br />

place.)<br />

Common-Size Income<br />

2013<br />

Statement<br />

Revenues $ 29,960 %<br />

Cost of goods sold (19,950)<br />

Gross profit $ 10,010 %<br />

Operating expenses (7,950)<br />

Net operating income $ 2,060 %<br />

Interest expense (870)

Earnings before taxes $ 1,190 %<br />

Taxes (433)<br />

Net income $ 757 %<br />

3) (Present-Value Comparison) Much to your surprise, you were selected to appear on<br />

the TV show "The Price is Right." As a result of your prowess in identifying how many<br />

rolls of toilet paper a typical American family keeps on hand, you win the opportunity<br />

to choose one of the following: 2,000 today, 9,000 in 9 years, or $ 32,000<br />

in 24 years. Assuming that you can earn 12 percent on your money, which should you<br />

choose?<br />

If you are offered $9,000 in 9 years and you can earn 12<br />

percent on your money, what is the present value of<br />

$9,000?

$<br />

(Round to the nearest cent.)<br />

If you are offered 32,000 in 24 years and you can earn<br />

12percent on your money, what is the present value of<br />

$32,000?<br />

$<br />

(Round to the nearest cent.)<br />

Which offer should you choose?<br />

(Select the best choice below.)<br />

A.Choose<br />

$32,000.00 in 24 in 24 years because its present value is the highest.<br />

B.Choose<br />

$2,000.00 today because its present value is the highest.

C.Choose<br />

9,000.00 in 9 years in because its present value is the highest.<br />

4)( Future value of an ordinary annuity) You are graduating from college at<br />

the end of this semester and after reading the The Business of Life box in this<br />

chapter, you have decided to invest 4,100 at the end of each year into a Roth IRA for<br />

the next 41 years. If you earn 6 percent compounded annually on your investment,<br />

how much will you have when you retire in 41 years? How much will you have if you<br />

wait 10 years before beginning to save and only make 31 payments into your<br />

retirement account?<br />

How much will you have when you retire in<br />

41 years?<br />

$<br />

(Round to the nearest cent.)<br />

How much will you have if you wait 10 years before beginning to save and only make<br />

31payments into your retirement account?<br />

$<br />

(Round to the nearest cent.)

5) ( Annuity Payments) Mr. Bill S. Preston, Esq., purchased a new house for 130,000.<br />

He paid $30,000 upfront and agreed to pay the rest over the next 10 years in 10 equal<br />

annual payments that include principal payments plus 13 percent compound interest<br />

on the unpaid balance. What will these equal payments be?<br />

a. Mr. Bill S. Preston, Esq., purchased a new house for 130,000 and paid<br />

$30,000 upfront. How much does he need to borrow to purchase the house?<br />

$<br />

(Round to the nearest dollar.)<br />

b. If Bill agrees to pay the loan over the next 10 years in 10 equal end-of-year<br />

payments plus 13<br />

percent compound interest on the unpaid balance, what will these equal payments<br />

be?<br />

$<br />

(Round to the nearest cent.)<br />

6) ( Annuity Payments) Lisa Simpson wants to have 1,100,000 in 50 years by making<br />

equal annualend-of-the-year deposits into a tax-deferred account paying 8.00 percent<br />

annually. What must Lisa's annual deposit be?The amount of Lisa's annual deposit<br />

must be

$<br />

7) (Calculating rates of return) The S&P stock index represents a portfolio<br />

comprised of <strong>500</strong> large publicly traded companies. On December 24, 2007, the index<br />

had a value of 1,410 and on December 24, 2008, the index was approximately 929. If<br />

the average dividend paid on the stocks in the index is approximately 4.5 percent of<br />

the value of the index at the beginning of the year, what is the rate of return earned on<br />

the S&P index? What is your assessment of the relative riskiness of investing in a<br />

single stock such as Google compared to investing in the S&P index (recall from<br />

Chapter 2 that you can purchase mutual funds that mimic the returns of the index)?<br />

The rate of return earned on the S&P <strong>500</strong> is_____ (Round to two decimal places.)<br />

What is your assessment of the relative riskiness of investing in a single stock, such<br />

as Google, compared to investing in the S&P index? (Select the best choice below.)<br />

A.<br />

In general, investing in a single stock is riskier than investing in the S&P index.<br />

B.<br />

In general, investing in a single stock has the same relative riskiness as investing in<br />

the S&P index.<br />

C.

There is not enough information given to answer this question.<br />

D.<br />

In general, investing in the S&P index is riskier than investing in a single stock<br />

8) James Fromholtz is considering whether to invest in a newly formed investment<br />

fund. The fund's investment objective is to acquire home mortgage securities at what<br />

it hopes will be bargain prices. The fund sponsor has suggested to James that the<br />

fund's performance will hinge on how the national economy performs in the coming<br />

year. Specifically, he suggested the following possible outcomes<br />

State of Economy Probability Fund<br />

Returns<br />

Rapid expansion and recovery 5%<br />

100%<br />

Modest growth 35% 40%<br />

Continued recession 55% 10%<br />

Falls into depression 5% -100%

Based on these potential outcomes, what is your estimate of the expected rate of<br />

return from this investment opportunity?Would you be interested in making such an<br />

investment? Note that you lose all your money in one year if the economy collapses<br />

into the worst state or you double your money if the economy enters into a rapid<br />

expansion.